Let’s face it:

Gold has this timeless allure, standing the test of centuries as a symbol of wealth and a safe haven in uncertain times.

But in this day and age, it’s natural to wonder:

- Does gold keep its value?

- Will gold ever become worthless?

- Is it smart to buy gold in 2024?

And that’s exactly what we’ll talk about today.

Specifically, we’ll cover why is gold so special, the factors contributing to its perpetual value and potential depreciation, as well as our predictions and friendly suggestions.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

Recommended: See our #1 recommended Gold IRA company

Factors Contributing to Gold’s Perpetual Value

First things first:

Does gold have intrinsic value? Yes, it certainly does.

Let’s face it, in the investment world, few assets boast the enduring charm and resilience that gold has.

As we discuss the factors that contribute to gold’s perpetual value, it’s crucial to recognize the historical track record that has solidified its status as the go-to store of wealth.

Historical Track Record

Gold’s reputation as a store of value spans millennia.

Dating back to ancient civilizations, this precious yellow metal has weathered economic storms, political upheavals, and societal shifts with remarkable consistency.

Unlike currencies susceptible to inflation and volatile market conditions, gold has stood the test of time, maintaining its purchasing power through the ages.

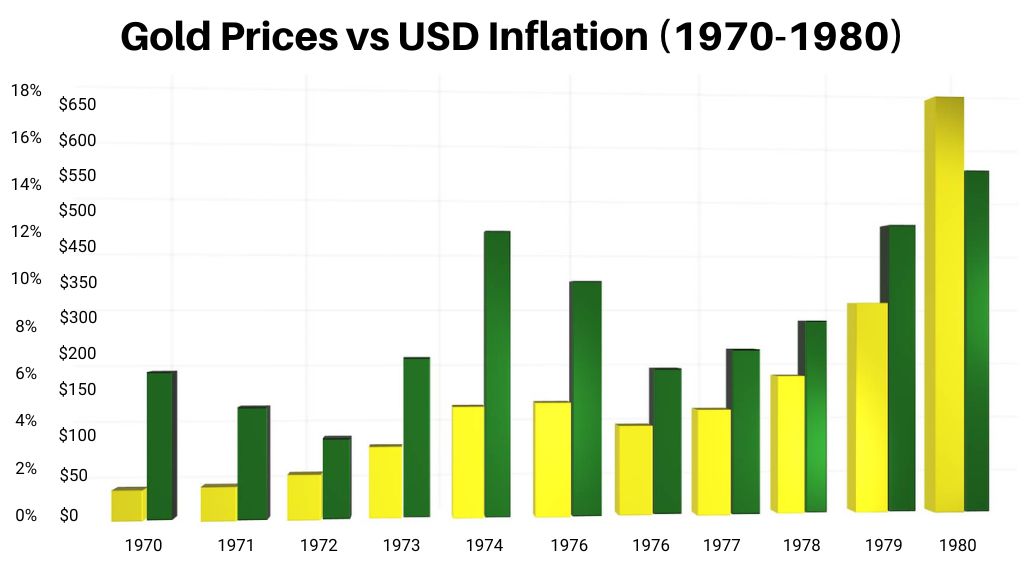

While we have a lot of examples we’ve used in our Gold & Silver Central content, The Great Inflation of the 1970s is one of our favorite ones to share:

The reason is because it’s a great historical proof how gold held up well during that highly inflationary period of time.

Economic Uncertainty

One of gold’s superpowers lies in its ability to shine brightest when economic skies darken.

In times of uncertainty, whether sparked by recessions, financial crises, or global pandemics, investors flock to gold as a safe-haven asset.

And that’s exactly what we saw happening during the early 2000s.

Then again during the 2008 Great Recession.

And most recently during the Global Pandemic in 2020. In August of that year, we saw the gold price go up to its new all time high of over $2000 per ounce.

The truth is:

This intrinsic characteristic is deeply embedded in the collective financial psyche, making gold an invaluable hedge against the erosive forces of inflation and currency devaluation.

Geopolitical Tensions

Gold’s allure isn’t confined to economic turmoil alone; it thrives in the midst of geopolitical uncertainties as well.

During times of political instability and conflicts, the yellow metal often emerges as a refuge for investors seeking to safeguard their wealth from the tumult of international affairs.

The most recent example is de-dollarization and the shifting power between the USA and the BRICS countries.

This is one of the reasons why individual investors and the governments, especially China, were stockpiling gold in the last few years.

The historical precedent of gold gaining value during such periods underscores its role as a geopolitical insurance policy in a world fraught with uncertainties.

As we can see here, this metal’s perpetual value is intricately linked to its ability to transcend the temporal fluctuations that impact other assets.

Without a doubt:

Its historical track record, coupled with its role as a haven in times of economic and geopolitical turbulence, positions gold as a reliable anchor in investment portfolios.

Potential Scenarios for Gold Depreciation

Now…

While gold has demonstrated remarkable resilience over centuries, it’s essential to acknowledge potential scenarios that could challenge its perpetual value.

Examining these scenarios provides insight into the dynamic nature of the precious metal market and the factors that might influence gold’s depreciation.

Economic Stability and Confidence

One conceivable scenario for gold depreciation involves a prolonged period of robust economic stability and confidence.

If global economies consistently perform well and there is confidence in the financial markets, investors may shift their focus away from traditional safe-haven assets like precious metals or art.

Again, historically speaking, during times of economic prosperity, the demand for riskier, higher-yielding investments tends to rise, like stocks and bonds.

Earlier we mentioned gold’s performance during the Great Inflation of the 70s.

After a decade of inflation and poor economic recovery, what we saw happening after was the “long boom“, when things started to turn around.

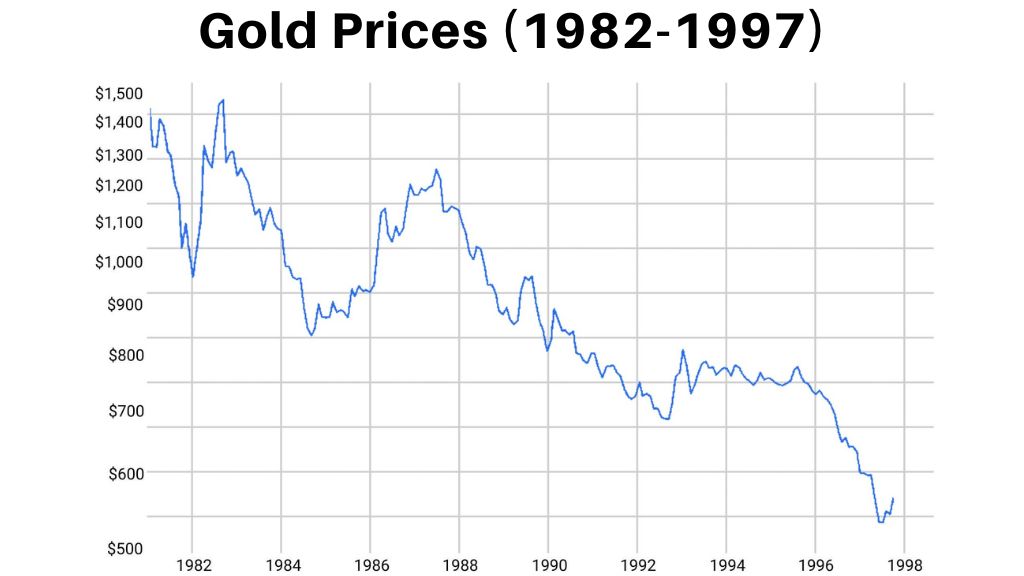

The 15 years beginning in 1982 and ending in 1997 are considered to be one of the greatest economic expansions in American history.

So…

During those 15 years starting in the early 80s, the allure of gold as a safe-haven asset diminished, leading to a decline in its price, whereas other investments like stocks and real estate did well.

However, even during what could be considered the “worst” macroeconomic period for the yellow precious metal, it didn’t crash back then; it simply underperformed.

That’s an important difference to recognize.

Technological Advances

Advancements in technology present another potential challenge to gold’s perpetual value.

Its significance extends beyond its role as a store of value; it’s a crucial component in various industrial applications, particularly in electronics.

However, if technological innovations pave the way for cost-effective alternatives or substitutes, the demand for this yellow metal in certain industries could decline.

The development of synthetic materials with properties akin to gold could impact both its industrial and investment demand, exerting downward pressure on its value.

Regulatory Changes

Gold’s value is also susceptible to shifts in regulatory landscapes.

Governments may implement policies that affect gold ownership, trading, or taxation.

For example, restrictions on precious metal imports or increased taxes on gold transactions could influence market dynamics.

Moreover, global trade dynamics and geopolitical shifts may lead to changes in regulations that impact the movement and trading of gold.

Such regulatory changes can introduce uncertainties, potentially influencing investor sentiment and affecting gold prices.

It’s crucial for investors and enthusiasts alike to stay attuned to these potential scenarios, recognizing that the dynamics of the precious metal market are subject to external forces.

While gold has a storied history of resilience, acknowledging the plausible scenarios for depreciation enables a more comprehensive understanding of the risks associated with precious metal investments.

Can Gold Ever Become Worthless?

The question remains:

Can or will gold ever become worthless?

(Which might seem paradoxical given its historical reputation as a steadfast store of value.)

However, exploring this inquiry provides insights into the fundamental attributes of gold and the potential scenarios that could challenge its enduring worth.

Inherent Value

Gold’s intrinsic value, stemming from its rarity and unique properties, forms the bedrock of its resilience.

Unlike fiat currencies susceptible to inflation and economic fluctuations, this yellow metal possesses an inherent value that transcends geopolitical borders.

Its malleability, durability, and conductivity contribute to its widespread use not only as a store of wealth but also in various industrial applications.

In this sense, both gold and silver are versatile and have monetary value.

Cultural and Historical Significance

The cultural and historical significance of gold further bolsters its enduring value. Across civilizations and centuries, gold has been revered as a symbol of wealth, power, and prestige.

I mean, think about the Grand Palace in Bangkok, where real gold decorates many buildings there, including the Temple of The Emerald Buddha.

This universal recognition and timeless appeal contribute to its status as a tangible asset that transcends economic paradigms.

Potential Scenarios

This is something we’ve already discussed in greater detail.

While the intrinsic and symbolic value of this precious metal is robust, envisioning scenarios where it could become worthless involves considering extreme and unprecedented circumstances.

Potential scenarios include the discovery of a vast and easily accessible new gold source, rendering the metal less rare and diminishing its allure.

Technological breakthroughs leading to cost-effective alternatives for industrial applications could also impact gold’s demand, potentially affecting its overall value.

Market Dynamics

The dynamics of supply and demand play a crucial role in determining the metal’s value.

While global gold mining continues, any drastic increase in supply without a corresponding surge in demand could impact its market value.

On top of that, changes in investor sentiment and preferences, influenced by macroeconomic trends, could affect the perceived value of this precious metal.

So, will gold ever lose its value?

To be honest, the likelihood of gold becoming completely worthless is remote.

The intrinsic value, cultural significance, and historical track record contribute to its enduring appeal.

However, as investors you should remain vigilant and recognize that the resilience of this precious metal is not immune to unforeseen events, technological shifts, or drastic changes in market dynamics.

Gold Prices In The Next 5-10 Years (Our Prediction)

Look:

While predicting exact figures for gold prices is nearly impossible, we can glean actionable insights by examining current trends and potential catalysts that may influence gold’s value over the next 5-10 years.

Investors seeking to position themselves strategically in the precious metal market should consider a range of factors that could contribute to both bullish and bearish scenarios.

Reminder: We do not offer personal financial advice here. Please consult with a professional before making any decisions.

Bullish Scenarios

1. Economic Uncertainty and Inflation Concerns

Suggestion: In times of economic uncertainty, consider allocating a portion of your portfolio to precious metals to serve as a hedge against potential market downturns.

Potential Increase: Analysts suggest a potential 15-20% increase in gold prices if inflationary pressures persist.

2. Low-Interest Rates

Suggestion: Given the prevalence of low-interest-rate environments, consider precious metals as an alternative investment to traditional fixed-income assets.

Potential Increase: A sustained low-interest-rate environment could contribute to a 10-15% increase in gold prices.

3. Geopolitical Tensions

Suggestion: Stay informed about global geopolitical events and consider increasing your precious metal exposure during periods of heightened tensions.

Potential Increase: Geopolitical uncertainties may drive a 10-15% increase in gold prices.

Bearish Scenarios

1. Strong Economic Recovery

Suggestion: Monitor economic indicators closely, and be prepared to reassess your alternative investment holdings if a robust economic recovery occurs.

Potential Decrease: A strong economic recovery could lead to a 10-15% decline in gold prices.

2. Technological Advances

Suggestion: Keep an eye on technological developments that could impact the industrial demand for precious metals, and diversify your portfolio accordingly.

Potential Decrease: Significant technological advancements may contribute to a 5-10% decrease in gold prices.

3. Stable Global Conditions

Suggestion: Assess your portfolio regularly and be ready to adjust your alternative investment holdings if global conditions stabilize.

Potential Decrease: Stable global conditions may result in a 5-10% decrease in gold prices.

Other Considerations

Balancing your investment strategy involves staying vigilant, understanding the macroeconomic landscape, and adapting to changing circumstances.

While these potential percentage increases and decreases provide a general framework, it’s crucial to conduct thorough research, stay informed, and consult with financial advisors to tailor your decisions to your specific goals and risk tolerance.

Remember, the key to successful investing is a well-informed and adaptable approach.

Now…

Should You Invest in Gold?

We’re all aware of its allure that beckons investors with promises of stability and wealth preservation.

But like we mentioned earlier, the decision to invest requires careful consideration of individual financial goals, risk tolerance, and the broader economic landscape.

Let’s explore the rationale behind investing in this asset and highlight some of the best avenues, including the increasingly popular Gold IRA investments.

Top 3 Reasons to Invest in Gold

Reason #1: Diversification Benefits

Gold’s low correlation with traditional assets makes it a powerful tool for diversifying investment portfolios.

During times of economic uncertainty, its performance often diverges from that of stocks and bonds, providing a potential hedge against market volatility.

Reason #2: Inflation Hedge

Gold has a historical track record of preserving wealth during periods of inflation.

Investors concerned about the eroding effects of rising prices may turn to gold as a safeguard against the diminishing value of fiat currencies.

Reason #3: Safe-Haven Asset

Gold’s reputation as a safe-haven asset shines during times of geopolitical turmoil or financial crises.

Its perceived stability attracts many folks who seek refuge when traditional markets face turbulence.

The 5 Gold Investments to Consider

While we have an in-depth guide on the best gold investments that we recommend you check out, in here we still would like to give you an overview of different options to consider.

Physical Gold

Acquiring physical gold coins or bars allows for tangible ownership. This can be stored securely or held in a personal safe, providing a sense of control over the asset.

Gold Exchange-Traded Funds (ETFs)

ETFs offer a convenient way to invest in gold without the need for physical storage. These funds typically track the performance of gold prices and can be bought and sold on stock exchanges.

Gold Mining Stocks

Investing in stocks of gold mining companies provides exposure to the potential profits of gold extraction.

However, this option comes with added risks associated with company-specific factors.

Gold Certificates

These represent ownership of a specific quantity of gold held by a financial institution. While convenient, investors should be aware of counter-party risks.

Gold IRA

This type of investment is increasing in popularity because you can diversify your retirement portfolio by buying precious metals in your self-directed IRA, commonly known as a Gold IRA.

What’s the benefit?

This individual retirement account provides the same tax advantages as traditional IRAs while offering exposure to the potential long-term growth and stability of gold.

Check out our in-depth video on Gold IRA tax benefits:

Now…

Setting up a Gold IRA account involves choosing a custodian, funding the account, and selecting approved precious metal products.

Working with a reputable dealers is essential to navigate regulatory requirements.

Speaking of which:

Check out our review of Augusta Precious Metals, which is our #1 recommended Gold IRA company.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Do keep in mind that their minimum contribution is $50,000, so it works best for high net worth investors.

If you can afford buying or rolling over $50K, then grab Augusta’s FREE Gold IRA guide or call them at 833-989-1952 to learn more.

Goldco is another great company, which offers a lower contribution amount of $25,000 (as cash purchase or rollover).

So if that works better for you, then grab their FREE investor’s kit to learn more.

Considerations and Caveats

This guide wouldn’t be complete if we didn’t mention the following:

- Risk Tolerance

Assess your risk tolerance and investment horizon before allocating a portion of your portfolio to gold. While it offers diversification benefits, no investment is without risk.

- Market Conditions

Stay informed about global economic trends, geopolitical events, and market dynamics, as these factors can influence the performance of alternative investments.

- Professional Advice

Consult with financial advisors or experts in precious metals to tailor your investment strategy to your individual financial goals and circumstances.

Without a doubt…

The decision to buy gold is a nuanced one that demands thoughtful consideration.

Whether you opt for physical gold, ETFs, gold mining stocks, or explore the Gold IRA option, understanding your objectives and the unique attributes of each option is paramount.

As with any investment decision, a well-informed and balanced approach enhances the potential for success in the ever-evolving landscape of the precious metal market.

Can Gold Become Worthless? (Verdict)

So…

Can gold lose its value and become completely worthless?

Will gold become worthless in the future?

We really don’t think so. Sure it can underperform during times of economic stability compared to other investments like stocks or real estate, but never in history has it crashed.

The truth is:

Gold stood the test of time and is an excellent hedge against inflation and other instabilities.

Its enduring value is deeply rooted in its historical resilience, intrinsic qualities, and cultural significance.

We looked at various possibilities and the trajectory of gold prices that can be influenced by a myriad of global factors.

While the potential scenarios for appreciation or depreciation unfold, the intrinsic value of gold as a tangible, versatile, and universally recognized asset stands firm.

Now, we’d like to hear from YOU:

- Will gold ever lose its worth, in your opinion?

- Do you diversify your portfolio with precious metals?

- Ever considered investing in a Gold IRA?

Share your thoughts and experiences in the comments below!