The truth is:

It has been a safe haven for centuries and has been used as a means of exchange longer than anything else on the planet.

Its ability to maintain a high value sets it apart from other assets. As a result, investors flock to the security this shiny metal offers during times of economic crisis or upheaval.

But with changes in global economies, politics, and the emergence of other assets – especially cryptocurrencies – can gold prices continue to rise?

Do a quick online search, and you’ll discover 100s (even 1000s) of opinions from the world’s top economists about where gold prices will be five, ten, or even 100 years from now.

And the one thing they all have in common is that they’re all different.

During my days at the bank, every January, we would gather in a big conference room to hear our economists give their predictions about the coming year.

And we had a running joke that they were the only employees that could be wrong 100% of the time and still keep their jobs.

Because the year never turned out the way they predicted.

So unlike other articles that proudly boast that they know where the price of gold will be in the future, we’re going to look at the factors that drive prices.

Let’s discover if this precious metal can continue to rise or if it has lost its luster.

Investing in precious metals? Join our #1 gold newsletter today! Use our code GSC20 to get 20% OFF any subscription plan.

Gold Price vs. Gold Value (Explained)

I know a lot of folks have questions similar to this, with slight variations like:

- Does gold always go up in value?

- Does gold keep its value?

- Does gold go up in value?

- Is gold going up in value?

- When will gold go up?

But it’s important to talk about gold price vs gold value first.

In case you didn’t know, the price of the physical metal is not the same as its value.

After all, an ounce of gold has been and always will be an ounce of gold.

And you can buy pretty much the same amount of goods with an ounce of this precious metal today that you could back in 1900.

As one common story goes, back then, you could buy a nice suit.

And this year, you can still buy a nice suit for that same ounce of gold (and throw in a tie, a shirt, and a new pair of shoes) – 123 years later!

Rather than its value, what changes is its relationship to money, whether that be in dollars, euros, pounds, or yen.

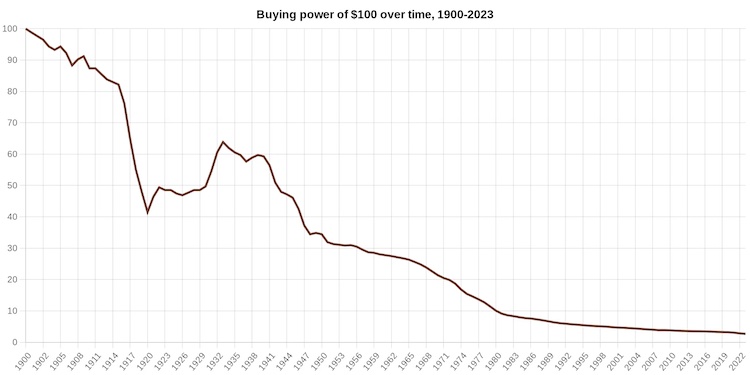

For example, since 1900, the US dollar has lost 97% of its purchasing power, while gold has increased 90 times in value.

Or, in other terms, what cost $1 in 1900 now costs $35.67, while an ounce of gold is now worth over $1823, up from $20.67 in 1900.

This inverse relationship between price and value makes gold an excellent hedge against inflation and rising prices.

What Drives Gold Prices?

Like all commodities, the underlying factor that drives the price of this precious metal is supply and demand.

When there’s more supply than demand, prices fall, while more demand than supply means higher prices.

When gold prices are high, miners are eager to capitalize and increase production.

Then when prices fall, miners cut back because it’s more expensive to produce gold, reducing the world’s supply.

Also, discoveries of large deposits of the physical metal are becoming rare.

Most gold production comes from older mines, and companies must continuously invest in newer extraction methods. This puts a floor on how low prices can drop before the miners stop.

On the demand side, only 10% of this precious metal mined is used for industrial purposes, like computer chips and printed circuits.

The rest is used to make jewelry, coins, and bars. And the demand for these products depends on the mood of consumers.

When people feel that their money is losing value through rising inflation or economic uncertainty, they look to preserve their wealth by investing in tangible assets, like precious metals and fine art – driving prices up.

For example, during the pandemic, gold hit an all-time high of over $2000 per ounce in August 2020.

Then when the crisis is over, and the economy is growing again, people return to stocks and other investments, selling their precious metal holdings. This decreases demand and leads to falling prices.

Overall, gold prices have consistently trended upwards, marked by pullbacks and corrections.

And we don’t see this trend ending during our lifetime.

With less gold being discovered and higher mining costs, there’s a price at which it isn’t worth producing more – putting a bottom on its prices.

While the expanding world population continues to put pressure on our scarce resources and the global supply chain – it leads to the probability of more economic and political upheavals, and increasing the demand for precious metals.

Gold Prices in the Age of Cryptocurrency

Since the emergence of cryptocurrency, many have speculated that it will replace precious metals as the perfect hedge during times of economic crisis.

However, we don’t necessarily agree with this statement.

Yes, crypto is trendy, pushed by social media influencers like Mark Cuban, Matt Damon, and Elon Musk.

But does this flashy new instrument have the legs to last for the long term?

After all, gold has been a safe haven investment for centuries.

Let’s face it:

Most Bitcoin and Ethereum investors tend to be young, while gold investors tend to be older.

They haven’t lived through market corrections like more experienced investors and are quick to sell during times of panic.

Unlike gold, digital currency only exists online, making it vulnerable to theft and hacking.

New tokens are created as if by magic by computer programs, while gold needs to be mined and refined. However, supply needs to be artificially controlled to keep crypto prices high.

Gold has industrial and consumer demand, while Bitcoin and other digital currencies have no physical use.

In addition, precious metal companies tend to be more stable, unlike the recent slew of crypto-exchange failures that have cost investors hundreds of millions of dollars.

(FTX collapse is a recent example.)

Also, it’s estimated that just 2% of crypto investors control 92% of the available supply.

These large investors, also known as whales, can easily manipulate prices by dumping large blocks and then repurchasing them when prices fall.

And during this most recent period of rising inflation, gold has maintained its value while cryptocurrencies have declined.

Overall, based on its long-standing history, gold still seems to be the better option as a store of value, providing excellent protection against rising inflation with less volatility.

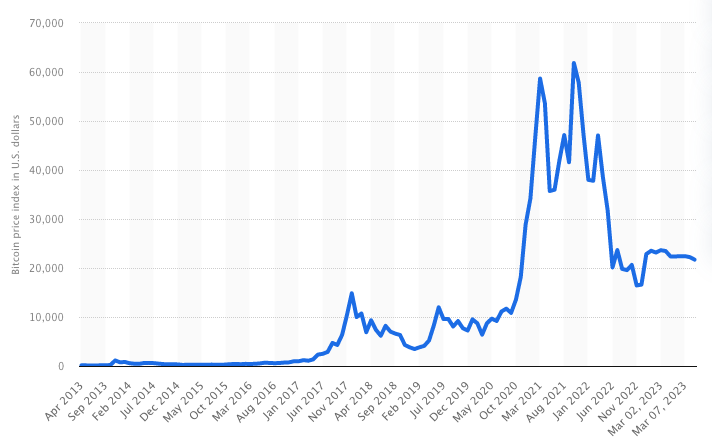

Bitcoin and the like may prove to be a good investment in the long term, but only for investors that can stomach the gut-wrenching price drops common to this financial instrument.

Have a look at this chart from Statista.com of the Bitcoin prices from 2013-2023:

I mean it’s much more volatile than you might think!

And on Seeking Alpha website, the financial blogger Jeremy Blum shared 18 reasons to choose gold and only had 6 in favor of crypto.

He also believes that, as of today, this precious metal is superior to digital currency.

Gold and Politics

Wars have been fought over it.

Civilizations have come and gone depending on their access to this precious metal.

And until 1971, when President Nixon took the US off the gold standard, all the world’s currencies were backed by it.

Not surprisingly, the US dollar, which had been declining steadily since the end of World War II, dropped sharply soon after the US left the gold standard.

But what does this have to do with the price of gold in the future?

Wouldn’t less demand by governments lead to lower prices?

Not necessarily.

A few countries are looking to create a new currency to knock the US dollar off its top spot.

These five countries are known as BRICS – Brazil, Russia, India, China, and South Africa – and they represent 40% of the world’s population.

And with the introduction of BRICS Bucks, this new currency would immediately become the world’s most powerful.

To give it instant credibility, they plan to back it using gold.

Each of these governments has been quietly stockpiling this precious metal over the past several years – especially China.

Russia is the world’s second-largest producer behind China and ahead of the US, Australia, and Canada.

However, sanctions imposed at the start of the Ukrainian Invasion have kept Russian gold from most of the world.

However, according to data released by the Chinese Ministry of Customs in January 2023, China has increased its gold purchases from Russia by 67% since the start of the war.

And since many of China’s purchases go unreported, a lot of people believe the number is much higher.

In fact, unknown or mystery buyers bought over 300 tons of gold in the third quarter of 2022 alone.

Rather than diminishing, the appetite for this precious metal by the world’s governments is growing.

And with renewed interest comes renewed demand and the possibility of higher prices in the future.

So, will the price of gold go up?

Let’s see…

Will Gold Prices Go Up Forever?

Though it will experience price swings, its upward trend appears to be intact for years to come.

And its top spot as a long-term inflation hedge remains unchallenged by newcomers.

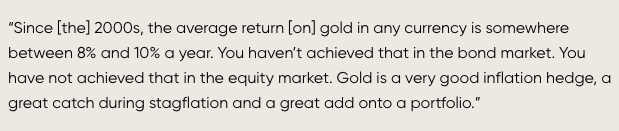

In fact, Juerg Kiener, the managing director and chief investment officer of Swiss Asia Capital, predicted that gold prices could surge to $4,000 per ounce in 2023.

He also added that:

As history has shown, gold has outlasted every other currency created by man since it was first used in ancient Egypt over 4000 years ago.

For these reasons, we believe this physical precious metal is one of the best forms of wealth protection available and the perfect legacy to leave your heirs.

After all, an ounce of gold will always be an ounce of gold. And over time, its value has only increased.

Now, we’d love to hear from YOU:

- What is your prediction? Will gold go up?

- Are you in the crypto or precious metals camp?

- What do you think about the possibility of the new BRICS currency killing the US dollar?

Share your thoughts in the comments below!