What if you could protect your retirement savings against the inflation?

What if there was a trustworthy firm that could help you diversify with gold and silver without hidden fees or commissions?

You’re in luck. There is one. It’s Augusta Precious Metals.

In this review, we want to explain why we think it’s one of the best retirement investment decisions you can make for yourself.

You’ll learn:

- What is a gold individual retirement account (IRA)

- Is Augusta Precious Metals legit?

- What makes this firm different from their competitors

- How to open your gold & silver IRA

- Fees, products, and customer reviews

- Lots more

If you’re interested in making safe and secure precious metals investments, then this Augusta Precious Metals review is for you.

Top-Rated Gold IRA Company in the US |

|

Highlights:

|

Our Rating: |

But first, let’s have a look at how gold fared historically and why people consider it a safe haven.

Why Is Buying Gold Worth It?

If you want to protect your portfolio during times of economic volatility, then diversifying with gold and silver may be the perfect solution.

After all, the world loves gold. As a result, gold and other precious metals have been a safe haven to protect wealth for centuries.

And when times get tough, people flock to safety, driving up the price of precious metals.

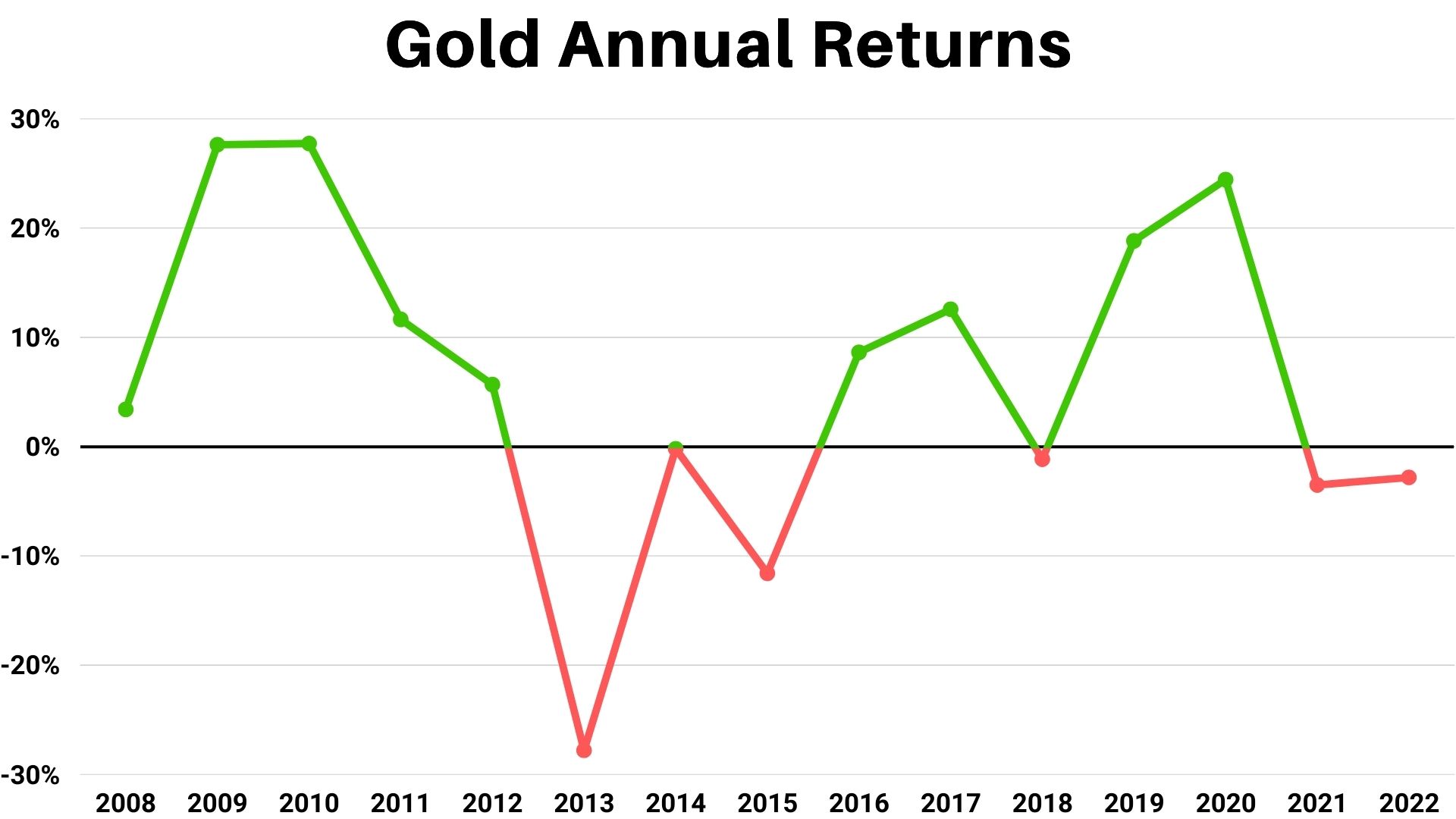

For example, take a look at the annual returns for gold since 2008.

Annual returns for gold since 2008 (data from Macrotrends.com)

As you can see from the chart above, gold performs well during times of economic uncertainty, like the Great Recession of 2008 and the COVID Pandemic in 2020.

Gold also tends to move in the opposite direction as the US dollar, making it an excellent hedge against inflation.

Even during 2022, when most other investments have taken a beating, gold has maintained its value, down only slightly through the middle of December.

And unlike other paper assets or crypto, when you own gold, you own an actual physical asset that maintains its intrinsic value.

But how can you easily and safely diversify your portfolio with gold?

Luckily, with the Taxpayer Relief Act of 1997, you can now hold physical gold and other IRS-approved precious metals in your individual retirement account.

However, you can’t set up these IRAs with a traditional custodian, like a broker. Instead, you need a firm that specializes in handling all the IRS paperwork and the actual storage for your gold and silver.

And with so many precious metal dealers online, we know it’s challenging to find a gold IRA company that you can trust with your hard-earned retirement funds.

That’s why we’ll talk in-depth about one of the largest and most-trusted gold IRA companies in the United States – Augusta Precious Metals.

This review gives you all the details about how they operate, their vision and philosophy, products, and industry and customer experiences.

We also list their pros and cons and whether it is the right gold IRA firm for you.

What Is Augusta Precious Metals?

So who is this company that Joe Montana keeps talking about?

Augusta Precious Metals is one of the largest and most reputable gold and silver providers in the US.

We’ll say more:

They are an industry-recognized PCGS (Professional Coin Grading Service) authorized dealer, who abide by the NGC’s (Numismatic Guaranty Corporation) coin grading standards.

Founded in 2012 and located in Casper, WY, Augusta Precious Metals was named “The Best Overall Gold IRA Company” by Money Magazine in 2022.

CEO Isaac Nuriani has made it his personal mission to help people understand potential retirement concerns caused by financial policies that favor big banks rather than individual investors.

(And clearly he’s doing a great job.)

Isaac launched APM to help educate retirement savers on how they can diversify their portfolios with precious metals and protect their hard-earned retirement savings.

With a strict commitment to ethics and professionalism, Augusta makes customer satisfaction its highest priority.

They aren’t just looking to sell you gold and silver but rather educate you about the benefits and risks of diversifying your portfolio with precious metals.

Every potential new customer receives a personalized call before they can open an account.

During this call, you will learn ways to diversify your portfolio to protect yourself against inflation, and what precious metals options may suit you.

This firm even offers you tips on avoiding gimmicks and high-pressure sales tactics while researching other gold IRA companies.

Augusta isn’t looking to make a quick sale but rather to build a relationship to be your precious metals provider for life.

What Is a Gold IRA?

Before we dive into our review, let’s take a quick look at what gold IRAs are.

Call Augusta Agent at (833) 989-1952 Today!

These individual retirement accounts were created with the Taxpayer Relief Act of 1997.

Under the Act, the IRS broadened the types of assets that could be held in this type of account to include physical gold, silver, platinum, and palladium, either as coins or bullion.

Since gold is the most popular of the four precious metals, these accounts are commonly referred to as gold IRAs.

Just like traditional IRAs, all increases in the value of your gold and silver are tax-deferred until you withdraw the funds from your account.

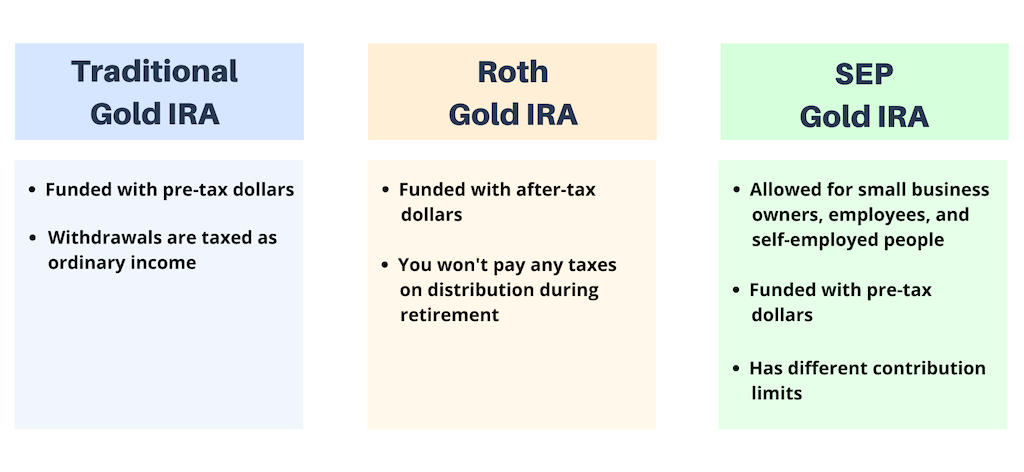

Gold IRAs come in three types:

- Roth Gold IRA (Post-Tax) – you invest with after-tax dollars, but all withdrawals during retirement are tax-free.

- Traditional Gold IRA (Pre-Taxed) – your deposits may be tax deductible, while your withdrawals during retirement will be taxed as regular income.

- SEP Gold IRA – a Simplified Employee Pension IRA that is available to small business owners, their employees, and self-employed workers.

As part of the individual retirement account, you must store your physical gold at an IRS-approved facility, like a bank or depository.

You can’t take actual possession of your gold, or it will be treated as a withdrawal under IRS rules and may be subject to penalties.

==> Get your FREE Gold IRA Guide to learn more.

How Is Augusta Different from Other Gold IRA Companies?

Is Augusta Precious Metals legit? What makes it unique?

One thing for certain is that Augusta is NOT a scam. Quite the opposite.

This firm is committed to transparency, simplicity, and excellent customer service before, during, and after your purchase.

Unlike other companies that just sell gold and silver, this precious metals provider offers account lifetime support for all customers.

Their experienced analytics team is always available to provide detailed information other companies can’t or aren’t willing to provide.

In addition, they are committed to helping you diversify with gold and silver, both now and in the future.

With Augusta Precious Metals, you get peace of mind knowing that their agents are always there for you, even after your transaction is complete.

1) Augusta’s Award-Winning Customer Service

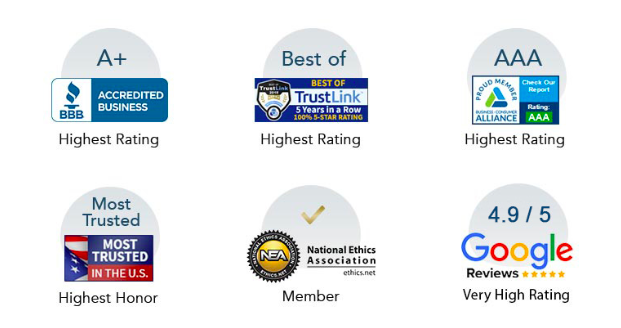

Augusta holds the top spot as the “Most-Trusted Gold IRA Company in the United States” with IRAGoldAdvisor.com for its excellent verified customer reviews, transparency, customer service, and great value.

Money Magazine named Augusta Precious Metals the “Best Overall Gold IRA Company” for 2022.

On top of that, Augusta has received two Stevie Awards for excellent Customer Service Success and Sales Distinction of the Year.

Judged by the most respected executives, educators, entrepreneurs, and innovators, these awards are some of the most coveted business awards in the world.

2) Excellent Customer Reviews

The commitment to customer service and transparency is reflected in Augusta Precious Metals’ excellent customer reviews.

Check them out…

- Better Business Bureau: 4.97/5.0 with over 100 reviews

- TrustLink: perfect 5.0 rating based on 278 reviews

- Consumer Affairs: 4.9/5.0 rating based on 129 reviews

- Business Consumer Alliance: AAA based on 85 reviews

- Google Reviews: 4.9/5.0 based on 221 reviews

In the majority of reviews, customers state that Augusta reps went above and beyond to make sure that all their questions were answered and that they never felt pressured to buy.

3) Augusta’s Gold Buy-Back Program

This program makes it easy if you decide to sell your investment in the future. Though Augusta can’t guarantee they’ll always buy back your gold, they haven’t turned anyone down yet.

And often, their buy-back prices are fair and competitive.

Plus, you won’t have the inconvenience of finding a buyer, confirming that you’re getting the best price, and arranging the transfer of the actual gold and silver.

With Augusta’s Gold Buy-Back Program, you have peace of mind that if you need to sell your gold or silver quickly, you’ll have a trustworthy buyer.

==> Request your Free Gold IRA Company Checklist here.

How to Open an Account with Augusta?

Augusta Precious Metals makes it easy to open a gold individual retirement account.

They’ve made the process simple and straightforward.

First, you’ll learn all about investing in a Gold IRA with your free web conference call with one of their experienced agents.

You can call them at (833) 989-1952.

They’ll ensure you understand the benefits and risks of investing in precious metals before you open an account.

Once you’re ready to proceed, Augusta will work with you to open your self-directed IRA with Equity Trust. They handle 95% of the paperwork and are with you every step of the way.

Once approved, your account is ready for funding.

This firm will help with all the paperwork to roll over funds from an existing IRA or retirement account.

Now that you’re ready to buy, Augusta’s order desk will go over all your options that best meet your personal financial goals, whether gold, silver, or a combination of the two.

(The process is completely transparent, and there are no hidden costs or fees.)

Just so you know, Augusta Precious Metals doesn’t accept online orders.

Instead, all orders will be confirmed by the confirmation department on a recorded phone line providing an extra layer of security.

After the purchase, the company will send your metals to the appropriate IRS-approved depository.

Though you can’t take actual possession, you can make arrangements to visit the depository to inspect your gold and silver purchases.

As a customer, you gain access to Augusta’s award-winning account lifetime support.

This means that for the life of your account, APM’s team of professionals is there for you to answer questions, help with future orders, and provide trustworthy financial advice.

Is There a Minimum Order Amount?

Augusta Precious Metals requires a minimum order of $50,000 for any purchase, whether for an IRA or cash account.

You can reach this amount using any combination of products offered – gold, silver, or a combination of both.

They don’t have a maximum order size. So even if you want to purchase a large quantity of gold and silver, this firm can fulfill your needs.

Augusta Precious Metals Fees

So, what fees does Augusta Precious Metals charge?

When you open a gold IRA with this provider, you incur a one-time setup fee and recurring annual fees.

Setup Fee (One-Time)

- Custodian application fee: $50

- Custodian annual fee (1st year): $100

- Sample depository storage fee (1st year): $100

- Total setup fee: $250

Recurring Annual Fee

- Custodian annual fee: $100

- Sample annual storage fee: $100

- Total recurring annual fees: $200

Please note that these fees are for the IRA custodian and the depository. Augusta doesn’t charge any management fees.

As it has been mentioned already, Augusta is transparent about the costs, fees, transaction statuses.

They have no hidden fees or commissions.

The price quoted by the order desk when you place your order is the exact price you’ll pay.

Is My Augusta Gold IRA Safe?

You may have wondered:

- Is Augusta Precious Metals a good investment?

- Where will Augusta Precious Metals store my gold?

- Is my gold individual retirement account safe with them?

To answer your questions, this firm makes sure that you can rest easy knowing that your gold and silver investment is safe and secure.

First, their preferred IRA custodian is Equity Trust.

Equity Trust has over 45 years of experience as a self-directed IRA custodian. They serve customers in all 50 states and have over $34 billion in assets.

Augusta will act as your liaison with Equity Trust. Still, you can contact Equity Trust directly and will always have complete control over your investments.

For storage, Augusta has contracted with Delaware Depository.

This depository is IRS-compliant, serves the CME (Chicago Mercantile Exchange) and ICE (Intercontinental Exchange), and specializes in precious metal storage.

Or you can choose from one of their other approved storage facilities:

- Los Angeles, CA

- Nampa, ID

- Salt Lake City, UT

- Dallas, TX

- Las Vegas, NV

- Shriner, TX

- South Fargo, ND

- Bridgewater, MA

- New Castle, DE

- New York, NY

In addition to the physical security provided by the depository, your gold and silver investment is protected by a $1 billion all-risk insurance policy provided by Lloyd’s of London.

What Products Does Augusta Offer?

Augusta Precious Metals offers some of the world’s purest gold and silver bullion coins and bars.

Gold Products

- Gold Bars – 10oz and 1 oz

- Gold American Eagle Coins – 1 oz, 0.5 oz, 0.25 oz, and 0.1 oz

- Gold American Buffalo Coin – 1 oz

- Gold Canadian Mapleleaf Coin – 1 oz

- Gold Austria Philharmonic Coin – 1 oz

- Gold South African Krugerrand Coin – 1 oz

- Special and Limited Edition Premium Gold Coins – check for availability, as many popular coins sell out quickly

Silver Products

- Silver Bars – 100 oz and 10 oz

- American Silver Eagle Coin – 1 oz

- America the Beautiful Coins – 5 oz

- Canadian Silver Maple Leaf Coin – 1 oz

- Austrian Philharmonic Silver Coin – 1 oz

- Silver Rounds – 1 oz

- Canadian Silver 5 Blessings – 1 oz

- Bags of silver rounds at $1000, $500, $250, and $100 face values

- Unique and Limited Premium Silver Coins – check for availability

The cost of the actual precious metals you buy varies based on current gold and silver spot prices and market rates for premium coins.

Is It Better to Buy Gold Coins or Bars?

We all know that gold coins hold their value, but what exactly do you choose for your account: coins or bars?

Simply put:

Gold coins are the best option if you want convenience and flexibility when diversifying your portfolio with gold.

Gold bars are better if you want to make a more significant investment and want to avoid paying the higher mark-ups associated with premium gold coins.

Now, let’s talk about the pros and cons of opening an account with Augusta Gold IRA company.

Augusta Precious Metals: Pros & Cons

Reasons to invest:

- Professional Coin Grading Service authorized dealer

- Abide by the NGC’s coin grading standards

- Excellent customer support

- A+ rating by the Better Business Bureau

- 5-star rating on TrustLink

- Competitive order pricing

- 7-day return policy for first-time buyers

- Low one-time and annual maintenance fees for IRA accounts

- Extensive free education

- No high-pressure sales tactics

- Named “Best Overall Gold IRA Company of 2022” by Money Magazine

- 2 Stevie Awards for Customer Service Success and Sales Distinction of the Year

- Account lifetime support

- No hidden fees or commissions

Reasons to avoid:

- The minimum order size of $50,000 may be high for some investors.

- Higher mark-ups on premium coins

Generally speaking, there aren’t many many gold-backed IRA cons.

In this particular case, however, you just need to be aware of the minimum investment amount and higher mark ups on some of the coins.

Who Should Open a Gold IRA at Augusta?

Augusta Precious Metals is the right gold IRA company for investors who:

- Are looking to diversify their portfolio with gold or silver but still have questions

- Don’t want to feel pressured to make a decision

- Are looking for help through every step in the process

- Desire a long-term relationship with the company

- Want a process that is simple, transparent, and straightforward

- Have at least $50,000 to roll over or invest

If this is you, then start by grabbing your FREE Gold IRA guide here.

Augusta Precious Metals: Final Thoughts

To summarize this Augusta gold IRA review…

If you’re looking to diversify your portfolio with gold and silver but still have questions, then APM is the right choice for you.

This firm prides itself on its award-winning customer service.

Their experienced agents will take the time to ensure you understand all the benefits and risks of diversifying with gold and silver. Plus, you’ll never feel pressured to buy.

They’ll even help you identify and avoid other firms’ gimmicks and high-pressure sales tactics, so you can safely explore your options without worry.

Then when you’re ready to open an account, their professional staff will handle all the details making the process quick, easy, and painless.

And with their account lifetime customer support, you’ll rest easy knowing that you’ll always have a professional to turn to when you have questions or concerns about your investment.

So if you’re ready to diversify your portfolio with precious metals or still have questions, give Augusta a call at (833) 989-1952 today.

We also recommend that you download the free Gold IRA guide and/or register for the free web conference for further details.

You’ll be glad you did.

Now, we’d like to hear from YOU:

- Your opinion on Augusta Precious Metals reviews?

- Are there any Augusta Precious Metals complaints you have?

- Any other Gold IRA company reviews you want us to cover?

Share your thoughts and experience in the comments below!