Let’s face it:

People often turn to physical precious metals in times of economic uncertainty.

With rising concerns about a potential recession and higher inflation, gold and silver may be the smart choice for investors this year.

But maybe you heard that the US government once confiscated all privately held gold in the country, making it illegal to own this precious metal.

Is it a rumor? More importantly, could they do it again?

Today we’ll set the record straight. You’ll find out…

- How much gold can a private citizen own?

- Does the government track your precious metal purchases?

- Can you store and sell it anonymously?

- And lots more

Without further ado, let’s get started.

Can a US Citizen Own Gold?

Though the answer seems perfectly obvious today, just 50 years ago, that wasn’t the case.

In 1933, during the Great Depression, the US government began to restrict private gold ownership.

The following year, President Roosevelt signed the Gold Reserve Act of 1934.

This is when the United States abandoned the gold standard.

This Act transferred all ownership of gold by individuals or institutions to the US Treasury in exchange for dollars.

On top of that, it regulated the use, acquisition, transportation, importing, exporting, and possession of gold.

For example, gold coins were prohibited, and all monetary gold had to be held in the form of bars.

These regulations stood until Congress passed and President Ford signed into law legislation once again permitting private gold ownership in the US, effective January 1st, 1975.

Since then, fellow Americans can freely hold gold and other precious metals without any licensing requirements or restrictions.

Now, what about the amount limits?

How Much Gold Can a US Citizen Own?

Throughout history, governments have attempted to restrict or prohibit gold ownership.

So it’s natural to wonder how much gold does the average person own and if there are any limitations today.

For example, India seized all private gold holdings and required citizens to exchange them for paper currency in 1966.

And in 1979, Iran did the same thing to avoid an economic collapse.

Many European governments confiscated private holdings during World War II to fund the war effort. Even the US prohibited individuals from owning any amount of gold from 1934 until 1975.

However, today with our global economy, you would be hard-pressed to find any governments that impose restrictions on gold ownership.

In the US, you can own as much gold as you want, limited only by your budget and common sense.

How Much Gold Bullion Can You Have?

Today, demand is at its highest level since 2011, and central banks are the biggest buyers.

They purchased 1136 tons in 2022, worth an estimated $70 billion. This amount is the largest in a single year since they started keeping records in the 1950s.

This record level reflects a 180-degree policy change from when governments sold millions of tons of this precious metal during the 90s and early 2000s.

And it seems like everyone is jumping on the gold bandwagon.

So if you’re looking to increase your holdings, no worries. Whether you hold coins or bars, the government has no restrictions or limitations on the amount of gold bullion you can own.

How Much Gold Can You Own Without Reporting It?

No matter the amount, gold purchases are considered private and confidential and are not reported to any state, local, or federal government agencies.

The only exception is a cash purchase.

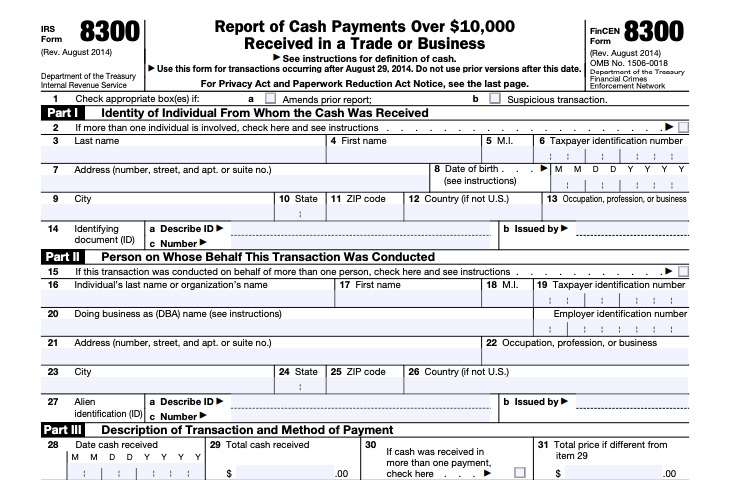

If you buy gold with cash or a cash equivalent (like multiple money orders or cashier’s checks totaling $10K or more), the dealer must file form 8300 with the IRS.

It includes information on both the buyer and seller and was created as part of the Patriot Act to curb illegal money laundering and drug dealers.

The IRS Requirements When You SELL Gold

Now…

If you sell your precious metals, is that reported to the government?

Does gold selling count as income?

Though there are no reporting requirements for gold purchases, sales need to be reported on Schedule D of your tax returns, just like any other investment sale.

You may be subject to long or short-term capital gains tax depending on how long you held it.

Also, certain gold coins fall under the Broker Reporting Act of 1982.

Therefore, form 1099-B must be filed with the IRS for any sale of South African Krugerrands, Canadian Maple Leafs, or Mexican Gold Onzas in quantities of 25 ounces or more.

Does the Government Track Gold Purchases?

Contrary to some conspiracy theories, the government isn’t interested in how much gold you own.

No state, local, or federal regulations require that your gold purchase be reported or registered when using single checks or a bank wire.

For many investors, this confidentiality is one of the top advantages of diversifying with this precious metal.

There are, however, there are instances where a reporting requirement will be triggered.

If you’d like to learn more about that, check out our separate post on governmental reporting requirements here.

Is There a US Customs Tax on Gold?

If you like or want to travel with gold, you may wonder:

- How much gold can you bring into the United States?

- Is there a tax on bringing your precious metals?

You can bring gold coins, medals, and bullion into the United States. However, regulations prohibit entry of any items originating or bought from Cuba, Iran, or Sudan.

Regardless of the amount, no duty tax is owed when bringing bullion into the US.

However, you must declare these items to Customs and complete a FINCEN 105 form at the time of entry for any monetary instruments worth over $10,000, including currencies and gold coins.

If you’re not sure about the value, it’s best to declare to avoid any penalties for making a false declaration.

Can You Sell Gold Anonymously?

Let’s say you want to sell your precious metals without disclosing your identity.

Unfortunately, in this case, your options are severely limited.

In the US, the law requires that all pawnshops and dealers keep a copy of the seller’s government-issued identification whenever they purchase gold from a private party.

This copy is saved as part of the sale and must be provided to authorities if asked for.

But don’t take it personally. Asking for your ID helps cut down on the sale of stolen goods.

Also, in the event of an illegal transaction, it makes it easier for the police to track down the suspects.

Instead of working with a company, you could deal directly with a private party and avoid providing your ID for amounts less than $10,000 in cash.

But remember, if it’s over $10K, the sale must be reported on form 8300, or you’re breaking the law.

If you do decide to go this route, beware of rogue buyers.

These buyers come into a city and run ads offering high prices for your gold – no questions asked. Since they usually operate out of a hotel ballroom, they’re also known as hotel or pop-up buyers.

They won’t ask for your ID. However, after buying, they’re gone as fast as they came, promising payments that never materialize.

Or at prices that are less than half the value of your precious metals.

So before meeting with any buyer, ensure you have a good idea of how much your gold is worth.

Also, if dealing with a private company, check with the Better Business Bureau to see if any complaints have been filed against them.

(We also do a lot of reviews here at Gold & Silver Central channel, so be sure to subscribe!)

Where Can You Store Gold Anonymously?

Unless you keep your gold at home, you’ll need to provide identification when applying for a safe deposit box or opening an account at a depository.

But if you’re willing to take a little trip, you’ll find a country high in the Alps that offers complete secrecy when it comes to storing your gold investments.

And no, it’s not Switzerland.

Austria is one of the only countries where you can still store your gold anonymously.

The country boasts several private vaults featuring state-of-the-art security that won’t ask for your ID, including the well-known Das Safe.

But anonymity doesn’t come cheap. You’ll pay a heft premium for this level of secrecy.

Not to mention, you need to take a plane ride across the Atlantic whenever you want to see your precious metals.

Should You Invest In Gold Today?

Look:

Since the government made gold ownership legal again in the 70s, gold prices have steadily risen.

With no limits on how much gold you can own as an American citizen, and considering the economic turmoil, now may be the best time to invest in it.

(Especially with a Gold IRA account.)

If you’re considering diversifying your current portfolio with alternative investments, call Augusta Precious Metals team at 833-989-1952.

Named the Best Overall Gold IRA Company by Money Magazine in 2022 and 2023, their representatives will answer your questions without any pressure to buy.

They even provide free guides on how to avoid gimmicks and high-pressure sales tactics used by other companies in this industry.

After all, don’t you deserve to work with the best when it comes to your retirement?