How do you know if a gold dealer is reputable?

What makes a good gold IRA company?

After all, diversifying with precious metals is a great way to protect your hard-earned retirement savings from the ravages of inflation.

However, it seems like everyone has an opinion about who’s the best.

And with so many choices, knowing who you can trust isn’t easy.

That’s why today, we’ll share what to look for in a gold IRA company with specific examples.

We’ll talk about the criteria we use to find the most reliable organizations, and you’ll see why they’re considered the best.

We’ll also provide a great place to start if you’re considering diversifying with precious metals.

By the end of this guide, you’ll have all the information necessary to reliably judge a firm on its merits rather than trusting someone else’s opinion – including ours.

So let’s take a few quick minutes to discover what it takes to be one of the best.

Independent Reviews

What’s the number one trait that all the top organizations share?

Great customer reviews.

And we’re not just talking about their website but verified reviews provided by third-party consumer watchdog sites.

What others say about working with a company tells us a lot about how they do business.

Ideally, we want to see all positive reviews; however, a few negative reviews or customer complaints doesn’t mean they aren’t trustworthy.

Negative experiences can often arise from situations outside of a firm’s control, such as shipping issues during the COVID pandemic.

But how they respond speaks volumes about their values. Do they pass the buck or take ownership of the problem?

The best companies quickly apologize for any misunderstanding and then work diligently to resolve the issue to the customer’s satisfaction.

As you conduct your research, the top independent review sites to investigate are:

Both the BBB and BCA provide corporate ratings and an average customer review rating, while Trustlink and TrustPilot give an average rating based on customer reviews.

The best will have close to a 5-star customer review rating across multiple platforms with few to no complaints.

For example, Augusta Precious Metals holds the top rating provided by the BBB and BCA, with nearly a 5-star average review rating on both platforms and zero complaints.

Pretty impressive.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

On the other hand, if you see numerous negative reviews and complaints with little to no response from the company, it’s best to avoid doing business with them.

Experience

Next up, experience, and no, we’re not just talking about how long they’ve been in business, though that’s important.

We’re talking about management experience.

The best gold companies will have a solid senior management team with extensive experience in capital markets, precious metals, and IRA investing.

This information should be readily available on their website.

You can then do a quick Google search on the key players to confirm their backgrounds independently.

Also, how long have they been in business?

Ideally, you want a firm that’s weathered one or two down cycles to see they have staying power and won’t disappear at the first sign of trouble.

And finally, look at their mission statement – it will give you insight into the company’s priorities. For example, do they value customer education over making sales?

Gold IRA Fees

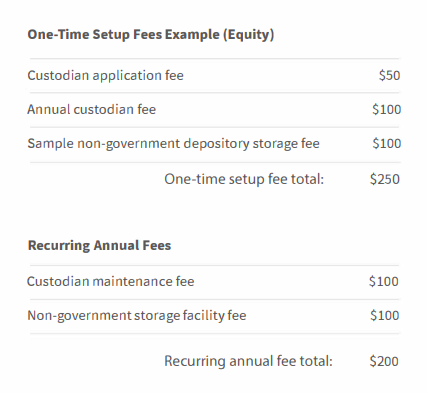

Gold IRAs come with two fees not generally found with traditional accounts – custodian and storage.

However, the top firms work hard to offer competitive prices while providing superior customer service.

So how much are gold IRA custodian fees?

On average, custodian fees run between $100 to $300 a year.

Storage fees usually start around $100 a year for non-segregated storage or $150 for segregated storage.

However, they may be higher depending on the pricing structure.

Some may charge a flat fee for these services, while others use variable pricing based on a percentage of the value of your account.

Regardless, no matter the form, the best will have competitive prices that fall towards the lower end of this range.

These fees should be readily available, and representatives should take the time to answer your questions before you open an account.

The top firms know that they are a normal part of doing business and will be upfront about what it costs to open and maintain a precious metals IRA.

Also, keep in mind that some companies may waive these costs for qualified purchases.

For example, Red Rock Secured states that over 90% of their customers qualify for their “no-fee-for-life” program.

Now…

If you reach out to a business of your choice and their representative glosses over or seems reluctant to answer questions about their pricing structure, consider it a red flag that you’d be better off looking elsewhere.

Education

The best companies make educating their customers their number one priority.

And to achieve this goal, they make sizeable investments to provide a top-notch library of educational resources.

For example, Augusta Precious Metals has a dedicated Director of Education, Harvard-trained economic analyst Devlyn Steele, with decades of experience in the capital markets.

Mr. Steele is tasked with providing Augusta customers with the best information available in the marketplace.

How this information is presented can vary.

Some may offer videos, while others maintain an up-to-date blog. Many also offer an easy sign-up so you can stay informed of changes in the precious metals markets.

Besides covering precious metal investing, they’ll talk about other important topics, such as retirement, social security, IRA account options, inflation, and the economy.

No matter how it’s presented, the common factor is that this information is relevant, unbiased, and accessible.

That way, you can decide for yourself if diversifying with these alternative investments makes sense.

Speaking of which…

Request your FREE “Ultimate Guide to Gold IRAs” here.

Precious Metals IRA Assistance

The best firms make opening an account easy.

Their dedicated IRA specialists will answer your questions without any pressure to buy.

And when you’re ready, they’ll walk you through the entire process and be with you every step of the way.

Opening a gold IRA takes four simple steps:

1. Decide if diversifying with gold and silver is right for you.

Only you can make the final decision, but the best companies will help you by covering not just the benefits but also the risks of diversifying with precious metals.

2. Open your account.

The top firms work with trustworthy custodians that specialize in precious metals IRAs.

Their specialists will explain the process, help with the paperwork, and act as your liaison to quickly get your account opened.

3. Fund your new account.

Next, they’ll assist you with any transfers or rollovers from an existing retirement plan, whether a 401K or traditional IRA.

4. Purchase your metals.

Now that your account is funded, their order specialists will help you select the best precious metals based on your financial situation.

And since you can’t take possession of your physical metals, they will insure and ship them to an approved IRS depository where you can arrange to see your goods in person.

Products

Regarding gold and silver, quality is more important than quantity.

Therefore, the top gold IRA firms work with reputable mints worldwide to ensure that their precious metals meet the strict standards imposed by the IRS.

They’ll offer a variety of products to meet your needs, whether it’s popular coins or high-quality bullion.

And unlike many dealers that leave it up to you to decide which metals to buy, their specialists will take the time to answer your questions about your various options available and what you can diversify with.

Buyback Programs

So what’s a buyback program, and why is it important?

A buyback is when the company that sells you your precious metals will repurchase them from you if you ever decide to sell them in the future.

This eliminates the hassle of having to find a buyer on your own. Instead, they will act as the buyer and handle all the details.

Top firms will clearly explain the terms of their programs.

Some may offer price guarantees like Goldco, while others may state that prices will be fair and competitive.

No matter what the form, a buyback program provides peace of mind should your circumstances change.

Competitive Pricing

Competitive pricing doesn’t mean the lowest.

If it seems too good to be true, it probably is.

A common tactic used by unscrupulous dealers is to lure you in by offering super low prices but then charging outrageous shipping fees that double or triple the cost of your purchase.

The top companies are upfront about all pricing, including shipping and insuring your metals.

Plus, they’ll make sure you understand the entire order process, including how to lock in your final price and confirm your order.

Usually, you’ll work directly with an order specialist on a recorded phone line for added security and to minimize the chances of misunderstandings or errors that can happen when using an online order system.

Also, remember that there’s a difference between the spot and retail prices for precious metals.

This difference is known as the premium, the cost to convert raw gold and silver into refined bullion and coins.

The bottom line:

The best firms provide transparent pricing so you can determine for yourself if the price you’re paying, including shipping, is competitive.

Customer Service

Nothing is more frustrating than not being able to get your questions answered.

Or leaving a message and never hearing back.

That’s why the best IRA gold companies focus on providing excellent customer service.

Whether you wish to talk with a representative via a 1-800 number or converse using an online chat, they make it easy to get the information you want.

In addition, all the best offer email support and will quickly respond to inquiries.

And with the very best firms, customer service doesn’t end once you make your purchase.

For example, Augusta Precious Metals provides customer service for the life of your account. That way, you always have someone to turn to, no matter what the future brings.

In Summary

So now that you know what to look for in a gold IRA company, you can stop listening to others and start making your own decisions.

And by sticking to firms that exhibit these traits, you can avoid falling prey to online scams.

Remember that no organization can be everything to everyone.

What’s important is to find a company that best meets your needs, and a great place to start is with Augusta Precious Metals.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Why is it our #1 recommendation, you may ask?

Named Best Overall Gold IRA Company by Money Magazine for 2022 and 2023, they offer the best education and white-glove treatment.

They have zero complaints and nearly flawless customer reviews across multiple independent review sites.

Augusta’s representatives will be with you every step of the way, making opening a Gold IRA account an easy and painless process.

Plus, they offer “Account Lifetime Support” for all their customers.

But don’t just take our word for it.

Instead, use what you learned today and put Augusta Precious Metals company to the test. You won’t be disappointed.