Let’s face it:

Reaching your 70s doesn’t have the same stigma as it had 50 years ago.

One of the burning questions today’s seniors have is how do you structure a retirement portfolio effectively?

And that’s exactly what we’re going to discuss here.

We’ll share the best investment portfolio for 70-year-olds and tips you can use today that make achieving your financial goals easier than ever.

Specifically you’ll learn…

- 4 approaches to portfolios for this age group

- safe and alternative investment opportunities to consider

- why diversifying with gold this year is worth it

As well as our answers to your commonly asked questions!

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

Balance Between Safety and Growth

Look:

With medical advances, Americans are living longer and healthier lives.

In fact, according to Social Security Administration’s life expectancy calculator, once you reach 70, a woman can expect to live another 17 years and a man another 14.

And while some seniors may decide to continue working, at least part-time, for many, this is a period of discovery, free from job and commute stresses.

I saw this with my parents.

After spending most of their lives on the corporate treadmill, they finally had the freedom to travel, explore new hobbies, and enjoy themselves with their grandkids.

And as you transition into this new age, now is the perfect time to revisit your portfolio.

While you may want to move to less risky assets, you also need to ensure that you still have enough to keep growing your investments.

The key is to strike a balance between safety and growth.

And since rising inflation can be a portfolio killer, it’s essential that you include those that can protect your savings from its adverse effects.

The 4 Investment Portfolio Types

So…

What is a good asset allocation for a 70 year old?

There are four approaches to portfolios once you reach this age:

- conservative

- income

- inheritance

- aggressive

The goal is to create a plan that matches your risk tolerance and financial goals. That way, you can stick to it no matter what the market throws at you.

After all, what good is an aggressive portfolio if you can’t stomach the ups and downs?

Before diving into the specifics, let’s cover some crucial first steps you need to take.

First, analyze your income and spending and identify gaps where you’ll need to access your funds.

Then, place a year’s worth of those expenses in a safe, liquid investment, like a high-yield savings account or money market.

The peak-to-peak recovery period for a diversified stock portfolio has been three and half years from the 1960s to today.

So, you might want to maintain an additional two to four years of living expenses in short-term, secure tools like bonds and CDs.

That way, you won’t have to sell stocks or other assets during a market downturn if you need cash.

Once you cover your near-term living expenses, it’s time to decide what to do with the rest of your retirement savings.

With this covered, let’s move on to the best investment portfolios for a 70-year-old.

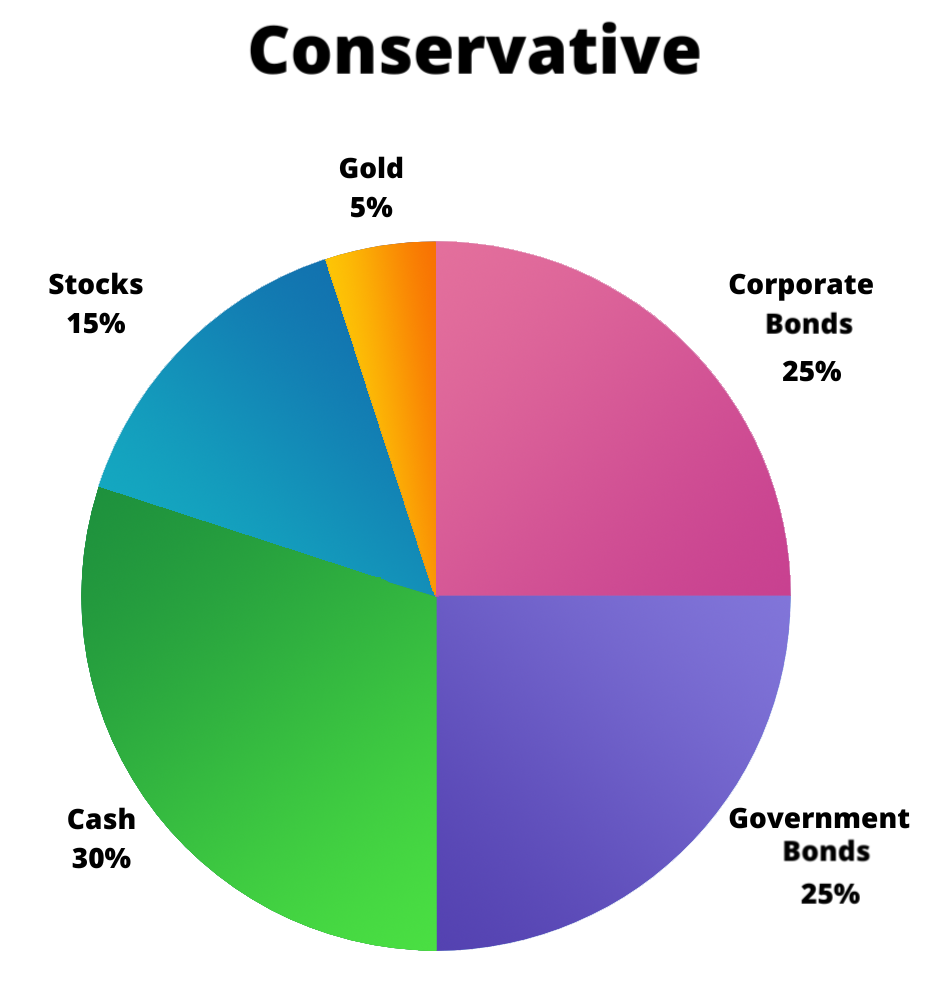

Approach #1: Conservative Portfolio

This one emphasizes capital preservation rather than growth.

As a result, it’s perfect for those that want to avoid a lot of volatility while still providing wealth-appreciation opportunities.

It looks like this:

- 25% high-quality corporate bonds and mutual funds

- 25% government bonds and mutual funds

- 30% cash and other liquid secure investments

- 15% dividend-paying stocks and mutual funds

- 5% gold and other aggressive assets

Approach #2: Income Portfolio

As the name suggests, it provides a reliable source of income.

It is perfect for seniors relying on their retirement funds to cover their living expenses.

It looks like this:

- 40% high-quality corp and gov bonds or mutual funds

- 30% fixed annuities

- 20% cash and other safe investments

- 10% dividend-paying stocks and mutual funds

Approach #3: Inheritance Portfolio

While not the most common one, it does take place.

This is for you if you don’t need to generate extra income and want to maximize your legacy to your heirs.

It looks like this:

- 30% high-quality corp and gov bonds or mutual funds

- 20% cash and other safe investments

- 30% dividend-paying shares and mutual funds

- 10% growth stocks and mutual funds

- 10% gold and other aggressive assets

Approach #4: Aggressive Portfolio

This one is for those looking to maximize their growth while still providing enough safety and security to weather market downturns.

If we’re talking about aggressive portfolio specifically for 70 year-olds, then it’ll look like this:

- 20% high-quality corp and gov bonds or mutual funds

- 20% cash and other safe investments

- 25% dividend-paying shares and mutual funds

- 25% growth stocks and mutual funds

- 10% gold and other aggressive assets

PRO TIP: Readjust your portfolio at the beginning of each year to keep your percentages in line and smooth out your returns.

Pay Off Debt for Big Returns

According to the Federal Reserve, the typical 70-year-old has $105,000 in debt, including home equity loans, mortgages, credit cards, and student loans.

Those monthly payments can seriously impact your quality of life during retirement.

By settling these debts, you not only get an immediate return equal to the interest rate you were paying, but you free up cash flow by reducing your monthly instalments.

Though some advisors recommend dealing with loans with a higher rate first, we find that there’s a better strategy that’s easy to follow:

Pay off the loan or credit card that has the lowest balance first. Then, add what you were paying on that debt to the next lowest. Keep doing this until all your loans are paid.

This was my approach in my late 20s.

And in my experience, once you start doing this, you’ll build momentum, making it easier to keep going until you’re debt free.

Six Safest Investments for Seniors

Safe investments are the cornerstone of any good portfolio.

Though they don’t have the higher returns of riskier assets, you don’t have to worry about losses during market downturns.

But what are the safest investments for seniors?

1. High-Yield Savings Accounts

Many offer higher rates than traditional CDs but without the penalties if you need to access your cash early. Your principal is protected by up to $250,000 in FDIC insurance.

Check with online banks for the best deals.

And if you have more than $250,000 to invest, consider spreading your accounts among several banks.

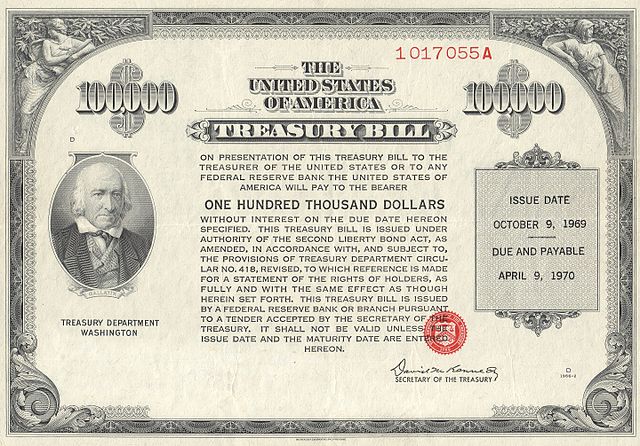

2. Treasury Bills

T-bills are considered one of the safest instruments because they are backed by the US government.

In addition, they have a maturity date of one year or less, so your cash isn’t tied up for the long term.

However, they don’t provide the same liquidity as high-yield savings or money market accounts.

3. Series 1 Savings Bonds

These low-risk government bonds adjust for inflation. You can buy them directly from treasurydirect.gov.

They provide a fixed rate of return and a payment adjustment every six months based on inflation.

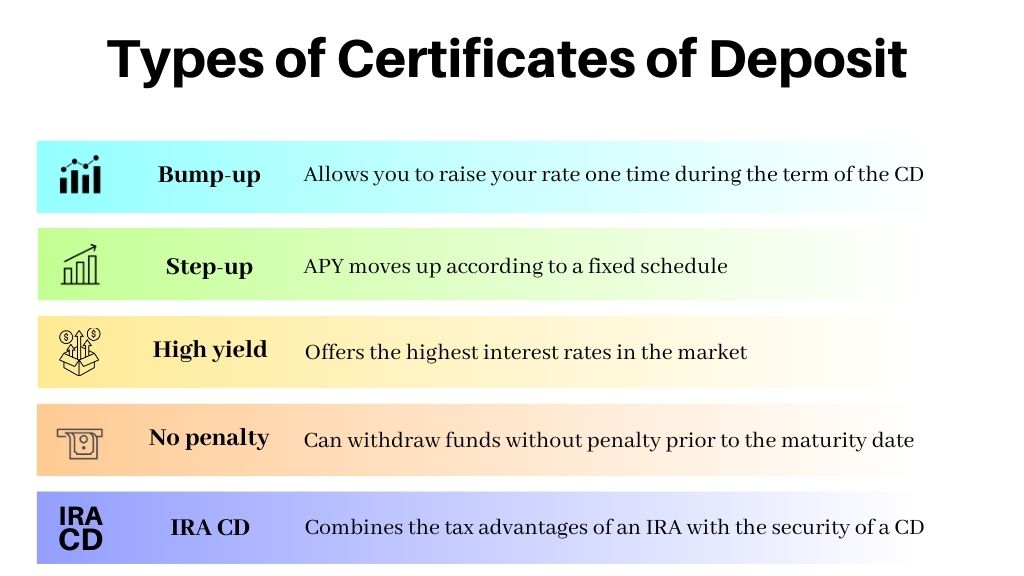

4. Certificates of Deposit (CD)

When you buy a CD, you invest a lump sum of money with a bank for a set period.

Timeframes can vary – the longer, the better the rate.

However, there’s a penalty if you take your funds early. All CDs are fully insured by the FDIC up to $250,000.

5. Fixed Annuities

Don’t want to worry about market ups and downs? Consider a fixed annuity.

When you buy an annuity, you trade a lump sum of money for guaranteed lifetime monthly payments.

Offered by insurance companies, they can be an excellent option to make up for cash flow shortages.

But be sure you do your homework as terms and conditions vary by company.

6. Money Market Accounts

Like CDs, they pay a fixed interest rate and are backed with FDIC insurance.

However, the advantage is that you can access your funds at any time without penalty.

Check out our in-depth guide on the safest IRA investments.

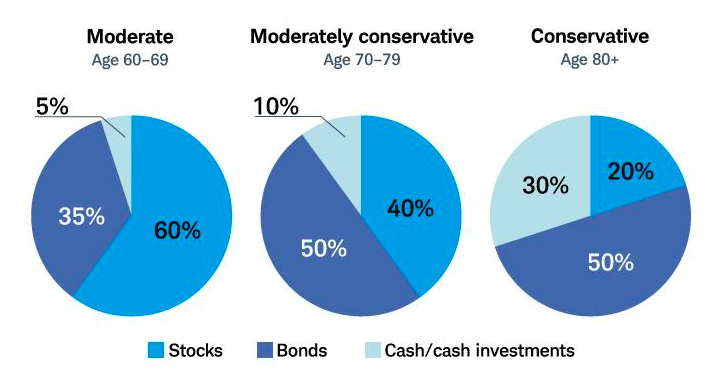

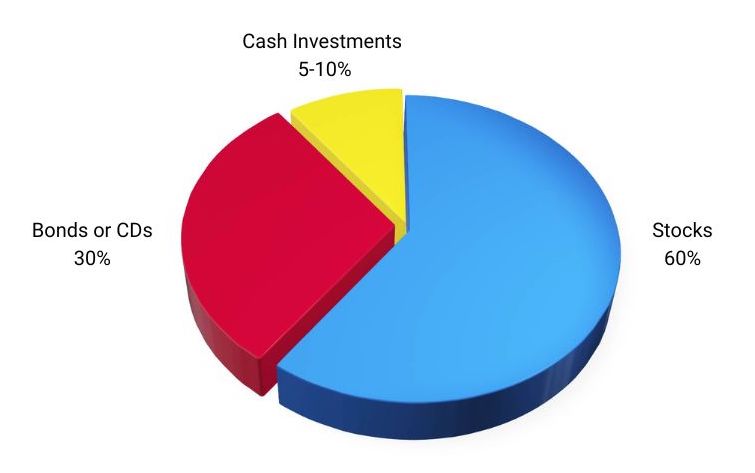

Percentage of Stocks for 70-Year-Olds

Now…

I’m certain most of you have or are considering stocks as part of your overall investment strategy.

But what percentage of stocks should a 70-year-old have?

Most financial advisors recommend subtracting your age from 100 to determine the percentage of stocks in your portfolio.

(This is known as the Rule of 100.)

For example, if you’re 70, you should keep 30% of your portfolio in shares.

However, with Americans living longer and enjoying a more active retirement, most advisors suggest increasing the rule to 110 or 120.

This means at 70, you can have up to 50% of your portfolio in stocks.

You might want to get blue-chip dividend-paying shares or mutual funds.

However, if you want bigger returns and can stomach the risk, you can include growth stocks as part of your allocation.

Include Gold in Your Portfolio

You should absolutely consider including gold and other precious metals in your overall portfolio.

The truth is:

This shiny metal offers benefits you won’t get with other resources, like stocks and bonds.

Over the long term, gold prices have consistently outpaced the rate of inflation, protecting the value of your retirement funds.

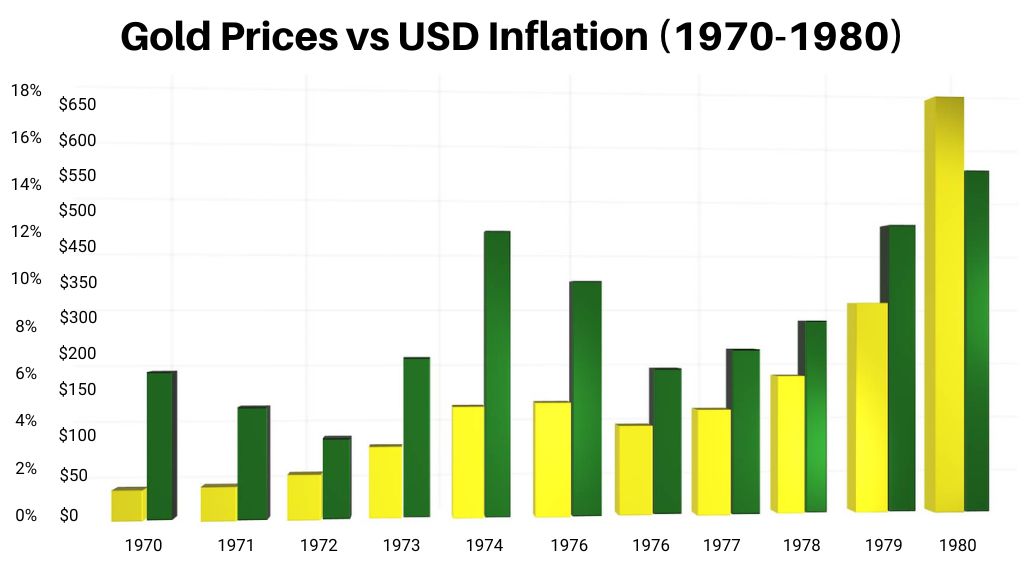

The Great Inflation of the 1970s is a good historical proof of that:

Since it’s a physical asset, it can’t be hacked or stolen online.

And prices tend to soar during periods of economic uncertainty.

Using the 1970s example, inflation was over 5.5%. But over the decade, it soared until it peaked in 1980 at over 13%.

And how did gold perform during that time?

It was just over $38 an ounce in 1970. But by the time inflation had peaked in 1980, an ounce of this metal was selling for $650!

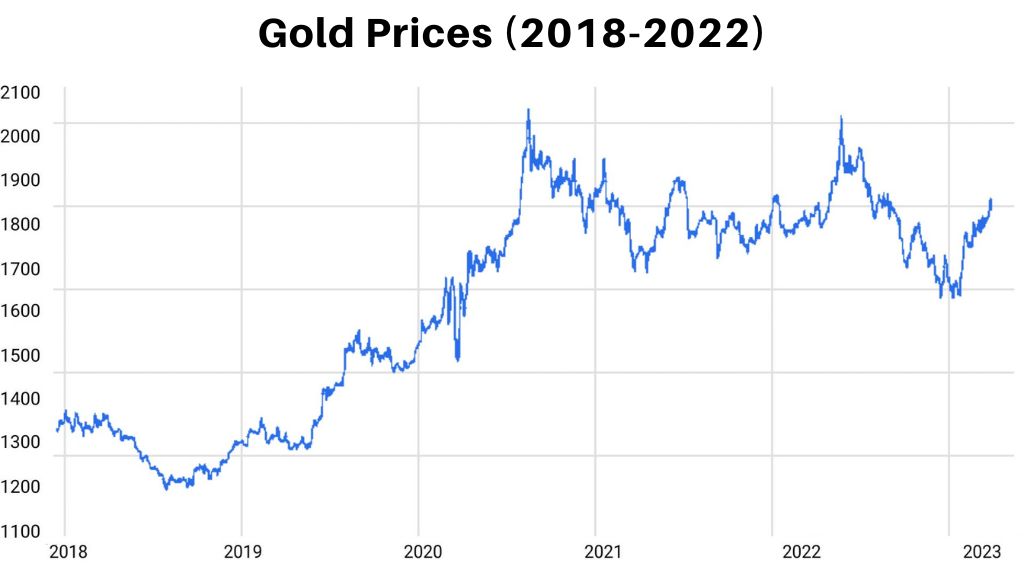

Similar thing happing in the more recent events.

The price of gold was up over 24% during the pandemic, reaching an all time high of $2074.88 in August of 2020.

Though they tend to appreciate over time, prices fluctuate, making them a riskier resource than others on our list.

Therefore, most advisors will recommend you limit the amount of gold to no more than 10% of the total value of your portfolio.

Now…

One interesting option that not a lot of people might be aware of is a Gold IRA.

What is a Gold IRA in a nutshell?

Under the Taxpayer Relief Act of 1997, the IRS broadened the types of assets that could be held in your individual retirement account to include high purity gold, silver, platinum, and palladium metals.

It works just like traditional IRAs, where all increases in the value of your gold and silver are tax-deferred until you withdraw the funds from your account.

Grab your FREE Gold IRA guide here to learn more.

Get Higher Returns Using a Bond Ladder

High-quality corporate and government bonds are a great source of income for seniors without adding any significant risk.

The key is to invest like professionals.

Rather than buying bonds with similar maturities, buy them with staggered due dates. This is known as a bond ladder and helps to maximize your returns and provide a steady income flow.

For example, using equal amounts, buy bonds with 1 – 5 year maturities. Of course, longer-term ones pay a higher rate, but short-term ones provide flexibility.

Now, when the one-year bonds mature, replace them with five-year bonds.

This way, you’ll enjoy the benefits of the latter while still having the same amount coming due each year.

Using this simple strategy works exceptionally well during times of rising interest rates and will help you maximize your income.

Investing in Fine Art with Masterworks

This new strategy can maximize your returns.

Investing in fine art has been a wealth-building strategy used by the ultra-rich for centuries.

Unfortunately, it was out of reach for the general public.

Until now.

With Masterworks, you can now put money into paintings by famous artists like Picasso, Basquiat, Banksy, and more.

According to this company’s CEO Scott Lynn:

“Contemporary art has outperformed the S&P for the past 26 years, but there has been no way to invest in it. Masterworks is the first company to offer art investment products to the retail investing public.”

And unlike stocks and bonds, collectibles – especially fine art – tend to appreciate during times of economic uncertainty and rising inflation.

So how does it work?

Masterworks’ team of professionals has developed a proprietary algorithm to identify and purchase blue-chip paintings with a high probability of price appreciation.

The painting is registered with the SEC, and they then sell shares so you can buy fractional ownership in the artwork.

These are liquid and can be purchased or sold at any time through their platform. The value of the underlying painting supports the current price for the shares.

When the artwork is sold, the proceeds are returned to the shareholders of record.

The fine art market is estimated to be worth $1.7 trillion and, according to statistics provided by Masterworks, has outpaced the S&P by 131% from 1995-2021.

However, this isn’t for everyone, and we recommend using no more than 5-10% of your portfolio.

It might be the perfect choice if you’re looking to diversify.

And how much fun will it be to brag about your new Picasso at the next cocktail party you attend?

Priceless.

Get started with Masterworks today.

Don’t Forget About RMDs

If you own a traditional IRA or 401K account, you need to be aware of RMDs, or required minimum distributions.

You must start withdrawing from your retirement accounts when you reach 73 years old.

Previously, the age was 72, but it was changed with the signing of the Secure 2.0 Act in December 2022.

You can be subject to additional taxes and penalties if you fail to take distributions.

Luckily, the IRS provides resources to help you calculate this.

PRO TIP: It’s a good idea to use your RMDs before selling other assets to pay for your living expenses since you have to take them anyway.

And if you decide to invest in a Gold IRA, here’s our updated post on the tax benefits of this type of individual retirement account.

Structuring Your Retirement Portfolio

So, what is the best asset allocation for 70 year old retiree?

The truth is:

Building the perfect investment portfolio at 70 isn’t difficult.

By using the ideas mentioned here, you’ll be able to create a plan that not only meets your goals but one that you can live with.

So rather than worrying about money, you’ll be able to truly enjoy your golden years.

After all, isn’t that what you’ve been saving for?

Now, we’d like to hear from you:

- What should a retiree portfolio look like, in your opinion?

- What should a 70-year-old invest in?

Share your thoughts and experience with asset allocation in retirement in the comments below!