Let’s face it:

Three US bank failures at the beginning of 2023 have many wondering where they can turn to protect their money.

After all, even the safest investments can carry hidden risks.

And what may seem safe today may not be the best for the long term.

While parking your retirement savings in an FDIC-insured bank account may seem secure to some, you’re actually losing money each year as inflation eats away at your buying power.

In fact, at a measly 3% inflation rate, you’ll lose over 60% of your buying power in twenty years.

That’s like taking a 60% loss.

Now imagine what’s happening to your savings with inflation running nearly double that rate.

Investors typically turn to assets with growth potential to combat inflation, like stocks and real estate.

But that opens you up to more risk. So, where can you turn to instead?

At GSC, we’re committed to providing you with the best, unbiased information so that you can make an informed decision.

We’ve analyzed different options to answer your most burning questions: What is the safest IRA investment today?

Rather than just protecting capital, we’ve looked at ideas that balance security with risk – covering your savings today and into the future.

We provide the pros and cons of each and how each can help you grow and protect your retirement.

Some of these options may surprise you.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s talk about the safe IRA investments in 2024.

Certificates of Deposit

CDs are low-risk investments offered by banks that pay a fixed rate of return for a specified time.

In addition, your principal is protected by FDIC insurance up to the statutory limit, currently $250,000 per depositor, per insured bank, for each eligible account type.

So if you have more than that to invest, consider spreading your accounts among several banks.

Presently, the best CDs offer the same, if not better, returns than high-yield savings accounts.

The drawback is if you take out your funds before expiration, you’ll pay an early withdrawal penalty.

Therefore, these accounts are best suited for those who won’t need their money until after the maturity date.

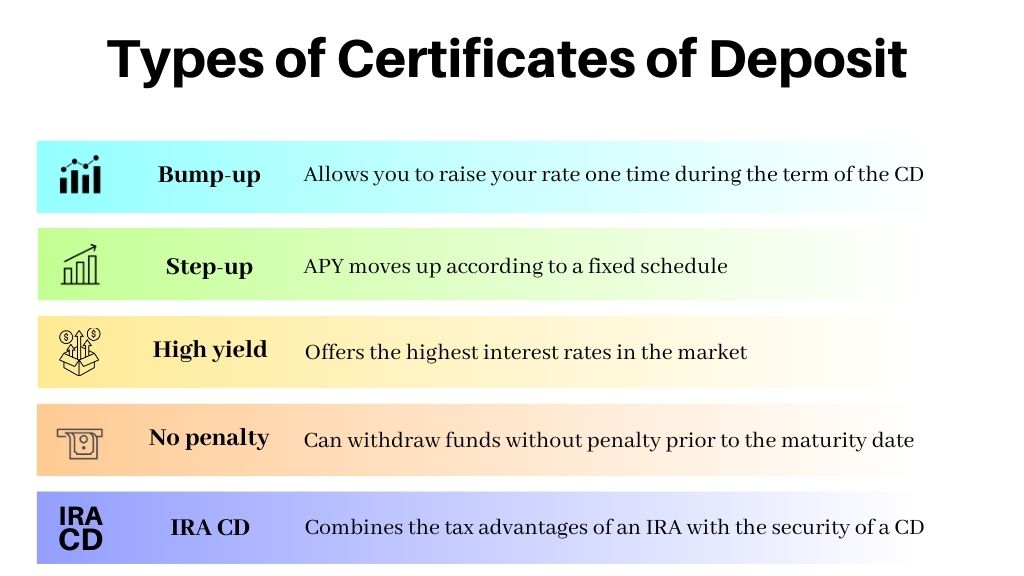

Also, certificates of deposit come in various options, including:

Bump-up: allows you to raise your rate one time during the term of the CD.

Step-up: the APY moves up according to a fixed schedule.

High yield: offers the highest interest rates in the market.

No penalty: can withdraw funds without penalty prior to the maturity date.

IRA CD: combines the tax advantages of an individual retirement account with the security of a CD.

Be sure to do your homework, as different institutions have different rules and fee schedules.

However, if you’re looking for a secure investment, an IRA CD may be one of your safest options.

T-Bills, Notes, Bonds, and TIPS

The US Treasury issues Treasury bills, notes, bonds, and Treasury inflation-protected securities (TIPS) backed by the full faith and credit of the US government.

It has historically paid its debts, making these investments one of the lowest-risk options available.

Treasury bills, also known as T-bills, come in a range of maturities – 4, 8, 13, 26, and 52 weeks.

Also, they are sold at a discount, making your return the difference between what you paid and the face value of the bond.

Treasury notes range from two to ten years, while Treasury bonds have longer maturities of up to 30 years. Both make interest payments every six months.

TIPS offer maturities of five, ten, and even 30 years.

They have a fixed interest rate, but their principal value changes depending on the current inflation rate determined by the CPI. Interest is paid every six months, based on their current value.

At maturity, if the current value is higher than the face value of the note, you keep the extra. If the value is less, you are guaranteed your original amount back.

You can buy treasuries directly from the US Treasury and through online brokers. The market is the world’s largest and most liquid, making them easy to buy and sell.

One caveat is, bond prices fluctuate with changes in interest rates – as rates rise, bond prices fall, and vice versa.

If you hold them until maturity, you’ll receive your principal back. However, if you sell before then, you can either gain or lose depending on the current bond price.

Treasuries are an excellent option for those who are looking for safety but are willing to take a little more risk to receive a better return than CDs offer.

Corporate Bonds

Besides the US Treasury, corporations also issue bonds. The risk can be relatively low to very high, depending on the issuer.

The riskiest bonds are known as high-yield or junk bonds and are issued by companies with less-than-stellar financials.

Like Treasuries, corporate bonds come in various maturities, and prices fluctuate over the bond’s life depending on changes in the prevailing interest rate.

You’ll receive the face value if you hold the bond until maturity.

However, suppose you need to sell before the due date. In that case, depending on its price, you may receive more or less than your original investment.

The most significant risk you face is that the company will fail to make good on its promise to repay bondholders, and you could lose all your investment.

Therefore, we recommend only buying from profitable, well-established corporations or mutual funds specializing in high-quality, low-risk bonds.

This type of investment is typically considered safer than buying stocks, but it isn’t risk–free.

In the event of bankruptcy, bondholders are paid before shareholders. However, if there isn’t enough to go around, both can lose their investments.

Corporate bonds may appeal to investors wanting higher returns than Treasuries and are willing to accept a corresponding increase in risk.

However, unless you’re a sophisticated bond investor, we advise you to steer clear of high-yield or junk bonds, no matter how big a return they offer.

Remember the adage – if it sounds too good to be true, it probably is.

Dividend-Paying Stocks

You might not consider stocks a safe investment, but with rising inflation, putting your money in a CD may not be the best option.

The interest rate isn’t high enough to overcome your loss of purchasing power over time.

Having a portion of your retirement in dividend-paying stocks can offset the debilitating effects of inflation.

That’s because not only do you have a steady income stream, but your initial investment has the potential to grow.

These shares are considered safer than non-dividend-paying stocks, which helps to limit their volatility.

Companies that pay dividends tend to be more stable and financially secure. Stock prices still fluctuate, but less severely than growth stocks.

But not all dividends are created equal.

And a company that falls on hard times may reduce or even eliminate it, which will severely impact share prices.

That’s why you should only consider corporations with solid financials and a proven track record of consistently raising its dividend every year.

And the best of the best – the Dividend Aristocrats.

Many public firms pay dividends, but to make this list, you need a long-term record of making dividend payments – 25 years, to be exact.

A company is considered a Dividend Aristocrat if they have raised its annual dividend 25 years in a row, without fail.

In addition, they need to be part of the S&P 500 with a minimum market cap of $3 billion.

If you’re looking for an asset that has the potential to grow while still providing steady income, the Dividend Aristocrats may be the perfect option.

Gold

A safe investment? You’re kidding, right?

No, actually, we’re not.

During times of uncertainty, investors flock to this precious metal to preserve wealth and protect their buying power.

For example, in 2022, when the S&P was down nearly 20%, gold was up 6.6%.

And when it comes to protecting your buying power from the corroding effects of inflation, few assets are as effective as gold.

While the dollar has lost nearly 60% of its buying power during the past 20 years, this precious metal has almost quadrupled in value.

And since 1900, gold prices are up nearly 90-fold while the dollar has lost nearly 97% of its purchasing power.

As the old saying goes, an ounce of gold is an ounce of gold. And although its price can change, its value doesn’t.

Investing in gold isn’t without risk.

Prices are volatile and can fluctuate in the short term, though they tend to rise over longer timeframes.

And if you buy physical gold, you have to consider storage and security issues.

Unless you open a gold-backed IRA account with a trustworthy company which will take care of everything.

Check out our video about what a Gold IRA is below:

Overall, this precious metal may be your best bet to protect your wealth during times of economic and geopolitical uncertainty.

Things to Keep in Mind

First things first:

An IRA is a type of account that can hold different investments.

We created the list here based on extensive research, and you may hold these investments outside of an IRA too.

Next. In case you didn’t know, IRAs come in several flavors:

- traditional (aka simple),

- Roth,

- SEP (for self-employed or small business owners)

A gold IRA is a self-directed individual retirement account that lets you hold alternative assets, including precious metals, and will fall within those three types.

The custodian charges different fees depending on the assets and will sub-divide the account by asset type.

We approached this topic not only in the traditional sense of a safe investment, but also from the perspective that safety means protecting your account from inflation and unforeseen events.

That allowed us to include gold and dividend paying stocks, as fixed-rate assets will continue to lose buying power due to rising inflation.

This being said…

When it comes to the safest investments, as we have seen earlier, these can come in various forms.

And what may be technically the safest may not be the best.

Plopping your money in a fixed-rate CD may sound good.

Still, with inflation constantly eating away at your buying power, you may discover that you “lost” more than if you had bought a riskier asset.

That’s why we don’t advocate any single asset when it comes to your safest IRA investments. And always consult with a financial advisor before making any decisions.

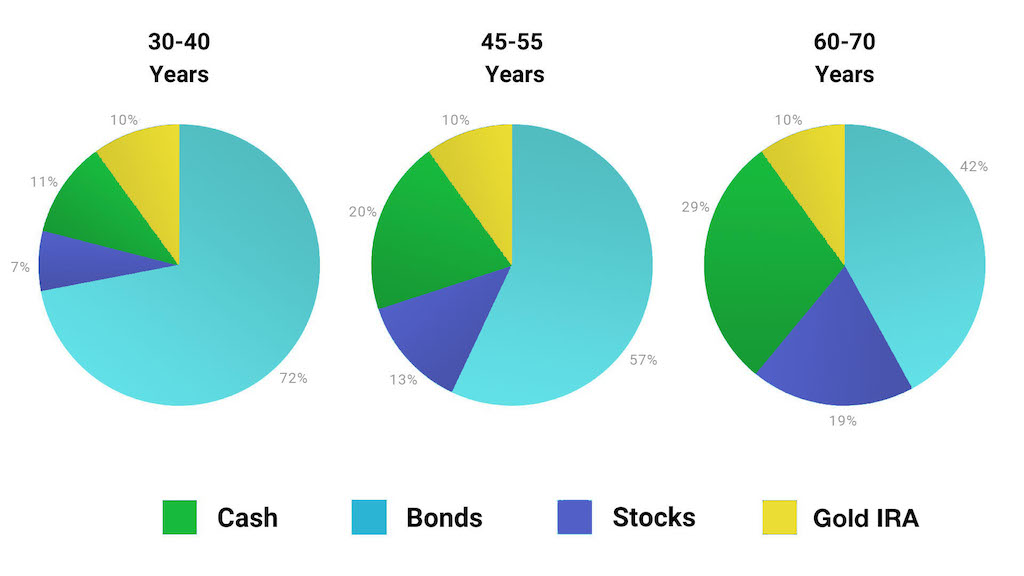

The idea here is that rather than putting all your eggs in one basket, look to diversify your portfolio with different asset classes:

- CDs

- bonds

- dividend-paying stocks

- precious metals

… just to name a few.

That way, you can rest easy knowing you’re protected no matter what the future brings.

And having peace of mind is truly the best investment of all.

Frequently Asked Questions

At what age should you start an IRA?

Most people consider opening an account when they are 30 to 35 years old. This is because you’re entering your prime earning years and typically have extra money available.

Plus, with over 30 years or more left until retirement, your portfolio has plenty of time to grow.

On the other hand, you’re never too old to open a Roth IRA.

Even retirees can open one as long as they have taxable income.

You aren’t required to take minimum distributions like a traditional IRA, and after five years, you can make withdrawals tax-free.

No matter what your age, opening an IRA makes good financial sense.

What type of IRA should I start?

Most experts recommend opening a Roth, but it’s not always the best.

For example, if you have higher taxable income, a traditional IRA can be the better choice as your contributions are tax-deductible, reducing your tax liability.

Does it matter where I open my IRA?

Not really. One thing is certain, stick with proven and reputable brokers. But do your homework, as costs and customer service can vary between companies.

Also, if you’re considering a gold IRA, Augusta Precious Metals is a great business to work with.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Not only do they have competitive fees, but their customer service is unmatched in the industry.

In addition, their trained team will make the process simple, straightforward, and completely transparent.

Now, we’d like to hear from you:

- Do you agree with our list here?

- Which IRA investments are the safest in your opinion?

Share your thoughts and safe IRA investment options (in your opinion) in the comments below!