Listen to this article:

Deciding when and how to invest in precious metals can be confusing, especially for beginners.

Specifically, you may wonder:

- Is now a good time to buy gold?

- Should you buy gold NOW or wait?

Many people agree that yes, considering the current political and economic instability, you should indeed buy it in 2024 to create an extra layer of financial protection for yourself.

And that’s exactly what we’ll discuss today.

We’ll also mention the different ways you can choose to invest in precious metals, and which one we consider to be the best one today.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

Why Should You Buy Gold in 2024?

Truth is:

Gold is a secure asset, and it just doesn’t make sense to hesitate. Remember the old saying: it’s not timing the market, it’s your time in the market.

While that old adage may have been written about stocks, it really holds true for almost all investments.

If you know that your portfolio will benefit from the addition of precious metals, why would you want to delay the process?

Earlier, we mentioned that it’s smart to buy gold in 2024 and we can back that up with the following reasons:

- buffer against inflation

- combat economic and political upheaval

- portfolio diversification

- retirement considerations

While it’s true that the rate of inflation has slowed in recent months, economists don’t think we’re out of the woods yet.

This means that your buying power can continue to decrease as prices go up.

You likely have noticed that your weekly expenses at the supermarket have increased quite a lot. Or filling up your tank takes more money.

These are just two quick examples of how inflation and price increases can affect your household budget.

Fortunately, gold is a resource that can help buffer your savings from these increases.

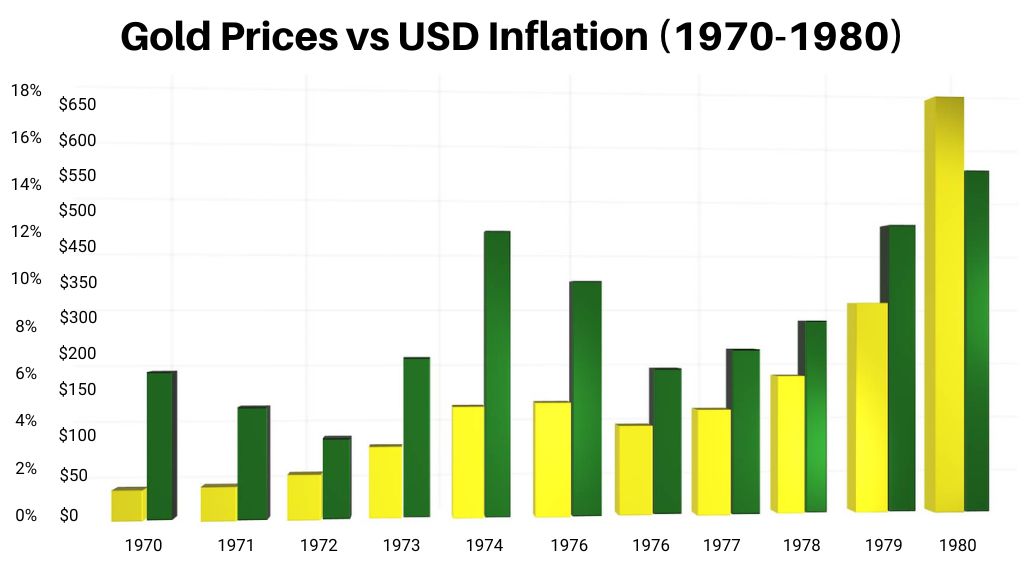

It was especially evident during the 1970s:

In addition to that, there’s still a lot of turmoil at home and around the world.

Politically, the United States is more divided than ever, and Congress continues to struggle with enacting bipartisan changes.

Globally, the war in Ukraine and China’s approach to the lingering problems relating to Covid are still affecting the world’s supply chain.

Of course, it’s not all bad news, but even a few issues like these can have a negative impact on the economy.

Finding appropriate investment instruments will help you become stronger financially.

Diversification is very important, especially as we age.

Your portfolio should be properly balanced as a way to decrease your exposure and adding new asset classes like precious metals can help achieve that.

You don’t want to have too much money put into the stock market, bonds, cash, mutual funds, and ETFs only as they don’t always give enough security.

Gold provides multiple benefits when it’s added to your list of assets.

Not only does it increase the overall diversification of your portfolio, but it is also a safe haven from the risks discussed above.

If it’s time for you to get serious about your retirement planning, you really do want to invest in low-risk holdings in 2024!

Why?

Because once you stop working, your investment portfolio will need to keep pace with inflation and be protected from changes in the market.

And adding gold today will help you be even more prepared when it comes time to retire.

Different Ways to Invest in Gold

Let’s say you’ve made a decision to purchase precious metals, but where to begin?

There are a few different ways to do that, and we’ll dig into a few of the best ones.

When ready to acquire the precious metals, you might find yourself heading over to the local dealer and getting some coins or bars. Or, you may consider buying some jewelry.

This is classified as bullion, which means that you’re getting gold in its physical form.

It is one of the most commonly known options, but you’ll have to take care of storage and security yourself.

(Be sure to consult with your tax advisor before buying because there are some reporting requirements for certain purchases.)

Another thing to note is that physical gold doesn’t have the same level of liquidity as the other assets. It’s a good way to begin with, but not the most efficient one.

Next, you can also opt to buy mining stocks, some of which are publicly traded.

Contrary to gold bullion, this option is more liquid. You’ll also enjoy diversification without having to worry about securing physical items.

ETFs and mutual funds that include precious metal and mining assets are another way to begin your investment journey.

These are pretty common to invest in and provide a nice degree of diversification. You can select them based on your age, level of risk tolerance, and your investment timeline.

Gold futures are one of the lesser known ways to invest in this commodity, but they are really only appropriate for experienced traders and commodities experts.

We certainly don’t recommend it for beginners.

And, saving the best for last:

Gold IRAs are another great way to stock up on IRS-approved precious metals and protect yourself financially.

We think they deserve their own discussion, so keep on reading!

Why Choose Gold IRAs?

In our opinion, there are three great reasons to choose to open a precious metal individual retirement account:

- Tax benefits

- Easy to execute

- Storage is handled for you

If you are going to hold precious metal investments anyway, why not open this type of account and enjoy all of the tax benefits that are available with this asset class?

You’ll also be able to work with skilled and experienced companies that do a lot of the heavy lifting for you, including arranging the storage and security to protect your holdings.

Best of all?

Aside from a cash bank transfer to invest in gold and other precious metals, you can also transfer funds from existing retirement accounts and 401ks.

This option may require a bit of paperwork, but when you work with a full-service precious metals company, they’ll provide the assistance you need.

Does a Gold IRA sound like the right choice for you?

We hope so!

The #1 Ranked Gold IRA Firm

Let’s be honest:

If you decide to invest in precious metals with an individual retirement account, choosing the right company is crucial.

As Gold IRAs become more popular, the number of agencies offering them is also increasing.

So many of them are online only.

While we’re all acclimated to buying things on the internet, we think that a substantial investment like this requires a bit more personal service.

If you are looking for a highly reputable firm that offers white glove treatment, then consider Augusta Precious Metals.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Their team is very hands-on and will walk you through the entire process, answering any questions that you may have.

With a minimum investment of $50,000, Augusta is used to dealing with successful folks who expect a lot from any company they work with.

They also offer a fantastic variety of different precious metals approved by the IRS.

If this firm interests you, then take a look at our in-depth review for further details.

Should You Buy Gold or Wait?

Look:

This precious metal continues to offer investors a safe haven during times of upheaval and political uncertainty.

It’s also an effective hedge against inflation and a way to protect your future purchasing power.

There’s no reason not to invest in gold in 2024.

In fact, we think now is an ideal time to do that, considering the events happening locally and globally.

As you’ve learned today there are numerous ways to get started, but we have found that a Gold IRA is a perfect option for most people.

Now, we’d like to hear from YOU:

- Is now the time to buy gold, in your opinion?

- Should we buy gold now or wait?

We hope that you found this article informative, and encourage you to share your thoughts in the comments below!