Look:

You have a lot of options when it comes to diversifying with gold and silver.

And it can be tricky to determine if the firm you’re considering is worthy of your hard-earned retirement savings.

After all, every business claims it has the best customer service and wants to earn your trust.

It’s another thing to back it up with verifiable actions.

That’s why, today, we’re taking a closer look at Red Rock Secured.

Although at first glance, RRS appears to be a solid organization, we want to dig deeper and see if anything is lurking below the surface.

We’ll review their policies, values, products, and, most importantly, what customers say about working with this precious metals company.

By the end of this article, you’ll be able to answer for yourself if Red Rock Secured is legit or whether you should steer clear.

Red Rock Secured Review (Video)

What Does Red Rock Secured Do?

Founded in 2009, Red Rock Secured is a privately held gold IRA company based in Southern California.

They specialize in educating investors on how they can protect their retirement savings by diversifying with different precious metals.

Above all else, this firm is committed to building client relationships. They believe and state that taking care of their customers is their most important value.

They go on to claim that the well-being of their client is more important than making additional sales.

Trust is a core value for the company, and they work hard to build it with their no-hassle policies.

Diversification is another key value shared on their website. They state that if you genuinely want to protect your wealth, you need to diversify across asset classes.

With an emphasis on hiring and retaining only the best talent in the industry, their experts are fully equipped to help you better understand precious metal IRAs and how to protect your retirement savings.

In addition, Red Rock Secured is a member of the National Ethics Association.

Never-Zero Policy

By its very nature, investing comes with risk, but with RRS’ never-zero policy, the company promises if you invest with them, your account will never go to zero.

Communication

Red Rock’s experts are available to answer your questions without any pressure to buy. In addition, the company promises high levels of communication and integrity in all its dealings.

Price Protection

Red Rock Secured offers price protection on qualified gold and silver. They state that if these precious metals go down for any reason, they’ll pay you the difference.

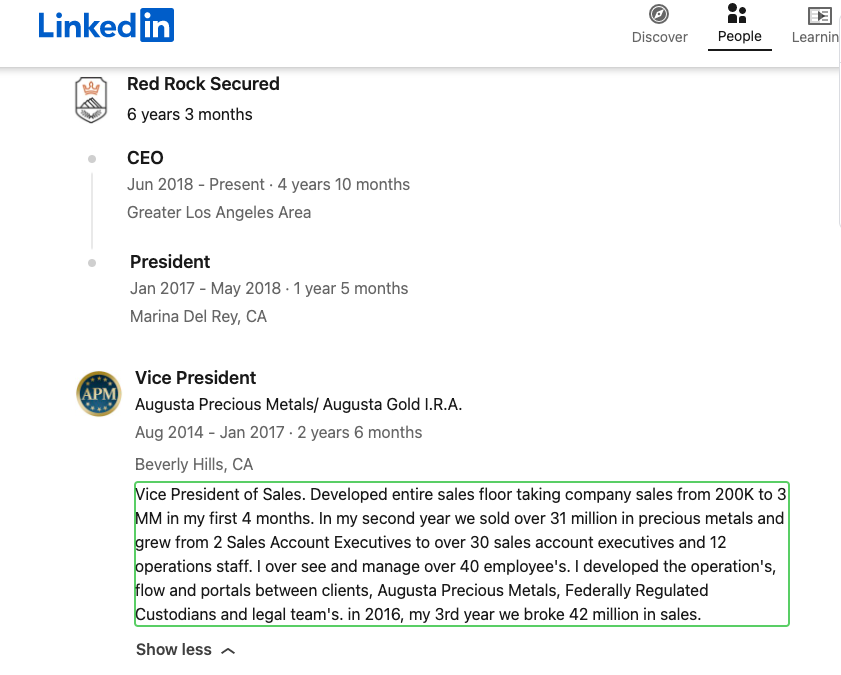

Who Is the CEO of Red Rock Secured?

Sean Kelly is the CEO of Red Rock Secured.

He has served in that position for the past few years.

Prior to that, he spent two and half years as Vice President of Sales at Augusta Precious Metals Gold IRA company, learning from the best in the industry.

With over twenty years of experience in the financial markets, Kelly’s leadership is the backbone driving Red Rock’s strong commitment to their customers.

And that commitment has paid off.

Red Rock Secured ranked in the top 4% of Inc’s fastest-growing private businesses in 2022. Out of 5000 companies, they ranked 211, securing their spot in the Inc 500.

Pretty impressive growth!

Education

Red Rock believes the best clients are informed clients.

And its commitment to providing customers with top-notch education is evident when you visit the website.

For example, under the Resources tab, you’ll discover a wide range of free educational tools to help you understand the benefits and risks of investing in precious metals.

Occasionally, when you land on their website you may see a sticker at the top that offers a free live webinar, should you want to learn more.

The Gold Watch

Their weekly newsletter presents an in-depth analysis of the latest financial and precious metals market developments.

Red Rock Secured’s Daily Global Gold News

Every day their skilled editorial team scours the top gold news sources to provide you with the most relevant and up-to-date market news.

Red Rock’s Intro to Investing in Gold & Silver

This detailed educational series will teach you about the different precious metals investment options, such as a Depository IRA, Home Delivery IRA, and cash transactions.

Free Investor Kit

You can request their investor kit, as well as a free metals assessment provided by one of their experts.

Click here to grab your FREE guide.

One-On-One Consultation

Every client receives a free one-on-one consultation before every investment they make so they can better select the type of precious metal they wish to purchase.

It covers the different metal categories, their fundamental differences, and how they can help diversify your retirement savings.

In addition, they offer real-time and historical price charts for both gold and silver and an extensive library of relevant articles on precious metals investing and retirement topics.

Products

Though their selection is smaller than other precious metals dealers, RRS has a diverse offering of high-quality gold, silver, platinum, and palladium products.

You’ll find all your favorite coins, including the American Eagle, America the Beautiful series, Canadian Wildlife series, and the Canadian Maple Leaf.

In addition, they also deal in platinum and palladium coins and offer various bars in all four precious metals.

For non-IRA accounts, they even sell what they term “junk” silver – a collection of 90% silver coins minted by the US Government.

However, they don’t provide online pricing information, so you need to speak directly with a company representative.

Purchasing Precious Metals from RRS

This gold IRA company makes protecting your retirement easy.

The process starts with you filling out the application with your name, address, phone number and email address.

Once the application is received, one of Red Rock’s representatives will contact you for a one-on-one consultation.

This is NOT a sales call.

Instead, your representative will answer your questions and help determine if investing in gold and silver is right for you with no pressure to buy.

When you’re ready, they’ll assist you in opening a self-directed IRA with an approved custodian.

Most customers opt for a gold IRA rollover, and their trained agents will work closely with your current retirement plan to transfer the funds to your new account.

Once funded, a representative will guide you through your options so you can select the precious metals that best suit your needs.

After confirming your order, Red Rock pays for the shipping and handles all the details to deliver your metals directly to an approved storage facility.

You can rest assured knowing that your investment is housed in a state-of-the-art facility and backed and insured by Lloyd’s of London, one of the world’s largest and most reputable insurers of alternative investments.

Clear documentation is kept to verify your ownership of each piece, and you can make arrangements to visit the facility anytime you want to see your precious metals in person.

Though your custodian will handle any transfers or purchases, you retain 100% control over all your investment decisions. You can choose to add more or sell your investment at any time.

Gold IRA Fees & Costs

Although there are no fees posted on their website, we personally contacted this firm’s team to ask for details.

They shared that 90% of clients qualify for RRS to cover their administration and storage for a minimum of one to 10 years; many qualify for their “no fees for life” program.

For the remaining 10%, the costs look like this:

- $100 annual custodian fee

- $80 account setup fee

- Storage is $100 a year ($150 if stored in Texas)

What about the minimum investment amount?

As of today, there is a $1,500 minimum for cash purchases and a $25,000 minimum contribution amount for a Precious Metals IRA.

Customer Reviews and Complaints

Let’s face it:

What customers have to say about their experiences can provide deeper insight into how a company operates.

So let’s take a look at Red Rock Secured ratings and some top consumer watchdog sites and see what they have to say about this business.

TrustPilot

Shows 4.8/5.0 based on 163 reviews.

The overwhelming reviews are excellent, like this one from February 2023:

Great at giving calls and updates. Easy to talk to ask questions. Definitely working with them again.

Or this one from April 2022:

I really enjoyed working with the staff at Red Rock Secured. They were very knowledgeable and friendly. They really understand precious metals and the potential they have. At this time, the diversity this can give you in a portfolio I think is important. They answered a lot of questions in a very professional manner and followed through. You feel safe working with them.

We found only one complaint filed in March 2022:

A customer stated that they had a rude experience with an employee.

Within two days, Red Rock Secured’s CEO Sean Kelly personally answered the complaint, apologized to the customer, and resolved the issue.

Business Consumer Alliance

BCA shows 5 stars based on 143 reviews and a AAA rating.

Once again, nothing but excellent reviews.

However, we did find one older complaint filed in October 2020 from a customer stating they hadn’t received an order placed months before and wanted to cancel it.

Customer service quickly responded and apologized for not keeping the customer informed of covid-related shipping delays (remember this took place during the height of the pandemic) and agreed to completely refund the order, which the customer accepted.

Even for issues outside their control, Red Rock Secured quickly made the situation right for the customer.

Better Business Bureau Complaints

BBB shows 4.74/5.0 based on 91 reviews.

They have been an accredited member of the BBB since June 29, 2017, with an A+ rating.

Though most reviews give Red Rock five stars, a few isolated complaints have been posted during the past three years.

In each instance, the company quickly responded, apologized, and resolved the issue to the customer’s satisfaction.

Red Rock Secured appears to conduct its business with transparency and integrity.

Rather than complaints, the majority of their customers describe the firm as courteous, prompt, informative, and helpful.

And when an isolated issue arises, they quickly make it right with the customer.

Important note:

The only discrepancy we found was on the Trustlink website. The company is currently rated a one star; however, nearly all the one-star ratings are marked as Fake Reviews.

The Trustlink webpage may have been hacked as these reviews are inconsistent with other consumer watchdog sites.

Is Red Rock Secured Legit? (Verdict)

So…

Is Red Rock Secured legit or scam?

No, it’s not a scam. After reviewing this business, we feel confident that Red Rock Secured is a legitimate company with nothing to hide.

Dedicated to building trust with its customers, it has a solid commitment to providing outstanding customer service, demonstrated by the hundreds of five-star reviews across several key consumer watchdog agencies.

And when an isolated issue arises, they step up and quickly make it right for the customer.

While Augusta Precious Metals is our #1 recommendation, it requires a minimum of $50,000 to open an account – something that not everyone can afford.

However, if your contribution or rollover amount for a Gold IRA is more than $25,000, then Red Rock Secured would be a solid choice to diversify your retirement with precious metals.

You can get started here with their FREE Gold IRA guide.

Frequently Asked Questions

Are Red Rock representatives investment advisors?

No, they are not advisors. However, they are trained agents who can help you better understand gold IRAs and investing in precious metals.

In any case, we always recommend that you speak with your financial advisor before making any decisions.

Does Red Rock Secured offer a buyback program?

Yes, they offer a hassle-free buyback program if you ever need to sell your metals quickly.

What is their return policy?

Once an order is confirmed, it’s considered final, subject to applicable state laws or regulations. However, they do provide a seven-day grace period for first-time purchasers.

Can I take home delivery of my IRA precious metals?

Red Rock Secured offers a Home Delivery IRA, the only gold IRA company to do so (that we know of).

Their website claims that by creating an LLC, you can hold gold and other precious metals within a self-directed IRA in a safe deposit box at a local bank near you.

According to their website, it’s the LLC that controls the assets, and the IRA holds interest in the LLC.

Though this may be a loophole in the tax law, we couldn’t find any mention on the IRS website that this practice is allowed.

On the contrary, the IRS clearly states that you cannot physically possess your IRA precious metals, and they must be held in an approved third-party storage facility.

Violations of this regulation can result in significant penalties and tax consequences.

We recommend that you exercise caution if you are considering this option and consult a qualified financial advisor before making any decision.

Now, we’d like to hear from YOU:

- Have you ever dealt with this business?

- Do you agree that Red Rock Secured is a legitimate company or do you have a different opinion/experience?

Let us know your thoughts in the comments section below!