It’s no secret that today we’re going through highly volatile economic times.

And this scares everyone, particularly seniors who worked for several decades to build a comfortable retirement plan and don’t want to see their hard-earned savings evaporate.

If you’re 65+ years old, you may wonder:

- what should my portfolio look like today?

- where should I invest my money at age 65 and beyond?

- what are the best safe investments for retirees?

And that’s exactly what we’re going to discuss today.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

Retirement Planning and Adjusting

Here’s a common misconception:

Many people believe that once you retire, all that planning ends and you simply start drawing your money in the hopes it can sustain your lifestyle in the subsequent years to come.

Truth is, your retirement planning after you retire is just as important as it is during the decades prior – if not more so!

An optimum plan is one that evolves over time to match the current phase of your career and life.

Just as a worker in their early 30s would tailor their retirement planning based on their age and goals, a retiree at 65 should do the same.

By wisely monitoring and adjusting their investment portfolio to match their current situation, investors can achieve optimum results that outpace a more passive approach.

But doing this requires some strategies that stray from the conventional wisdom often told to seniors, especially during uncertain economic conditions.

There are some key strategies for 65 years olds and what they should be doing to make sure their retirement plan is optimized and capable of supporting their lifestyle for years to come.

And today we’ll look at the traditional portfolio allocation for seniors vs the alternative strategies to adopt considering today’s economic and inflationary climate.

Spoiler alert:

We’ll discuss a gold-backed IRA and why it is one of the best low risk investments for retirees to help mitigating risk and insulating them from negative economic factors.

Traditional Portfolio Allocation

What does the investment portfolio for 65 year-olds look like?

Much of the traditional advice about investing after 65 is to take a rather passive approach to their retirement planning.

The thinking is that you don’t want to do anything that involves too much risk.

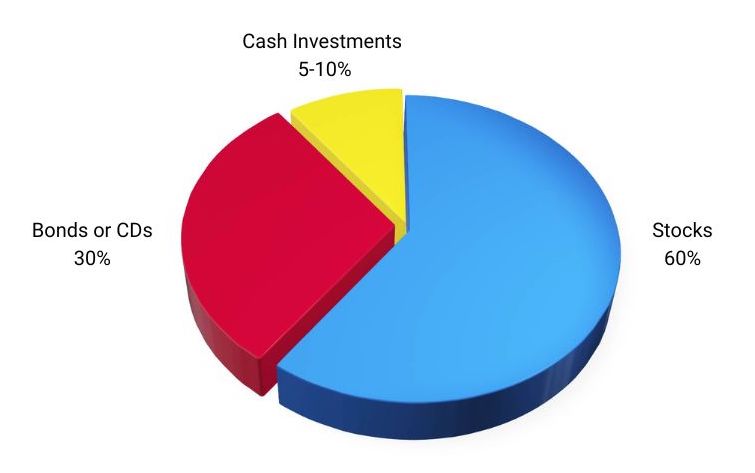

Traditional wisdom for the optimum portfolio at age 60-something is a mix of stocks, bonds, and cash investments.

Exposure to stocks can either be directly by owning stocks or indirectly via funds and other products.

Generally, the allocation would be 60% stocks, 30% bonds or CDs (depending on risk tolerance), and 5-10% in cash investments.

Of course, these numbers are not written in stone. A person’s total net worth and goals for the future will also play a part in deciding these various allocations.

Here’s a general example of the model portfolio for 65 year olds:

Keep in mind that your income from pensions, Social Security, annuities, and other sources will also play a role.

The higher your income from various sources, the more risk you can tolerate in your portfolio, and that may change some of these allocations.

Should You Follow Traditional Advice?

Now, when should you stray from traditional portfolio allocations?

While the above is good overall advice, it mostly applies to stable economic times where growth and returns fall squarely within the average.

Unfortunately, following it too closely during market upheavals can lead to your savings being eroded.

Even worse, you may have to cut back on lifestyle choices to try to make your money and purchasing power last.

For example:

Traditional financial advice for those at or near the age of 65 may be to explore investments such as CDs due to their low risk and stable return.

The traditional wisdom is that seniors should have a majority of their portfolio allocation in lower-yield investments with the associated lower risk that comes with them.

However, during highly uncertain economic conditions, this advice becomes rather detrimental to someone’s future.

Short-term CDs and similar investments at the moment do not keep up with inflation.

So you may ask, what about exploring longer-term CDs to lock in higher returns?

The problem there is you still are outpaced by inflation, but now your money is locked up for an even longer period of time, exposing you to more risk.

Somewhat recently, new products have been released to try to entice investors back to products like CDs.

One common version is known as an “inflation-linked CD”.

But while the name may sound great, these have their own risks, which could leave you with an even lower return if inflation peaks and starts to fall during your time holding them.

In other words, these actually increase your risk relative to inflation instead of mitigating it because now you can get burned on both sides of the equation.

This being said, where should seniors invest their money then?

Precious Metals as An Alternative

Look…

Many of these products that were designed and advertised to protect your purchasing power with low risk don’t work when inflation has reached the level it has over the past year.

That may have you wondering, what can you do to protect your savings and your purchasing power so you can maintain your lifestyle in the coming years?

Quick answer/actionable tip:

You can open a Gold IRA account with Augusta and invest in IRS-approved precious metals like gold and silver to diversify your retirement portfolio.

(As always, consult with your financial advisor first.)

But before we discuss gold individual retirement accounts, let’s look at what central banks around the world are doing and why.

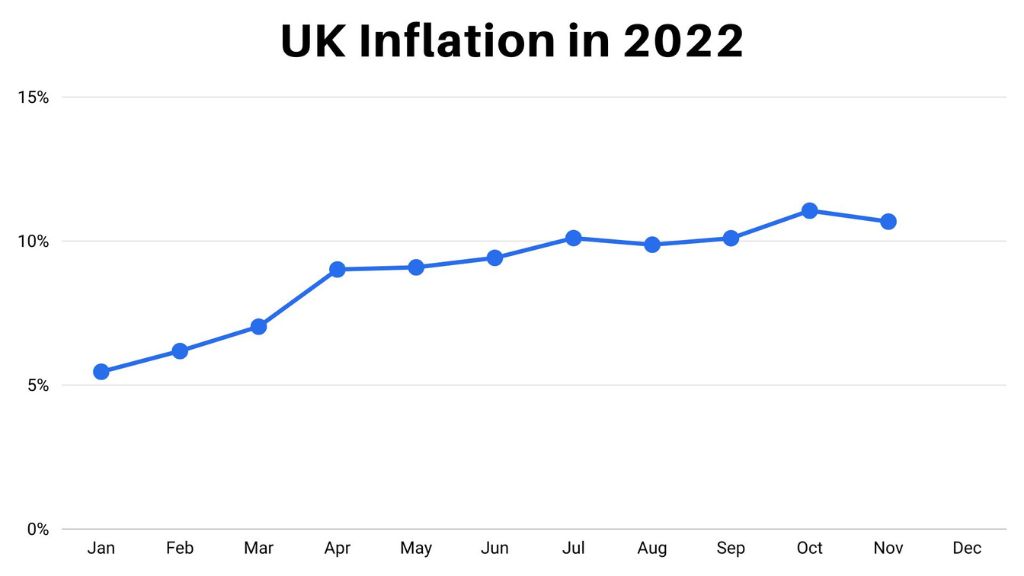

What we see today is not just an American issue.

It’s global, and nearly every country is dealing with extreme inflationary pressures combined with slowing national economies.

In the U.K., for example, inflation hit double digits toward the end of 2022.

Central banks are well aware of what’s going on, and that’s why they’ve been scooping up precious metals as fast as they can.

According to a study by the World Gold Council report, the demand for gold rose 28% in 2022!

It’s important to note the actual number is likely even higher due to central banks either underreporting or simply delaying reporting, as they are allowed to do.

Now stop and ask yourself:

What other investment assets saw an increase in demand of 28% in 2022?

The answer is none.

Stocks, real estate, crypto, and just about every other asset class saw decreasing demand and, of course, lower prices.

And what was the key driver of this soaring demand for precious metals when people were fleeing other asset classes?

The answer is inflation and economic uncertainty.

Gold Performance (Historical Data)

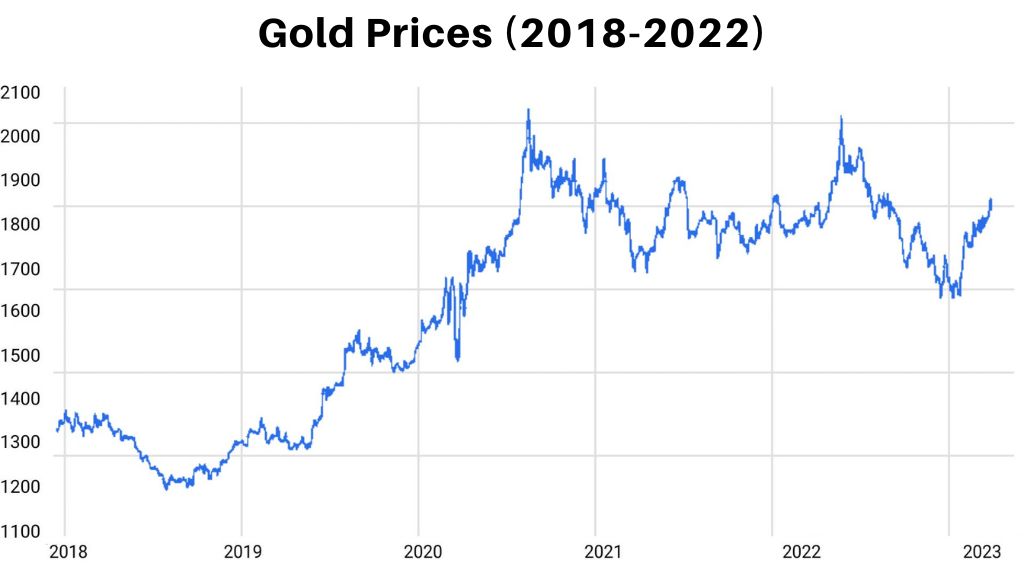

All you needs to do to see why this is happening is to look at the price chart for gold over the past few years.

When inflation was much lower in 2018, gold was still strong but priced at around $1200 per ounce.

Have a look at this chart:

You’ll see that as inflation starts to rise in recent years, gold starts to take off.

But remember, the key impact and fear of inflation didn’t really kick in until the later portion of 2022.

(Same with the talk of the coming recession in 2023 and 2024.)

So this precious metal is poised to continue this trajectory barring some miracle that squelches inflation and calms the economy, which is unlikely to happen.

For more evidence, we can look further into the past to see how gold performance and inflation are correlated.

You can maybe recall the Great Inflation of the 1970s.

This was the period known as “stagflation”, where the inflation grew with unemployment.

Investopedia shared that it was the “monetary policies that financed massive budget deficits and were supported by political leaders were the cause”.

The recession that followed greatly hurt businesses and individuals.

Now let’s look at inflation rates and gold prices during that period.

In 1970, inflation was over 5.5%. But over the decade, it soared until it peaked in 1980 at over 13%.

How did gold perform during that time?

It was just over $38 an ounce in 1970. But by the time inflation had peaked in 1980, an ounce of gold was selling for $650!

What can we take away from this historical data?

It shows that high inflation and economic uncertainty is clearly the time when investors need to take shelter in gold to protect their hard-earned savings and purchasing power.

Do Gold and Silver Have Risks?

The short answer is, of course, yes.

All investments have some risk involved. Even storing cash under your mattress entails risk.

So what are the risks exactly?

Generally, precious metals underperform during strong economic times or economic recovery.

For example, let’s look at the data we previously presented showing gold’s performance during the 70s.

After that decade of inflation and poor economic recovery, things started to turn around.

In fact, the 15 years beginning in 1982 and ending in 1997 are considered to be one of the greatest economic expansions in American history.

Moreover, economists and college textbooks now refer to that period as the “long boom“.

So during those 15 years starting in the 80s, gold underperformed as other investments like stocks and real estate did well.

However, even during what could be considered the “worst” macroeconomic period for gold, it simply underperformed; it didn’t crash.

A look at gold prices from that era tells us that at the start of the long boom in 1982, it was $376 an ounce (average). At the end of the long boom, gold was $331 an ounce.

So really there was no need to “time the market” to sell at the best price if you happened to hold through the 1970s and were looking to sell as the economy improved.

What this confirms is that this precious metal underperforms during very strong economic times when other investments outpace it for short-term returns.

However, even when underperforming, the risks are low for those who used gold as a hedge during the preceding years to protect themselves from inflation and uncertainty.

Now here’s the question:

For those of us in 2023, are we entering an economic boom and recovery like during the historic 80s or, instead, a period of inflationary pressures and slowdowns like the 70s?

Well, with a majority of high-profile CEOs around the country predicting a recession in 2023 and 2024, any recovery is likely several years off.

You would be hard-pressed to find any CEO who feels strongly in the opposite direction and is predicting a historic boom.

Diversifying Your Portfolio With Gold

Those in the know and those with the ability are starting to increase their precious metal reserves to insulate themselves from economic uncertainty.

But central banks are one thing. What about the average investor or retiree?

Thankfully, there are many options for those who are 65 years old or near that age and want to add precious metals to their current retirement portfolio.

One of the best ways to do so is by rolling over an existing 401k into a gold-backed IRA, either traditional or Roth, depending on the circumstances.

READ ALSO: The Difference Between Gold IRA vs Traditional IRA

Even if you’ve stopped contributing to your 401k due to retirement, you can still roll it over into another qualified retirement plan. You simply can’t contribute more to it.

If you’ve already withdrawn your 401k or are planning to, those funds can be placed into a gold-backed IRA.

Withdrawing your 401k does mean you pay tax on the amount like income. However, after 55, you don’t pay any additional penalties for doing so.

These methods are the most common for seniors when they want to allocate a portion of their portfolio to precious metals.

Investing in a gold IRA is easy, fast, and has low fees. It’s one of the safest investments for retirement that you can have.

And in case you didn’t know, there are great tax benefits of Gold IRAs that you’ll enjoy.

How to Get Started the Right Way?

Look:

We understand that in these uncertain economic times, the stress of financial worries can take a toll on us all.

But with some smart planning and portfolio diversification, you can help alleviate that stress and better plan for the future you’ve always dreamed of.

We’ve already seen how precious metals can insulate your retirement savings from inflation and economic uncertainty, two things we all know are happening right now.

But if you’ve never thought of gold and silver as an investment before, it can be overwhelming figuring out where to start.

(Especially when you’re investing at 65 and beyond.)

But it’s much easier than people think.

You can go with a trustworthy firm like Augusta Precious Metals.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Voted the best gold IRA company in 2022 and 2023 by Money Magazine, APM has helped countless of investors allocate a portion of their portfolio to gold as a hedge against inflation.

They’ve streamlined the process and have taken the guesswork and complexity out of precious metal investing so that customers can easily understand how it all works.

Grab their FREE Gold IRA guide, or contact the Augusta team directly at (833) 989-1952 to learn more.

Now, we’d like to hear from you:

- What should a 65-year-old invest in, in your opinion?

- What do you think is the best asset allocation for a 65-year-old this year?

- What would you say is the model portfolio for 65-year-old?

Share your thoughts in the comments below!