Listen to this article:

Look:

If you’re interested in opening a Gold IRA account, then we believe now is a perfect time to do it, especially considering the current economic environment.

In this article, we’ll cover a commonly asked question, is a Gold IRA a good idea in 2024?

We’ll explore a few of the reasons why this investment vehicle is a good move and investigate if it is the right choice for YOU.

We all know that diversification is important, but incorporating that knowledge into your portfolio can be a bit more challenging.

Fortunately, we are here to help you make the most of your retirement savings.

Without further ado, let’s dig in!

Reasons to Open a Gold IRA in 2024

There are many reasons why a precious metals IRA is a smart idea. In fact, probably too many to count!

Below are some of the main ones that make an investment in gold or silver an attractive financial move for many people who want a comfortable retirement.

Reason #1: Options for Tax Treatment

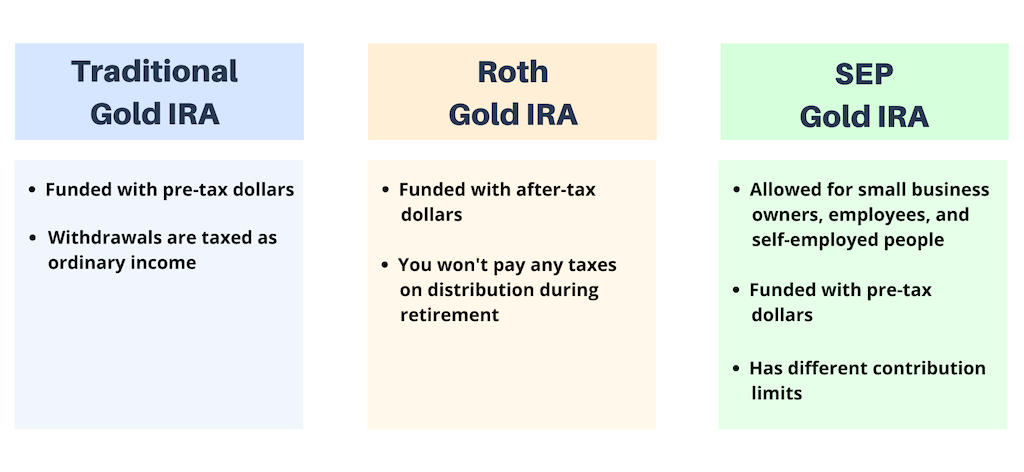

A Gold IRA offers the same options when it comes to tax treatment as traditional IRAs.

When you’re actively working, you are in a higher tax bracket than the one you will likely be in post-retirement.

Traditional IRAs are not taxed when you create an account because you fund it with pre-tax money. This means that you will pay the tax at withdrawal at a lower rate.

For many folks, the difference between their tax rates is substantial once they retire.

With an investment in a traditional IRA, you can choose to defer the payment of taxes until after you are finished working and access the retirement funds.

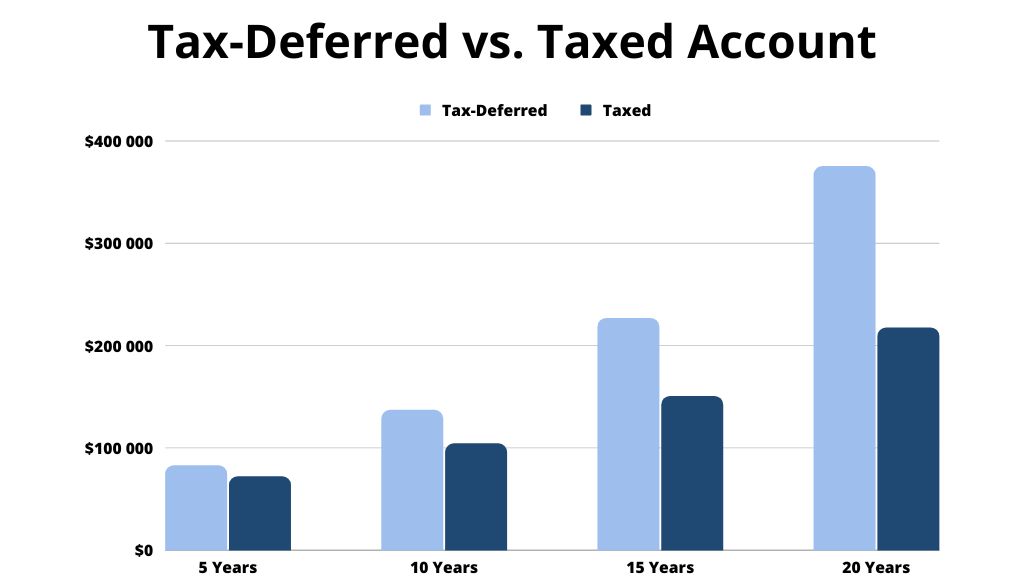

An example below will show you how tax-deferred gains are a huge benefit of Gold IRAs.

We’ll use…

- a 10.61% annual return (the historical average annual return on gold from 1971 to 2019, according to statista.com),

- a 28% annual tax rate for the taxed account,

- and a starting balance of $50,000 for both.

TAX-DEFERRED | TAXED | |

After | Account Balance | Account Balance |

5 years | $82,746 | $72,217 |

10 years | $136,937 | $104,305 |

15 years | $226,619 | $150,650 |

20 years | $375,036 | $217,589 |

And here’s a graph for visual reference:

We can see that it’s over a $157,000 difference between the tax-deferred and taxed accounts after a couple of decades.

(Which is pretty huge.)

Conversely, Roth IRAs are funded with post or after-tax dollars.

This means that you pay taxes on the funds as they are earned, and there aren’t any taken out upon withdrawal.

With a Roth IRA, you’ll enjoy accessing your money in retirement without having to pay taxes because it was paid at the time of investment.

SEP IRAs are also an option if you are an employee or self-employed. It is funded with pre-tax dollars and has different contribution limits.

Truth is:

The tax treatment of all IRAs, whether traditional or backed by precious metals, is basically the same, so if you understand the one, you should be able to understand the other.

And it can’t be overstated that one of the foundations of good retirement planning is a smart tax strategy.

Disclaimer: We are not tax advisors, so please always consult with your financial advisor before making any decisions.

Reason #2: Economic & Geopolitical Upheaval

If you’re anything like us, watching the daily news or reading the local paper can be pretty depressing.

There’s a lot that’s going wrong today, and if you’re not concerned, you should be!

The recent pandemic and subsequent disruptions to the global supply chain are great examples of how quickly things can go badly when it comes to the world economy.

And, even with the United States holding the world’s reserve currency, we have our fair share of economic problems here too.

This means that it’s important to plan for the unexpected.

Precious metals are an effective way to protect your savings from losses caused by turmoil that disrupts the markets.

Reason #3: Looming Recession & Inflationary Pressures

It seems like everyone’s talking about the looming recession that’s going to be big news in 2024 and beyond.

While the experts don’t always agree on how severe or long-lasting the recession might be, most agree that there’s one coming.

A recession, coupled with inflationary concerns, can be a double whammy when it comes to retirement planning.

As economists focus on cooling the economy and lessening inflation, the effect on retirement can be mixed.

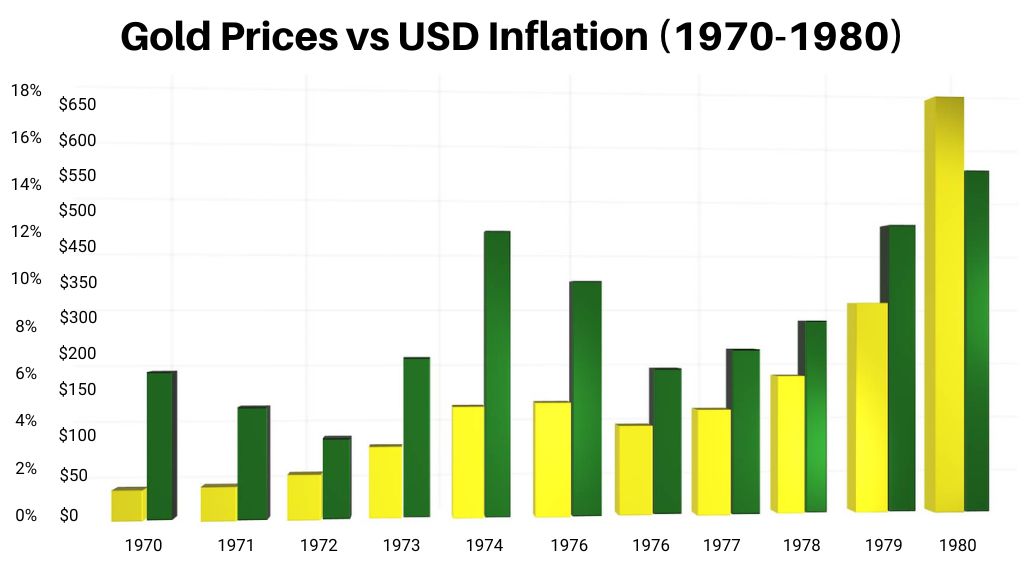

Fortunately, precious metals are an effective hedge that will help to protect your buying power even as prices increase.

Check out the graph here on how gold performed extremely well during the Great Inflation of the 1970s:

Even when the rate of inflation decreases, as it did in the final quarter of 2022, prices have continued to rise.

This means that the funds you’ve saved for your golden years will not go as far as you may have planned.

Alternative investments, like precious metals, can help you protect your purchasing power during retirement.

Reason #4: Diversification

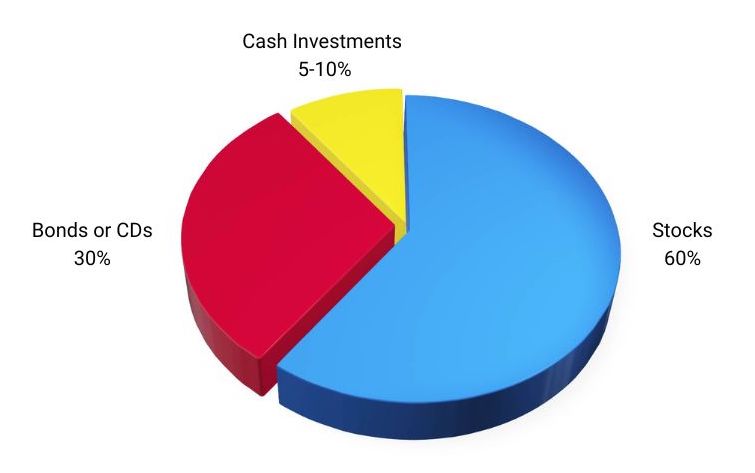

Have you heard of the Rule of 100?

It’s a simple way to check to see if you have a good amount of diversity in your retirement portfolio.

Here’s how it works. Just subtract your age from 100 to determine a ballpark estimate of the percentage of stocks you should hold.

An easy example is a retirement planner who is 50 years old.

Their portfolio should be comprised of holdings equalling about half of the allocation in stocks and the other half in bonds or cash.

Now, we all know that the stock market can be pretty unpredictable.

Bonds are also reliant on the Federal Reserve and the interest rate that they decide on. Remember when everyone was refinancing their homes because of historically low-interest rates?

The flip side of these low rates is that cash, fixed income, and the like suffer.

When we’re young, lower rates are desirable as we’re probably borrowing more money for our education, home, vehicle, and such.

And as we age, we’re more likely to be saving and decreasing or even eliminating debt.

When you have 50% of your portfolio in cash and fixed-income investments, you are at the whim of Federal interest rates.

Of course, you should always hold bonds and cash in addition to your stocks.

But, and here’s the important part, limiting your portfolio to only these options can cause heartache in the future.

Even now, as interest rates are steadily rising, having a fully diversified retirement fund is beneficial.

Adding a complementary IRA to your already diverse holdings can decrease the likelihood of financial catastrophe in your golden years.

If you’re ready to protect your savings, keep reading to learn more about how to get started with this type of individual retirement account and if it could be an effective choice for you.

Gold IRAs Aren’t for Everyone

Now…

You may wonder “are gold iras a good idea?”, but there’s something else we need to mention.

While these financial tools are effective hedges against recession, inflation, and market upheaval, they’re not for everyone.

Yes, even with all of their benefits, precious metals do not always outperform stocks and bonds.

The value of such investments is that they’re a “safe haven”, especially during periods of uncertainty.

This means that if you are just starting your retirement planning, investing in metals may not be the right move. This is something you do to boost the stability of an already robust portfolio.

The downside to a Gold IRA is that investing in the stock market will likely provide higher returns.

However, as we all know, the stock market can experience a lot of volatility, and you should tread lightly.

If you have a low tolerance for risk, you may want to review your financial goals with a specialist in the field of precious metals.

And, as you get closer to retiring, this type of investment becomes a lot more attractive.

How to Get Started with a Gold IRA?

Let’s face it…

As we all grow older, funding our later years is a higher priority. Choosing the right company to work with can also have an impact on your experience.

If you want to invest a minimum of $10,000 or can roll over your funds, a Gold IRA may be just right for you.

Now is an ideal time to learn more about the many benefits that come with investing in this type of accounts.

The first step is choosing a reputable firm that has experience with this type of unique investment.

There is one we strongly recommend. It is Augusta Precious Metals.

The APM team is known for their professionalism and high level of knowledge when it comes to helping their clients successfully invest in IRS-approved metals.

They will help you understand everything you need to know and evaluate your current financial situation to see if adding a Gold IRA is worth it specifically for YOU.

You can read our full review here, or you can give them a call at (833) 989-1952.

All in all, we believe that adding gold and silver to your account is an effective way to ensure that you have the money you need to enjoy a full and happy retirement.

Now, we’d like to hear from you:

Do you also agree that a Gold IRA is a good idea in 2024, or do you prefer to use other financial tools to protect yourself?

Are gold and silver IRAs a good idea in your opinion?

Let us know your thoughts in the comments below!