Not sure if you have to pay sales tax on your gold investment? Don’t worry, you’re not alone.

With each state treating this precious metal differently, it can be confusing to know where you stand when it comes to taxes.

But it doesn’t have to be.

Today, you’ll find a breakdown of which states charge sales tax on gold and silver. More importantly, you’ll discover how you can avoid it regardless of where you live.

You’ll also learn some effective strategies that can eliminate your taxes, whether you’re buying or selling this precious metal.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making decisions.

Now with this disclaimer out of the way, let’s get started.

Is Gold Taxed When Bought?

Yes, unlike other investments, some states charge sales tax on precious metal purchases. And due to a recent Supreme Court decision, these taxes apply even if you buy from an online dealer.

In the 2018 case of South Dakota vs. Wayfair, the Supreme Court reversed its position prohibiting states from collecting sales tax on online purchases.

Previously, the court had ruled that online, out-of-state purchases were exempt from state sales tax.

This new ruling allowed states to charge sales tax on these purchases, including precious metals.

However, states soon discovered that doing so came with some unintended consequences.

1. States don’t charge sales tax on other investments.

So why treat a gold investment differently than a stock or bond purchase? Investors couldn’t understand why a state would tax one but not the other.

2. Taxing gold can reduce a state’s revenue.

A state sales tax discourages trade shows and conventions, a significant source of income.

3. It discourages sound investment strategies.

Many investors will turn to riskier strategies to avoid paying this tax rather than diversify with precious metals.

Fortunately, after feeling the pain, many states recently passed legislation eliminating sales tax on gold and silver investments.

However, not all states have jumped on board, so it’s important to confirm your state’s laws before investing.

What States Have No Sales Tax On Gold and Silver?

If you’re looking to buy gold and silver and happen to live in one of the following states, you don’t need to worry about paying sales tax:

- Alaska

- Delaware

- Georgia

- Idaho

- Iowa

- Kansas

- Louisiana

- Montana

- Nebraska

- New Hampshire

- North Carolina

- Oklahoma

- Oregon

On the other hand, the following twelve states (including the District of Columbia) still charge sales tax:

- Arkansas

- Hawaii

- Kentucky

- Maine

- Minnesota

- Mississippi

- New Jersey

- New Mexico

- Vermont

- Virginia

- Wisconsin

- Wyoming

While the remaining twenty-five states have either complete or partial sales tax exemptions for precious metal purchases:

- Alabama: No sales tax on bullion

- Arizona: No sales tax on bullion

- California: 7.5% on purchases below $1,500

- Colorado: No sales tax on most precious metals

- Connecticut: 6% on purchases below $1,000

- Florida: 6% on purchases below $500, with an exemption if it qualifies as legal tender

- Illinois: 6.25% on South African Krugerrands only; all other bullion is exempt

- Indiana: No tax on high-purity bullion, 7% on other types of precious metal

- Maryland: 6% on purchases below $1,000

- Massachusetts: 6.25% on transactions below $1,000

- Michigan: No sales tax on high-purity bullion

- Missouri: No sales tax on high-purity bullion

- Nevada: 6.85%, but with some exemptions

- New York: 4% on transactions below $1,000

- North Dakota: 5%, but high-purity bullion is exempt

- Ohio: Sales tax of 5.75% applies to silver and gold bezels; high-purity bullion is exempt

- Pennsylvania: 6% on silver and gold coins which are not legal tender; bullion is exempt

- Rhode Island: 7% tax applies only to bullion that’s not been refined or smelted

- South Carolina: Most precious metals are exempt, but some coins and processed items are taxed at 6%

- South Dakota: No sales tax on investment-grade bullion or legal tender

- Tennessee: No sales tax on gold or silver bullion

- Texas: No sales tax on gold or silver bullion

- Utah: A 4.75% tax applies to bullion with a purity below 50%

- Washington: No tax on any non-collectible precious metals

- West Virginia: Investment-grade bullion and coins are exempt

When you place your order, your precious metals company will inform you of any sales taxes due and include them in your purchase price.

Also, remember that the tax laws are always changing. Therefore, it’s essential you check your state’s current regulations.

Can You Buy Gold Without Sales Tax?

At this point you may wonder:

- How can I buy gold without paying sales tax?

- How can I avoid paying tax on gold (and silver)?

So what can you do if you live in a state that charges sales tax?

Fortunately, you can legally avoid it using one of the following strategies.

1) Use a Precious Metals IRA

The first option is to buy your precious metals within an individual retirement account.

No sales taxes are due for purchases made by your IRA custodian.

And when you work with a highly reputable company like Augusta Precious Metals, they handle all the details, from opening to funding to purchasing your precious metals.

(By the way, they can help if you decide to buy physical gold with a cash transfer outside of an IRA too.)

Check out our in-depth review of them here.

2) Ship to a Depository in a Tax-Free State

Want to buy gold outside of your IRA? You can still avoid this tax.

Since sales tax depends on where your order is shipped, you can avoid it by sending it to a storage facility in a state that doesn’t charge sales tax.

For example:

There is no sales tax on buying precious metals in Texas (whether it’s numismatic coins or gold, silver or platinum bullion), so that could be one of your options.

Does The IRS Know When You Buy Gold?

Another concern many investors have is if the IRS is notified when you purchase precious metals.

This only comes into play if you use cash to make the purchase.

If you buy $10,000 or more with cash or a cash equivalent (money order or cashier’s check), the dealer is required to file form 8300 as part of the Anti-Money Laundering regulations.

This form provides information on the buyer and seller in the transaction and is provided to the IRS.

However, if you use any other payment source, including purchases within your IRA, no report is filed with any state, local, or federal agency, regardless of the amount.

How Much Gold Can You Buy Without Reporting It?

There are no limits on how much gold you can purchase. However, you will need to report any sales on your tax returns.

In addition, if you are buying more than ten grand worth of gold or silver using cash, your dealer will need to report the sale on form 8300 with the IRS.

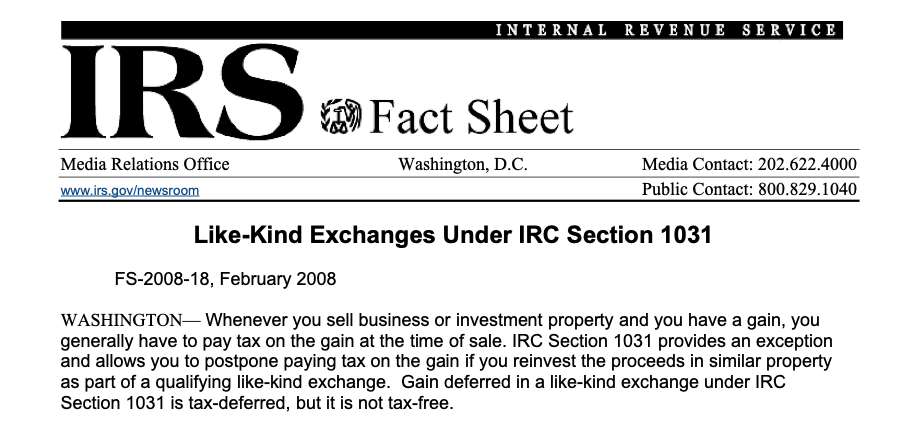

Avoid Capital Gains Taxes With A 1031 Exchange

The IRS considers precious metals a capital asset, and you are required to report all sales on schedule D of your tax returns in the year that you sell.

If held for more than a year, any gains are subject to a capital gains tax equal to your marginal tax rate of up to 28%. For metals held for less than a year, profits are taxed as ordinary income.

However, you can still avoid paying capital gains taxes on gold held outside of an IRA. That’s by doing a 1031 exchange.

Commonly used by real estate investors to defer taxes on property sales, you can apply the same rules to precious metals.

Under IRS rules, you can defer taxes on a like-kind exchange if you meet specific requirements.

First, you must exchange gold for gold or silver for silver. You can’t change the type of metal that you hold.

However, you can change the physical form for ease of use and storage. For example, you can exchange gold bullion bars for gold bullion coins.

You can also do an exchange for location.

For example, if you currently hold your metals outside the US, you can sell them and replace them with like-kind metals held within the US and defer paying capital gains taxes.

We should note that you are actually deferring taxes, not eliminating them.

And you need to complete the exchange within 180 days.

Also, you must use an Exchange Company and include specific verbiage in the sale and purchase to meet IRS regulations.

Therefore, we recommend you check with your CPA whether a 1031 exchange makes sense based on your financial situation.

How Much Gold Can You Legally Own?

As a US citizen, you are only limited by your budget and common sense. The government doesn’t impose any restrictions, so you can own as much as you want.

Also, depending on the amount, security can become an issue.

It’s one thing to keep a few coins locked away at home. But what if you have a more significant investment?

In that case, we recommend you consider a safe deposit box at your local bank or a state-of-the-art storage facility.

Avoid Taxes By Using A Gold IRA

If you want to avoid federal and state taxes on your precious metals, you can’t beat a gold IRA.

Regardless of your state, you won’t incur any sales taxes on your purchases.

Also, capital gains taxes are deferred in a traditional IRA or tax-free in the case of a Roth.

As long as you don’t take any withdrawals, you can sell your precious metals, keep the proceeds in your IRA, and then turn around and repurchase them at some point in the future without triggering a taxable event.

Buying Gold Without Paying Sales Tax

All in all:

Don’t let sales tax keep you from enjoying the benefits of investing in this precious metal.

By using these strategies, you can avoid paying any sales tax regardless of where you live.

And with a gold IRA, you can defer or eliminate any capital gains taxes, making your investment tax-free.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Still trying to figure out if gold is right for you?

Give the folks at Augusta Precious Metals a call at 833-989-1952.

They’ll be happy to answer your questions without any pressure to buy.

You can also grab their guide, which is 100% free and will help you understand about the power of diversifying your portfolio with gold and silver today.

Plus, you get a FREE GOLD coin when you open a Gold IRA account with Augusta.