You may wonder:

Is it a good idea to invest in gold this year?

What are the pros and cons of buying gold coins as investment?

Are gold coins worth investing in, or should you choose bars instead? Or is silver a better choice?

And these are the questions that we’ll answer today.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

Why Invest in Gold (Coins)?

The truth is:

No longer just for collectors and hobbyists, gold and silver coins have become a popular alternative investment for those looking to protect their wealth with an asset that can’t be hacked or stolen online.

They also provide benefits you won’t find with other investments, from being an excellent hedge against inflation to providing stability during turbulent markets.

However, many potential investors feel overwhelmed by the sheer amount of conflicting information available online that they end up feeling paralyzed and doing nothing.

But it doesn’t have to be that way.

Here, we’ll provide you with everything you need to know about investing in gold coins – including the different types available, their advantages and disadvantages, and the most popular styles coveted by investors today.

Types Of Gold Coins

Look…

We have had a fascination with gold dating back to the Bronze Age when this precious metal was first used as a method of trade.

However, King Croesus of Lydia (in present-day Turkey) ushered in a new era when he ordered struck the first gold coins in 550 BC.

Even paper currency was directly linked to a nation’s gold supply until the 1930s, when the world went off the gold standard.

Rather than used as money, today, they are a popular alternative asset to hedge against inflation.

The three categories of coins available are bullion, numismatic, and semi-numismatic.

Bullion

The top choice for investors. These are issued by both government and private mints around the world.

One-ounce coins are the most common, though they can range from a tenth of an ounce to multiple ounces.

Bullion coins are priced based on their gold content rather than their collectibility.

For this reason, it’s essential you only invest in high-quality ones backed by the mint that produced them, guaranteeing their purity.

Fineness and karats are the two most common methods used to measure gold content.

Fineness is a precise measurement of the purity level when referring to bullion and is expressed as a three-digit number.

For example, a coin with a fineness of 999 is 99.9% gold and 0.1% other metals. Typically, a fineness of 995 or higher is considered pure gold.

On the other hand, many consumers are already familiar with the karat system. It’s a simpler method commonly used in jewelry that expresses the gold content as parts per 24.

For example, 18 karats represent 75% gold, while 24-karat gold is almost 100% pure gold.

With a few exceptions, most bullion coins are considered pure gold, while numismatics usually contain alloys like copper.

Numismatic Coins

What are numismatic coins, you might ask?

Unlike bullion which is valued based on the precious metal content, numismatics are priced based on their rarity, historical significance, condition, and overall appeal.

Rare or ancient coins can trade for many times the value of their gold content.

For example, a Greek Panticapaeum stater recently went for $6 million at a Swiss auction, making it the most expensive ancient coin sold.

Other popular examples are:

- Pre-1933 $10 Gold Eagles

- The Swiss 20 Franc

- Original British Sovereigns

It takes a skilled eye to tell the difference between an ordinary coin and a valuable numismatic.

So if you are considering investing in these, make sure that they have been authenticated by an independent third-party coin grader.

Also, keep in mind that since they aren’t pure gold, as per IRS’ strict rules, they can’t be included in an IRA account.

Semi-Numismatic Coins

These coins derive their value from their gold content and numismatic appeal.

The premium usually falls between the typical premium of a bullion coin and the higher premiums of authenticated numismatics.

Unlike bullion, the premium isn’t the cost of production but rather the value placed on these coins by collectors.

Think of them as hybrids, closely tracking gold prices but with an extra premium based on their collectibility.

Some famous examples of semi-numismatics are:

- Victorian Sovereigns

- Queen Elizabeth II proofs

The bottom line when investing in gold coins is that investors should stick to bullion, while numismatics are for collectors and hobbyists.

Are Gold Coins a Good Investment?

Investing in gold coins offers advantages you won’t find with other investments.

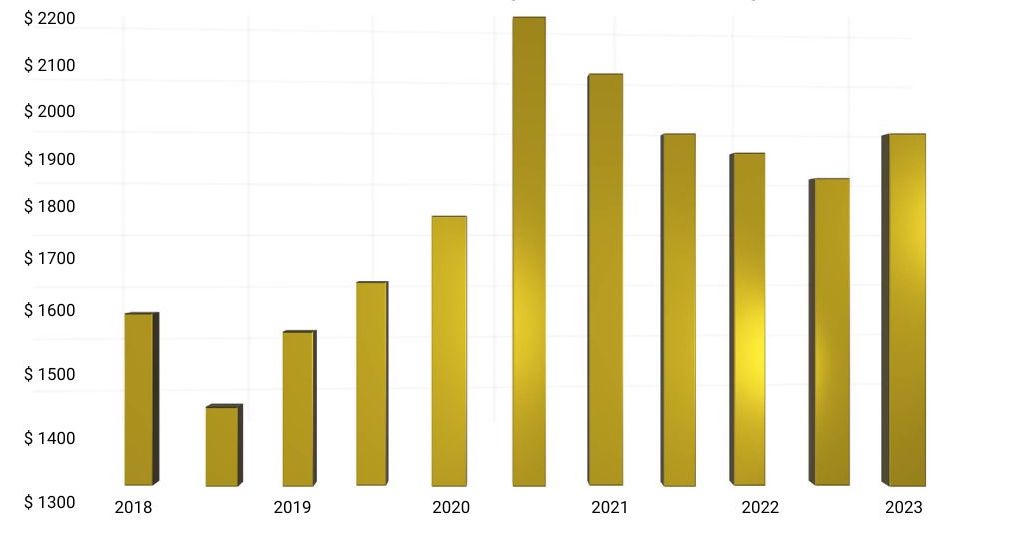

- Inflation hedge

Since 1974, when inflation has been above 5%, gold prices have averaged 15%, beating out equities, bonds, and real estate.

- Protects your value

Prices tend to rise over time, making it an excellent long-term strategy to protect your wealth.

- Diversification

Gold is uncorrelated with virtually all other asset classes. It’s the ultimate investment to diversify your portfolio and lower volatility.

- Simplicity

So easy even a beginner can learn how to invest. There’s no need to track industries or monitor company financials.

- Can’t be hacked

As a physical asset, it can’t be hacked or stolen by online thieves.

- Hedge against disaster

Prices tend to rise when other investments are falling, and gains can offset losses in other areas of your portfolio during challenging economic times.

- Physical asset

Perfect for those that want to touch and feel their investment.

- Collectibility

Desirable coins can command prices greater than just their precious metal content.

- Privacy

No reporting means nobody needs to know you own it. Perfect for those that want to hold part of their wealth “off the grid.”

Note: There are some events that may trigger reporting requirements, which you can check out here.

- Can hold them in an IRA

This is limited to high-quality bullion coins that are IRS-approved. You can take advantage of the tax benefits of a Gold IRA and let your investment grow tax-deferred.

- Protection during a financial collapse

In the event of a massive currency devaluation, they can be used instead of money to buy necessities. Though it sounds like science fiction, this has already happened in other countries.

Disadvantages of Investing in Gold

While the benefits appeal to just about everyone, it’s essential to also understand the risks of investing in gold coins before diving in.

- Higher premiums

They cost more to produce than bars, so you’ll pay a higher price for the same amount of gold.

- Storage costs

Whether you keep them in a home safe or a state-of-the-art storage facility, you’ll pay extra to keep your investment secure.

- Authenticity issues

Stick with top mints to avoid buying counterfeits.

- Insurance costs

It’s important to protect your investment from theft and natural disasters.

- Poor resale value

Coins can fall out of favor with investors, leading to lower resale prices in the event you need to sell your investment quickly.

- Theft

Thieves love gold and are ingenious in finding ways to separate you from your precious metals.

- No income streams

Unlike other assets that may pay dividends or interest, gold produces no additional income other than price appreciation.

- Time

Buying gold coins isn’t a get-rich-quick method, as it can take years for your investment to appreciate. So you would have to be patient.

Gold vs Silver Coins As Investment

Now…

Is it better to buy silver or gold coins?

The truth is, both have become popular alternative assets for investors looking to protect their wealth and lower portfolio risk.

However, before investing, make sure you understand the critical differences between silver and gold precious metals.

1. Silver Is More Closely Tied To Economic Cycles

Over half of all silver mined is used for heavy industry and technological products.

This precious metal is second only to oil for the number of industrial applications in which it is used in our day-to-day lives.

As a result, it is more susceptible to the economic climate than gold, which has few uses beyond jewelry and investment.

Silver prices tend to fall faster during recessions and then take off again during the subsequent recovery.

2. Silver Prices Are More Volatile

Daily volatility can be two to three times greater than gold.

This volatility may make silver an excellent trading vehicle but can prove challenging for investors looking to reduce overall portfolio risk.

3. Gold Provides Greater Diversification than Silver

Gold is uncorrelated with stocks and other asset classes due to its limited industrial uses, making this asset a better diversifier than silver.

4. Silver Is Cheaper than Gold

Silver tends to cost less per ounce, making it easier for small retail investors to diversify with this precious metal.

What Is the Best 1 Oz Gold Coin to Buy?

Gold coins come in many designs.

Ultimately, deciding which is the best comes down to your personal preferences.

Here are nine of the most popular styles available today.

The US American Eagle

One of the world’s most widely traded gold coins, it was first introduced by the US Mint in 1986.

Since its release, this coin has been in high demand and is considered the standard for US investors by which others are measured.

South African Krugerrand

The South African Krugerrand was first minted in 1967.

It was the original gold bullion coin and was named after the first Republic of South Africa President, Paul Kruger.

In 1980, they represented 90% of all the gold coins in the world, and it’s estimated today that there are more Krugerrands than all other gold coins combined.

The Austrian Philharmonic

Introduced by the Austrian Mint in 1989, the Austrian Philharmonic pays tribute to the Vienna Philharmonic Orchestra.

China Panda

The China Mint started striking coins in 1982.

Every year they introduce a new panda portrait making this coin popular among both investors and collectors.

Canadian Maple Leaf

This popular coin is issued annually by the Royal Canadian Mint and carries a legal tender of $50 Canadian.

The RCM also calls their coin “international symbol of purity” because it is 99.99% pure gold.

Because of this level of purity, the Maple Leaf coins scratch more easily and should be handled carefully.

American Buffalo

First offered in 2006, this coin is the US answer to the Canadian Maple Leaf.

It follows the design of the Indian Head nickel and features a Native American profile on one side and a buffalo on the other.

They can vary in thickness and have irregular edges.

Australian Kangaroo

First introduced in 1986, it is one of the few bullion coins that changes its design every year (the other being the China Panda).

They have become a top choice for Asian investors.

British Britannia

The Royal Mint is famous for creating detailed and beautiful coins, and this coin is no exception.

First introduced in 1987, it features a well-known design by sculptor Philip Nathan, known as the “Standing Britannia.”

It is one of the most beloved bullion coin collections, not just in this series, but in the world.

British Sovereign

Earlier we mentioned these coins, but those were the numismatic ones we referred to.

Here, the British Sovereign was introduced in 1987 and is modeled after the original British Sovereign, first minted in 1816.

It has the strongest secondary market for all gold bullion coins, and rare sovereigns can be worth several times their weight in gold.

Gold Bars Or Gold Coins for Investment

You may wonder:

“Should I invest in gold or gold coins?”

While buying bars is a pure investment play, gold coins can be worth more than their gold content based on their rarity and cultural significance.

Plus, they start as small as 1/10th of an ounce.

This size makes it easier to diversify between different mints and styles and puts gold within reach for smaller retail investors.

Another thing to keep in mind is that mints produce limited quantities each year, and many go on to become highly sought after by collectors.

Final Thoughts

This being said…

Gold coins come in all sizes and designs, from the common to the rare.

And with sizes starting as little as a tenth of an ounce, even the most budget-conscious investors can profit by diversifying with this precious metal.

In addition, they offer privacy not found with other assets.

They are the perfect investment for those wishing to remain anonymous yet have a tangible asset they can pass on to their heirs.

Whether used to protect your wealth, diversify your portfolio, or you simply enjoy collecting them, investing in gold coins may be the most fun you’ll have with your investments this year.

Now:

Whether you want to take possession of your physical coins, or looking to buy them in an IRA, check out our #1 recommended Gold IRA company in the US, Augusta Precious Metals.

They will educate you on diversifying with gold and silver, will hold your hand through every step of the process, and do 95% of the paperwork with you.

If this is something that interests you, give the Augusta team a call at 833-989-1952 to learn more.

You can also grab their guide here and get a FREE GOLD coin when you open a gold IRA account with them.

Now, we’d like to hear from you:

- Are you buying gold coins as investment this year?

- If yes, who is your go-to precious metals dealer?

Share your thoughts and personal experience in the comments below!