Look:

When it comes to Gold IRAs, IRS rules, and precious metal investing in general, there are a lot of questions that people have.

And we’re here to help answer those.

In today’s post we’ll cover the following:

- Can you make money on a gold IRA?

- Does a Gold IRA earn interest?

- Reasons to invest in precious metals IRA

- How to get started the right way

- And lots more!

Without further ado, let’s find out if you can earn interest on gold.

Does a Gold IRA Earn Interest?

No is the simple answer to this question.

Gold is a commodity, not a security or a cash asset. This means that its value is derived from the value determined by the precious metals market.

Interest-bearing accounts such as traditional savings and money market accounts will earn interest. Some stocks and bonds pay dividends or coupons.

But alternative investments like precious metals do not, no matter in what type of account they’re held.

They are typically held as hedges.

Meaning that when there is economic turmoil or a spike in inflation, it’s helpful to have these investments in your portfolio.

Think of precious metals as just one part of your overall investment strategy.

Gold is an effective way to ensure that your life savings won’t be wiped out by factors that affect the stock market and the overall economy.

Because it feels like the world has been in a constant state of turmoil for the past few years, many more people are becoming interested in precious metal IRAs.

(Commonly referred to as Gold IRAs.)

And even though Gold IRAs don’t pay interest, you’ll soon find out about the benefits of investing in these types of accounts.

The ABCs of Gold IRAs

Like other individual retirement accounts, you can invest in a traditional, Roth, or SEP Gold IRA.

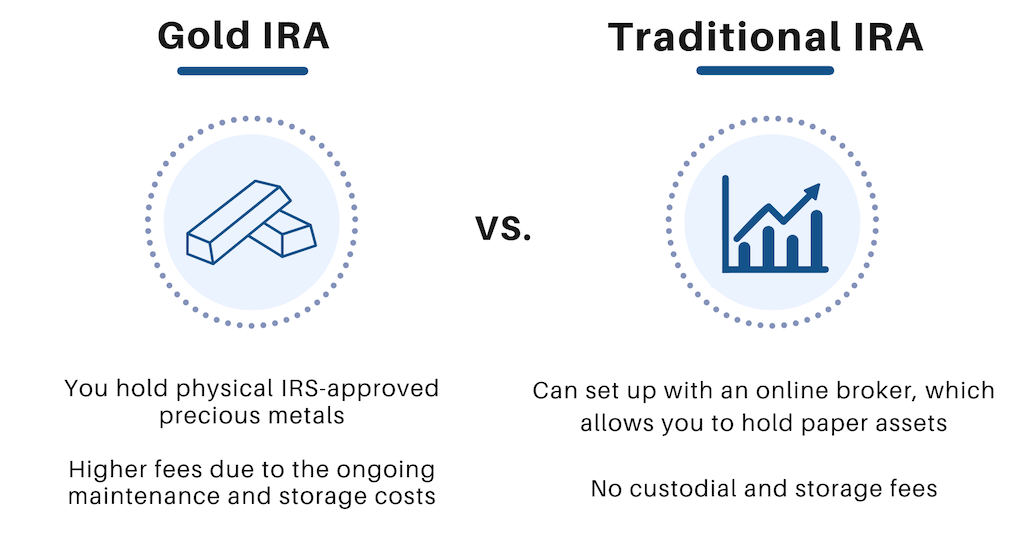

Read this in-depth post on how gold-backed IRAs differ from traditional ones.

Even though Gold IRAs tend to have higher fees due to maintenance and storage costs, many people find that this is what makes the most sense for them to protect their savings.

When you choose this option, you don’t have to worry about physically storing or securing your investment.

Beginner investors are often worried about fraud and buying the wrong thing.

This is another reason why an IRA makes so much sense.

Working with an experienced and trustworthy precious metals company allows you to feel secure about your purchases.

Important note:

Always do your due diligence. For example, you’d want to be cautious with Regal Assets.

Also, always consult with your professional advisor before making any decisions.

Now…

As a rule, a top level Gold IRA firm knows what is and isn’t acceptable to the IRS and will ensure that your investments qualify for inclusion in your retirement account.

The #1 Gold IRA Company in the US |

|

Why is Goldco Best?

|

Our Rating: |

If you’re just getting started with investing in precious metals, choose a reputable Gold IRA company that will take the time to educate you and help with anything you need.

At this point you may wonder, what are the benefits of Gold IRAs?

Gold IRAs: Main Benefits

As mentioned above, gold is a hedge against inflation and market upheaval.

The returns that it provides aren’t likely to change your life, but they will protect you from ruin!

What do we mean?

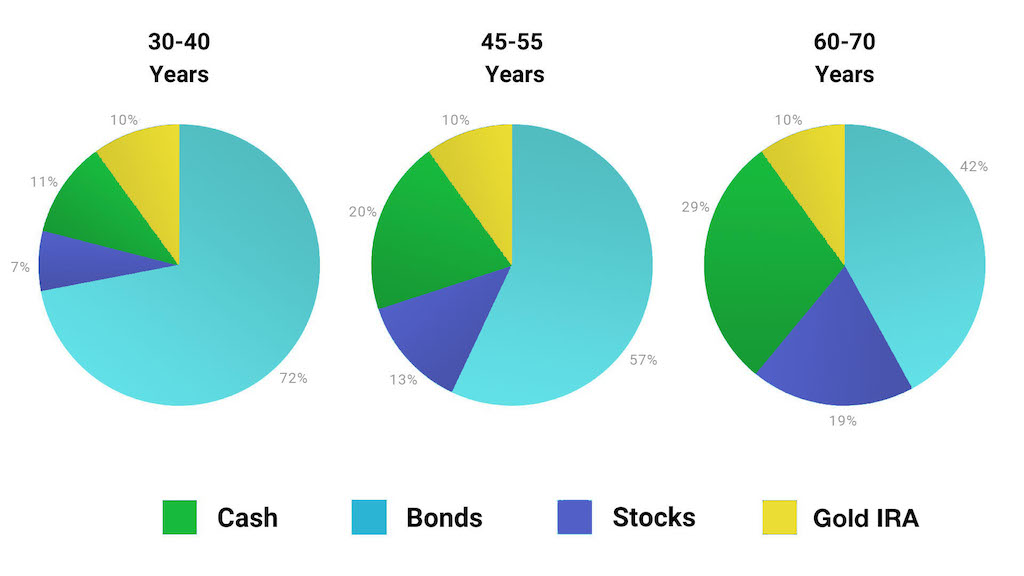

Well, let’s say that you’re nearing retirement and more than half of your portfolio is invested in the stock market.

Now, hopefully, you’ve taken the time to diversify your portfolio.

If you’re lucky, you’ll have some money in cash and cash equivalents, as well as some alternative investments.

Say you saw the turmoil coming and you increased your allocation in gold.

This means that, as a percentage, your portfolio will be less affected by the losses experienced in the stock market.

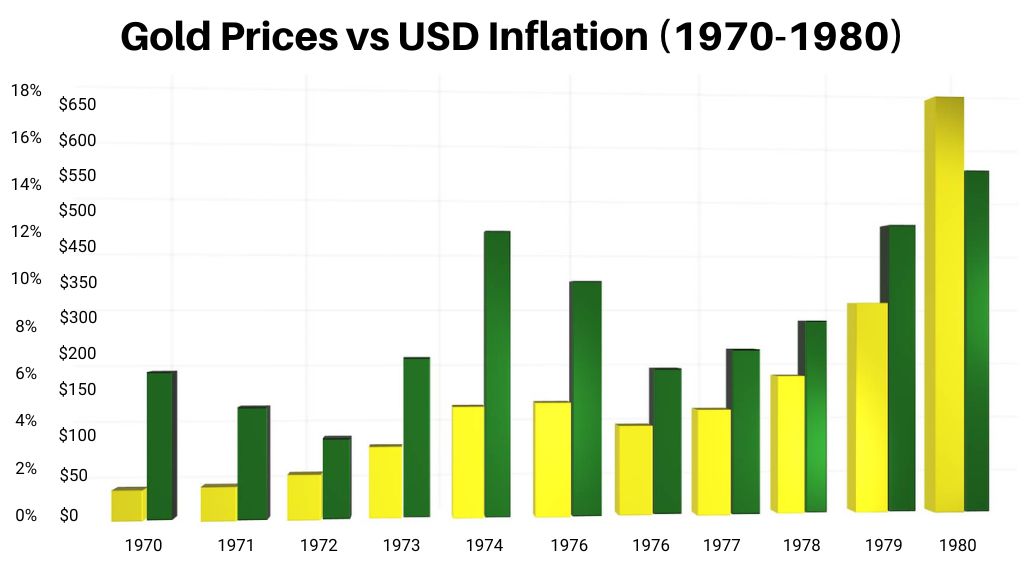

You’ll also benefit from having an investment that’s resilient in times of high inflation.

When inflation rises, so do prices.

This means that all of the money that you’ve been saving during your working years will deliver less bang for the buck.

As purchasing power decreases, having an appropriate amount of precious metal holdings can provide a buffer.

Historically speaking, gold rises during times of high inflation.

This graph of the 1970s is a great proof of that:

This being said…

When you access your Gold IRA during retirement, you’ll enjoy the greater purchasing power that this money will provide.

How to Get Started?

A lot of people start their precious metals journey with gold coins. Popular ones include American Eagles, Canadian Maple Leafs, and Kugeraands.

If you are just getting started, the first step is to find a reputable dealer.

Next, you’ll want to stick to coins that are approved by the IRS if you are considering opening a self-directed IRA.

From the IRS website:

“Your IRA can invest in one, one-half, one-quarter, or one-tenth ounce U.S. gold coins, or one-ounce silver coins minted by the Treasury Department. It can also invest in certain platinum coins and certain gold, silver, palladium, and platinum bullion.”

Now, if you’re like us, that data point raises more questions than it answers!

(That’s the Internal Revenue Service for you.)

This ambiguity can lead to a lot of confusion, and investors may find themselves holding coins or bullion that aren’t IRA-approved.

Another reason why it’s important to deal with a precious metals company that knows the ins and outs of investing in these assets.

Here’s a list of the top rated Gold IRA firms that you can choose from.

Frequently Asked Questions

Is a Gold IRA worth it?

We think it is, especially considering the current economic landscape. Check out this short video below:

Should I invest in a Gold IRA if I won’t earn interest?

Yes. There are many great benefits that come with investing in a Gold IRA.

If you’re ready to explore this option a bit further, we highly recommend that you read our full review of Augusta and how their Gold IRAs can benefit your retirement planning.

Do the tax advantages of a Gold IRA outweigh the lack of interest payments?

Let’s say that you buy gold at age 50 and then access your Gold IRA once you retire at age 65.

The increase in the value of your investment will now be available to you tax-free or at a lower tax rate than the one you were paying during your working years.

The tax treatment of Gold IRAs is identical to any other IRA (say, one where you invest in ETFs, mutual funds, stocks, or bonds).

Again, always consult with your tax advisor before making any financial decisions!

Will my gold appreciate in value?

Well, no one has a crystal ball, so no one really knows what the financial future holds.

The value of gold tends to have an inverse relationship with other investments, like stocks. What that means is, when stocks go down, the value of gold typically goes up.

This is one of the reasons that gold is such a popular investment for people planning for retirement.

Does gold always go up in value? This video might be helpful to watch:

Now, we’d like to hear from YOU:

- Was this information helpful to you?

- Do you agree that investing in a Gold IRA makes sense in the current economic climate?

Let us know your thoughts in the comments section below!