It doesn’t take a genius to understand why gold IRAs are becoming one of the most popular alternative investments for everyday investors.

Let’s face it:

With bank failures rattling the financial markets, parking your money in a savings account or CD doesn’t provide the same peace of mind as before.

Plus, with increased pressure on prices and a tight labor market, inflation continues to eat away at our buying power.

The Fed has been little help.

Instead, they’re piling up pressure on an already weakened economy by tightening the money supply and raising interest rates.

Luckily, precious metals can be a great solution.

A Gold IRA offers something you won’t find with a traditional IRA – whether you’re looking for stability, want to take back control, or an investment that historically thrived during rising inflation.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s discover the top 5 Gold IRA benefits and why diversifying with this precious metal may be one of the best decisions you can make today.

But first…

What Is a Gold IRA?

Created with the Taxpayer Relief Act of 1997, the IRS expanded the types of assets allowed to be held in IRA accounts to include physical gold, silver, platinum, and palladium.

And that’s how the gold IRA was born.

Historically at times, this type of account has offset losses during times of economic stress/volatility.

Unlike stocks and mutual funds, you can’t hold these precious metals in a traditional individual retirement account.

Instead, you’ll need to open a self-directed IRA with a custodian who can handle the necessary IRS reporting and storage requirements of investing in precious metals.

Though it may sound more complicated, it really isn’t.

In addition, there are companies that specialize in helping investors diversify their retirement savings with precious metals.

One of the most trustworthy is Goldco, the 7-time Inc 5000 winner and Company of the Year 2022 with the thousands of 5-star ratings.

Their team make the process straightforward and will handle 95% of the paperwork required to set up an account and get you started.

Now that know what it is, what are the benefits of having a gold IRA? Why should you consider one?

Benefit #5: Diversification

Look:

Most traditional IRA accounts depend on a select group of assets – stocks, bonds, and mutual funds – that are tied to the overall economy.

Unfortunately, when the economy struggles, so does your IRA.

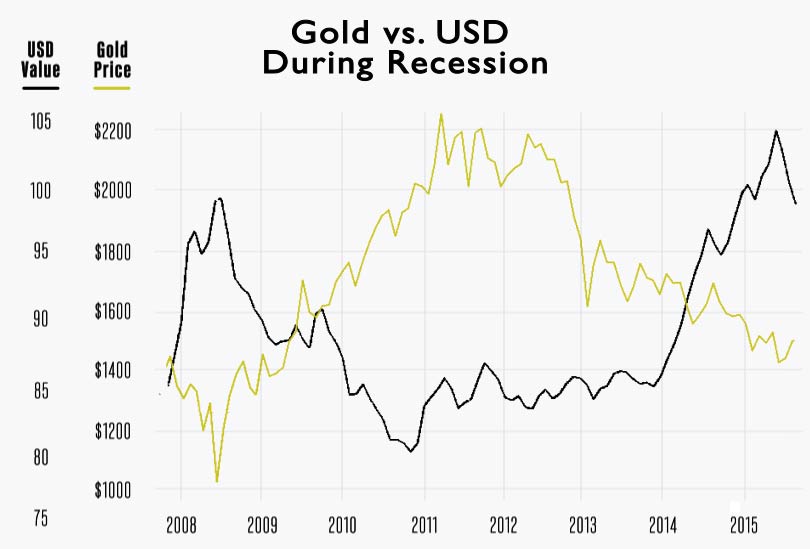

And diversifying within these assets isn’t the answer, as investors learned during the Great Recession of 2008.

From October 2007 until March 2009, the overall stock market was down 54% – wiping out decades of gains with few places to hide.

However, gold provides a level of diversification that can’t be achieved with these traditional assets.

For example, during the same period, gold prices rose 25%. You would have cut your losses in half by diversifying with this precious metal.

And unlike paper assets that can go to zero, it has a fundamental intrinsic value that makes its prices more resilient to market turbulence.

For this reason, institutions and governments have been using this shiny metal as a safe-haven investment during times of political and economic uncertainty for centuries.

As former Fed Chairman Ben Bernanke said, “the reason people hold gold is to protect against tail-risk – really bad outcomes.”

And according to Henry To, partner at CB Capital Partners of Newport Beach, CA, “gold tends not to move in the same direction as US stock prices, providing a cushion during times of market corrections.”

By diversifying your retirement savings with precious metals, you smooth out the volatility within your portfolio.

As a result, you can better weather economic downturns as price increases offset losses in other areas and give you the greatest return of all – peace of mind.

Benefit #4: Stability and Security

Maybe you’ve heard that cryptocurrency will replace gold as the next great store of value. The problem – it’s easy to steal.

In fact, according to a CNN report, over $3.8 billion was stolen in 2022.

And that’s up from $3.3 billion in 2021.

Not so with this shiny metal. As a physical asset, this precious metal is immune to online hacking and theft.

And when you hold it in your IRA, it’s housed in a state-of-the-art depository and fully insured against any loss.

Yeah, Die Hard 3 made it look pretty easy to steal truckloads of it. But that’s not the case in the real world.

And unlike cryptocurrencies, gold has an intrinsic value.

Whether used as a store of value, a component in technology applications, or to make jewelry, there will always be demand for this precious metal.

Therefore, we can feel confident its price won’t go to zero.

It gets better:

Gold prices aren’t dependent on a company’s or fund manager’s performance. Instead, they are driven by macroeconomic conditions rather than at the mercy of poor decision-making.

We can’t say the same about stocks.

As we saw during the Dot Com bubble and the 2008 Recession, many companies failed (even big names like Shearson Lehman, Enron, and Washington Mutual) due to poor management decision-making.

And investors were left holding the bag.

Even when the government stepped in, taxpayers ultimately had to foot the bill.

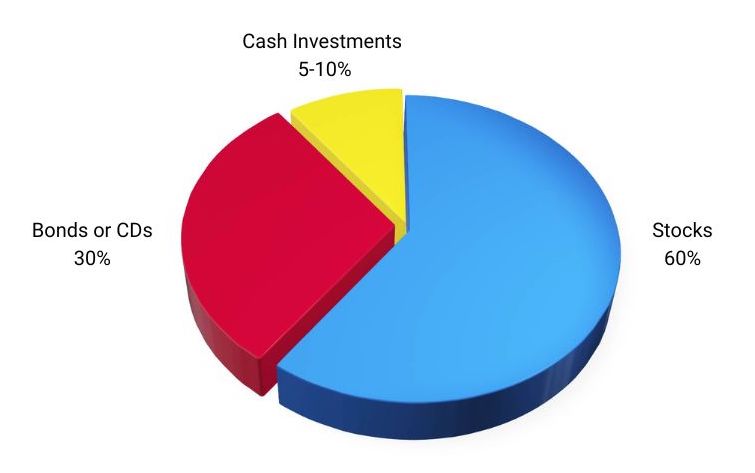

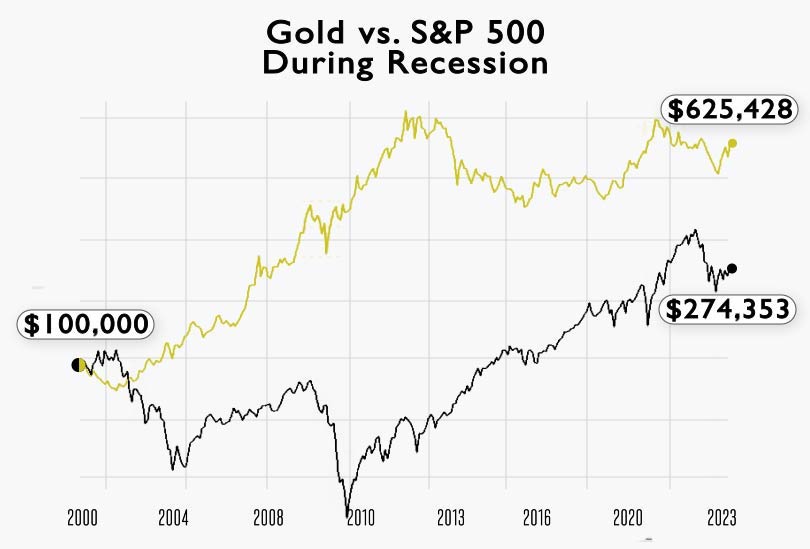

However, if you had invested $100,000 in gold in 2000, you would now have $625,428 as of March 8, 2023.

Compared to:

- $288,908 for the DOW

- $274,353 for the S&P

- and $288,160 for the NASDAQ

Pretty big difference, don’t you think?

Besides providing consistent returns and stability during market turmoil, many investors prefer the security of holding a physical asset rather than intangible concepts like stocks, ETFs, and mutual funds.

And with more and more cases of cyber theft, it makes good financial sense to keep part of your retirement savings in an investment immune to the risk of online hacking.

Benefit #3: Take Control

When you have a precious metal IRA, you have an unmatched level of control not available with traditional accounts.

Rather than relying on a financial planner or money manager, you’re making 100% of the decisions about your future.

And unlike most 401k plans, you’re not locked into a pre-determined selection of mutual funds.

Since these IRAs are self-directed, you aren’t restricted to holding traditional IRA investments, such as publicly traded stocks, bonds, or mutual funds.

Instead, you can invest in alternative assets, such as precious metals, currencies, privately held stock, and even real estate.

You decide your level of risk, which assets you want to include, and their allocation.

And when it comes time for withdrawals, you can choose to receive the physical asset or sell and get the proceeds.

If you’re tired of leaving your financial future in the hands of an anonymous fund manager, you’ll find no better tool to take back control of your retirement savings than a gold IRA.

Benefit #2: Inflation Hedge

Do you remember when the whole family could eat at McDonald’s for under $5?

Or when a gallon of gas was less than a buck?

My parents still talk about buying their first home in upstate New York for $15,000. Try doing that anywhere in the US today – even at ten times that price.

Whether we like it or not, inflation is here to stay and is a normal part of our economic cycles.

Since 1971, the dollar has lost 87% of its value. In real-world terms, what cost $100 in 1971 now costs $743.

Or that $5 McDonald’s meal now runs $37.

If you’re not planning for inflation, you may wake up to a surprise when you discover you won’t be able to maintain the same lifestyle during retirement that you’re enjoying today.

Unfortunately, that may be the case for many Americans.

And the best way to protect your buying power is by diversifying your retirement savings with precious metals.

For example, gold prices increased over 53 times during the same period – $100 in 1971 would now be worth $5300.

And if we go all the way back to 1900, the dollar lost over 98% of its buying power while gold increased by 98 times.

Inflation is the silent killer of retirement accounts, slowly eating away at your purchasing power.

However, as an anti-inflation asset, gold provides a unique tool to diversify and protect your retirement savings.

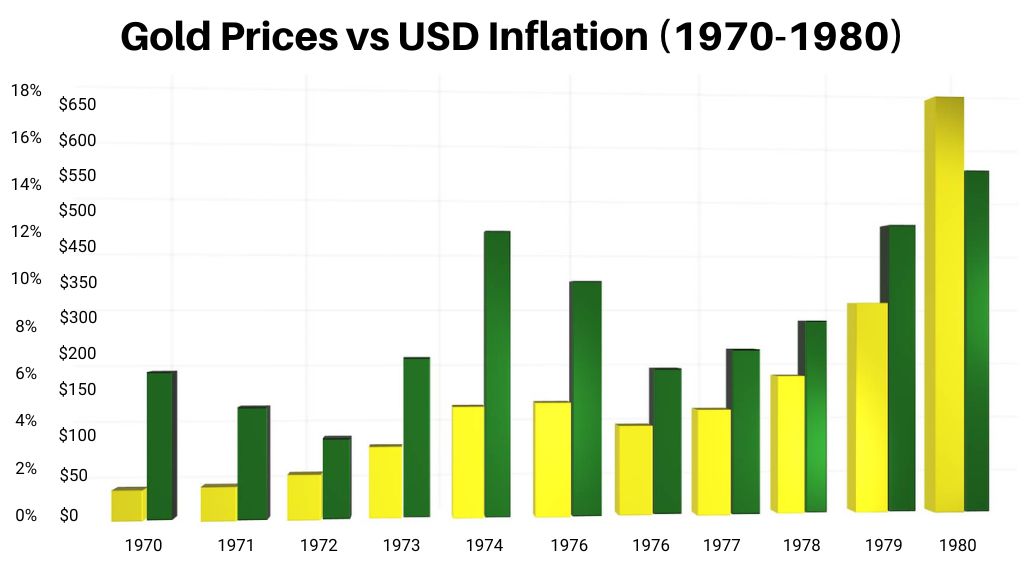

While no one can predict the future, historically, precious metals have held up well during inflationary periods.

The Great Inflation of the 1970s is a good historical proof of that:

Therefore, having a gold IRA may be an excellent way to enhance your long-term portfolio health.

Benefit #1: Tax Advantages

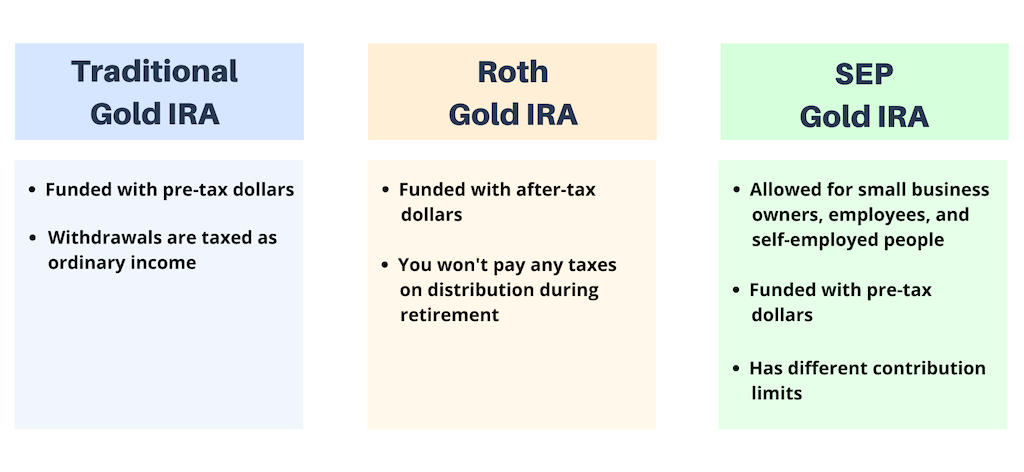

The number one benefit of a gold IRA is that your investment grows tax-deferred.

You don’t pay any capital gains as long as the assets remain in your account.

For example, you can sell your coins and bullion for a profit, and as long as you don’t take a distribution, the sale is tax-deferred (or tax-free in the case of a Roth).

By leaving the funds in your account, you can then re-invest in precious metals without any tax consequences.

These IRAs come in either traditional or Roth variations.

A traditional account allows you to take a tax deduction on contributions, but you’ll pay taxes on your withdrawals during retirement based on your tax bracket.

On the other hand, Roth contributions aren’t tax-deductible the year you make them.

However, your withdrawals during retirement are tax-free.

No matter which option you choose, if you withdraw funds before you reach 59 ½ years old, you may be subject to penalties and taxes.

This includes if you take physical possession of your precious metals.

By letting your investment grow tax-deferred, your account can grow to a sizeable amount, making the difference between just getting by or living the retirement of your dreams.

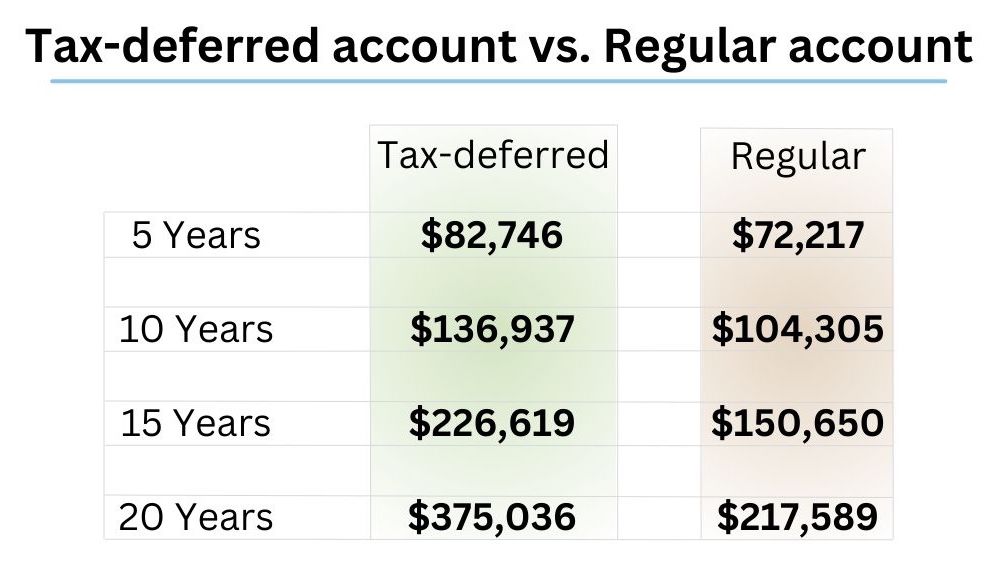

For example, let’s look at the difference between two accounts.

The first account will grow tax-deferred while the other incurs taxes each year.

In this example, we’ll use…

- an annual return of 10.61% (the historical average return for gold from 1971 until 2019, according to statista.com),

- a tax rate of 28%,

- a starting balance of $50,000 for both accounts.

Here are the results:

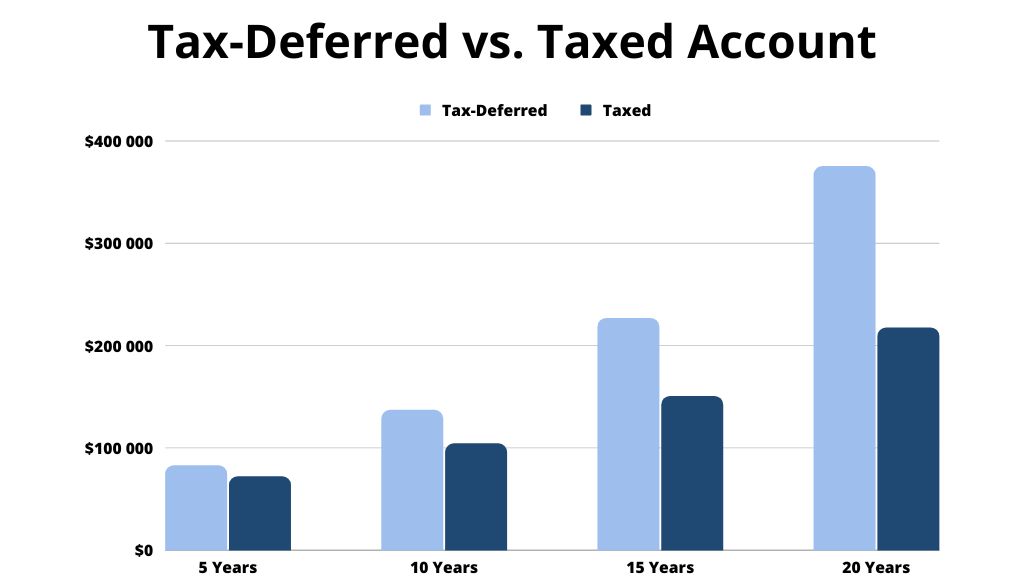

And here’s a graph for visual reference:

After 20 years, the tax-deferred account has over $157,000 more than the taxable account.

Even if you withdrew all your money the first year of your retirement and paid taxes, you would still have over $53,000 more than the taxable account.

There’s a reason Warren Buffett calls compounding “the most powerful force in nature.”

And when you make it tax-deferred, it’s like compounding on steroids.

What Are the Benefits of a Gold-Backed IRA and Who to Work With?

Look:

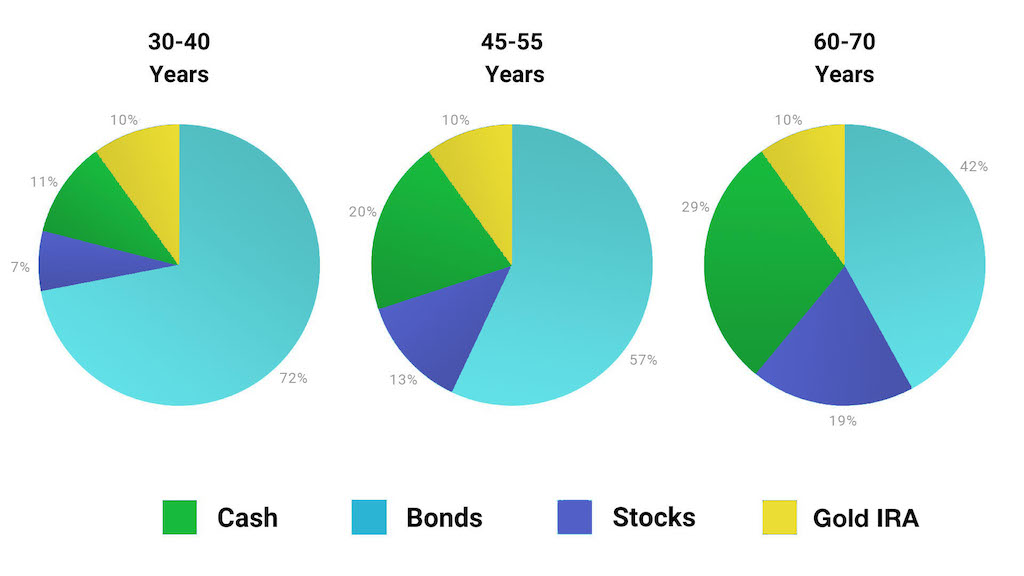

Diversification is the number one rule when it comes to protecting your hard-earned retirement savings.

Most advisors recommend diversifying across at least three different asset classes to get the maximum benefit.

And a gold IRA should be one of them.

As we have seen, no other investment provides the same level of protection during economic and political upheaval while combatting the debilitating effects of inflation.

And since gold prices tend to move opposite stock prices, it’s the perfect hedge to smooth out your volatility and reduce your overall portfolio risk.

Now…

Let’s say you’re ready to learn how to protect your retirement by diversifying with gold and silver, who to turn to?

Goldco is our #1 choice. Here’s why:

The are one of the best, if not the best, in the industry.

You can also request their FREE investor’s kit here.

It is full of valuable information on precious metal investing and how you can get started today.

It gets better:

You may be eligible for up to $10,000 in FREE SILVER if you open an account with them.

When you add physical gold and silver to your portfolio, not only are you protecting yourself from the unexpected, but you can sleep better at night.

After all, everyone deserves a good night’s sleep.

Now, we’d like to hear from you:

- Do you agree or disagree with our list here?

- What are the benefits of investing in Gold IRA, in your opinion?

Share your thoughts in the comments below!