Listen to this article:

Does the thought of a stock market crash keep you up at night?

What if you didn’t have to worry about a comfortable life after you retire?

Without a doubt, for many people finding the best solution to protect their lifetime savings is not easy.

There are a lot of different options available today. There’s also a lot of misinformation. And there are often new IRS rules and regulations that take place.

But we’re here to help.

In today’s post, you’ll learn:

- The new IRS changes to be aware of in 2024

- What are the benefits of having a Gold IRA?

- Are these retirement accounts tax deductible?

- How is a gold IRA taxed and what are the advantages?

- How do these plans work and are they really worth it?

- Lots more

NOTE: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with your tax advisor before making any decisions.

Now with this disclaimer out of the way, let’s get started.

Does Gold Provide Extra Protection?

Let’s face it, the closer we get to retirement, the more at risk we are of a stock market correction wiping out a large portion of our hard-earned savings.

Especially during volatile economy times.

I saw this happen with my father during the Dot Com Bust. He retired in 2000 only to see half his retirement account evaporate over the next year and a half.

And it didn’t fully recover for another 12 years.

That’s 12 years of worrying if he and my mom would have enough to last after they stopped working.

But he could have saved himself a lot of stress if only he had diversified his portfolio with a gold IRA.

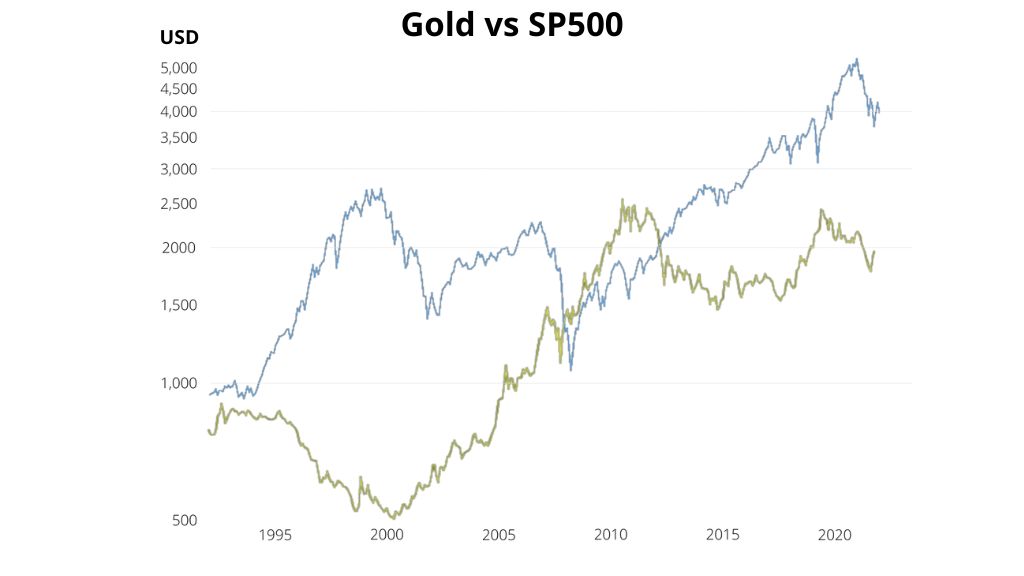

Truth is, physical gold tends to do well when other assets are getting crushed as people flock to this precious metal during difficult times.

We saw this happen during the early 2000s.

Again during the 2008 Great Recession. And most recently during the Global Pandemic in 2020.

Due to many tech stocks being crushed lately, some investors wonder if we are in another Dot Com Bust.

As you can see, sometimes the market is so unstable that diversifying your portfolio with precious metals definitely sounds like a good idea.

Now, investing in gold can do more than protect your funds from market upheavals.

A gold IRA can provide significant tax benefits that make it easier to plan for a comfortable retirement.

And with recent IRS changes, it’s gotten even easier.

So let’s look at what’s new for 2024 and all the benefits to see if this type of account is right for you.

What Is a Gold IRA?

Gold IRAs were first offered in 1986 and allowed investors to hold gold and silver US coins for retirement.

The IRS expanded the rules in 1998 with the Taxpayer Relief Act of 1997, allowing bullion and other government-approved precious metals.

However, you can’t open this type of account with a traditional custodian, like an online broker.

Instead, you need a special custodian approved by the IRS that manages self-directed plans and can handle the storage of your gold and silver.

And just like a traditional IRA, all gains are deferred until retirement, and contributions may be tax-deductible depending on your financial situation.

What Are the Tax Benefits of a Gold IRA?

At this point you may wonder:

- How is gold taxed in an individual retirement account?

- What are the top benefits of a Gold IRA?

- And what are the withdrawal rules?

Well, gold IRAs come in three different types, each with its own unique requirements and tax advantages. Let’s discuss those.

Traditional Gold IRA

A traditional Gold IRA is a tax-deferred savings account that works like a traditional IRA.

Gains are tax-deferred until you retire, and contributions are fully tax-deductible if you aren’t covered by an employer-sponsored retirement plan.

Now, if you are covered by this plan, and your AGI (adjusted gross income) is $116,000 or less for 2024, you can still take a full deduction.

You will receive a partial tax deduction on contributions if your income falls between $116,000 and $136,000. But they are eliminated if your income exceeds $136,000 for 2024.

The Internal Revenue Service raised contribution limits for 2024 from $6500 to $7000.

It also allows an additional $1000 known as a catch-up for taxpayers 50 years or older for a total contribution of $8000.

You can start withdrawing funds without penalty at age 59 ½. Plus, you are required to take minimum distributions at age 72.

However, if you withdraw funds before 59 ½, besides paying taxes, there’s an additional 10% penalty.

Roth Gold IRA

A gold-backed Roth IRA works just like a regular Roth IRA.

Contributions aren’t tax deductible, but all gains are tax-free when withdrawn during retirement.

The IRS increased the contribution limits for Roth IRAs in 2024 to $7000, plus an additional $1000 catch-up for taxpayers aged 50 or over.

However, income limits exist on whether you can contribute to your Roth IRA account.

You can make a full contribution if your income is $218,000 or less for 2024.

Contributions are reduced if your income is between $218,000 and $228,000 and eliminated if you are above $228,000.

You can start taking withdrawals at 59 ½, and there is no minimum withdrawal requirement or age at which you need to begin taking distributions.

However, like other individual retirement arrangement plans, there’s a 10% penalty if you withdraw early.

SEP Gold IRA

SEP gold IRA plans are available to small business owners, their employees, and self-employed individuals.

Contributions are tax-deductible.

A Simplified Employee Pension works like a traditional IRA but with higher contribution limits.

You can contribute the lesser of 25% of your compensation or $66,500 for 2024. However, there are no “catch-ups” allowed.

And just like a traditional IRA, gains are tax-deferred until retirement, and you must start taking minimum distributions at 72 years of age.

Gold IRA Tax Rules

As we saw above, the Internal Revenue Service increased IRA contribution limits for 2024.

However, ensure you don’t over-contribute, as the IRS taxes excess contributions at 6% a year until the error is corrected.

In addition, you need an IRS-approved trustee to open and manage your account.

(We recommend Augusta Precious Metals.)

Whatever the firm you choose, they can transfer funds to another custodian, rollover funds from another retirement plan, and accept deposits.

However, you can’t add gold you already own to your account. It must be purchased through the precious metal provider of your choice.

So if you have physical coins or bullion you’d like to add to your IRA, first, you would need to sell it through your trustee.

And then you rebuy within the contribution limits allowed by the IRS for your plan.

(But make sure you check with your tax advisor first to avoid any unforeseen tax consequences.)

You also can’t physically possess gold or silver, even if you keep it in your local bank safe deposit box.

The government requires that a federal bank or approved depository holds your precious metals.

Otherwise, the IRS considers it a distribution, and you may have to pay taxes and penalties.

How Do These Retirement Plans Work?

Gold IRAs work like traditional IRAs that invest in stocks, bonds, or mutual funds.

The key difference is that you can diversify your holdings with physical gold, silver, platinum, or palladium, either as coins or bullion.

Now, what are the IRA eligible precious metals?

The IRS requires certain metal purity levels to be acceptable for a gold IRA.

- Gold must be 99.5% pure.

- Silver – 99.9% pure.

- Platinum and palladium must be 99.95% pure.

In addition, you will need to open an account with a self-directed IRA trustee and arrange storage for your precious metals.

For this reason, this type of accounts tend to have higher costs than traditional plans.

(Just so you know, Augusta firm handles 95% of the paperwork and is with you every step of the way.)

Are Gold IRAs Worth It?

Yes, they are worth it.

When it comes to Gold IRAs, as Investopedia correctly shared, you’re literally turning part of your retirement nest egg into gold.

Since precious metal prices tend to move opposite other paper-backed assets, a gold IRA provides greater diversification for your portfolio than you can achieve by solely investing in stocks, ETFs, or mutual funds.

In addition, it is an excellent hedge against inflation and provides greater stability during challenging economic times.

And when you hold your physical gold in an IRA, you can defer (or eliminate) taxes until retirement – allowing your account to grow tax-free.

However, since you’re investing in just one asset class, you should consider adding a gold IRA as part of an overall, diversified investment strategy.

Benefits of a Gold IRA

A gold individual retirement account provides several key benefits not found with traditional IRAs because you hold a physical asset rather than just paper-backed securities.

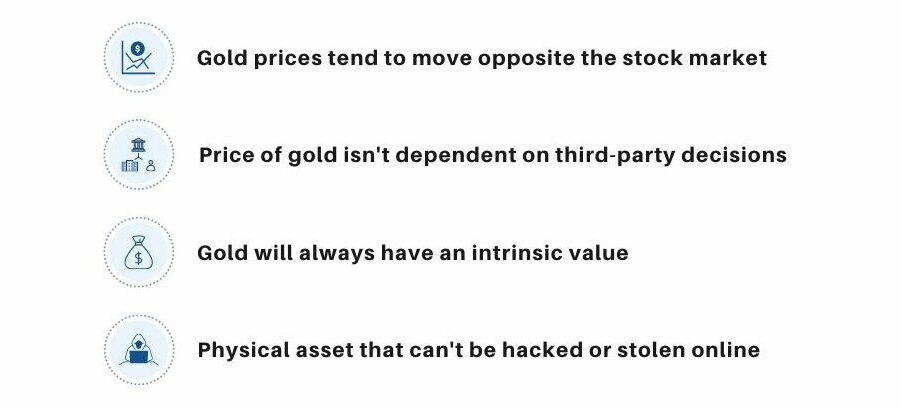

First, gold prices tend to move opposite the stock market, making gold an excellent hedge against market downturns and reducing your overall portfolio risk.

Using a gold IRA as part of your investment strategy will provide greater balance and stability for your retirement savings.

Next, the price of gold isn’t dependent on third-party decisions, like a company’s or fund manager’s performance.

Instead, gold prices are determined by macroeconomic conditions rather than at the mercy of bad management decisions.

On top of that, as a physical asset, gold will always have an intrinsic value, whether used as a store of value, a component in technology applications, or jewelry production.

As we saw during the Dot Com Bubble and the Great Recession of 2008, companies can fail, and stock prices can go to zero. Not so with gold.

And with the threat of online hacking and identity theft growing each year, having part of your retirement in a physical asset that can’t be hacked or stolen online provides greater peace of mind.

And the #1 Benefit of a Gold IRA Is…

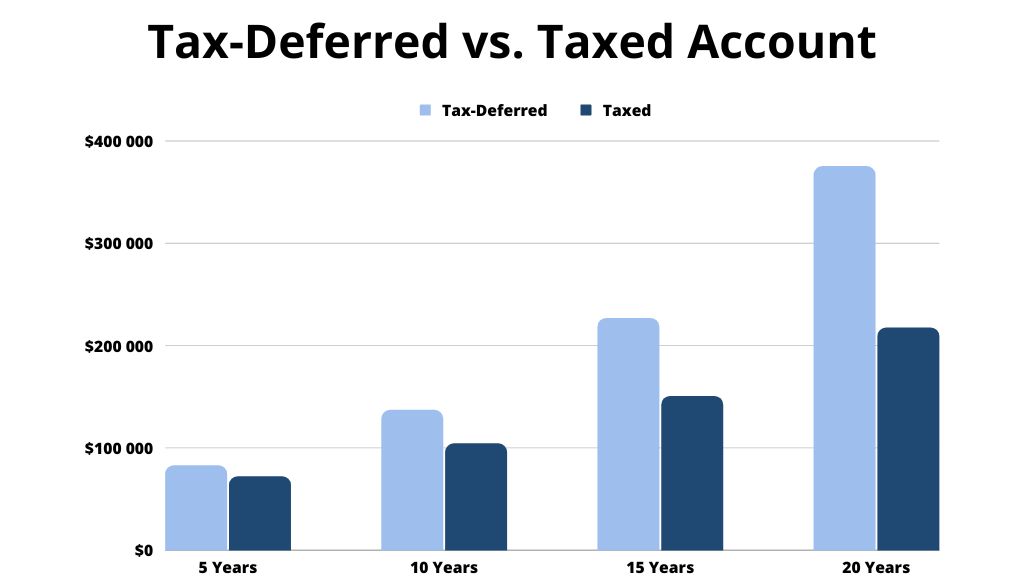

Your gains are tax-deferred until retirement.

Over the years, this can add up to a significant chunk of money and can mean the difference between just getting by or really enjoying your retirement years.

For example, let’s look at the results between two accounts – the first is tax-deferred while the other is taxed.

In this example, we’ll use…

- a 10.61% annual return (the historical average annual return on gold from 1971 to 2019, according to statista.com),

- a 28% annual tax rate for the taxed account,

- and a starting balance of $50,000 for both.

Here are the results:

TAX-DEFERRED | TAXED | |

After | Account Balance | Account Balance |

5 years | $82,746 | $72,217 |

10 years | $136,937 | $104,305 |

15 years | $226,619 | $150,650 |

20 years | $375,036 | $217,589 |

And here’s a graph for visual reference:

After 20 years, that’s over a $157,000 difference between the tax-deferred and taxed accounts.

And even if you withdrew all the funds from the IRA in the first year of your retirement and paid taxes, you would still have $270,000, over $53,000 more than the non-IRA account.

That’s the power of allowing your gains to grow tax-deferred, and now you know the tax benefits of a gold investment in an IRA too.

What Is a Gold IRA Rollover?

That is certainly a commonly asked question.

A gold IRA rollover is when you transfer funds from a different type of retirement account, such as a 401k, to a gold IRA.

On the other hand, an IRA transfer is when you move funds from one IRA to another.

You can roll over part or all of your account to a self-directed gold IRA.

And you don’t need to invest all of your money immediately. Instead, you can leave the funds in your account until you are ready to buy.

Just as long as you don’t take possession of it, you won’t pay any taxes.

The best time to initiate this rollover is when you change jobs, since most employers won’t let you roll over your retirement account while you are still employed.

(Every company is different though, so check with your employer to see if you have the option.)

Your IRA trustee will handle all the paperwork and make sure the funds are transferred directly to your gold IRA to avoid any tax consequences.

Should I Roll My 401K Into a Gold IRA?

Now that you know what a rollover is, should you roll your 401k into a gold IRA?

You see, a gold IRA transfer makes perfect sense if you’re changing jobs and looking to diversify and add stability to your retirement savings.

Though most employers allow you to leave your funds in their 401k when you change jobs, most plans offer limited investment options with just a handful of mutual funds.

This makes it difficult to truly diversify your retirement savings and leaves you at the mercy of unexpected market drops.

However, you can achieve a more stable and balanced portfolio by rolling over all or part of your 401k to a gold IRA.

Plus, you’ll reduce your overall market risk with an asset that tends to thrive during uncertain economic times.

Can I Cash Out a Gold IRA?

You can sell the gold or silver at any time, and you won’t have to pay any taxes as long as you don’t withdraw the funds from your IRA.

You also have the option to add to your account balance over time within the annual IRA contribution limits.

Can I Trade Metals in My Account?

Yes, you can trade, transfer, swap, or sell any IRS-approved precious metals without having to pay taxes as long as the funds remain within your IRA account.

How to Invest In a Gold IRA?

The best way to open a gold individual retirement account is through a trustworthy and respected gold IRA company like Augusta Precious Metals.

It is the largest one in the United States and was named the “Best Overall Gold IRA Company for 2022” by Money Magazine.

Unlike other companies that simply want to sell you gold, Augusta believes in education first and foremost.

Therefore, they’ll take the time to ensure you understand all the pros and cons of a gold individual retirement account based on your financial situation – without any pressure to buy.

Plus, once you become a customer, you can access their Lifetime Customer Service.

So whenever you have a question, a trained agent is just a phone call away for as long as you have your account.

As we’ve already established, a gold IRA provides an excellent way to diversify your retirement savings and give you peace of mind from unexpected market upheavals.

It can also provide significant tax benefits to help you plan for a more comfortable retirement.

So if you’re concerned about rising inflation, recession risk or just want to know more, it makes sense to talk with a professional at Augusta to see if a gold IRA is right for you.

Check out our in-depth review here.

Now we’d like to hear from YOU:

- What do you think about Gold IRA tax benefits?

- Do you see the benefits of having a Gold IRA?

Share your thoughts in the comments!