Listen to this article:

Let’s face it:

In uncertain times, people seek a safe haven to protect their savings and hold diversified investments.

Gold is the preferred precious metal for investors who want a physical item that isn’t subject to economics, management decisions, or social trends.

It has been a store of value and a trade-able currency since the early days of humanity due to its rarity and beauty.

Today, we’ll answer the following:

- How can you buy LARGE amounts of gold?

- What are the reporting requirements?

- Which is the go-to precious metals provider?

- Lots more

Without further ado, let’s get started.

Is It Possible to Buy a Lot of Gold?

Here’s a fun fact:

The world’s entire amount of gold above ground and mineable is estimated only to be enough to fill 88 semi-truck van trailers.

According to Mining.com, if it were stacked in a perfect cube, each side would be 22 meters.

The world’s estimated above-ground value was $12.5 trillion in 2021.

Gold is limited and rare because it is a very heavy element, meaning it is one of the last ones stars produce right before they go supernova.

Yes, it is extraordinary.

Despite the limited amount of gold in the world, there is no limit to the amount of it you may own.

Your investment might be physically held by yourself or stored and protected by a custodian, as many people do.

While custodians charge a yearly fee, you rest assured that your physical metal is safe.

Should you choose to store it at home, taking out an insurance policy is highly recommended.

It guarantees that in the case of theft or natural disasters, when you cannot access your goods, you can collect for the value insured.

And if you hold it in a safe deposit box, remember that they are not federally insured.

What Is Investment Quality Gold?

Investment quality gold coins or bars need to be of high purity.

At least 99.5% purity is considered worthy, with the rest of the bar comprised of an alloy like silver or copper to make smelting possible.

If you invest in a Gold IRA, then the IRS has the following requirements for your metals to be eligible:

- Gold must be 99.5% pure.

- Silver – 99.9% pure.

- Platinum and palladium must be 99.95% pure.

If you purchase gold bars, then they should feature the manufacturer’s name, weight, and purity stamped on the face.

In terms of coins, the American Eagle gold coin is respected, as are ones from European sovereign banks, the Royal Canadian mint, and the Perth mint, to name a few.

What Sizes Are Best to Buy?

An important consideration is the ability to liquidate your precious metals or own useable sizes for trade in the event of an economic meltdown.

For example:

If gold is $1,800 an ounce and the investor has $18,000 worth of it, it will be easier to sell it later if it comprises 1 oz coins or bars instead of a single 10 oz bar.

The 1 oz coins could be sold one at a time as needed. Even smaller bars and coins are available in sizes as little as 1 gram bars or .25 oz coins.

While storing this metal in the physical form of jewelry is possible, the investor would pay the jewelry markup.

Buying jewelry is a money-losing endeavor and not a recommended gold investment method.

Difference Between Bars and Coins

Gold has value, but not all investment quality is created equally.

The American Eagle coin previously mentioned is produced by the U.S. Mint at 91.67% purity, yet it has a higher value than an equal-weight bar due to its collectability value.

Coins might skew the investor’s portfolio, but you might desire the ones that have the value associated with collectability.

When gold is used as a store of value, bars might be more preferable for investors, but both bars and coins are excellent investments.

How to Buy Large Amounts of Gold?

There are two ways you can do that, invest in an IRA or cash purchases, and each has advantages and drawbacks.

Gold IRA

One of the safest, most convenient, and efficient way to buy gold and silver in bulk is by opening a Precious Metals IRA.

It is a retirement account with specific tax advantages.

They are an excellent investment for those who want to diversify and protect their savings.

Similarly to traditional IRAs, all increases in the value are tax-deferred until you withdraw your funds.

And just like with traditional IRAs, if you decide to distribute early, it may result in taxes and penalties, so always consult with your financial advisor before making any decisions.

READ ALSO: Gold IRA vs Traditional IRA (Explained)

Now…

This year, the yearly distributions are limited to $6,500, and those over 50 may make an additional contribution of $1,000 as a “catch-up”.

But there’s a better way to invest, known as a rollover.

What this means is that you can move any amount from your Roth, 401k or 403(b) into a precious metals IRA, tax and penalty free.

The huge upside of choosing this type of account is that it saves you from all the hassle when you work with a reputable firm, who will handle all the paperwork, actual purchase, and storage.

(Our #1 Gold IRA company is Augusta Precious Metals, but more on that later.)

Cash Purchase

This is the second option to buy large amounts of physical precious metals.

Cash purchases have no yearly contribution limit. You’re only limited by the amount of money you have to do so.

Whereas IRA-purchased physical metals must be stored by a custodian that does charge fixed yearly fees, a cash purchase allows you to to hold the gold at home (should you want to).

Also, you are not limited to certain IRS-approved bars and coins.

Do you like that Somalian gold coin or the South African Krugerrand? Buy away.

Cash allows you to buy whatever holds sentimental or personal collectible value to you.

However, this method also means having have to deal yourself with the reporting requirements, choosing the custodians, depository, and/or storage facility.

Our Go-to Precious Metal Provider

Look:

Regardless of the option you chose earlier, Augusta Precious Metals is the premier gold IRA and cash purchase provider.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

It has more than a decade of experience and has established itself as the country’s most respected firm based on impeccable customer service and alternative investments assistance.

You can check out our in-depth review here with all the reasons why this firm is nothing short of exceptional.

Now…

Augusta specializes in gold individual retirement accounts, but they can help you buy precious metals outside of an IRA too.

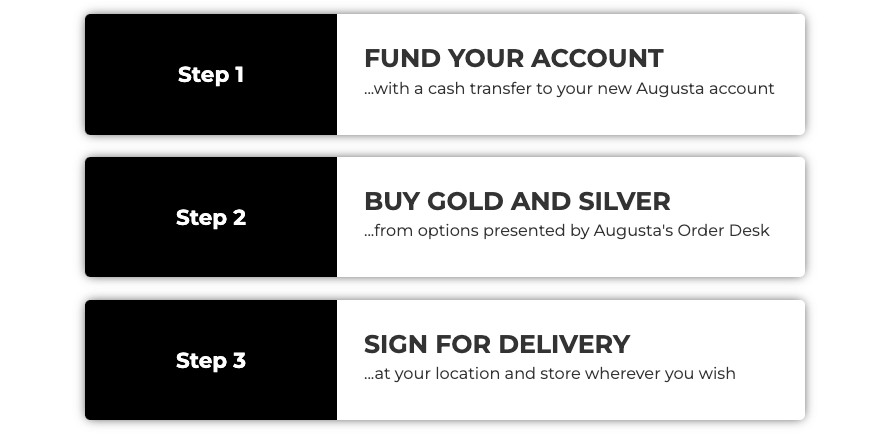

It’s a simple 3-step process:

First, you fund your account with a cash transfer; then you buy gold and silver from options presented by Augusta’s Order Desk; and lastly, you sign for delivery at your location and store wherever you wish.

All in all:

Their concierge level of service and account lifetime support for all customers make Augusta the firm of choice for those looking to buy large amounts of gold.

So if you’re ready to diversify your portfolio or still have questions, give them a call at (833) 989-1952 today.

Frequently Asked Questions (FAQ)

In addition to the topics addressed above, people also ask the following questions.

What is the maximum amount of gold you can buy?

This will really depend on your financial limitations. Residents of the United States can own as much gold as they want without any legal limitations.

However understand that it should be just one part of a fully diversified portfolio, and it’s never a smart idea to hold all of your funds in precious metals.

There are also reporting obligations that your dealer will have to adhere to.

And, when you sell gold, you will also have to pay taxes on any gains. Different rules might apply if you invest with a Gold IRA.

Always consult with your financial advisor before making any decisions.

How much gold can I buy without reporting?

A lot of folks want to avoid mainstream banking and digital records systems and they wonder if the government tracks gold purchases one way or another.

If you buy using cash, any transaction equaling or exceeding $10,000 has to be reported.

You should also check with your tax advisor about the IRS requirements that could be triggered by your purchase of bullion or coins.

When you work with a reputable dealer, they will handle the reporting for you.

But even then, it’s ultimately your responsibility to ensure that everything is handled properly.

Who holds the gold in a Gold IRA? Can I see them?

As part of your account-opening process, sometimes you get to choose the depository storage facility.

This might not be true with all the companies you work with, but more often than not, you can make arrangements to check out your purchased metals in person by contacting your custodian directly.

If you decide to invest in your individual retirement account, then your Gold IRA provider will handle all the paperwork for you.

Is a Gold IRA worth it?

Yes, we believe it is worth it.

As Investopedia correctly shared, you’re literally turning part of your retirement nest egg into gold.

Check out all the benefits of a precious metals IRA here.

If this something you’d like to do, Augusta is our #1 choice when buying large amounts of gold.

Download their free guide and/or register for their web conference to learn more.