With government deadlock threatening a stock market collapse and the overall global instability, 2024 may be one of the best year yet to buy gold.

Prices are once again approaching all-time highs as skittish investors turn to it for stability not found with traditional assets.

But before you jump on board, do you know what is the best form of gold to own?

Gold IRA vs physical gold: What’s the difference?

The truth is, both have advantages and disadvantages that any aspiring precious metals investor needs to understand.

However, finding reliable and unbiased information on the Internet can be challenging.

That’s where we come in.

In this comparison guide you’ll learn which is better, a gold IRA or physical gold?

You’ll discover the key differences, the pros and cons of each, and most importantly, which would be the better choice based on your financial goals.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

What Is a Gold IRA?

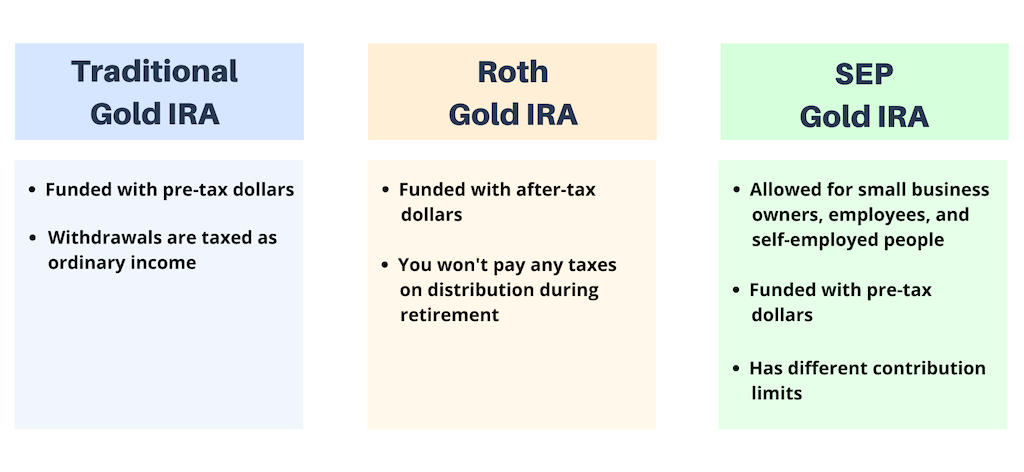

Unlike traditional IRAs that only allow stocks, mutual funds, and other conventional paper assets, a gold IRA is a self-directed retirement account that will enable you to hold physical gold and other IRS-approved precious metals.

These accounts were established by the Taxpayer Relief Act of 1997, which expanded the assets allowed to be held within an IRA to include gold and silver coins and bullion.

However, not all precious metals are eligible, and the IRS imposes strict purity standards to include them in a retirement account.

- Gold – 99.5% pure

- Silver – 99.9%

- Platinum and palladium – 99.95%

Another thing to keep in mind is that many institutions that provide ordinary IRAs don’t offer gold IRAs due to the additional reporting required by the IRS.

Therefore, you’ll need a custodian that specializes in these accounts.

Gold IRA vs Physical Gold: Pros & Cons

When investing in this precious metal, you have two main options – a gold IRA or physical gold.

Weighing the pros and cons of each can provide greater insight into which would be the better choice based on your investment strategy.

Gold IRA Pros

Before rushing to open an account, evaluating the advantages and disadvantages is essential to determine if this is the right decision based on your financial goals.

Here are some key benefits to consider.

1) Tax Benefits

The top advantage of an IRA is that earnings grow tax-deferred or even tax-free, depending on the account.

Also, contributions may be tax deductible in the year you make them, lowering your tax liability.

2) Self-Directed

You’re in control rather than relying on an outside manager to make investment decisions for you.

3) Can Hold Alternative Assets

You’re not limited to just stocks and mutual funds like an ordinary IRA.

You can pretty much hold anything except collectibles or life insurance, including real estate, cryptocurrency, and even private companies and LLCs.

4) Safer Storage

The IRA-approved depository is more secure than self-storage. Plus, most offer comprehensive insurance to cover any potential losses.

5) No Self-Reporting

Your custodian will handle any required IRS reporting. You can focus on your investments, knowing that the details are covered.

6) Perfect for the Long Term

Due to distribution requirements, an IRA is ideally suited for investors looking to implement a long-term strategy.

7) Waived Fees for Higher Contribution Amounts

Sometimes, top Gold IRA companies may waive your annual fees if you invest or rollover a higher investment amount to your gold IRA account.

For example, American Hartford Group offers $0 fees on first-year trades and free shipping for orders over a certain amount.

Goldco may be able to waive your fees as well. Plus you may get up to 10% in FREE silver on qualified purchases.

Another one, Augusta Precious Metals, might waive your fees, but do keep in mind that their minimum contribution is high – it’s from $50,000 USD.

Whatever firm you decide to work with, be sure to speak with their representatives and ask if they can waive your annual fees.

Now…

If this type of alternative investments is something that interests you, then consider Goldco with their NEW no purchase minimums.

You can check out our in-depth Goldco review or you can grab their investor’s kit.

It’s 100% free and explains everything you need to know about diversifying with precious metals.

Plus, you get up to $10,000 in FREE silver if you open an account with them.

Click here to request your guide now.

Gold IRA Cons

While the benefits appeal to most investors, what is the downside to a gold IRA?

1) Higher Costs

Gold IRA fees are more expensive than ordinary IRAs, which can impact your overall returns.

(But as was mentioned earlier, you may have them waived depending on who you decide to work with and how much you contribute.)

2) You Need a Custodian

You can’t do it yourself. By law, you need an IRS-approved custodian to handle the reporting requirements and distributions.

3) Less Flexibility

Due to IRS regulations, you can’t access your precious metals immediately in case of an emergency.

4) Higher Storage Costs

Since you must store your gold with an IRS-approved depository, you may incur higher fees than keeping it in a local bank vault or home safe.

(Again, these may be waived depending on who you work with and what your Gold IRA initial contribution amount is.)

5) High Purity Levels

You are limited to the type of coins and bullion you can buy.

6) No Personal Access

While you could make an arrangement with the storage facility to check out your precious metals in person, you can’t take physical possession of them, or you could be subject to additional taxes and penalties.

7) Early Withdraw Penalties

If you want to use the funds before age 59 ½, you’ll have to pay a penalty as well as any taxes owed on your distribution.

8) Contribution Limits

For 2024, your maximum contribution for either a traditional or Roth IRA is $7000 ($8000 if you’re 50 or older).

Physical Gold Pros

Now that we’ve seen what a gold IRA offers, let’s review the benefits of holding physical gold outside a retirement account.

1) Immediate Access

You can directly access your bullion since you don’t need a custodian or third-party storage facility. On top of that, you can sell at any time without restrictions or limitations.

2) No Custodian Fees

No custodian means no fees, lowering your ownership costs.

3) No Purity Levels

You can invest in lower-purity coins and bullion, which may be more economical. Also, you can consider collectibles that would be prohibited with an IRA.

4) No Early Withdraw Penalties

If your plans change, you can sell before age 59 ½ without any additional penalties or taxes.

Physical Gold Cons

This type of investment doesn’t come without a few drawbacks.

1) Security

It’s up to you to determine how best to secure and insure your precious metals.

2) No Deferred Tax Benefits

Gains don’t grow tax-deferred. You are responsible for paying taxes on the profits in the year that you sell.

3) Greater Responsibility

You must handle all the details of your investment, including IRS reporting, shipping, insurance, and storage.

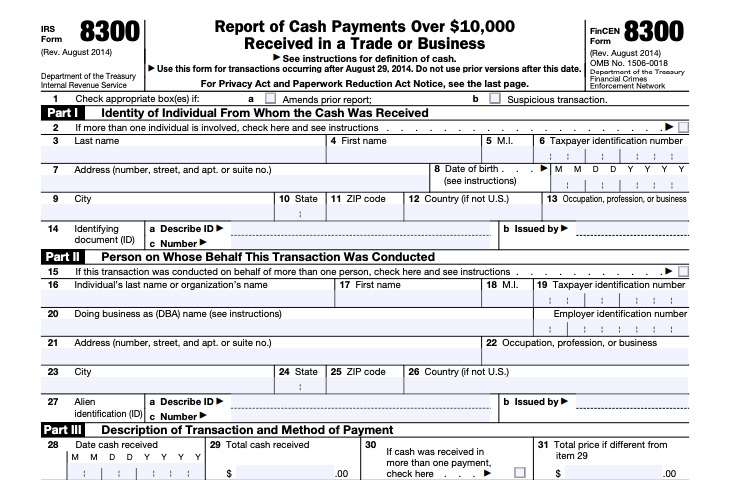

4) Reporting Requirements

If you sell over $10,000 worth of gold or silver, you may need to file form 8300 with the IRS.

Also, you must report any sales on Schedule D of your tax returns. Since you don’t have a custodian, it becomes your responsibility to ensure they’re reported correctly.

5) Capital Gains Taxes

Coins and bullion fall under a special category of assets called collectibles, and the IRS taxes these differently than other assets.

If you hold for less than a year, you could face a marginal capital gains tax rate of 28%, depending on your income.

Which Is Better: A Gold IRA or Physical Gold?

As we’ve seen, both have advantages and disadvantages. Ultimately, deciding which is the better option is up to you.

Who Should Consider a Gold IRA

If you can answer yes to the following questions, a gold IRA may be your best bet.

· Do you want to take advantage of tax-deferred compounding to grow your portfolio?

· Are you looking to diversify with alternative investment options, like precious metals, real estate, or cryptocurrencies, but want the protection an IRA offers?

· Do you feel confident you can secure a custodian to administer your IRA?

· Do you want to protect your retirement savings against inflation?

· Do you have a long-term investment strategy?

· Do you want to control your investments rather than let a financial advisor decide for you?

If you’ve answered “Yes” to most of these questions, then a Gold IRA may be the right choice for you.

And here’s the best part:

It’s easier to set an account up than you think, especially when dealing with one of the best Gold IRA companies in the United States – Goldco.

Be sure to grab their investor’s kit to learn more.

It’s 100% free and explains everything you need to know about diversifying with precious metals.

Plus, you get FREE SILVER on qualified purchases when you open a gold IRA account with them.

Click here to request your kit now.

Next…

Who Should Consider Physical Gold

On the other hand, if the following are important to you, consider holding physical gold.

· The freedom to choose which metals to buy without purity restrictions imposed by the US government.

· Don’t want any limitations on when or how you can access your investment.

· Prefer to make your own decisions rather than having the IRS dictate when and how you can take distributions.

· Desire complete control over your gold, including the option to store it at home or in a bank safe deposit box.

· Don’t want to pay custodian fees and feel comfortable handling any reporting requirements.

· May not have a long-term strategy and want the option to sell without paying a penalty.

As you can see, it’s a matter of understanding your goals and your preferences.

Earlier we mentioned that Goldco is our go-to provider.

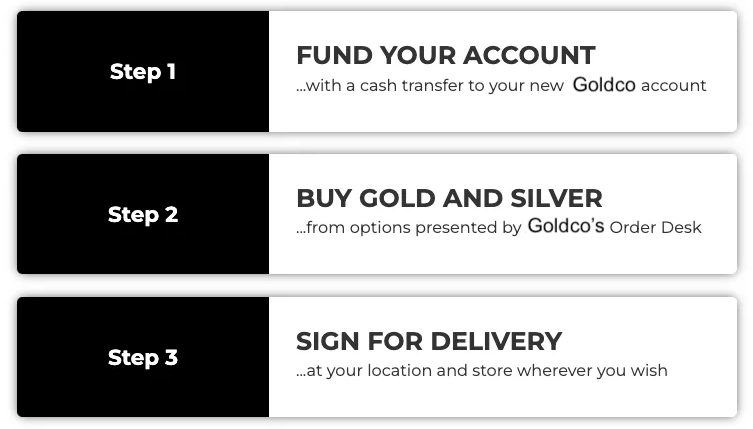

While their main focus are gold individual retirement accounts, they also deal with cash purchases, and can help you buy large amounts of precious metals outside of an IRA too.

It’s a simple 3-step process:

First, you fund your account with a cash transfer; then you buy the products presented by Goldco’s Order Desk; and then you sign for delivery at your location and store wherever you wish.

All in all:

The white-glove treatment and account lifetime customer support make Goldco the firm of choice whether you choose a Gold IRA or owning physical metals option.

Contact this firm or grab their FREE investor’s kit here to learn more about diversifying with precious metals.

Alternative to Physical Gold

Let’s face it:

Physical gold isn’t the only way to hold this precious metal.

You can also invest in exchange-traded funds that specialize in gold.

Two of the biggest are SPDR Gold Trust (GLD) and iShares Gold Trust (IAU).

An ETF is traded just like a stock and allows you to participate in the gold market without the need to buy the physical metal. So there is no need to worry about storage and insurance.

However, all ETFs charge management fees which will impact your returns.

Plus, even though each share represents a percentage of the gold the fund holds, it doesn’t get you any closer to owning it.

No matter how many shares you own, you can’t convert or use them to buy gold.

Note:

If you’re an aspiring precious metals investor, we highly recommend you check out our in-depth guide on the best gold investments in 2024.

Storage Options for Physical Gold

Let’s say you want to buy and hold physical metals.

First, you want to make sure you buy gold without paying sales tax.

Next, you need to decide where to store it.

Many people elect to store their precious metals at home or their place of business. And while a standard homeowners policy may cover you for loss, most limits are around $200.

For this reason, we don’t recommend home storage if you have a more significant investment.

Another option is a safe deposit box at your local bank. Though not covered by FDIC insurance, there are private insurance companies that will insure your metals stored there.

However, certain banks may officially prohibit keeping coins and bullion at their institution.

This would be outlined in the terms and conditions when you open your account, so be sure to review them carefully.

So what’s your best bet? A private depository.

Besides offering state-of-the-art security, most provide full insurance coverage for any precious metals they house.

Knowing that your investment is fully protected, the peace of mind is well worth the extra cost.

Is Gold IRA a Good Investment?

Look:

All investors aim to maximize gain and minimize risk.

Unfortunately, this can be challenging using just paper assets, like stocks and mutual funds.

Moreover, since they usually move in tandem, mitigating risk during market downturns can prove difficult.

On the other hand, gold prices tend to move opposite most financial markets, providing key benefits you won’t find with conventional assets.

- Diversification

Gold isn’t correlated to other financial instruments making it an excellent vehicle to diversify your portfolio and lower volatility.

- Inflation hedge

Since 1971, the dollar has lost 87% of its buying power, while gold is up over 4800%, outpacing inflation by a wide margin.

- Stability

During the Great Recession of 2008 and the COVID Pandemic in 2020, gold prices significantly outperformed most other asset classes, stabilizing portfolio returns.

However, like all investments, gold comes with its own set of risks.

First, prices tend to be volatile in the short term and may not be suitable for investors looking for stable returns.

Also, it doesn’t pay dividends or provide an income stream like dividend-paying stocks or bonds.

When adding precious metals to your portfolio, the best option is to use it as part of a balanced long-term strategy rather than trying to time the market for some quick gains.

If you are interested about diversifying with these alternative investments, grab Goldco’s FREE Wealth Protection kit to learn more.

Gold IRA vs Physical Gold? (Verdict)

So…

What’s the verdict on precious metals IRA vs physical ownership?

The truth is:

Gold IRAs and physical gold are excellent alternative investments for folks looking to protect their portfolios from the ravages of inflation and the volatility of the financial markets.

But which is right for you?

While a gold IRA is perfect for those wanting to grow their investment tax-deferred, physical gold is better suited for those who desire unrestricted control without paying extra fees.

Regardless of what you choose to do, you should carefully weigh your options and fully understand the benefits and risks of each.

It’s also a great idea to consult with a professional before making any decisions.

Hopefully, you found this guide helpful. If you have any questions, just reach out in the comment section below. We’re happy to help.

And, as always, safe investing!

Over to you:

- Thoughts on this Gold IRA comparison to physical gold?

- Any other Gold IRA pros and cons you see?

Share your thoughts on gold accounts vs physical gold in the comments below!