Let’s face it:

Most wealthy people are financially-literate and take advantage of different investment tools to preserve or increase their wealth.

Now, do rich people invest in gold?

The answer is YES, they definitely hold this asset in their portfolios. This probably comes as no surprise to you as it has long been associated with wealth and wise investing.

Today, we’ll discuss why and how they do that, and the ways you can get started yourself too.

Without further ado, let’s dive in.

Why Do (Rich) People Invest in Gold?

The most obvious answer is wealth preservation.

If there’s one thing that they know how to do, it is how to preserve their wealth for future generations and one of the most effective ways to do it is by investing in physical assets.

They may own a rental or other investment property, have a serious art collection, and possess a variety of precious metals.

Why gold though?

Looking at the historical reasons and advantages of investing in it will help understand that.

The truth is, this precious metal has been used as a form of currency and a store of value for thousands of years.

Ancient civilizations such as the Egyptians, Greeks, and Romans used gold coins and bullion for trade, and it has continued to play an important role in the global economy throughout history.

Here are some of key reasons people invest nowadays (not just the rich):

-

Store of value

Due to its intrinsic value and rarity, gold has been considered a safe haven for centuries.

That’s because when economic turmoil hits, the stock market typically dips, and people move their money to more stable assets.

The trick is to have a reasonable amount of your investments in precious metals before catastrophe strikes, which is likely to protect your portfolio from losing value.

Historically speaking, gold has maintained and even increased in value over time (more on this later).

This makes it a popular long-term investment option for those who want to preserve wealth.

-

Buffer against inflation

Gold has historically served as an effective hedge against inflation, as its value tends to rise during periods of high inflation.

(It also lessens the impact of a purchasing power loss that also occurs during these times of market instability.)

Let’s take a couple of examples.

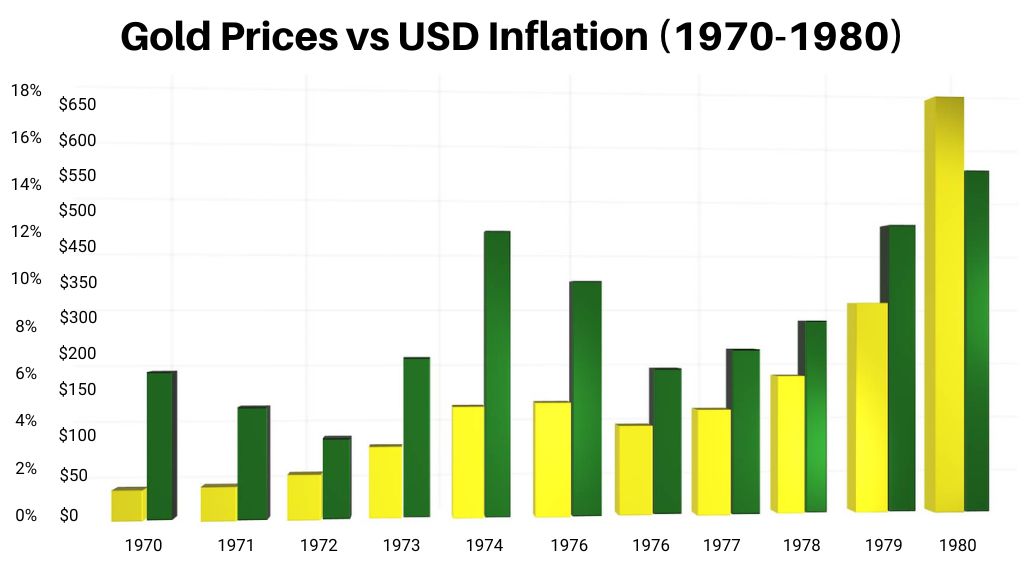

The 1970s are known as a highly inflationary period in time.

During that decade, the gold prices kept increasing and even outperformed inflation in 1980.

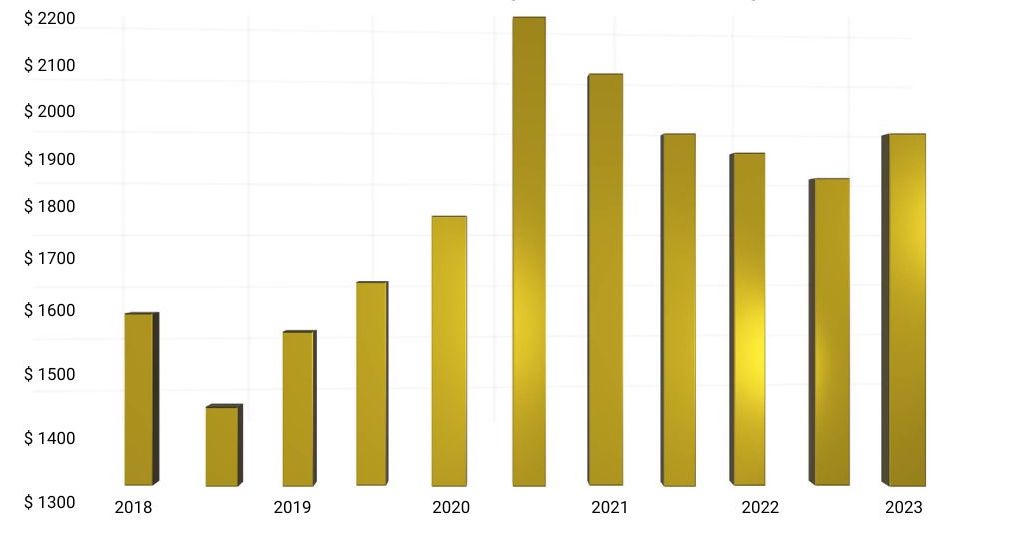

The more recent examples include the Great Recession in 2008, as well as the global pandemic in 2020.

It’s no secret that in the past couple or so years, we’re facing a great economic turmoil and a constantly high inflation.

If you’ll look at this chart, you’ll notice that the gold prices increased during the 2020, and continue to remain at a high level this year.

Such excellent performance during uncertain times is a big reason why people, especially the wealthy ones, diversify their portfolios with gold.

This leads us to the next point, WHY is it a popular investment with the wealthy?

-

Diversification

When it comes to old-money families that possess life-changing levels of wealth generation after generation, protecting that capital is of the utmost importance.

And what better way to protect it than with an investment that isn’t affected by economic upheaval as much as stocks and bonds?

Of course, it’s gold.

Based on the historical data, we can notice that it is an effective hedge against inflation and a great way to offset market and economic risks, hence why wealthy people invest in it.

This is in addition to more traditional investments like stocks, bonds, ETFs, and mutual funds.

Having a wide range of asset types helps to protect them from serious losses if one sector takes a serious hit.

But of course, this applies to just about everyone with an investment portfolio, not just the rich.

Everyone should take the time to establish a robust succession plan, no matter how great or small their fortune may be.

Famous “Gold Bug” Investors

The term ‘gold bug’ was popularized in 1896 during the presidential election.

At that time, there was a lot of controversy surrounding silver.

William McKinley voters wore lapel pins, headbands, and neck-ties, all in gold, showing support for this shiny metal over silver.

Over time, the term came to describe anyone who felt strongly about holding gold.

Some well-known “bugs” that you may be familiar with include:

- former Fed Chairman Alan Greenspan,

- Judy Shelton (economist & former advisor to Pres. Trump),

- Ron Paul (a medical doctor, retired politician, and a long time advocate of sound money and sensible economics)

By the way, Ron Paul has recently partnered with Birch Gold Group, one of the well-known precious metal IRA companies.

In addition to obvious reasons to invest in gold, such as inflation, loss of purchasing power, and economic turmoil, these folks don’t have a lot of faith in fiat currency.

While this topic expands beyond the scope of this article, it is something interesting to consider when thinking about putting money into precious metals.

How Do Rich People Invest in Gold?

There are three main ways they do that:

- coin collecting

- bars and bullion

- self-directed IRAs

The first one is a favorite pastime for those who want their hobbies to add value to their lives.

With their connections, sourcing adequate transportation, security, and storage for their physical assets isn’t much of a challenge for the uber-wealthy.

This means that they can buy a lot of coins and bullion and not have to fret too much about how to keep it safe.

Another pretty popular financial vehicle is the self-directed Precious Metals IRA, which offers great tax benefits.

The good news is that this option is available to “regular” people too, and we’ll discuss it in more detail a little later.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Ways Everyone Can Invest in Gold

Today’s stock market isn’t like your grandfather’s market!

It may even be a lot different from the economic environment that your father participated in.

Things have changed quite a bit, and there is a wide range of financial opportunities available today to even the most novice of investors.

We have a detailed post on the best gold investments this year, but we’ll mention some here too.

1. Stocks and ETFs

If you are not sure you’re ready to purchase physical metals yet, but would like to get started, then you may want to consider gold exchange-traded funds (ETFs).

This option allows you more liquidity and can help you become more comfortable with investing in a new asset class.

Another option is mining stocks.

These are generally counter-cyclical. Meaning that when the market is headed down, they provide more stability during times of upheaval.

However, these are the investments that are prone to volatility due to uncontrollable events.

If you decide you want to expand your portfolio as you get serious about investing for retirement, you’ll need to look beyond stocks and bonds.

2. Coins and Bullion

One popular option is bullion.

This term simply means bars, ingots, plates, and other physical forms of gold and other precious metals.

Coins are another popular way to get your feet wet.

These investments provide a safe haven from market instability and economic turmoil as discussed above. If you haven’t invested in coins or bullion yet, now might be the time to get started.

However, before you start to buy physical assets, you’ll need to consider a few things like storage and security.

Home safes can be an acceptable option if they are bolted or cemented in place and aren’t easily accessible.

Safe deposit boxes come at reasonable prices and provide a higher level of security.

The one drawback is that many folks invest in precious metals due to their worry about the health of the US dollar and the fear of a run on our banks.

If a major event affects the banking industry (a recent example is a Silicon Valley Bank collapse), the contents of your safe deposit box could be at risk.

Just something to think about.

Buyers of high quantities of gold and other metals can also arrange for secure storage from their dealers. These can be expensive.

There’s also the additional risk of securing the assets while they are moved from the dealer to the secure storage location.

There’s no perfect solution! But there’s one that’s pretty close.

3. Gold IRA

When you invest in a Gold IRA you don’t have to worry about security or storage.

Here’s how it works:

You choose a precious metals company, say Augusta Precious Metals, and open an individual retirement account with them.

Next, you fund it with cash or a rollover from an existing IRA or 401k to place IRS-approved metals.

And here’s a pretty big advantage that we haven’t touched on yet.

These IRAs offer the same tax benefits as traditional IRAs.

This means that, in addition to the protection against economic and market forces, the hedge against inflation, and having a portion of your funds in a safe haven, you’ll also enjoy preferential tax treatment.

Your financial advisor or tax professional can help guide you through the process of determining which tax scenario or investment opportunity is best for your situation.

Gold In Your Overall Investment Plan

So…

How can gold fit into your overall investment plan?

Regular folks like us can learn a lot by following the investment patterns of rich and wealthy people who have managed to hold on to their money generation after generation.

Holding alternative assets is one way to diversify your overall wealth-building plan.

And if you invest in it as part of your retirement plan then it’s fairly easy when you open a self-directed IRA with a reputable company.

We all need to save for our retirement, so it makes sense to choose financial tools that will provide benefits during that time of our lives.

But remember:

Investing in gold should be just one piece of your overall savings puzzle.

Your portfolio should also include equities, bonds, and cash equivalents. Alternative investments are just one part of a fully-diversified savings strategy.

This is an important lesson that can benefit all of us, not just rich people.

Now, we’d like to hear from you:

- Have you ever invested in gold coins or bullion?

- What are your favorite alternative investments to diversify portfolio?

Share your thoughts in the comments below!