All that glitters isn’t always gold.

So before you send a single dollar, make sure you understand the dangers to gold IRA investing.

Many dealers like to paint a rosy picture.

They’ll hype the benefits – it’s an excellent hedge against inflation, provides greater diversification, and offers security during economic and political uncertainty.

However, they go mute when asked about the potential pitfalls or risks. (cue crickets)

Unfortunately, the Internet is littered with unscrupulous dealers, misrepresentations, and outright lies, making it challenging to know the difference between fact and fiction.

Yes, this precious metal offers some key benefits you won’t find with other investments.

However, it doesn’t come without its risks.

Rather than jumping in blindly, our aim is to make sure you have all the facts before you make a decision.

So today, we’re covering the biggest cons of a gold IRA account. By the end of this guide, you’ll know what to watch out for.

But most importantly, you’ll discover how you can minimize, if not eliminate, the risks associated with this alternative investment.

Let’s get started.

1) Higher Fees and Premiums

The first drawback is that Gold IRAs come with higher fees than traditional accounts.

Not only do you need an IRS-approved custodian, but you’ll also need a third-party depository to store it.

The prices for these services can run from a couple hundred dollars to over $600 a year, with the average being around $250.

These costs can seriously impact your returns when holding smaller amounts of this precious metal.

For example, let’s say the annual maintenance and storage fees run $250 a year, and you have $5000 invested.

Then, they would represent 5% of your investment, significantly higher than many mutual funds or ETFs.

Or, in other words, since gold has averaged 8.6% over the past 20 years, they would cut your returns by over half.

Another important consideration is the difference between the spot and retail prices for coins and bullion.

This difference is known as a premium and is the manufacturing cost to produce different products.

The premium can vary among sellers.

Unfortunately, some dealers will charge up to 300% over the spot price for specialized coins. This hefty markup makes it nearly impossible to recover your investment and can lead to losses.

Here are a few simple steps can help you avoid these dangers.

First, this physical asset may not be suitable for all investors.

If you plan on holding smaller amounts, it would be better to do so outside of an IRA, though we don’t recommend keeping it at home due to the risks.

However, you can store it in a safe deposit box at your local bank, minimizing the fees and avoiding the extra custodian costs.

Next, do your homework.

Calculate the difference between the spot price and premiums for any coins you’re considering.

Also, stick to high-quality coins and bullion – the Royal Canadian and US Mint both guarantee their coins and bullion.

Therefore, these tend to have a higher resale demand.

And by working with reputable gold IRA companies, like Augusta Precious Metals, you can reduce the danger of overpaying for your coins and bullion.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Their team can walk you through your options and help you diversify with gold and silver, at competitive prices.

Check out our Augusta review here.

2) Illiquidity

Look:

Gold is a physical asset, and unlike stocks and mutual funds that can be sold with the click of your mouse, selling it can be more complicated.

First, you need to find a buyer and agree on a price.

Then, once you have an agreement, you need to arrange to ship, insure, and receive payment for your precious metals.

The best place to get the highest price is an online dealer that specializes in buying premium coins and bullion, such as:

- APMEX

- JM Bullion

- American Hartford Gold

- BGASC

- SD Bullion

Or maybe you feel more comfortable talking to someone in person. In that case, you can also check with local dealers or pawn shops specializing in precious metals.

Just be careful. They’ll often only offer the current spot (or melt) price rather than the actual market value of your coins.

And if you decide on an online dealer, do your homework to ensure you’re working with a reputable business to avoid any unwanted surprises.

(By the way, we also publish a lot of video reviews here at Gold & Silver Central channel, so be sure to subscribe!)

Fortunately, you can take one easy step when buying your precious metals to avoid all these headaches…

Buy your precious metals from a trustworthy company offering a simple-to-use buyback program.

When you work with one that offers a buyback program, they make it easy if you ever decide to sell your physical assets.

In addition, they’ll handle all the details, so you don’t have to worry about shipping, insuring, and receiving payment.

And many times, the business will pay higher prices than those you’ll receive from online or local dealers.

By taking this one simple step, you can minimize any danger that may come from having to sell your precious metals on your own.

3) Scams and Company Failures

The Internet is full of gold IRA companies.

However, not all are created equal. Your biggest danger is working with a less-than-reputable firm or even an outright scam.

Unfortunately, scammers have created many ways to separate you from your retirement savings.

One popular scam is delivery fraud.

It works like this – they lure you in by only requiring a portion of the purchase price upfront.

But you never receive your order, and when you try to contact the company, you find out they no longer exist.

Or along the same lines, a dealer will only require a small deposit, but in this case, you receive a portion of your purchase.

Feeling secure, you send the rest of your payment, but you never receive the balance, and “poof,” the company is gone with all your money.

Another popular scam is selling counterfeit coins.

Rather than receiving the high-quality products you were promised, you receive lower-quality ones or even outright fakes.

And even sellers that appear to be reputable may trick you by offering below-market prices, only to charge outrageous shipping fees that double or triple the cost of your order.

So how do you avoid these scams?

First, if it sounds too good to be true, it probably is.

Stick to reputable firms and avoid working with online dealers using unregulated platforms.

Next, visit the CFTC (Commodity Futures Trading Commission) website and educate yourself on common scams and high-pressure sales tactics to avoid.

Do your research.

Remember that it’s easy for a company to create a professional-looking website full of positive reviews.

So be sure you check their reputation by visiting third-party consumer watchdog sites, like the Better Business Bureau, TrustPilot, Trustlink, and Business Consumer Alliance.

If you see a lot of negative reviews or customer complaints without any resolution or corporate response, be wary. Those are huge red flags that you should avoid doing business with them.

Regal Assets is a prime example.

Once considered one of the “good” gold IRA companies, the firm started receiving a slew of complaints beginning in 2021 from customers who hadn’t received their shipments.

At first, the company was vague and said they would look into the issue, but with no resolution (red flag).

Then they stopped responding altogether (bigger red flag).

Finally, early this year, they took down their website, and the CEO went missing.

A little research could’ve saved many from becoming victims of Regal Assets and losing all their savings.

Transparency.

A reputable company should be transparent throughout the process.

They will focus on your education first and answer your questions without any pressure to buy.

They’ll go into detail about both the benefits and risks of diversifying with precious metals and provide straightforward answers about fees, shipping, and prices.

During your investigation, a great resource is this free video provided by Augusta Precious Metals.

In it, they go through the top 10 gold IRA dealer lies, what to look for, and how to avoid them.

So don’t become a victim. Instead, do your homework and limit your dealings to only the very best gold IRA companies.

Price Volatility

So, this one is more of a bonus section and depends on how you look at it.

Some people view price instability as a major risk, but it can be used to your advantage if done right.

Look:

Though prices have historically risen over the long term, they can be volatile in shorter timeframes.

Price volatility is the change in prices as new information becomes known.

For gold, this may be an inflation report, a mining strike, or a political crisis with an uncertain outcome.

Gold has roughly the same volatility as stock prices.

Mutual funds and ETFs attempt to minimize their risks by diversifying among various companies.

As a single-asset class, gold doesn’t lend itself to this same type of diversification.

However, this isn’t necessarily bad, as it makes an excellent investment to diversify your portfolio.

Since its prices tend to rise during inflationary periods or economic uncertainty, it’s an excellent hedge for portfolios heavily weighted in paper-backed assets.

For example, during the 2007-2009 financial crisis, gold prices rose 25% while US stock prices fell 54%.

You could’ve cut your losses by half simply by diversifying with this precious metal.

And unlike some stocks that can go to zero, it has an intrinsic value that provides price support.

For that reason, institutions and governments have used this shiny metal to protect wealth for hundreds of years.

So rather than run from its inherent volatility, use it to your advantage.

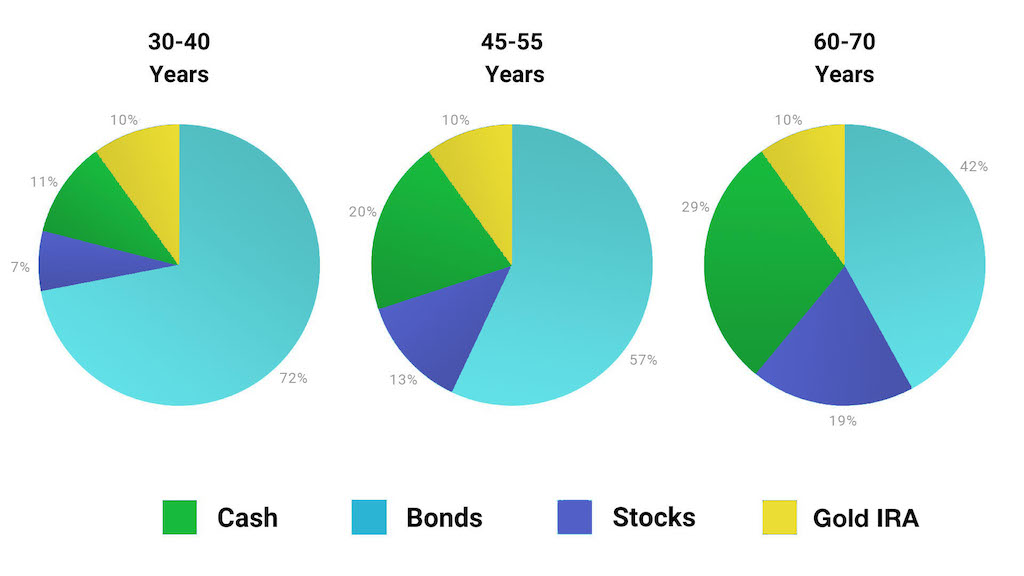

Diversify part of your portfolio with physical gold and reduce its overall volatility.

As a result, you’ll benefit from rising prices during economic recessions and inflationary periods that can offset losses in other areas.

Keep in mind that most experts recommend that you should have at most 5-10% of your overall portfolio in precious metals.

Also, it would be best if you planned on holding your position for at least five years to reduce your risk of short-term price fluctuations.

While price volatility should be an important consideration in any investment strategy, you can diversify your retirement between asset classes, reduce the volatility, and maximize your returns by taking these two simple precautions.

In Summary

Let’s face it:

All investments come with risk, and gold is no different.

However, you can minimize these risks by taking the steps and precautions we discussed.

Whether you’re concerned about inflation, looking to protect yourself from the next recession, or want to regain control of your financial future – a gold IRA may be the perfect answer.

And if you’re considering diversifying with gold and silver, give the team that Money Magazine calls “the Best Overall Gold IRA Company” a call – Augusta Precious Metals.

Their representatives will answer your questions without pressure to buy and help you avoid potential dangers or risks.

If this is something that interests you, give the Augusta team a call at 833-989-1952 to learn more.

You can also grab their gold IRA guide.

It’s 100% FREE and explains everything you need to know about diversifying with precious metals.

Plus, you get a FREE GOLD coin when you open a gold IRA account with them.

Check the guide here for further details.

Now, we’d like to hear from you:

- What are the main cons of a Gold IRA, in your opinion?

- Any other downsides you can think of?

Share your thoughts in the comments below!