Listen to this article:

Look:

Gold, silver and other precious metals are smart investments at any time, but especially in 2023.

They are an effective hedge against inflation and are considered a safe haven that can be used to protect your money.

However, this doesn’t mean that these are the only investments that you should hold.

We’ll discuss why precious metals should be a part of your investment strategy, along with other asset types.

In addition to a few tips that you can use to ensure you have a diversified portfolio, we’ll also share a few reasons why investing all of your money in gold is a bad idea.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

Putting Your Savings Into Gold? (Video)

So…

- Is it smart to put all your money in gold?

- How much of your money should be in gold?

Check out the video below:

Are Precious Metals Smart Investments?

You likely have heard of the “don’t put all of your eggs in one basket” expression.

The same holds true when it comes to investing.

There are a number of different ways to ensure that your portfolio has the diversification it needs.

Gold and silver should be a part of it, but they shouldn’t be the only types of assets that you hold.

While these precious metals have their place in your portfolio, they’re more of a hedge than a money maker.

This means that you aren’t going to see the same levels of returns as you would in the stock market.

But, when times are tough, your investment in precious metals will help to prevent you from losing money.

It’ll gain value when stocks fall, but it’s unlikely that you’ll realize the levels of return that you can get from mutual funds, ETFs, and other similar investments.

Here’s an example:

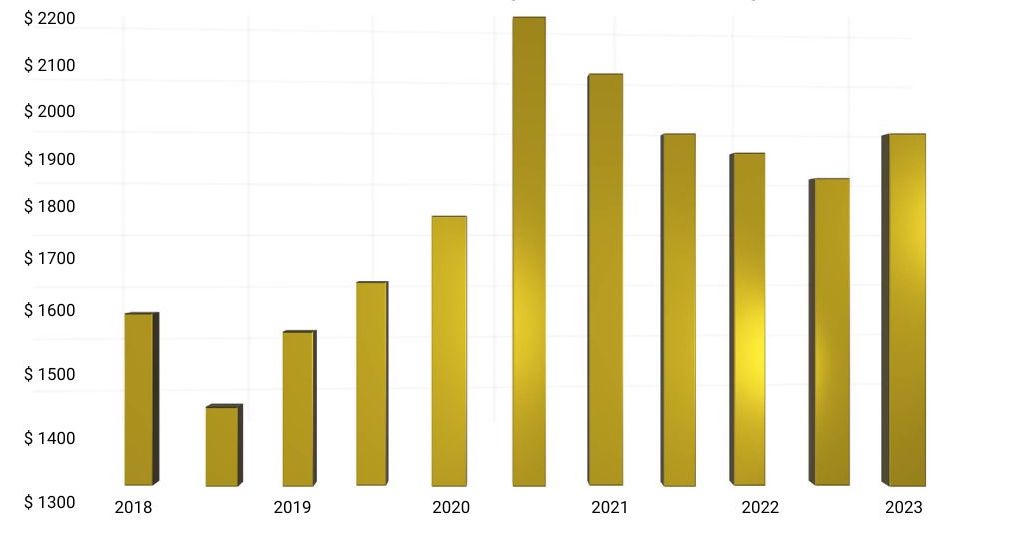

The average price for an ounce of gold in January 2023 was just under $1,930. Five years ago, the price was about $1,560.

So, not much of a return, as you can see.

That’s because the main benefit of gold is to keep pace with inflation and to protect the money you have, not to make money.

Of course, we all love to see our investments increase in value, but that’s just one piece of the puzzle.

Knowing that you have wealth protected can help ease your mind during times of severe market losses and high inflation.

Now, to clearly answer the question on whether you should put ALL your money in gold the answer is an unequivocal NO.

But, this doesn’t mean that it shouldn’t be a part of your investment strategy. It definitely should be!

Here are a few ways to successfully invest in precious metals as part of your portfolio.

What Is a Strong Investment Strategy?

Let’s face it:

A successful investment strategy includes diversification.

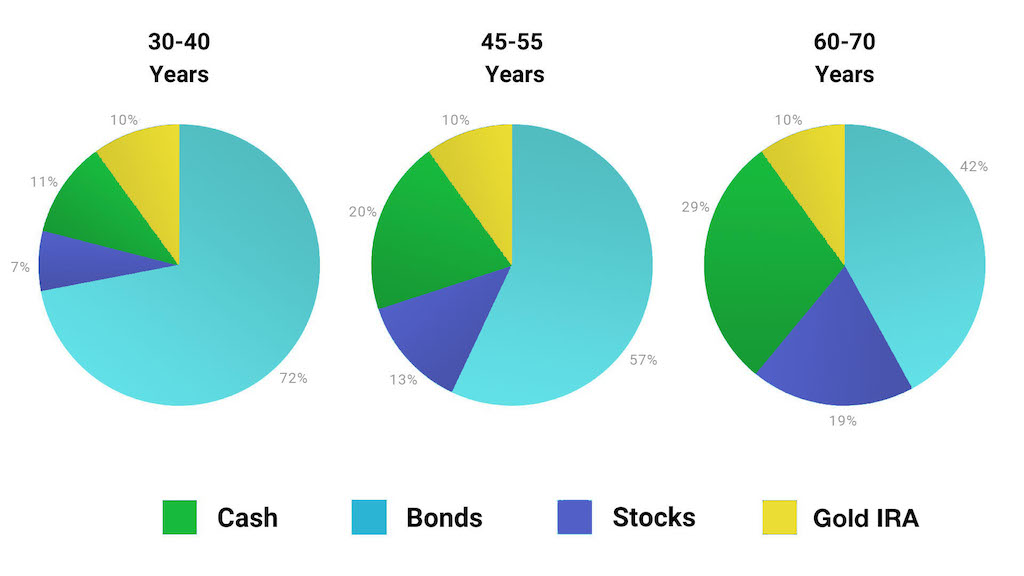

There are a few different allocation models that you can use to include precious metals in your investment portfolio.

Let’s take a closer look at some allocation percentages that people can have and in what scenarios.

(For the sake of this discussion, we’ll use gold, silver, and precious metals pretty much interchangeably as they’re all part of the same asset class.)

Allocation Model 1 (30% – 50%)

The first example we’ll use is when people allocate 30% to 50% of their total portfolio to gold and silver.

This approach is appropriate when negative economic realities loom on the horizon.

If it’s expected that we are going to enter into a period of market turmoil, and stocks are expected to go down, it makes sense to invest more of your funds in physical assets.

It’s okay to have up to half of your portfolio invested in precious metals, but don’t go above that threshold.

Also, you’ll want to do what’s called “rebalancing” every year.

During that, you’ll look at how your portfolio has performed in the last year.

And, if it looks like sunnier days are ahead, you’ll want to sell off some of your physical assets, hold onto some profits, and reinvest the bulk of the funds in the stock market.

Generally speaking, holding between 30% and 50% of your portfolio in gold isn’t a good long-term strategy.

Allocation Model 2 (15% – 25%)

The second allocation model is when people invest 15% to 25% of their holdings in precious metals.

This is a smart approach during inflationary periods.

The economy is doing better than the first example mentioned earlier, and stocks are expected to dip slightly or not at all.

The total economic outlook may not be all positive, but it’s still pretty good.

When you have this allocation in place, you’ll enjoy protection from inflation and increased consumer prices as well as market fluctuations.

It is also a good one for those in or nearing retirement.

You’ll be protected from risks like inflation and stock market losses but you’ll still be in a position to make some healthy gains from your equity holdings.

Allocation Model 3 (5% – 10%)

The third allocation model is when people dedicate 5% to 10% of their overall investments to precious metals.

Now, in the event that the economy is humming along, there’s no global strife, and the future outlook is more of the same, you’ll want to lower this asset type holdings even a bit more.

Having this level of silver, gold, platinum, or palladium means that everything’s great, and you expect the good times to continue into the future.

When times are good, physical assets like these usually decrease in value. You’ll get a lot more bang for your buck in the stock market during these periods of stability and economic growth.

Everyone wants their money to perform as well as possible.

And holding too much physicals precious metals during times of growth will mean that you’re missing out on higher returns.

However much you decide to invest in gold in 2023, be sure to give your portfolio allocation a close review at least once a year.

And, it’s always a good idea to discuss any investment strategy with a tax advisor or a professional financial expert.

Stable Investment, But No High Returns

Understand this:

Gold is a stable investment that doesn’t always provide high returns. It is what they call a ‘safe haven’.

This means that when investors are nervous or concerned about the stock market or the overall economy, they turn to precious metals.

So, when the market is doing great, and the economy is humming along as expected, gold becomes less attractive.

Your return will be a lot lower as the value of precious metals will dip and stock prices will rise.

Gold is one of those investments that will need to be reallocated as economic times change.

When things are good, you’ll want less of it, and conversely, as economic outlooks worsen, you’ll want to increase your holdings.

This strategy allows you to enjoy safety during hard times and growth during good times.

It’s not a good idea to just buy physical precious metals and forget about it. (That is if you want your money to grow as much as it can.)

This is the main reason why it’s a bad idea to invest all of your money in gold in 2023 or any other year.

The goal is to give yourself enough protection without missing out on maximum returns.

Include a Gold IRA in Your Portfolio

If you’re investing in gold, don’t forget about individual retirement accounts.

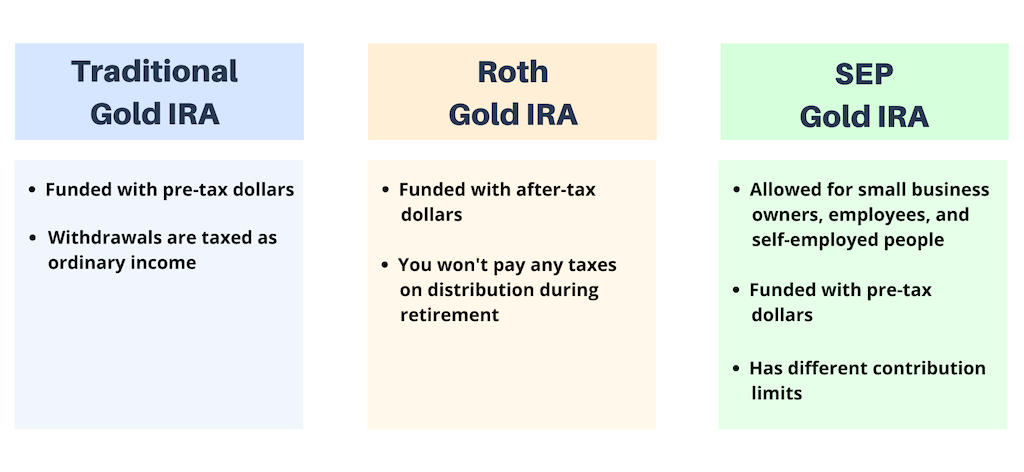

A self-directed Gold IRA is an effective way to invest in IRS-approved precious metals while also receiving pretty nice tax benefits.

You’ll also add some important diversification to your portfolio.

Precious Metal IRAs provide you with the protection from market turmoil and inflation that you want, while also helping you prepare for retirement.

Depending on the type of account you choose (Roth, SEP, or traditional gold IRA), you’ll enjoy some tax savings now or after your retirement.

The good news is that it’s also possible to transfer a current IRA or 401K into a Gold IRA, known as a rollover.

As you get closer to retirement, this is an effective financial vehicle that should definitely be part of your investment strategy if you want to protect and maximize your funds.

And it is probably the easiest way to get started too.

You’ll have all of the benefits of investing in precious metals without having to worry about keeping your physical assets secure.

Having someone else handle the storage of your physical assets can help you save both money and worry.

Now, our preferred Gold IRA is offered by Augusta Precious Metals.

This company is one of the best in the industry and is definitely worth checking out.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

You can read our complete review of it here.

We hope that this article has helped you understand the benefits and limitations of gold investing a bit more.

Now, we’d like to hear from YOU:

- What is the current allocation of your portfolio?

- How much of it would you invest in precious metals?

Let us know your thoughts in the comments below!