Look:

Buying precious metals, be it gold, silver, or palladium, is a huge investment. That’s why it’s important to do thorough research on the company you’re dealing with before you splurge a lot of cash.

One company that’s becoming increasingly popular in the precious metals market is Bullion Exchanges. The question is: Can you trust them with your money?

Today, we’ll discuss the following:

- Is Bullion Exchanges legit or a scam?

- How long have they been in the industry?

- Any complaints about their service?

- And so much more.

So, if you’re keen on learning these things, let’s get started.

Credentials

First things first:

You might have a lot of websites popping up when Googling ‘bullion exchanges’. Just to be clear, we’re talking about bullionexchanges.com business.

(With Eric Gozenput as the co-founder and CEO.)

Now that we’ve cleared that, let’s talk about licenses and registration.

Of course, if you’re making a big purchase or trusting them with your retirement account, you need to know if they run a legitimate business.

After all, it’s your hard-earned cash that’s on the line.

So, with some digging, we found that:

1) Bullion Exchanges is a registered for-profit company operating in New York.

2) Its CrunchBase account shows that it has around 11 to 50 employees and was founded by Eric Gozenput.

3) A quick check on their LinkedIn account proves all the information you see on CrunchBase.

4) The company is associated with numerous review sites like Better Business Bureau, Shopper Approved, and even Yelp, and Trip Advisor. (We’ll get more into this later.)

If you check their website, they don’t have much information about their credentials and other registrations.

However, you can see several badges from third-party coin grading and certification service companies like Numismatic Guaranty Company and Professional Coin Grading Service.

While these badges don’t say anything about the provider’s credentials, it’s a testament to how they ensure the quality of their coins, which we will discuss in the next section.

Bullion Exchanges Reviews and Reputation

While we didn’t find much information about Bullion Exchange’s credentials, there are numerous customer reviews online across different platforms.

So, is Bullion Exchanges reputable?

Let’s give the floor to the real and verified customers and Bullion Exchanges ratings.

On Better Business Bureau, it has a rating of 2.91 out of 5 stars based on 11 customer reviews.

It has closed 12 complainants in the last 3 years with 2 of them addressed within the last 12 months.

Upon checking, the complaints predominantly concern delivery and product quality, with many users saying that they never received their order.

On Trustpilot, the company boasts a rating of 3.7 out of 5 stars from 1,007 reviews. Similarly to the feedback on BBB, the negative reviews highlight issues with delivery and product quality.

However, these 2 review sites aren’t promoted on Bullion Exchanges’ website. Instead, when you check their review page, you will be directed to their Shopper’s Approved profile.

On this platform, they have a rating of 4.8 out of 5 stars based on 48,504 customer review.

The number on this site is significantly higher compared to the other two platforms that most precious metal providers use in the industry.

(Their customers probably just prefer to use this platform, or there’s something else going on. Don’t worry, we’ll dig deeper in the next sections.)

As mentioned earlier, they also have Yelp and Tripadvisor accounts, which don’t directly reflect their online service but rather, their physical store.

Years in Business

When reviewing precious metal dealers and gold IRA providers, it’s important to learn about how long they have been operating.

This is because it will help in assessing their legitimacy.

Newly established companies with little to no online presence or business history can naturally raise suspicions.

In contrast, long-standing entities typically have proven track records that underscore their reliability.

According to CrunchBase, Bullion Exchanges was founded in 2012.

You can also find the same date on their LinkedIn account, which means that they have been in the industry for over a decade.

Just like we mentioned in our SD Bullion review, when you’re in the industry for that long, it’s usually good news.

Physical Presence

For those planning to purchase collectible items, it’s beneficial to view the product in person before parting with your money. After all, you wouldn’t want your investment to go to waste.

Fortunately, you have this choice with Bullion Exchanges.

They have a physical store located at 30 W, 47th St, Store 1 New York, NY, right at the heart of New York City’s Diamond District.

Here you can check out their coin collection, as well as their diamonds and other precious metals.

If you have something to sell, you can also bring it to their store and their team will be glad to appraise it for you.

Bullion Exchanges Products & Quality

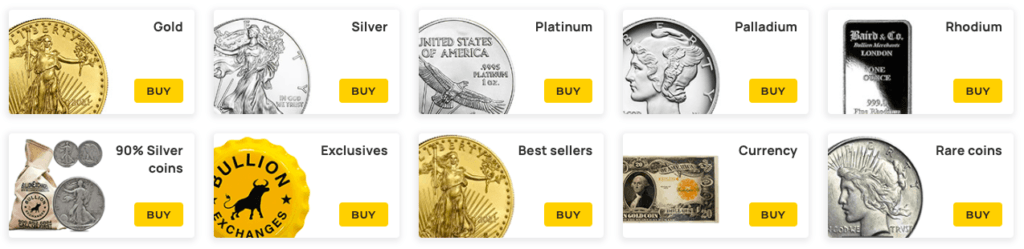

We’ve reviewed a lot of Gold IRA companies and precious metal dealers, and not a lot of them have the variety that Bullion Exchanges offers.

You can find gold, silver, platinum, palladium, and even rhodium products.

You can also find paper currency, regular coins, as well as rare coins that the collectors especially love.

What about quality?

Whether you plan on buying physical precious metals for cash, you want to make sure you get top quality.

And if you want to open a gold IRA, you need to know if the products you’re interested in are qualified for your retirement account.

The thing is that the IRS imposes specific purity standards to be acceptable for IRA accounts.

They are:

- Gold 99.5% pure

- Silver 99.9% pure

- Platinum 99.95% pure

- Palladium 99.95% pure

So when you shop at Bullion Exchanges specifically for your individual retirement account, make sure that these precious metals are IRA-approved.

The good news is all the products listed on their site have this information, so you can check this before purchasing.

Now…

If you choose to buy gold and silver in an IRA, we favor Gold IRA companies that focus specifically on this type of investment.

Here are our top 2 suggestions:

- Goldco (with a $25,000 minimum investment amount)

- Augusta Precious Metals (minimum $50,000 to invest)

Both of these firms are one of the best in the industry when helping you diversify with gold and silver, specifically for your individual retirement account.

Transparency with Pricing and Products

What we love about Bullion Exchanges is that they’re transparent with their pricing.

They even even price charts on their website that show real-time pricing.

One concern we have is that, based on our research of their reviews, some customers have complained about receiving products that differ significantly from what is listed online.

These may be isolated incidents, but they are still worth mentioning.

Pricing and Fees

Let’s be real:

When buying a precious metal, there are other fees involved with the purchase apart from the price of the metal itself. Thankfully, this dealer offers free shipping for orders exceeding $199.

And when you open a precious metal IRA, there are tons of fees involved.

From storage, maintenance fees, and account opening, you’ll surely see a bunch of them on top of the product purchase.

While Bullion Exchanges doesn’t list the exact amount you’ll pay for all the fees involved with opening an account, they’re very open about the fees and sales taxes that come with it.

But like we mentioned before, if you wish to open a gold IRA account it’s best to go either with:

(Depending on your minimum investment amount.)

For the prices, Bullion Exchanges pretty much follow the standard market rate.

They even have a price match guarantee, which essentially means that they can match the prices of their eligible competitors.

Customer Service

Bullion Exchanges can be reached through various channels: chat, email, phone, and fax.

Their live chat operates from 9 a.m. – 5 p.m. EST, Monday-Friday. Their email support desk is available 24/7 and typically responds within one business day.

You can call their toll-free hotline at 800-852-6884 or, if you still use a fax, send your queries to 646-213-3187.

If you’d like a face-to-face conversation, you can visit their physical store.

We like this multi-channel customer service approach as this allows customers to reach them at whatever channel they prefer.

Return and Refund Policies

According to their website, customers can initiate a return or refund within 7 days of receiving their purchase.

However, shipping and handling charges are non-refundable, as well as taxes and other fees related to the return.

The company reserves the right to reject any returns or exchanges that do not comply with their requirements.

For those opening a gold IRA, the company offers a buy-back program, which allows you to sell your precious metals back to them.

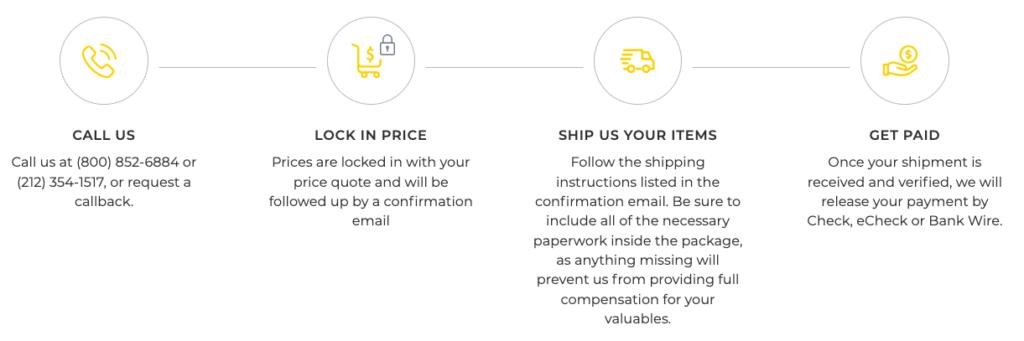

On top of their buy-back program, anyone can sell any metals, including coins, bars, and even jewelry or diamonds.

This can be done through their site or their physical store.

Is Bullion Exchanges Legit? (Verdict)

Buying gold, silver or any precious metals is no joke.

That’s why you need a reliable company that can provide you with the quality you deserve.

Of course, you also need to ensure that the company offers real business before you give them your cash.

With this in mind:

Is Bullion Exchanges legit?

The answer is yes, they’re a legitimate company.

If you want to open a gold IRA or just get something for your collection, you might enjoy the variety and the quality offered by this provider.

You can even visit their physical shop to see the different products they offer.

However, like with anything else, you need to be very thorough with your purchase to be sure you get the best bang for your buck.

At the same time, some reviews we came across did raise concerns. They might be isolated incidents, so they might not be a consistent issue to worry about.

Last but not least:

When it comes to Gold IRA accounts, check out Augusta Precious Metals instead.

They have a high minimum investment amount, but the company offers white glove treatment and goes above and beyond to help you diversify within your individual retirement account.

Apart from offering transparent pricing and products, they do 95% of the paper work with you.

The best part?

You get a FREE GOLD coin as a bonus when you open a Gold IRA account with them.

Now, we’d like to hear from YOU:

- Have you dealt with this business before?

- Do you agree with this Bullion Exchanges review and its legitimacy, or do you have a different opinion/experience?

Let us know in the comment section below!