Listen to this article:

Let’s say that you’ve researched the top-rated Gold IRA companies and are ready to open an account.

But then you wonder, just how much should you invest in precious metals?

That’s a good question.

A number of different factors can affect your decision. A couple of which are the remaining years before retirement and your future lifestyle goals.

You should also consider the relevant IRS rules, especially for annual contributions. There are also certain fees that can affect your overall investment.

And that’s exactly what we’ll cover today.

NOTE: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s dig in.

Why Diversify with Gold?

Adding a Gold IRA to your overall retirement strategy is an effective way to ensure that you have the diversification that can help you enjoy a comfortable lifestyle.

Equities can have a lot of volatility and while treasury bonds and bills are more stable, the returns they provide don’t always match the rate of price increases.

Low-risk securities are an important part of a well-balanced portfolio, but the stability they offer isn’t always a great trade-off.

Many investors find gold to be a perfect middle ground. While it won’t provide as high of a rate as equities, it is more likely to grow at the same pace as inflation.

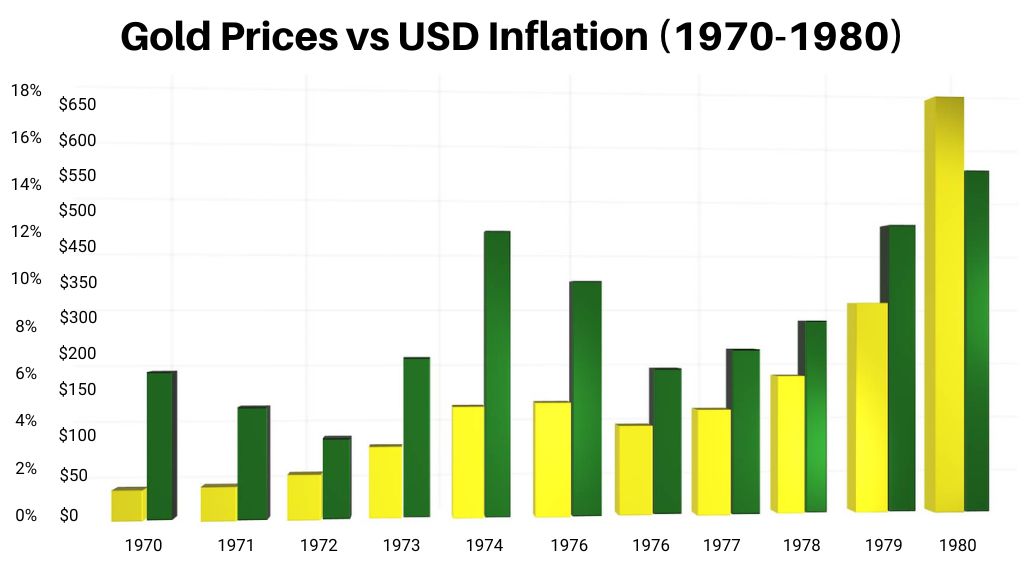

Here’s an interesting graph of its performance during 1970-1980, which was a highly inflationary period in history:

As you can see, there’s a reason why holding physical precious metals is worth it.

(Especially in today’s unpredictable economy.)

Finding & Funding Your Gold IRA

After you’ve decided on the best Gold IRA firm for you, you’ll get your account set up and you’ll be ready to start acquiring precious metals.

To be clear, this should be just one part of your overall portfolio. Sound investing requires a well-balanced strategy.

By adding this to your current portfolio, you are able to gain the diversity you need while also protecting yourself from inflation and economic volatility.

There are a few different ways to fund your new account.

1) Rollover

The first is rolling over a current IRA into gold and silver.

If you already have existing ones, or you’ve lost track of an old one that you had through a former employer, you’ll want to consider transferring those over to your newly opened account.

If you are with Augusta Precious Metals or Goldco, these companies will handle most of your paperwork.

2) Direct Funding

This simply means that you’ll electronically transfer from your bank or investment fund.

You could also send checks, which take longer to be received and processed, but if you’re not comfortable with e-transfers, this is an option.

It doesn’t matter how you initially put money in your account. What’s more important is getting started.

Once it has been established, you’ll be able to make periodic or regular deposits to increase the balance later.

Now, back to the main question:

How much money to invest in a Gold IRA?

Experts believe that it shouldn’t be more than 10% of your overall retirement portfolio.

Plus, keep in mind that the IRS raised the contribution limit for this asset class to $6500 with an additional $1000 “catch up”.

However, this is the government’s limitation on the contribution.

A company’s minimum contribution amount has nothing to do with the Internal Revenue Service rule.

Many people have saved for several years, and are converting their traditional IRA, Roth IRA, 401K, or 403(b) into a Gold IRA.

There are a number of variables to consider when it comes to deciding how much money you should put in, so let’s dig a little deeper.

Gold IRA Fees and Minimum Deposits

Here’s the thing:

The amount of your capital can affect the percentage of fees that you pay. Unlike other investment vehicles, gold funds tend to have flat-rate charges.

This means that the more money you deposit, the lower the percentage of your total cash that will go toward that expense.

For example, if they are charging an annual cost of $200, the rate will be as follows based on the balance of your account:

- $1,500 = 13.33%

- $5,000 = 4.0%

- $10,000 = 2%

- $15,000 = 1.33%

You get the idea, the more you invest, the lower your fee will be as a percentage of your investment.

For comparison purposes, the typical mutual fund charges between 2% and 5% of the total investment.

In this scenario, if you contribute over $10,000, you’ll enjoy a fee rate comparable to or lower than that of a mutual fund.

In addition to the management fees, you’ll also want to ask if you have to pay for any storage.

As a physical item, gold and other precious metals must be stored in a safe environment. Before selecting your IRA, inquire about any vault or storage costs.

You’ll want to know exactly what monthly and annual payments are associated with your new asset acquisition.

So, look for precious metal companies that offer great services and products without having high fees that eat into your savings.

#1 Recommended Gold IRA Company in the US (With the lowest fees and strongest reputation!) |

|

Highlights:

|

Our Rating: |

Tax Implications of Your Investments

Tax planning is a key part of any good financial strategy. The same holds true when purchasing precious metals.

Opting for a gold individual retirement account makes it easier for you in terms of taxes than buying physical coins or bullion.

Look:

It is possible to manage your precious metal investments in a self-directed IRA on your own, but doing so comes with risk.

The tax code in the United States can be confusing even for experts! As you age and become more focused on retirement, the last thing you probably want is the burden of tax planning.

When you have the right company handling your Gold IRA account, then you get the best of both worlds.

You receive all the benefits of alternative investments without getting stressed about the IRS rules and taxes.

This isn’t to say that you shouldn’t familiarize yourself with the basic reporting duties and how they can affect your future plans.

If you don’t have a financial advisor, you’ll want to educate yourself on broad tax realities and implications that may come with Gold IRAs.

Again, working with a reputable precious metal company can help alleviate some of the risks involved.

Consider Your Investment Horizon

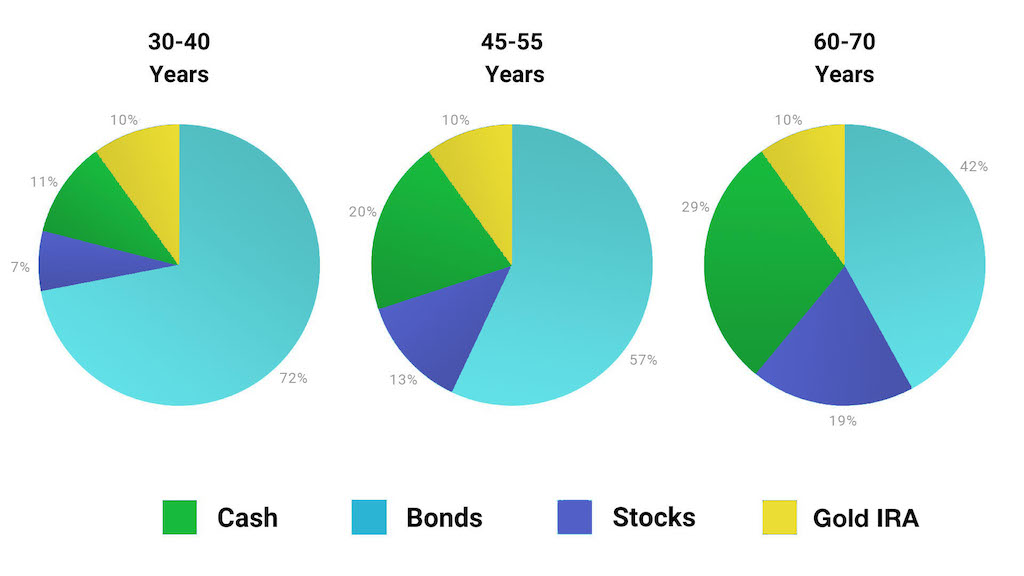

When you are determining how much money you want to allot for your Gold IRA, the time to retirement is a huge factor.

The 30-year-olds will have a significantly different approach than folks in their 60s.

Logic dictates that the longer your investment horizon, the time between now and when you will need to access your funds, the more risk you can safely take on.

Because precious metals are often considered safe havens, they are attractive to people of all ages.

For example, if you are in your 30s, it could make sense for you to have a retirement plan that is more heavily weighted with stocks.

Equities can be very volatile and, in some cases, a high-risk investment.

This makes them appropriate for younger folks who would have more time to recoup any losses that they may experience.

As you age, you’ll want to rebalance your portfolio to include less equities.

Let’s face it:

The closer you are to retirement, the less room you have to make up for losses.

This is another reason why the stability provided by a Gold IRA becomes more attractive as you get older.

By including precious metals in your portfolio, you are adding a new type of asset that doesn’t have a maturity date.

This can help balance out the bonds and fixed-income vehicles held within your overall retirement account.

Ready to Open a Gold IRA Account?

Here’s the thing:

Adding a Gold IRA to your overall holdings is an effective way to protect your finances from volatility and inflation.

With the unpredictability of today’s equity markets, it’s important to have a robust retirement portfolio that includes a number of different types of investments.

If you’re ready to get started, Augusta Precious Metals is our #1 recommended Gold IRA company.

It is a full-service firm and they are absolutely amazing.

The downside is that their minimum investment amount is $50K. (However, it can be rolled over from your other IRAs.)

If this is a high amount for you, then consider Goldco.

Unlike Augusta, they have a $25K minimum deposit requirement, should you want to open and fund your account with them.

Both of these companies are highly reputable and will help protect your retirement savings with a Gold IRA.

After all, you’ve worked hard your whole life and deserve to have a comfortable lifestyle during your golden years.