If the upcoming financial crisis has you worried, now may be a great time to consider a gold IRA.

Here’s the truth:

Gold has stood the test of time. From ancient Egypt to modern times, this precious metal has been used to protect wealth for thousands of years.

And unlike other alternative investments, it’s an excellent hedge against inflation or a declining dollar.

Unfortunately, the internet is full of bold statements and even outright lies about this shiny metal, making it challenging to know who you can trust.

That’s why we create these head-to-head reviews.

Our goal is to provide you with the best, unbiased information about all your options so you can make an informed decision.

Today, we’re comparing two gold IRA companies – Goldco and Monetary Gold.

We’re going to put both to the test based on some key criteria:

- Gold IRA Fees and Costs

- Products Offered

- Education Provided

- IRA Account Assistance

- Order Process and Minimum Investment Amount

- Customer Service

- Buyback Programs

- Reviews and Complaints

When you finish, you’ll know how each compares, their strengths and weaknesses, and most importantly, whether you can trust them with your business.

Gold IRA Fees and Costs

Gold IRAs come with additional fees not generally associated with traditional accounts – custodian and storage costs.

So our first step is to compare and see if their rates are competitive.

Monetary Gold

Goldstar Trust is their preferred custodian, but they will work with any IRS-approved trustee.

Set-up and first-year fees cost $290. Annual custodian rates start from $75 and will increase depending on your account size.

Annual storage fees run $100 for up to $100,000 in precious metals and $1 for every $1000 after $100,000. So, for example, if you have $200,000 in gold, your annual rate would be $200.

They will waive first-year fees for investments of $50,000 or more, so be sure to check with your representative.

Goldco

If you’re wondering about Goldco IRA fees, here’s a clear breakdown: the required minimum purchase at Goldco to start a gold IRA is $25,000.

Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50, as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually. Goldco does not charge any storage fees for cash transactions over $25,000.

Products Offered

Not all coins and bullion are created equal, and the IRS imposes strict purity standards to be included in an IRA account.

For example, gold must be 99.5% pure, and silver 99.9%.

So it’s essential to work with a firm that not only offers a wide range of products but can guarantee that they meet these standards.

Monetary Gold

As a precious metals dealer, MG sells a wide variety of coins, including many collectors’ editions.

According to their website, they offer 15 gold coins, including the always popular American Eagle, American Buffalo, and Canadian Maple Leaf.

They have 17 different styles in silver, featuring the America the Beautiful collection and Morgan Silver Dollars.

In addition, they offer two platinum coins and a palladium Maple Leaf coin. On top of that, you get to select from extensive offering of lesser-known collector’s coins in gold and silver.

Goldco

This firm offers an extensive selection of high-quality gold and silver coins and bullion.

They work with only the best mints worldwide to ensure that the products they offer are eligible for IRA accounts.

They have a wide range of gold coins in various sizes. We counted 17 styles, including the American Eagle, Canadian Maple Leaf, and Washington Monument.

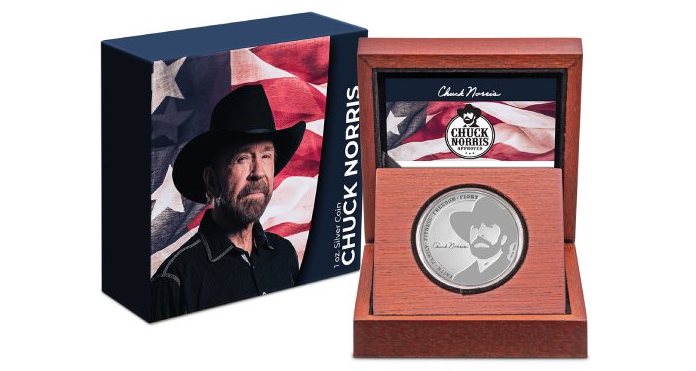

Or if you prefer silver, they have 29 options, including the Chuck Norris “5 Principles” series, Silver First Moon Landing, and Silver Dragon.

They also have gold and silver bars available in different weights.

Education

Diversifying with precious metals can seem foreign to most investors. The top firms understand this point and make providing education a priority.

Monetary Gold

Though less extensive than other companies we’ve reviewed, Monetary does provide various resources to help investors.

First, they offer daily price charts for all four precious metals. They also have a small video library with gold commentaries.

They have an extensive collection of market news videos, and you can subscribe to stay updated with new releases.

They provide a retirement calculator and articles comparing gold to the US dollar and inflation.

In addition, you can request up to six free guides from their website that provide information on the changing economic environment and money mistakes to avoid.

Goldco

This company believes in educating its customers.

They strive to provide their customers with high-quality resources that will help them make better-informed decisions.

You can request their FREE investors’ kit here.

It includes valuable information about precious metals investing, IRA accounts, and how you can get started 100% tax & penalty free.

They also provide an up-to-date library of financial articles you can search by topic to find the information you’re looking for quickly.

Last but not least:

Their website features gold and silver price charts that show the current spot price as well as historical data going back 40 years.

IRA Account Assistance

You shouldn’t have to do it alone.

It’s best to work with a company that has extensive experience with precious metals IRAs and a team that can guide you through the process every step of the way.

Monetary Gold

Their IRA team will help you fill out all required forms and navigate the process of opening and funding your new account.

First, request an investors’ guide from their website to see if diversifying with precious metals makes sense for your financial situation.

Next, an IRA specialist will call you to discuss your goals and answer any questions.

When ready, they will send you the required forms and help you complete them. You may need to provide proof of your current assets and income at the company’s discretion.

Next, you’ll work with your trustee to fund your account. Then their order specialists will assist you in selecting the appropriate coins based on your requests.

Finally, they will arrange to ship your order directly to your selected storage facility.

Goldco

Their precious metals specialists has streamlined the process of opening a gold IRA. You can speak directly with a specialist or fill out an online form to start the process.

Next, they’ll send you a precious metals investing guide (or you can get it right here).

After reviewing, if you still have questions, they’ll be happy to help.

When you’re ready, you’ll sign a term of service agreement. Then your precious metals specialist will help you to complete any required paperwork.

They will assist you throughout the process, from opening your account to funding – including any rollovers.

Once funded, Goldco’s precious metals specialists will help you select the appropriate coins and bullion based on the financial goals you have previously determined to be best for your situation.

Order Process and Minimum Order Size

Don’t leave it up to chance.

A secure and reliable order process should be a top concern when selecting a precious metal IRA company.

Monetary Gold

Orders are placed by phone with an order specialist.

They will confirm your selections and quote a final price, including shipping.

For payment, Monetary accepts bank wires, personal or cashier checks, or rollover funds provided by your trustee.

Their minimum order size is $10,000 for IRA accounts or $5000 for cash purchases. In addition, they charge a $30 delivery fee.

For orders greater than $50,000, they will waive the first-year fees.

Goldco

All orders are placed using a recorded phone line for added security. A precious metals specialist will confirm your selections and provide a final quote.

Goldco accepts bank wires, checks, or rollover funds as payment.

When planning your investment, it’s important to understand Goldco fees, as these include the one-time IRA set-up, wire fees, annual maintenance, and storage costs, all of which may affect the minimum investment strategy.

The Goldco minimum investment required is $25,000 to open a precious metals IRA and provide free shipping to your selected storage facility.

In addition, they offer up to 10% in free silver on qualified purchases, so be sure to check with a representative.

Customer Service

When you have a question, the last thing you want is to be left on hold. Or worse – leaving a message and never hearing back.

Excellent customer service sets the best apart from the rest and is an important factor when comparing companies.

Monetary Gold

Monetary’s customer service is available Monday through Thursday from 6 am – 4:30 pm PST and Friday from 6 am – 2 pm. They are closed on all major holidays.

You can also leave a message on their website to have a representative call you.

Goldco

They make it easy to get the information you’re looking for and have built an outstanding reputation for providing the very best customer service.

The website features an online chat feature available during business hours where you can speak directly with a representative.

After hours, you can leave a message to get an answer the following day.

Or, if you prefer to speak by phone, their precious metals specialists are available Monday through Friday from 4 am – 8 pm PST or 6 am – 6 pm on Saturdays.

You can also email customer service from the Contact Us section of their website.

Buyback Programs

Don’t leave selling your gold and silver up to chance.

A buyback program means that the company will purchase your precious metals and handle all the details should you decide to sell in the future.

Monetary Gold

Makes no mention of an official buyback program, leaving it up to you to handle the details if you decide to sell your precious metals in the future.

Goldco

With this firm, you’ll have no worries. Not only do they provide a buyback program, but they guarantee that they will pay you the highest price for your coins and bullion.

Customer Reviews and Complaints

Reputation is everything when deciding whether to do business with a company.

This Monetary Gold review also takes customer feedback into account, providing insight into the company’s reliability, service quality, and overall experience.

And seeing what others say about working with a firm gives us great insight into how they operate.

Therefore, it is a critical factor in earning our endorsement.

Monetary Gold

Better Business Bureau shows 5/5 stars based on 34 reviews and one complaint in the past three years. They have been a member since September 2014 and have an A+ rating.

No customer reviews on Business Consumer Alliance and an A rating. MG isn’t presently a member on BCA platform.

TrustPilot has one negative review submitted.

And Trustlink shows a 5-star rating based on 12 reviews.

Goldco

On TrustPilot we see 4.8/5.0 based on 1196 reviews.

BCA shows AAA rating with one resolved complaint and one positive review.

Trustlink gives Goldco a 5-star rating based on 254 reviews.

And on Better Business Bureau there’s 4.83/5 stars based on 570 customer reviews.

They have been a member since December 9, 2011, and have an A+ rating.

On BBB, we can see that they’ve received 26 complaints in the past three years, with ten coming in the past 12 months.

Goldco has a 100% response rate and has worked diligently with customers to resolve their issues.

You can also check out our in-depth Goldco review here.

Goldco or Monetary Gold? (Our Winner)

Now that we’ve seen the facts, which Gold IRA company is best and which one is right for you?

Both of them have excellent reputations and customer reviews.

Both offer competitive IRA fees.

Monetary Gold may be the better choice if you’re considering platinum or palladium coins.

However, if you want a company that exemplifies excellent customer service and white-glove treatment, Goldco is the clear winner.

As we’ve seen from their nearly 2000 verified customer reviews, this firm makes customer satisfaction a top priority.

And the free silver for qualified purchases doesn’t hurt.

Start with their FREE investor kit here.

Now, we’d like to hear from you:

- Have you dealt with any of these 2 businesses before?

- Which one do you think is best: Goldco or Monetary Gold?

Share your thoughts in the comments below!