Did you know that diversifying with gold and silver can be one of the best ways to protect your retirement portfolio?

That’s because gold prices tend to move in the opposite direction of stocks, bonds, and mutual funds, making it the perfect hedge during challenging economic times.

However, just because you have an individual retirement account doesn’t mean you can go out and buy precious metals with it.

(For this, you’ll need something called a Gold IRA.)

In this post, you’ll learn:

- Differences between a gold IRA and a traditional IRA

- Types and benefits of a gold individual retirement account

- Whether you should roll your 401k into a Gold IRA

- How much money do you need to start one

- Lots more!

Read on as we break down the pros and cons of a traditional IRA vs gold backed IRA, and whether the latter is the right choice for you.

Gold IRA vs Traditional IRA

You are probably already familiar with traditional IRAs.

These accounts are set up with a custodian, usually an online broker, and allow you to hold paper assets, such as stocks, mutual funds, and bonds.

Gains are tax-deferred until retirement, and contributions may be made with pre-tax dollars.

The key difference between a traditional IRA and a gold backed IRA is that in the latter, instead of paper assets, you can hold physical IRS-approved precious metals.

(This includes gold, silver, platinum, and palladium in the form of coins or bullion.)

And just like traditional IRAs, all increases in the value of your gold and silver are tax-deferred until you withdraw the funds from your account.

The second key difference is that gold IRAs typically have higher fees than traditional ones.

This is due to the ongoing maintenance and storage costs associated with holding physical metals.

Now…

Some folks prefer the precious metals retirement accounts because typically gold performs well during economic volatility.

Have a look at its annual returns since 2008:

As you can see from the chart above, gold fared well even in 2008 and 2020 (which were the most economically challenging years in the last couple of decades).

Because of that, many savvy investors use this solution to protect their hard-earned retirement funds.

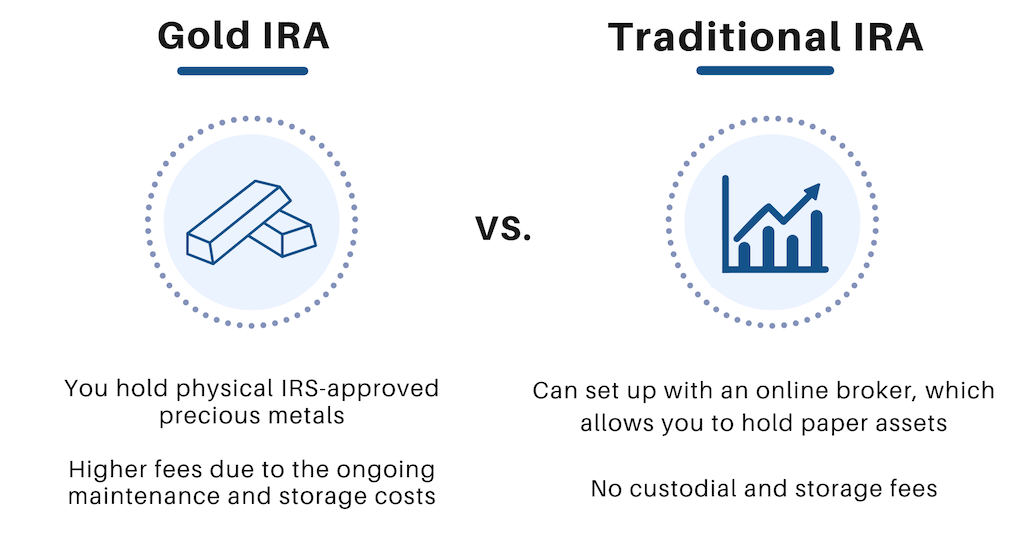

Three Types of Gold IRAs

Gold IRAs come in three versions – traditional, Roth, and SEP.

1) Traditional Gold IRA

This account is funded with pre-tax dollars, meaning you don’t pay taxes on the funds you contribute to your IRA.

Taxes are deferred on any gains until you start taking withdrawals during retirement, at which time, they are taxed as ordinary income.

2) Roth Gold IRA

This type of account is funded with after-tax dollars, so there is no tax benefit when you contribute.

However, unlike traditional gold IRAs, your account grows tax-free, and you won’t pay any taxes on distributions during retirement.

3) SEP Gold IRA

A Simplified Employee Pension gold IRA is available for small business owners, employees, and self-employed people.

Just like a traditional gold IRA, contributions are pre-tax, and gains are tax-deferred until you take withdrawals during retirement.

However, this type of accounts has different contribution limits, and employers can contribute funds on behalf of their employees.

Two Unique Benefits of Gold IRAs

A gold individual retirement account is self-directed and functions like a traditional IRA.

This is where you can hold physical IRS-approved precious metals instead of being limited to standard paper assets like stocks, bonds, and mutual funds.

In addition, taxes are deferred (or eliminated in the case of a Roth gold IRA) on any gains until you withdraw the funds during retirement.

It gets better:

You can roll over funds from an approved retirement plan, such as a 401K or traditional IRA, to a gold IRA without triggering any tax consequences and maintain the tax-deferred status of your investments.

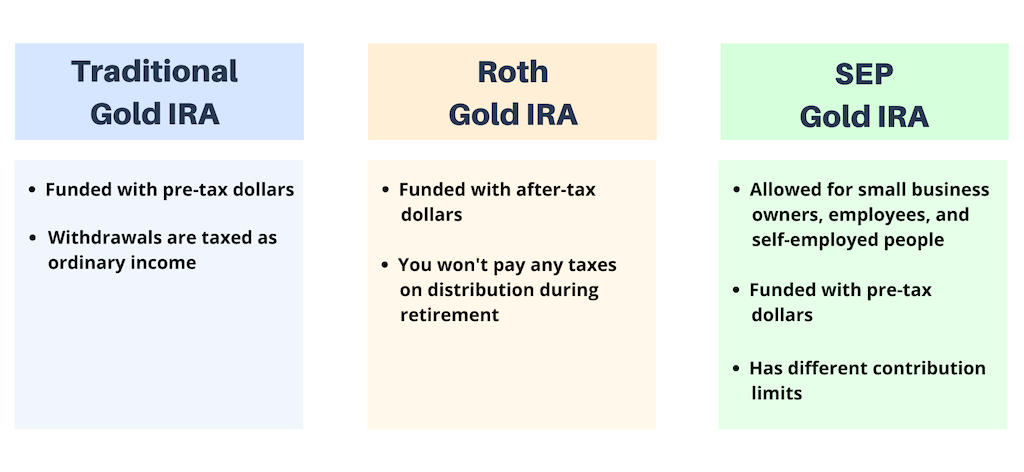

However, gold-backed IRAs offer two unique benefits not found with traditional ones.

1) First, these investments don’t carry third-party risk.

That’s to say, the value isn’t dependent on the performance of a third party, such as a board of directors or fund manager.

Unlike stock values that can be impacted by poor corporate or management performance, gold’s intrinsic value is based on overall economic factors and can provide greater stability to your portfolio.

2) Second, online hacking is becoming a global threat to our financial security.

By holding physical precious metals, you have the added security of knowing it can’t be hacked or stolen online.

Now, what are the pros and cons of a gold IRA?

Gold-Backed IRA: The Pros & Cons

Reasons to Invest:

- Gold is an excellent hedge against inflation.

Gold prices tend to increase during inflation and economic uncertainty as investors flock to safe-haven assets to protect their investments.

- Gold is an excellent store of value.

Gold has intrinsic value.

As we learned during the Dot Com Bubble and the Great Recession of 2008, companies can fail, and stock prices can go to zero.

However, gold will always have value because it is a physical asset. So you never have to worry that you’ll wake up one morning and your gold will be worth nothing.

- Precious metals provide greater diversification.

The prices of precious metals tend to move contrary to stock and bond prices, making it an excellent way to diversify and lower your overall portfolio risk.

Reasons to Avoid:

- Gold IRAs have higher fees.

The costs to open and maintain a gold IRA are higher than traditional IRAs due to the increased custodial and storage fees.

- Gold is an illiquid asset.

Unlike stocks and mutual funds that can be sold with a single click, selling your precious metals can be more of a challenge.

You need to locate a buyer, agree on a price, and arrange the transfer of the physical gold & silver.

(However some companies, like Augusta Precious Metals, have a Gold Buy-Back Program which means that you’ll likely be able to sell fast and easy.)

- Gold can be stolen.

While very unlikely, a physical asset can be stolen or lost.

The good news is that you can protect yourself by using a gold IRA company that maintains an all-risk insurance policy that protects your gold from any theft or loss.

How to Set Up a Gold IRA Account?

You have two options:

- do it yourself, or,

- use a gold IRA company to help you.

If you do it yourself, first, you need to open a self-directed IRA with an IRS-approved custodian.

As you already know, it allows you to hold physical precious metals in your IRA.

But since you can’t physically possess them, you will also need to select an IRS-approved depository to store it.

Once approved and funded, you can then contact a metals dealer to buy your physical assets and arrange to ship it to your designated depository.

As you can see, the DIY option involves a lot of steps and nuances.

But if you want to streamline the process, then consider Augusta. It’s a highly trustworthy Gold IRA company that can handle all the details for you.

Should I Roll My 401k into a Gold IRA?

When changing jobs, most of us don’t give our 401k Plan a second thought.

But did you know that rolling your 401k to a gold IRA may be the best decision you can make to protect your retirement?

Most 401K plans offer few investment options, typically limited to a handful of mutual funds.

And most of these funds tend to move in the same direction, making it difficult to diversify and protect your portfolio from unexpected market drops and challenging economic times.

However, gold prices tend to move opposite the overall market, making it the perfect hedge to reduce your risk.

By rolling over your 401k into a gold IRA, you will have a more diversified and stable retirement portfolio.

Pricing Requirements for Gold IRAs

At this point you may wonder:

“How much money do you need to start a gold IRA?”

Depending on the firm, most of them will require a minimum investment of $10,000 to $50,000.

Now, you may even find ones that don’t have a minimum deposit for a Gold IRA, but be very selective who you go with.

Keep in mind that due to the higher fees associated with these accounts, it doesn’t make sense to fund it with less than $10,000.

For example, let’s say your gold IRA annual fees are $200.

This amount represents just 0.4% of the value of a $50,000 account.

But on a $10,000 account, it would be 2% of the account value, higher than many mutual funds.

And on a $1000 account, it represents a whopping 20% of your account value – per year!

With this simple math it becomes clear that it’s in your best interests to invest a higher amount.

Can I Store My Gold at Home?

Though some deceptive firms may lead you to believe you can hold your gold at home, the IRS requires that your IRA-eligible precious metals must be in the “physical possession of a bank or an IRS-approved non-bank trustee.”

If you take possession of your physical assets, the IRS considers it a withdrawal, and you may have to pay taxes and penalties.

So, while technically you can do that, it’s definitely not advised.

Gold IRA Fees & Costs

Gold IRAs tend to have higher fees than traditional IRAs due to the set-up and ongoing maintenance and storage fees.

Depending on the IRA custodian you choose, you can expect to pay a one-time-only set-up fee of between $100 to $250.

In addition, your custodian will also charge an annual maintenance fee to cover account processing, handling the IRS-required paperwork and reporting, and the associated record keeping.

The industry average is between $75 and $300 yearly.

You will also have to pay an annual storage fee to the depository to safeguard your gold.

Depending on the depository, this fee can be a flat $100 up to 1% of the value of your gold.

Looking for the Best Gold IRA Firm?

If you’re looking for the #1 rated firm in the industry, check out Augusta Precious Metals.

Named the “Best Overall Gold IRA Company for 2022” by Money Magazine, this precious metal provider prides itself on transparency and its award-winning customer service.

Their trained agents will take the time to help you understand all the benefits and risks of diversifying with gold and silver.

(Without ever making you feel pressured to buy.)

Once you’re ready to open your gold individual retirement account, Augusta’s team will handle all the details, making the process quick, easy, and painless.

And with their lifetime customer support, you’ll rest easy knowing that you always have a professional to turn to when you have questions or concerns about your investment.

You can get started today by giving Augusta Precious Metals a call at (833) 989-1952.

They will be happy to answer all your questions and help you decide if this type of retirement investing is right for you.