If you are looking for ways to diversify your retirement funds, precious metals are a smart place to start.

Gold, silver, and other metals offer an effective hedge against inflation and economic turmoil.

Now, you may wonder:

- Are gold certificates worth it?

- What is the difference between physical vs paper gold?

- Why is one better than the other?

And that’s exactly what we’ll answer today. Plus, you’ll learn about the benefits of investing in gold with an IRA.

Without further ado, let’s get started.

Physical vs “Paper” Gold (Certificates)

Look:

Not all alternative investments are created equally.

If you are interested in precious metals, there are a few things you need to know.

A smart rule of thumb to remember is that physical assets are better than paper (which gold certificates are).

It’s not fair to say that they aren’t worth anything, but neither are they a smart investment.

(It’s not the same as owning physical metal.)

Historians and collectors are drawn to gold certificates because they are so unique.

They are historical documents that have intrinsic value due to their place in history. As with most other collectors’ items, this value is calculated as a function of the rarity of the item.

(Not to be confused with Goldbacks or AGNs.)

Anyone who is interested in precious metals as financial investments can consider some of the many more suitable options that are available.

It’s important to dig a little deeper into gold certificates and how they are valued. We’ll also compare paper-backed investments with those backed by physical metal, such as Gold IRA.

Now, adding precious metals to your retirement fund is a smart move that can also be confusing to newbies.

(We’ll be recommending a highly reputable firm, should you go the gold IRA route, but more on this later.)

Gold Certificates and Their Value

Gold certificates make a wonderful collector’s item.

Because their value is based on rarity, different certificates have different worth.

Remember, when it comes to investing in gold, you want your investment backed by physical gold, not paper. And, if you choose the wrong certificate, it can be close to worthless.

Before the US abandoned the gold standard in 1934, gold certificates were equal to their face value and were used as currency.

Once the country moved away from the gold standard, these U.S. currency equivalents became valued as collector’s items.

Now that they’re no longer used as currency, they’re valued based on how rare certain types of gold papers now are.

In addition to the subjectivity by which they’re valued, these can be difficult to sell for a fair price.

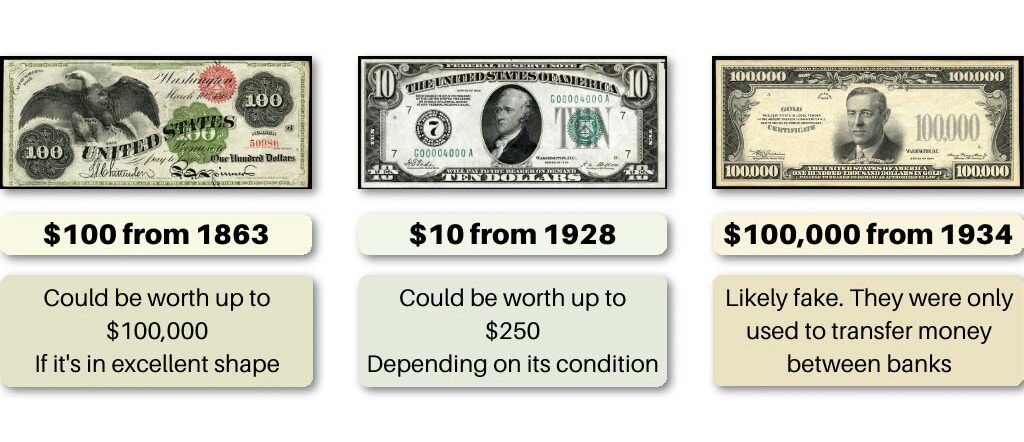

Here are a couple of examples of different historical US gold certificates and their worth:

1) A $100 certificate issued in 1863 could be worth up to $100,000 if it’s in excellent shape.

2) A $10 certificate issued in 1928 could be worth as much as $250 today, depending on its condition.

3) A $100,000 certificate issued in 1934 is likely a fake and worth nothing! (This is because these were only used to transfer money between banks and it’s illegal for individuals to own them.)

As you can see, there’s a wide range of value attached to these “gold papers”, and some are worthless too!

This makes working with a reputable dealer a must. Due to these factors and many others, there are a lot of investors who stay away altogether.

To be clear, investing in gold certificates is a wonderful hobby or collector’s item, but a less-than-ideal way to build wealth for your retirement.

They shouldn’t be part of your retirement planning.

Don’t be fooled by collectors offering them as a viable financial investment (if you ever come across those).

Physical assets are always the better option when compared to paper-backed metals. If you’re still wondering which way you want to go, continue reading to learn more about both options.

Why Is Metal Better than Paper Gold

Now that gold certificates are out of circulation, they are much less liquid due to their status as collector’s items.

However, that doesn’t mean that there still aren’t ones that are newly issued.

Those are generally by some banks and precious metals companies, are not backed by the US Treasury, and are only used as a means to show ownership of gold bullion.

In the best of times, precious metals can be difficult to sell for a fair price.

Buying gold that’s backed by paper rather than physical gold can be a risky decision.

If you purchase a gold certificate, its value will fluctuate as the price of gold changes. These aren’t tied to any currency and must be converted to cash in order to be spent.

Buying newly issued paper gold carries a lot of risks. If the precious metals company goes out of business, your investment will become worthless.

However, buying physical bars, bullion, or coins is the only prudent way to go.

An even safer way to invest in most precious metals is through a gold IRA. This option allows you to know the exact value of your investment without the subjectivity of certificates.

Edmund C. Moy, former U.S. Mint Director and U.S. Money Reserve Senior IRA Strategist said the following:

“Because gold prices generally move in the opposite direction of paper assets, adding a gold IRA to a retirement portfolio provides an insurance policy against inflation. This balanced approach smooths out risk, especially over the long term.”

Investing in Gold With an IRA?

Now…

We all agree that holding some amount of precious metals in your overall investment portfolio is a wise idea.

We’ve also established that there are different ways to invest in these alternative assets, with some being better options than others.

To diversify your retirement portfolio, a gold IRA is one of the best ways to go. Check out the 2-min video below on what it is:

When you invest in this type of account, you will enjoy a number of different benefits.

The main one for anyone thinking about their financial health and retirement is peace of mind.

Top-quality gold IRAs only invest in metal-backed assets. This means no paper.

As we have already discussed, paper-backed metals are an inferior choice, and are considered to be more a collection item than an investment.

If you want an asset with an objective valuation process and a fair amount of liquidity, you want to have physical assets.

A gold-backed IRA allows you the diversity and safety of precious metal investments along with a few more benefits.

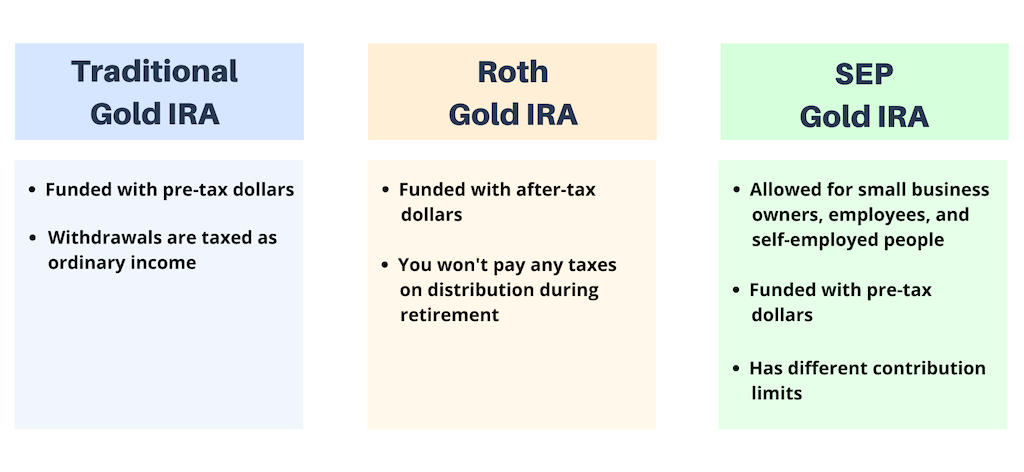

One of these is the tax treatment of gold and silver IRAs.

In fact, a gold IRA receives the same tax treatment as other more traditional retirement vehicles. Can you say the same about your coin collection?

After you open this account, you can select from a variety of different IRS-approved precious metals in the form of coins and bullion.

Holding physical assets rather than currencies or equities with a lot of volatility can help you sleep much better at night!

But of course, a gold IRA should be just one part of your overall retirement savings strategy.

Best Gold IRA Firm Today

Look:

Many experts believe that a gold IRA fund provides a safe haven from economic turmoil, liquidity, and good tax treatment.

Working with a full-service company like Augusta can help you get a clearer picture of how a gold IRA will fit into your current financial investments.

They also handle all of the transfer paperwork, which can sometimes be overwhelming.

The advantages of having precious metals as part of an overall retirement planning strategy cannot be underestimated.

If you want to ensure that your life is comfortable when you’re retired, now is the time to find out more about gold IRAs.

Proper diversification can ensure that your retirement funds are protected. Won’t you want this peace of mind during the next economic downturn or when inflation takes another uptick?

Contacting Augusta Precious Metals

When you’re ready to invest in an IRA fund that is backed by gold, we highly recommend working with Augusta Precious Metals.

You can also call them at (833) 989-1952 and their trained agents will be available to answer any questions that you may have.

When on a call, you can also request the guides that the Augusta team has put together to help you understand this area and make an informed decision.

You’ll soon realize that a gold IRA might be much better fit for your retirement planning than gold certificates.