Let’s face it:

Economic uncertainties will always plague us. Just this year, a lot has happened: rising interest rates, high inflation, and bank failures.

In times like this, it’s natural to worry about the future of your investments, particularly your retirement savings.

Now…

A gold IRA is one of the strategies to safeguard your retirement portfolio against these risks.

But with all the precious metal companies out there, how can you be sure you’re investing in the right one?

That’s where we come in.

At GSC, we provide you with the best and unbiased information about all the options in the market, so you can decide which company fits your needs.

Today, we’re comparing two popular companies: Oxford Gold Group and Augusta Precious Metals.

While Augusta remains our top choice, we’ve been hearing a lot of positive feedback about Oxford Gold Group.

So, we’ve stacked them up against each other to see if APM will still hold the crown.

We’ll use the following criteria:

- Gold IRA Fees and Costs

- Product Selection

- Education Provided

- IRA Account Assistance

- Minimum Order Amount, Process, and Pricing

- Customer Service

- Buyback Programs

- Customer Reviews and Complaints

Will we still have the same opinion after this comparison review? Let’s find out!

Gold IRA Fees and Costs

When you start an individual retirement account, there are numerous fees and costs involved outside of purchasing the actual precious metals.

These vary, but the most common ones you’ll see are custodian and storage fees.

Unfortunately, there’s no way for you to avoid them, no matter what company you choose.

So, the goal here is to find the one with competitive rates so they won’t eat up your returns.

Oxford Gold Group Fees

There’s a certain level of confidentiality regarding its fee structure.

It is our understanding that prospective investors should be prepared for an annual fee that could cost anywhere between $75 to a few hundred dollars.

For the initial set-up cost, you can expect the fees to be between $50 to $500.

Like other gold IRA managers, Oxford has partnered with different IRS-approved custodians. This means that you can choose which one you’d like to have for your precious metals.

However, if you don’t have any preference, OGG might suggest Equity Trust or STRATA.

Since Oxford doesn’t disclose all of its fees, we went ahead and checked the fees of their preferred custodians, so you can have an idea of how much you need to prepare:

Equity Trust

- $50 for the online application

- $225 to $2,250 yearly (depending on the portfolio value)

- from $100 annually for storage

- $10 to $100 for other fees

- $250 fee for full termination and $100 per asset for partial termination

Strata Trust

- $50 setup cost

- $95 annual fee

- $100 for commingled and $150 for segregated storage

Do note that you may get a more competitive rate than those listed here since you will be directly investing through Oxford.

When it comes to storage, this company uses two facilities: the Delaware Depository in Wilmington, Delaware, and the Brinks Depository in Salt Lake City, Utah.

Both of these are insured by Lloyds of London, a well-known and respected insurance company.

Besides that, Oxford uses insured carriers to transport your precious metals to and from these locations.

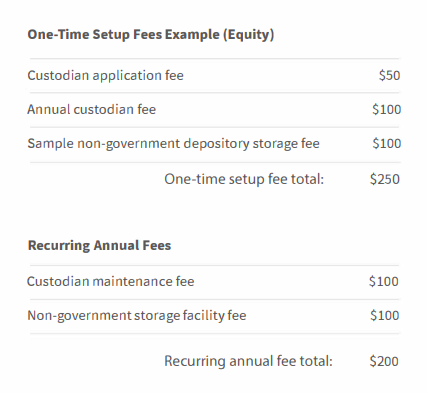

Augusta Precious Metals Fees

Unlike Oxford, APM is more transparent here.

These include a $50 one-time fee to open an account, a $100 annually for the administration of the IRA account by the custodian, and another $100 annually for storage.

In other words, you’ll only be paying a total of $250 for your first year, and $200 for the succeeding years, regardless of the amount of your account.

Yes, you heard that right.

Even if you invested millions into your account, you’ll still be paying the same fee.

For its custodian, like Oxford, Augusta also prefers Equity Trust, which has been named the Best Overall Self-Directed IRA Company of 2023 by Investopedia.com.

(No wonder many gold IRA companies choose Equity Trust.)

Now…

Do you want to get zero fees for up to 10 years at Augusta Precious Metals?

Simply call them at 833-989-1952 to waive your Gold IRA fees.

You can also get a FREE GOLD coin as a bonus when you open an account with them.

WINNER: Augusta Precious Metals.

The company’s fee structure remains constant, regardless of the total balance maintained in the IRA. Plus, they’re transparent with their fees, which is refreshing.

Product Selection

The IRS imposes strict standards on precious metals so that can be included in your IRA. This means that the company you choose must be following this standard too.

A quick rundown of the IRS’s purity requirements:

- Gold 99.5% pure

- Silver 99.9% pure

- Platinum 99.95% pure

- Palladium 99.95% pure

This part is very crucial to your gold IRA.

If you end up buying precious metals from a firm that doesn’t follow this standard, you’ll end up flushing your money down the drain—no one wants that.

So, let’s see how these two companies comply with this.

Oxford Gold Group

Offers different types of gold including the American Eagle, South African Krugerrand, and Canadian Maple Leaf, as well as mints of Great Britain, Austria, and Australia.

Oxford also offers other precious metals such as silver, platinum, and palladium, all of which follow the IRS purity standard.

On the company’s website, you can check the product’s composition and IRS eligibility to ensure that the coins and bars you’ll be purchasing are qualified for your IRA account.

Augusta Precious Metals

Has an impressive selection of gold coins for you to choose from.

Not only do these hold intrinsic value, but they also offer a sense of historical significance.

Here are some of them:

- Gold American Eagle Proof

- American Gold Buffalo Proof

- Certified American Eagle

- Certified American Buffalo

- 2020 Australian Striped Marlin

- 2018 Royal Mint ¼ oz Gold Year of the Dog

- 2017 Great Britain ¼ oz Gold Year of the Rooster

- 2016 Great Britain ¼ oz Gold Year of the Monkey

Augusta also offers qualified silver ranging from common to rare coins.

Like Oxford, you can check more information about the product when you visit their website.

WINNER: Because of its extensive product range, Oxford wins this round.

However, APM isn’t far behind as it offers premium and rare items you might not find with Oxford.

Education Provided

Precious metals investing isn’t just a one-off thing.

For it to be successful, you need to understand how your asset works, so you can manage risks effectively, and potentially increase your returns in the long run.

That’s why it’s important to choose a company that supports and educates its customers every step of the way. This signifies their interest in your success.

Oxford Gold Group

Has a learning center on its website, featuring different materials such as articles, market news, guides, frequently asked questions (FAQs).

For new investors, you can request a free investment guide.

It introduces you to the world of gold IRA, as well as information that you need to know when you finally decide to take a leap.

You can also check out the precious metal charts, which give an up-to-date price of gold, silver, platinum, and palladium, as well as their historical performance.

Augusta Precious Metals

It is one of the few Gold IRA firms that go above and beyond when it comes to educating their customers.

Besides providing articles and price charts, APM has an extensive video library that talks about almost everything you need to know about diversifying with precious metals.

On top of that, the company’s director of education, Devlyn Steele, is a Harvard-trained economist, who has decades of experience in the capital markets.

This means that customers have access to top-tier economic insights and guidance straight from the horse’s mouth.

Augusta also offers great tools like inflation and retirement calculators.

You can check it out right now to see how does today’s inflation affect the purchasing power of your assets.

You can also request a free gold IRA guide.

It will show you all the things you need to know about diversifying with precious metals and the getting started process.

Plus, you get a FREE GOLD coin when you open a precious metals IRA account with this firm.

WINNER: Augusta clearly wins this round.

IRA Account Assistance

Let’s be real.

Not everyone has the time to figure out how to open a gold IRA successfully.

And even if they did, you can’t open this type of retirement account on your own.

You would need to work with a Gold IRA provider and their representatives to ensure a seamless process.

Question is, how helpful are they?

Oxford Gold Group

The process comes down to the following three steps.

Step 1: Open a Self-Directed IRA

Here you’ll be working with a dedicated manager who’ll help you with the paperwork and open an account with the qualified custodian.

Step 2: Fund Your Account

Once you complete the first step, Oxford’s dedicated IRA department will work with you and your custodian to fund your account.

This can be done by either rolling over existing retirement funds or making a new cash contribution.

Step 3: Purchase and Deliver

Once you open and fund your account, you can select and buy IRA-eligible precious metals, which are then delivered to an IRS-approved depository for safekeeping.

Oh, and you’ll also need to fill out an application before you can open an account. It is about a few pages long and takes about ten minutes for you to complete.

Augusta Precious Metals

It is the crown holder for the Best Overall Gold IRA Company for two consecutive years now, 2022 and 2023.

One of the reasons why it is unbeatable in the industry is its superb service.

Augusta has a dedicated team that supports new customers in opening their accounts. This includes funding the account and doing 95% of the paperwork with you.

When it’s time for you to choose which precious metals you want, the order department will answer your questions and help you select products that are eligible for your IRA.

Simply submit your request online or contact them directly at 833-989-1952 to get started.

WINNER: Augusta wins this round. The award from Money Magazine says it all.

Order Process and Minimum Order Size

Opening an account is just the start of your gold IRA journey.

The next step is knowing how you can place an order for your account.

Let’s see how secure and reliable these companies are when you place an order.

Oxford Gold Group

Like opening an account, OGG also requires you to place an order via call with one of their order department.

During the call, your order will be confirmed, along with its price and shipping method.

The company can handle the purchase of physical assets by IRA holders. It can also broker purchases of precious metals for investment outside the retirement account.

For the minimum order, you’ll need at least $25,000 to contribute.

Augusta Precious Metals

First, you’ll learn all about investing in a Gold IRA with your free web conference call with one of their experienced agents.

You can call them at (833) 989-1952.

This is where you’ll learn more about gold IRAs, pros and cons of diversifying with precious metals, as well as get answers to questions that you might have before opening an account.

Once you’re ready, you go through the IRA processing step where Augusta team will do 95% of the paperwork with you.

Once your account is approved, you can fund it with the following methods:

- bank wire (no limit)

- personal check (up to $50,000 maximum)

- rollover any amount from traditional IRA, Roth IRA, 401(k), or 403(b) accounts

After that you can purchase eligible precious metals with Augusta’s order desk, which are then safely stored in an IRS-approved depository.

Now…

While the order process with APM is undoubtedly seamless, keep in mind that the minimum contribution amount is higher than Oxford’s.

It is $50,000, which can be too much for smaller investors.

WINNER: For this round, we’d say it’s a tie.

Both of them require you to jump on a call when placing an order, which ensures the security of your purchases.

Customer Service

When you choose a gold IRA company, you’re with them for the long haul.

That’s why you need one that won’t only support you while getting started, but also be there during the life of your account.

Oxford Gold Group

There are three ways to contact them: visit their office, through phone, or via a form.

If you live near or are located within the Beverly Hills area, you can visit their office at 9100 Wilshire Blvd., Suite 800E Beverly Hills, CA 90212.

For those who prefer a phone call, you can reach them at 833-600-GOLD. You can also schedule it on their website if you wish to set up a meeting with one of their representatives.

If you don’t have any immediate concerns and prefer someone to reach out to you instead, you can fill out the form on their website.

All you need to provide is your name, email, and phone number.

Augusta Precious Metals

This company makes it easy for you to contact them if you need an answer fast.

The website has a chat option, which allows you to talk to a live person—no chatbots!

If you like to speak with someone on the phone, you can call their customer service hotline at 833-989-1952 available from 6 am to 5 pm PST, Monday through Friday.

If you’re not comfortable with phone calls, that’s okay. You can also contact them through email.

New customers will also get a free web conference call with the director of education Devlyn Steel, where he’ll answer your questions.

Just to be clear, this isn’t a sales call and you won’t be pressured to buy or open an account right away.

For those who already have an account with APM, you can also expect customer support for the life of your account.

They even have a dedicated hotline for existing customers—a testament to their commitment to quality customer service.

WINNER: Augusta wins this round. They have more support options, plus they are known for their white-glove treatment.

Buyback Programs

At some point in your account’s life, you may want to sell your precious metals.

However, selling them can be a tedious process. One way to avoid this is to choose a company that offers buyback programs.

Oxford Gold Group

If you no longer want to invest in gold, Oxford has a buyback program. They will offer you a reasonable price for your precious metals if you wish to sell them.

Augusta Precious Metals

Also offers a buyback program, with fair and competitive prices for those who decide to sell their gold. While there are no guarantees in this program, they haven’t turned down anyone yet.

WINNER: For this round, Augusta wins because only they have this information freely available on their website.

Customer Reviews and Complaints

While we’re very particular with the firms that we review and endorse, it’s still important to hear what real and verified customers say about them.

These reviews will let you take a peak at what kind of company you’re going to be in business with.

So…

- Is Oxford Gold Group legit?

- Is Augusta indeed that great?

Let’s see what their customers say.

Oxford Gold Group Ratings

Better Business Bureau gives them an A+ rating and 4.93 out of 5 stars, based on 90 customer reviews.

According to BBB, Oxford has been accredited since 2018 and has closed 17 complaints in the last 3 years.

On Trustpilot, they have a rating of 4.9 out of 5 stars, based on 182 reviews.

While on Business Consumer Alliance, Oxford has a rating of 5 stars based on 36 reviews with 1 closed complaint.

Augusta Precious Metals Ratings

On BBB, this company has a rating of A+ and 4.92 out of 5 stars, with 0 complaints and 121 customer reviews. It has been accredited by the association since 2015.

Augusta has a perfect 5-star rating based on 96 reviews on BCA.

And they have a perfect 5-star rating on Trustlink based on 285 reviews.

WINNER: Because of the number of good reviews and its high rating, Augusta Precious Metals takes the win for this round.

Which Gold IRA Company Is Best?

So…

What’s our final verdict in this head-to-head match: Oxford Gold Group or Augusta Precious Metals?

Both offer a wide range of high-quality precious metals, buyback programs, and good customer service.

Oxford has a smaller minimum order size, ideal for smaller investors. On top of that, it offers more products, like platinum and palladium.

However, it does have limited information about its fees and buyback program, which are two of the most crucial pieces of information new investors should know.

On the other hand, Augusta provides more extensive learning resources and tools.

It is also very transparent about its fees and buyback program. On top of that, it’s highly rated by its customers, which is not surprising given their white glove treatment.

So, after careful consideration and a couple of rounds, Augusta Precious Metals clearly wins this match and still holds the crown as our #1 recommended gold IRA company.

Call them at 833-989-1952 or grab your FREE guide here.