Listen to this article:

If you own physical precious metals, whether it be coins or even bullion, there may come a time when you need to fly with it.

(Unless they are in your Gold IRA account, which you wouldn’t have to actually carry around.)

The question arises as to whether you have to declare your gold at the airport. We all know regulations exist and can often be tricky to navigate.

So today, we’ll cover the following:

- can you travel with gold and silver bars and coins

- how much of it can you carry to the USA

- TSA regulations with precious metals on domestic flights

- how much gold is allowed on international flights

Without further ado, let’s get flying!

Investing in precious metals? Start profiting with our #1 gold newsletter today!

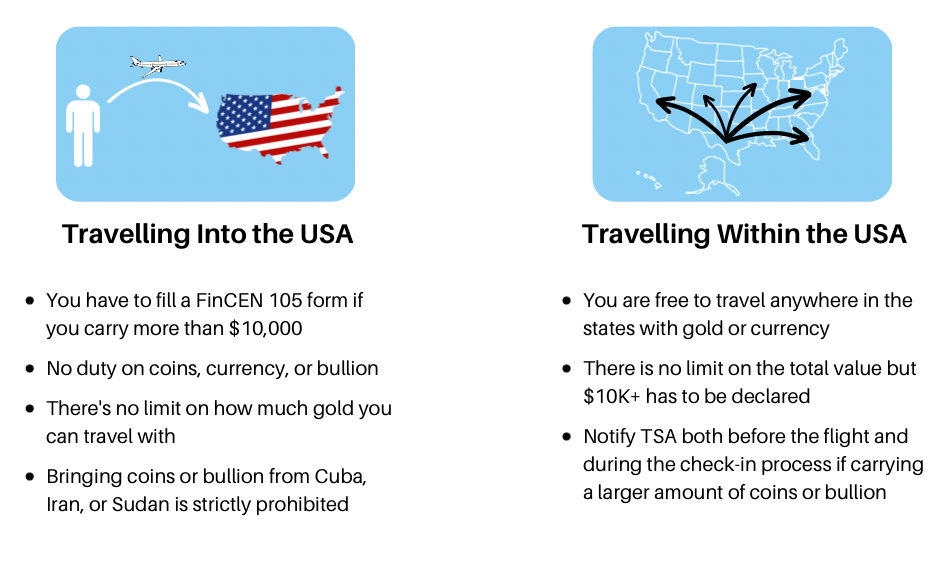

Traveling Into The U.S. With Gold

First, let’s talk about bringing gold into the USA, especially as an American citizen.

If you’re traveling back home after being abroad, then there are regulations on bullion, coins, and even medals.

In this case, you’ll be dealing with U.S. Customs and Border Protections (CBP).

Any currency or monetary instrument must be declared, and a FinCEN 105 form must be filled out if the value is over $10,000.

So you may be asking, what’s the difference between a currency and a monetary instrument?

Currency is exactly like it sounds.

It means actual paper or metal currency issued by a government. So, many gold coins would fit this description and fall under this regulation.

A monetary instrument can be things like traveler’s checks, bearer bonds, stocks, and so on.

(In this case, you will not have to worry about it.)

So what should you do with precious metals that are not coins or currency? How much gold can you travel with?

Technically, if we follow the strictest interpretation, bullion is not classified by these rules.

Although not legal advice, it would be wise to also declare to a CBS Officer anything if the value is $10,000 or greater.

(Even if you wear gold on you or carry in your pocket.)

The reason is that you still may be stopped or questioned.

You may even be charged with a false declaration.

Of course, you may be able to argue these things in court, but this isn’t how you want to start or end your trip.

One important note is that there is no duty on coins, currency, or bullion. So there is no reason to try to under-declare as that will only bring possible problems.

And one last thing:

There’s no limit on how much you can travel with, but if flying from Cuba, Iran, or Sudan, then gold coins or bullion are not allowed entry under any circumstances.

Gold Rules on Domestic Flights (USA)

We covered the process of flying into the United States with precious metals.

Now we’ll look at what happens when traveling domestically within the country.

In this case, you’ll be dealing with the TSA.

You are free to travel anywhere in the states with gold or currency, and there is no limit on the total value.

However, this doesn’t mean that traveling with large quantities of gold won’t raise the suspicions of the TSA.

This is why you should notify them both before the flight and during the check-in process.

So while not technically a formal declaration like when entering the United States and filling out a FinCEN 105 form, you should still declare it to avoid any hassle.

I’ll say one thing:

Don’t try to hide gold in the airport (or hiding anything else from the TSA).

This will definitely arouse suspicion if they find it, and you’ll likely miss your flight as they try to learn why you are transporting large quantities of undeclared physical assets.

Also, when they x-ray luggage, the gold will block the view of the x-ray scanners.

This means they will have to inspect to see what’s underneath for security reasons to make sure nothing is being hidden.

This is another reason why it’s best to be as transparent as possible when at the airport.

Remember, you can request a private screening room if the TSA agent will want to inspect your precious metals.

You’re also allowed to have one companion in the room to observe the process.

It’s certainly to exercise this right as you don’t want the entire airport to see your bullion and coins on full display and protect yourself from possible bad scenarios.

Main Tips When Flying With Gold

When flying with precious metals of any kind, it’s a good idea to follow a few best practices to avoid any chance of theft or loss.

Never put your gold in a checked bag.

Always carry it with you on board the plane and in a bag or luggage you can keep an eye on.

You don’t want to store it in an overhead bin unless you absolutely have to. In front of you or under your seat is best.

Next, if possible, try to bring along any receipt or invoice declaring the goods are yours.

This is not necessary, but if any issues do come up, being able to quickly show documentation that you own the precious metals will make the process much easier.

(This is especially true when carrying large amounts.)

Frequently Asked Questions

Can you bring gold and silver on a plane?

You certainly can. Your precious metals can be in any form (coins, bars, medals, etc.). Just be sure to follow the TSA or Customs guidelines to avoid any issues.

How much gold can you carry to the USA?

You may wonder what is the US Customs gold limit. There’s no limit.

But it’s unlikely that you’d be bringing precious metals worth millions of dollars into the country, right?

In any case, anything you carry that has a value of more than $10K must be accompanied by special forms like FinCEN 105.

Can I carry gold on domestic flights (USA)?

You certainly can, and there’s no limit.

The rules are a bit more relaxed in the sense that you wouldn’t have to provide the FinCEN 105 form; however, you still would have to declare your goods to a TSA agent.

(Make sure to do so both before the flight and when checking in.)

How much gold is allowed on international flights?

Again, technically, there’s no limit.

However, just like the United States, other countries also have their own requirements and documentations.

Check out the official websites on declaring goods in Canada, the UK, and European countries:

- Canada

- United Kingdom

- EU (gold coins and bars to be declared as cash!)

As you can see, these countries have similar regulations when it comes to declaring goods that are worth more than 10,000 dollars, British pounds, or euros, respectively.

All in all, by following the tips and rules we mentioned here, you should be able to travel with your physical precious metals and avoid any hassle or delays on your way to your destination.

Investing in precious metals? Start profiting with our #1 gold newsletter today!