You may wonder:

Are silver coins a good investment?

We all know about gold’s effect, but the truth is, these shiny little pieces have also been captivating the minds of collectors and investors alike.

But before you dive in and start hoarding them like a dragon with its treasure, it’s a good idea to size up whether they’re a solid bet this year.

Today, we’ll talk about the pros and cons of investing in silver coins now, why some people find them attractive, the potential payoffs they could bring, as well as pitfalls that might pop up.

By the time we finish this info guide, you’ll be armed with the knowledge to decide whether this should be part of your game plan.

Note: Gold & Silver Central is for informational and educational purposes only, and does not offer any personal financial advice. Please consult with a professional before making any decisions.

Now with this disclaimer out of the way, let’s get started.

The Appeal of Silver Coins

The truth is:

These coins got this timeless charm that’s been drawing in collectors and investors for ages. And there’s a handful of reasons why these shiny metals get people all starry-eyed.

Let’s discuss those.

Intrinsic Value of Silver

It isn’t just a pretty face; it’s a precious metal prized for its good looks, staying power, and rarity.

As a touchable asset, silver’s got this core value that’s been toughing it out over time.

And it’s not just all about jewelry or industry uses – the silver love extends to folks looking for a bit of a safety net for their cash.

Historical and Cultural Significance

Silver coins have got some serious street cred in the history department. They’re like little snapshots of the art, culture, and economies of civilizations gone by.

When you’re holding a precious metal, you’re basically holding a slice of history – and that’s pretty cool, right?

Tangibility and Security

Unlike cryptocurrency or paper trails, silver coins are something you can actually hold, admire, and stash in a safe spot.

This hands-on factor gives you a sense of security and control over your investment – after all, you’ve got the goods right in your hand.

Diversification and Portfolio Hedging

If you’re looking to add a little variety to your investment spread, silver coins could be a good move.

We know that gold is a good idea to invest in, but silver’s also got a track record of moving to its own beat, separate from traditional assets like stocks and bonds.

It could provide a buffer against the ups and downs of the market and other economic curveballs.

Collectibility and Potential Rarity

Some silver coins have that extra special sprinkle — maybe it’s a limited run, a one-off edition, or a historical gem.

These can skyrocket in value over time.

The buzz from collectors hunting down these rare pieces can push their prices, potentially giving you a nice little profit.

Global Demand for Silver

This metal is not just for coins and jewelry — it’s got a whole slew of uses in industries from electronics to solar panels.

As technology advances, the world’s hunger for silver keeps growing, and the value of your coins might grow along with it.

Just a quick heads-up, though – while silver coins have inherent value, their worth can bob around based on market conditions, current prices, and how much collectors are willing to pay.

So it’s key to do your homework and keep your finger on the pulse of what’s happening in the market to make informed decisions about your shiny investments.

Pros of Investing in Silver Coins

Dropping some cash on these can dish up a bunch of potential upsides that make them a pretty appealing option for both collectors and investors.

Here are the potential cool perks you can expect.

Hedge Against Inflation and Economic Uncertainties

Historically, precious metals have been a decent shield against inflation.

When economies are on a rollercoaster ride, or when paper money takes a hit, they tend to keep their cool and value – or sometimes even rise.

So, if you’ve got silver coins in your investment mix, they might just be your superhero, safeguarding your cash and spending power.

Liquidity and Portability

One of the top perks of silver coins is that they’re super liquid and portable.

Unlike other forms of the metal, like bars or rounds, the coins are easily recognizable and widely accepted.

If you’re in a pinch, you can convert them into cash or other assets, giving you flexibility and speedy access to funds.

Potential for Capital Appreciation

Silver coins have the potential to bump up in value over time.

As the world’s craving for this shiny metal keeps climbing, thanks to industrial uses and investors jumping on board, the rarity of the. coins might boost their worth.

Plus, some of those with a unique history or numismatic value can demand higher prices in the collector’s market.

Tangible and Aesthetic Appeal

Silver coins are a physical investment that you can hold and admire for their good looks.

Their intricate designs, historical engravings, and cultural connections make them not just a potential moneymaker but also a joy to behold.

Owning them can give you a sense of pride and satisfaction that goes beyond their cash value.

Potential Portfolio Diversification

Tucking precious metals into your investment portfolio can give it a nice little shake-up.

Silver often dances to its own beat, separate from other traditional assets like stocks and bonds.

By tossing in some coins, you might bring down the overall risk of your portfolio and beef up its ability to handle market twists and turns.

While silver coins have some pretty sweet potential upsides, they also come with some things to consider. The prices can bounce around, and the value of silver coins can change with it.

On top of that, you must consider the costs of keeping your coins safe and sound when investing in physical assets.

One of the best ways to diversify is buying precious metals in an IRA.

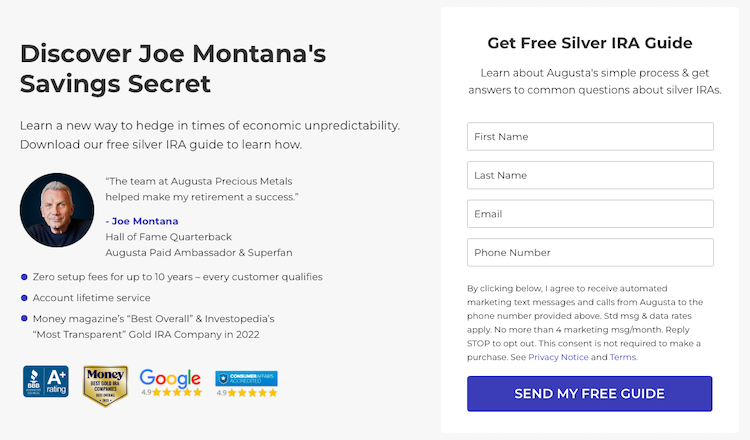

Well-known names like Joe Montana, Ron Paul, Mark Levin among many others diversify with this type of individual retirement account.

Grab your FREE silver IRA guide to learn more.

Cons of Investing in Silver Coins

While this type of investment sounds pretty enticing for many people, it’s crucial we also have a good look at the potential not-so-fun bits that come with it.

So, let’s dig into some of the potential downsides when it comes to investing in silver coins.

Volatility and Price Fluctuations

Silver prices can be a wild ride, with a bunch of market factors like the world economy, investor feelings, and industrial demand all influencing the ups and downs.

These swings can make timing your purchases and sales a little tricky.

So, if you’re getting into this, you’ve got to be in it for the long haul and be ready for some short-term price rollercoasters.

Storage and Security

Whenever you invest in stuff you can touch, like silver coins and bars, you’ve got to figure out how to keep it safe.

Making sure your shiny goods are safe from being stolen, damaged, or messed up by environmental factors is an extra cost and responsibility you’ll need to consider.

Storing them might mean you need secure vaults, safety deposit boxes, or other specialized storage solutions, which can cost you extra cash.

This is one of the reasons why gold and silver IRAs are so popular, especially if you’re buying precious metals in large amounts.

Costs Associated with Buying and Selling

If you’re dipping your toes into silver coin investing, remember to factor in the costs that come with buying and selling.

They include dealer premiums, auction house fees, shipping, and potential transaction fees.

These extra expenses can take a bite out of your overall returns and affect how much you make from your investment.

Market and Counterfeit Risks

The silver coin market, especially the collectors’ market, can go through ups and downs in demand and changing trends.

What’s super popular and in high demand today might not be as desirable tomorrow, and that can mess with the coin’s value.

Also, learn how to spot fake gold and silver metals.

Always ensure that your goods are the real deal and buy from reputable sources to protect your investment.

Tips for Investing in Silver Coins

Now that we’ve talked about the general pros and cons of investing in silver coins, let’s talk about some pro tips that’ll help you.

Set Clear Goals and Timeframe

Before you rush headlong into investing, let’s take a moment to talk about your game plan.

Are you on a quest for long-term wealth preservation, hoping for capital appreciation, or looking to add a bit of sparkle to your portfolio?

Identifying your goals will steer your journey and help you pick the right shiny silver coins for your treasure trove.

Consider talking to your financial advisor as well, should you need help in this department.

Work with Reputable Dealers and Experts

When buying silver coins, only work with dealers who’ve earned their stripes for being trustworthy.

Go for those known for their authenticity, fair prices, and top-notch customer service.

Don’t be shy to ask the experts — they can give you invaluable advice and guide you throughout your journey.

Track Market Trends and Monitor the Prices

The silver market can be a wild ride, so keep an eye on it.

Track how silver prices have moved in the past, look for patterns, and pay attention to factors that might influence the market, like economic indicators and supply-demand dynamics.

This intel will help you make smarter investment decisions and spot the best times to buy or sell.

Consider Dollar-Cost Averaging

Ever heard of this term?

Dollar-cost averaging is a strategy where you put a set amount regularly, regardless of the current silver price.

By spreading out your investments over time, you can minimize the impact of short-term price swings and get a more balanced average cost per coin.

It’s a bit like avoiding putting all your eggs in one basket at the wrong time.

Focus on Quality and Authenticity

Remember, you want to buy precious metals that are top quality and authentic.

Watch out for any signs of fakes, like weird weights, odd markings, or sloppy craftsmanship.

We’re after the real deal here—it’s key to protecting your investment’s value over time.

Diversify Your Portfolio

While we love silver coins, it’s smart not to put all your eggs in one shiny basket.

Consider spreading your money to other areas, like silver bullion bars, ETFs, precious metals IRA, or even completely different asset classes.

You can also invest in gold, which is a bit more stable.

This diversification helps protect your portfolio from market squalls and fine-tunes your overall risk-reward balance.

Stay Informed and Adapt

The silver market can be a fast-moving river, so stay on top.

Keep learning, and keep up with industry news and trends. Markets change, and new opportunities or risks can pop up.

Being ready to tweak your investment strategy will help us respond to those shifts.

Patience and Long-Term Perspective

Investing in silver coins calls for patience and a long-game perspective.

Sure, the prices can jump around in the short term, but you need to focus on the potential long-term benefits of adding silver to our asset mix.

Stick to your guns, steer clear of impulsive decisions based on fleeting price changes, and stay faithful to your investment strategy.

Remember, adding precious metals to your portfolio should match up with our financial goals, risk comfort zone, and how long we’re willing to wait.

You need to do your homework, get advice from trusted sources, and take a long-term view for the best shot at success.

Silver Coins As Investment

As a silver coin investor, it’s natural to wonder: “Is buying silver coins a good investment this year?”

We’ll say this:

While they’ve got a real charm to them, mixing value and history, silver coins can also act as a safety buffer when the economy gets a bit unpredictable.

And their value can even increase over time.

But before you get carried away, please recognize that investing in these can be a bit of a rollercoaster ride.

Prices might go up and down, and you’ve got to figure out where to keep your goods safe. That might cost a bit, too.

Regardless of your reasons to invest, remember that doing good old-fashioned research, staying patient, keeping up to date with the market shifts, and having a long-term outlook are key.

We also encourage you to consider a Gold or Silver IRA.

If that’s something you want to learn more about, then check out our #1 recommended Gold IRA company in the US, Augusta Precious Metals.

They’re all about education and will help you get your bearings in the silver market with no strings attached.

And when you’re ready to take the plunge, they’re right there with you, guiding you every step of the way.

Even better, they handle 95% of the paperwork with you.

If this sounds like your cup of tea, call the Augusta team at 833-989-1952 to learn more.

You can also grab their guide here and get a FREE GOLD coin when you open an account with them.

Now, we’d like to hear from you:

- Will silver ever be worthless, in your opinion?

- Are you buying silver coins as investment this year?

- If yes, who is your go-to precious metals dealer?

Share your thoughts and personal experience in the comments below!