You might be wondering:

- Can you pawn 585 gold or use it as collateral?

- Are there any pros and cons to doing that?

Now, diving into pawnshops can feel a bit like a whole new world.

There’s a bunch to know about how they work, especially when it comes to something as precious as gold. But hey, that’s what we’re here for – to help you navigate it all.

Without further ado, let’s get started.

Investing in precious metals? Join our #1 gold newsletter now. Use our code GSC20 to get 20% OFF any subscription plan!

Pawning Gold (Basics and Expectations)

So you’re thinking of getting some quick cash and got your eyes on that 585 gold of yours?

Cool. Let’s break down the details of whether taking it to a pawnshop is your golden ticket.

First things first:

- What does 585 on gold mean?

- What is 585 gold in karat?

- Is 585 gold worth anything?

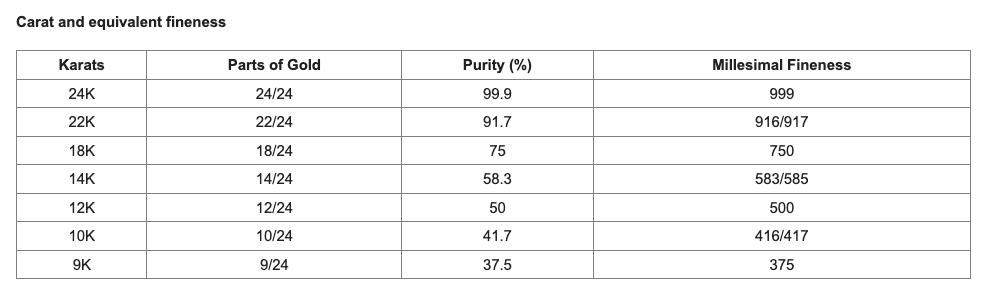

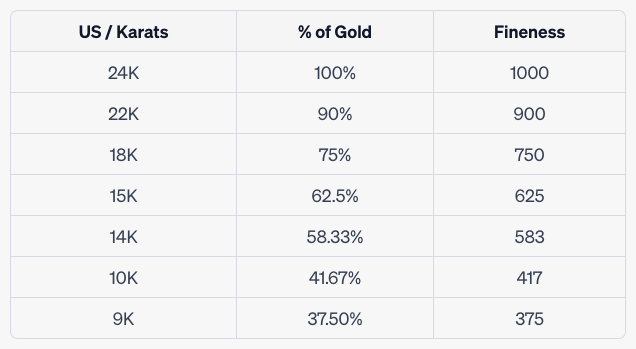

The 585 gold is labeled as 14 karats and it means that it’s 58.5% pure gold, so it’s got some real value.

When taking it to the pawnshop, the whole process is easy as pie. They’ll weigh it, check out its karat purity, and then crunch some numbers to figure out how much moolah they can offer you.

The biggest question is: Will they even be down for 585 gold?

Absolutely.

Pawnshops are all about gold, no matter the karat. Why?

Because this precious metal is a big deal everywhere. And 585 or 14k gold? Totally valuable.

Once they’ve checked out your gold, the pawnshop people will then work out its value.

But keep in mind, they’re not gonna hand over cash equal to its full market value.

They’re going to give you a bit less–that’s the loan-to-value (LTV) ratio thing, which is like their safety net.

The good news is that a bit higher karat gold, like yours, usually gets you a better deal.

So, before you shake hands, don’t forget to check out their interest rates and how they want you to pay back.

Every pawnshop has its own rules, so shop around and pick the one that works with your risks.

The 5 Factors for Pawnshop to Accept Your 585 Gold

The truth is:

Even though 585 gold is pawnable, not all pawnshops accept it right off the bat.

Some factors influence their acceptance, so be sure to familiarize yourself with them before you head down to the nearest store.

After all, you want to get the best deal out of your yellow metal.

Let’s dive into the nitty-gritty.

Karat Purity

Okay, so first up – karats.

Imagine gold karats as the “street cred” of the gold world. The higher the karat, the more legit it is.

As it we already mentioned earlier, your 585 gold is 14-karat, which is basically 58.5% pure. Pawnshops are totally into that because it means more value for them.

If you were to pawn the 375 gold, for example, then you’d get less, because it’s less pure.

Market Demand

Think of this as a “how cool is my gold right now?” factor.

Just like those retro sneakers, some gold types are just more in vogue. Luckily for you, 585 gold is like the classic white tee of the jewelry world – always in style.

Durability

Let’s get real. No one wants stuff that breaks or wears out easily, right?

Your 585 gold has this cool mix of other metals like copper and silver, which makes it tough! They dig that because durable stuff holds its value.

Pawnshop’s Own Rules

You know how every coffee shop has its own unique vibe and rules? Well, these shops are the same.

While most of them are fans of 585 gold because of its solid rep, each shop might have its own quirks.

Gold Market

Last but not least, the gold market can be moody, like that one friend who’s always unpredictable.

Pawnshops always have one eye on these market mood swings, so they know how much to offer for your gold.

Pros and Cons of Pawning 585 Gold

Before you decide to pawn your 585 gold, you need to know whether it would be a good idea to do so (or not!).

Here are its advantages and disadvantages:

Advantages:

- Speedy Cash

Need some quick cash? Pawning that gold is like a fast-track ticket. No long queues, tedious paperwork, or snoopy credit checks.

- You Still Own It

Think of pawning like letting a friend borrow your favorite jacket. You’re lending it out for a bit, but with the intention to get it back. Pay up the loan with its little extras (interest and fees), and your gold is right back with you.

- Credit Score Stays Cool

Forget those scary credit scores! Pawning’s chill. Whether your score’s a rockstar or a bit of a fixer-upper, pawning doesn’t mess with it.

Disadvantages:

- Not the Full Wallet

Let’s face it – pawnshops won’t shower you with money.

They’ll give you some cash, sure, but it’s just a fraction of what your gold’s really worth in the market.

- The Extra Costs

Like that surprise service charge on your brunch bill, there’s interest and fees on your loan. Always good to know the tab before diving in.

- Risk of Saying Goodbye

This one’s a bummer. If for some reason you can’t pay back the loan, you might have to part ways with your gold. Forever.

This being said, just like with everything else, it’s all about what works best for you.

Consider your needs, stay informed, and you’ll make the best call.

Loan Amount and Terms for 585 Gold

As mentioned, when pawning 525 gold, you don’t really get the full amount of what it’s worth.

On top of that, there are associated terms with the transactions.

So, before diving in head first, you need to know these details to make your decision work for you instead of the other way around.

Here’s what you can anticipate when you take this plunge.

Loan Amount

Pawnshops typically give you a percentage of what your gold’s worth in the marketplace. Think of it like trading in a used car – you won’t get the full original price.

For your 14-karat gold, most shops would typically hand over around 50% to 75% of its current value.

Not too shabby!

Interest Rates

Now, imagine ordering a pizza and then having some extra toppings you didn’t account for. That’s the interest.

Pawnshops sprinkle a bit of this on your loan. The amount varies, and local laws usually keep it in check.

Always a good move to ask about repayment terms and interests upfront – nobody likes unexpected toppings!

Repayment Terms

Pawnshops will hand you cash, but they’ve got a timeline for you to pay it back.

This is where the grace period comes into play. It’s like a short break where you can gather your funds.

Don’t worry much if you missed the deadline, you might be able to extend it.

But keep in mind, that’ll cost you a bit more.

Alternatives to Pawning 585 Gold

Before you head to the nearest pawnshop, let’s talk about some other options you might not have considered. This will allow you to make an informed decision on your current situation.

Selling Your Gold

Ever thought about just selling your 585 gold? Yes, just let it go. Find a good jeweler or a gold buyer, and you could get a nice chunk of change based on its current worth.

Jewelry Loans

Imagine getting a loan specifically tailored for your shiny 585 gold.

Some financial institutions offer jewelry loans, and you might snag a better deal than at the pawnshop. Higher loan amounts and sweeter interest rates? Sounds tempting!

Investing in Gold

Not in a hurry? Consider playing the waiting game. Gold can appreciate over time. So, your 585 gold might just be your golden ticket to bigger gains in the future.

Personal Loans

Banks or credit unions can be your pals here. If your credit game is strong, a personal loan might offer you more bucks and a smoother ride in terms of repayment.

Credit Cards or Lines of Credit

Got a credit card? Or maybe a line of credit?

It could be your go-to for immediate cash needs. Just remember: those interest rates can be sneaky high.

All in all, before you take the leap, mull over these alternatives. Whatever you decide, make sure it vibes with both your current needs and plans.

Is 585 Gold Pawnable? (The Verdict)

Look:

While you have other options like selling it outright or looking into jewelry loans, if you want to pawn your 585 gold, then you absolutely can.

The good news is that pawnshops generally dig the 14-karat stuff. So you’re in good hands there.

And the cool part?

You could walk out with cash in hand, no pesky credit check needed. Just remember they’ll be eyeballing your gold, checking its weight and purity, to decide how much dough they’ll hand over.

But hey, you do need to think about the interest and the terms of repayment, and that little voice reminding you that if you don’t pay back, you might just lose your gold for good.

On the bright side, pawning does come with some nice perks like getting cash on the spot and the chance to get your gold back once you settle the loan.

Whatever path you choose, do your homework and trust your instincts.

After all, it’s your gold, and you want to make the best play possible.