Look:

Gold IRA is a great way to diversify your retirement portfolio, but opening an individual account isn’t an easy process.

You need a great partner to support you in your journey—a reliable precious metals IRA provider.

How can you find one?

And that’s where we come in.

Today, we’re going to pit two companies against each other: Augusta Precious Metals vs. Noble Gold Investments.

Specifically, which of them provides the best service in terms of:

- Years in business

- Gold IRA fees and costs

- Products offered

- Education

- Account assistance and minimum investment

- Customer service

- Buyback programs

- Customer reviews and complaints

Spoiler alert: Augusta Precious Metals is a tough contender and always comes out on top in all our previous face-offs.

So, will Noble Gold have a chance? Let’s find out.

Years in Business

Retirement is no joke, as well as the money you’ll be putting into your IRA.

It’s crucial to understand that the security of your future depends largely on the stability and reliability of the company you choose to invest money in.

With this in mind, let’s see how long these two players have been in the industry to see if you can count on them.

Augusta Precious Metals

Founded in 2012, it first planted its roots in Casper, Wyoming. It has been around for over a decade now and has opened a second office in Beverly Hills, California.

These years serve as a testament to Augusta’s reliability and dedication to its customers.

When it comes to stability, it has weathered the volatile economy during 2020-2022 and came out strong.

Noble Gold Investments

This provider was established in 2016, making them a relatively new player in the industry.

Even though they’re new, the founders of the company have 20 years of experience in dealing with precious metals transactions.

Even though NGI hasn’t been around for too long, they have also come out of pandemic strong, which shows the company has good roots to weather economic downturns.

Winner: Since we’re talking about years in business, Augusta Precious Metals takes the win for this round.

Gold IRA Fees and Costs

When it comes to opening an individual account, there’s more to pay than just the gold itself.

This is a standard in the industry as there are many other layers in the investment itself like setting up the account, storage, and maintenance.

That’s why you need to find a provider that has lesser fees, allowing you to invest more money in your account.

Here are the fees you’ll incur with these companies:

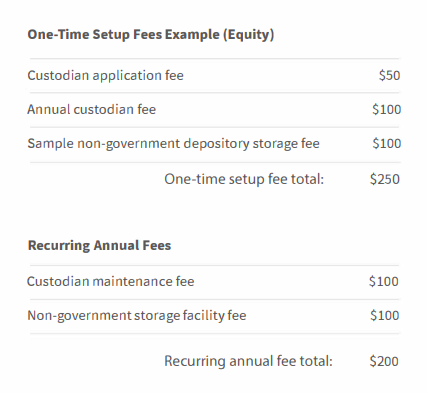

Augusta Precious Metals

With APM, what you see is what you get.

They lay all the fees tied up with opening a gold IRA account right off the bat. This means that you don’t have to worry about any hidden fees sneaking up on you.

Let’s start with the first fees you’ll incur.

When you open an account, you’ll have to pay a one-time $50 setup fee per account.

This payment goes to, as you may have guessed, setting up your account with the custodian, or another company that protects your assets and ensures that IRS rules are followed.

Augusta chose Equity Trust, the Best Overall Self-Directed IRA Custodian of 2023, according to Investopedia.

On top of that, you’ll also be incurring a $100 annual fee for the custodian and a $100 annual storage fee.

For storage, APM’s number one choice is Delaware Depository, with all of its assets under management insured by Lloyds of London.

The best part?

You’ll be paying the same amount, regardless of how much money is in your account.

So, even if you have millions in it, you’re only going to pay $250 for the first year, and $200 for the succeeding years.

It gets even better:

You can get ZERO FEES for up to 10 years, and everyone is qualified for this offer!

Simply call Augusta at 833-989-1952 to waive your Gold IRA fees. They will also throw in a FREE GOLD coin as a bonus when you open a new account.

Noble Gold Investments

If you’re on a budget and trying to cut down on fees, NGI might be the one for you.

They don’t have any setup fees, which is kind of rare in this industry.

They will charge you $80 for the custodian fee. They haven’t explicitly said who’s their preferred trustee, but they have mentioned they have a couple of trusted partners.

You’ll also be charged $150 for storage, and their preferred choice is International Depository Services in Dallas.

One of the highlights of NGI’s pricing structure is that they waive the first-year fees for qualified IRA accounts. This includes storage and custodian fees.

Winner: Both providers are transparent with their fee structure.

However, Augusta Precious Metals offers to waive your fee for 10 years, unlike Noble Gold which will only waive the first year.

Because of this, APM takes this round again.

Products Offered

Apart from gold and silver, some providers also offer different types of precious metals like platinum and palladium.

However, for these metals to qualify for an IRA account, they must follow the IRS’s purity standards, which are as follows:

- Gold 99.5% pure

- Silver 99.9% pure

- Platinum 99.95% pure

- Palladium 99.95% pure

So, for those who would like to explore other options, will you be able to do that with these two companies? Let’s see!

Augusta Precious Metals

Boasts an impressive array of gold and silver, ranging from coins to bars. There are even collector items offered by this company.

On top of that, all products follow the strict purity standard of the IRS, so whichever precious metal you choose, you’ll be able to use it for your account.

When you check out their products on their website, you’ll be able to see their composition and other details you need to know about the precious metal.

You’ll also get to see whether it is available for purchase or not.

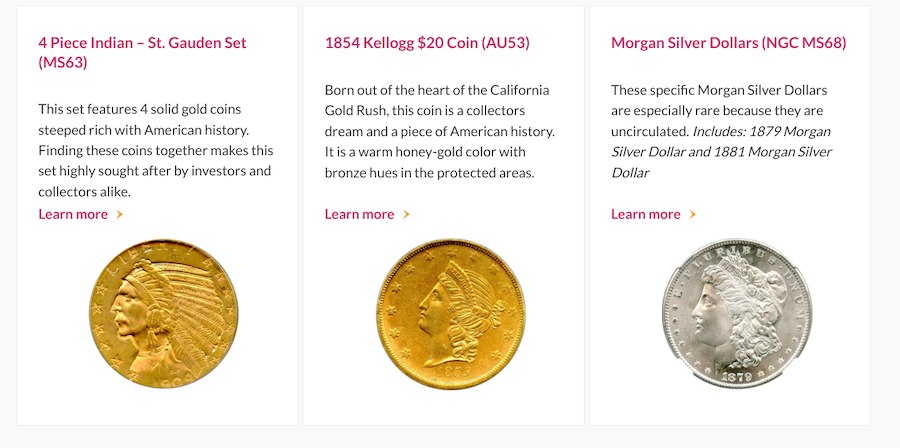

Noble Gold Investments

If you want more options, NGI has got you covered.

Apart from gold and silver, they also offer palladium, platinum, and rare coins.

When you check each product they offer, you’ll see its history, design, and features, plus other important details you need to know about the precious metal.

This allows you to find the appropriate asset for your investment.

However, unlike APM, there’s no way for you to tell whether the product is still in stock or not. You’ll need to contact the company to make sure it’s available.

Winner: This round is a tough match, but because of the extensive range of products, Noble Gold wins.

Education

For any investment to succeed, you need to be able to learn the ins and outs of the asset to make it work for your needs.

That’s why it’s important to find a provider that’s dedicated to providing you with the support of learning the intricacies of investing in gold IRA.

Augusta Precious Metals

When it comes to educating its customers, APM takes it very seriously.

You’ll find an extensive library of videos to market news and articles about precious metals IRA.

It even provides helpful tools like our favorite inflation and retirement calculator as well as a price chart to monitor the value of your metals.

It gets even better.

APM’s education department is headed by a Harvard-trained economist, Devlyn Steele, who has decades of experience dealing with the capital markets.

Therefore, all learning materials you get are vouched by an expert in the industry. Isn’t that great?

Well, we’re not yet done.

Apart from their resource center, you can also request a FREE Gold IRA guide to get you started.

If it’s not enough, you can also schedule a conference call with experts on their website—stellar service, indeed.

Noble Gold Investments

While NGI hasn’t stepped up their game when it comes to providing learning materials, they offer a couple of articles that will enlighten you about this type of investment.

From their website, you can access articles about precious metals, investment basics, and gold IRAs. You can also grab their free guide here.

NGI website also has a news page where you can check the latest financial news.

Although they do have a YouTube channel where they publish quite regularly.

Other than that, there’s really nothing much else there in the education department.

Winner: Augusta wins this round by a mile.

With an extensive video library, learning resources, and tools, you can easily learn how to navigate the precious metals industry.

IRA Account Assistance

One thing that really separates a top dog provider from just an average one is how they treat their customers throughout the process of opening a gold IRA.

We’re talking about more than just the service here, it’s about holding your hand every step of the way.

So, how do these two perform in this aspect?

And what is their minimum contribution amount?

Augusta Precious Metals

Did you know that APM has been voted the Best Overall Gold IRA Company for 2022 and 2023?

Yep, you read that right. That’s 2 years in a row. But let’s just not look at their awards, let’s look at their process.

From the onset, you’ll be receiving special treatment from Augusta. They have a dedicated team that makes opening and funding your account easy as pie.

On top of that, everything is transparent. No surprises along the way.

When it comes to the custodian, Augusta chose a major player in the industry, Equity Trust, and they do 95% of the paperwork with you.

Simply submit your request online or contact them directly at 833-989-1952 to get started.

During the process, you’ll be in the driver’s seat the whole time, meaning you are in control of your money and investment decisions.

You’ll get to choose what metals you want to include in your account. Basically, Augusta will act as your liaison and support you from opening to funding your account.

If you have any questions, a dedicated account manager will answer your questions and make sure that whatever metals you choose are eligible for your IRA.

Although this firm is top-notch when it comes to customer assistance, you need to have at least a $50,000 contribution to open an account with them.

Pretty high compared to other providers, but that’s also the reason why you get to enjoy the top level experience you deserve.

Noble Gold Investments

Before you open an account, NGI suggests you to download their guide to help you get started with your journey.

Once you have read through it, you’re free to consult with one of their team members to answer any of your questions.

If you don’t have any, you can continue with opening the account. You can start the process by signing up on their website, or you can go ahead and contact their hotline to speed up the process.

Like APM, you’re also free to choose which metals you’d like to add to your account.

Now…

What is the minimum investment for Noble Gold?

You can open an account for as low as $20,000. The same goes for cash purchases outside of an IRA. This makes it easy for small-time investors to diversify with gold and silver too.

Winner: Both offer great service when it comes to opening a precious metals retirement account. However, they’re targeted toward different types of investors. So, this round is a tie.

Customer Service

We know how frustrating it is to deal with slow and unreliable customer support.

That’s why we check how gold IRA providers handle customer queries. Here’s how APM and NG handle theirs.

Augusta Precious Metals

This firm offers three channels:

- live chat,

- contact form,

- hotline.

If you need an answer fast, you can visit their website and use the chat option.

If it’s not immediate, you can use the contact form on their website and wait for a representative to call or email you.

Lastly, if you want to talk to someone, you can call their customer service available from 6 am – 5 pm PST, Monday through Friday.

As a new customer, you also get a chance to go on a one-on-one web conference call where your questions will be answered without any pressure to buy.

Of course, APM goes beyond that.

After your purchase, they offer excellent customer support for the life of your account, which is rare in this industry.

Noble Gold Investments

Unlike Augusta, NGI only offers two channels: phone and email.

The firm has two different hotlines: one for investment advice and the other for general concerns.

Unfortunately, they haven’t provided any schedule for their phone support, so it’s best to assume that they can accommodate you on weekdays.

For emails, you can reach them any time of the day.

You can also check out an FAQ page. While it’s not comprehensive, you’ll be able to find value in them.

Winner: I think it’s pretty obvious who wins this round — Augusta Precious Metals.

Buyback Programs

What if you decide not to hold your gold anymore? How are you going to sell it?

Well, don’t fret. That’s where buyback programs come in.

But do these providers offer them?

Augusta Precious Metals

Does have a buyback program.

While there are no guarantees that they will take your metals, they don’t usually turn down their customers. And if they buy, you’ll get a fair and competitive price.

Noble Gold

Like Augusta, the firm offers a buyback program but there’s also no guarantee.

Winner: It’s a tie.

Customer Reviews and Complaints

So…

- Is Noble Gold a good investment?

- Are there any Augusta Precious Metals complaints?

There’s truly nothing more reliable than the feedback from real, verified customers of these firms.

Let’s see what they say.

Augusta Precious Metals Ratings

Has a 4.93 out of 5 stars rating based on 121 reviews on Better Business Bureau.

They also have an A+ rating and have been accredited for 11 years.

The most impressive? No complaints at all! That’s for all the years the business has been active in BBB.

On Business Consumer Alliance, APM has a perfect 5-star rating based on 97 reviews. There are also no complaints on the website.

TrustLink also shows a 5-star rating based on 285 reviews.

Overall, the company is in great standing given the years they have been in the business. This shows how much they value their customers.

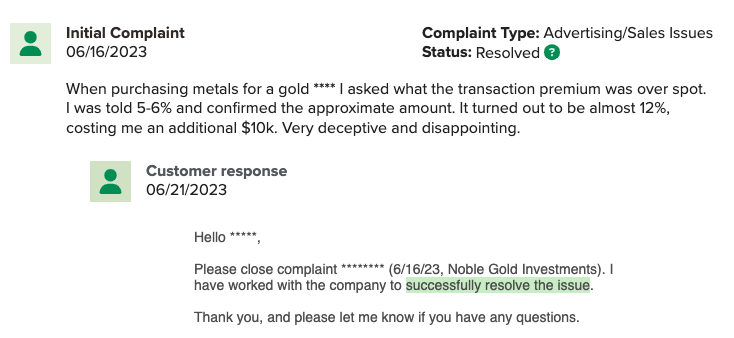

Noble Gold Investments

Boasts a 4.98 out of 5 stars rating based on 84 customer reviews on BBB.

However, they have closed a total of 4 complaints in the last 3 years and 2 complaints in the last 12 months.

One of the more recent complaints states the gold they have purchased is overpriced. Noble Gold was able to address this concern in 4 days and get it resolved.

They’re also on BCA, with a rating of 5 stars based on 4 reviews.

On TrustLink, they also have a perfect 5-star rating based on 123 reviews.

Winner: Since Augusta Precious Metals has no complaints in the past few years, it clearly wins this round.

Which Gold IRA Company Is Best?

We’re at the end of the Augusta Precious Metals vs Noble Gold Investments match, and we’re pretty sure you already know who wins.

But before we announce the winner, let’s do a quick recap.

Both offer IRA account assistance and a buyback program.

However, Noble Gold offers more products and has a lower minimum order size.

Augusta, on the other hand, has been industry longer and offers an extensive range of learning resources. When it comes to their customer support, they have set the bar too high.

The winner?

Without a doubt, it’s Augusta Precious Metals.

I mean, customers just rave about their services. You can tell from all the Augusta Precious Metals reviews and ratings on various third-party sites.

They’re still unbeatable, which is why they’re our #1 recommended gold IRA company.

Call them at 833-989-1952 or grab your FREE guide here.

Now, we’d like to hear your thoughts:

- What are your experiences with these providers?

- Which one do you prefer more: Augusta or Noble Gold?

Let us know in the comments section!