Let’s be real:

Investing in a Gold IRA can be an attractive option for many. It’s like hitting two birds with one stone—you’re not only investing for your retirement but also acquiring a historically valuable asset.

However, the initial investment barrier can be a hurdle.

(For example, Goldco and Augusta Precious Metals are our top recommended Gold IRA companies, but they have a minimum of $25,000 and $50,000 respectively which not everyone can afford.)

For those interested but needing more funds, choosing the right precious metals IRA provider can be challenging.

And we’re here to help.

Today, we’ll be reviewing Birch Gold Group, one of the leading precious metals companies that offers a low minimum deposit amount.

But are their services worth it?

We’ll find that out in this Birch Gold review 2026, along with the following information:

- Company background

- Birch Gold Group fees and costs

- Products offered

- Customer reviews

- Lots more

Without further ado, let’s get started.

Is Birch Gold Group Legit?

Before we dive deep into the services and products offered by BGG, let’s peek behind the curtains and check the background of this company.

Upon visiting their website, you will immediately find various exclusive interviews with popular personalities discussing gold IRAs.

For someone who’s looking for a provider to trust, seeing this can be quite comforting.

But, of course, those are just interviews.

When researching a precious metal provider, it’s best to go beyond deeper than just that.

So, going deeper into their site, you’ll see that that company has been around since 2003 and is currently based in Iowa. They have also served over 28,000 customers over the span of 20 years.

But that’s not all.

On their website, you’ll find endorsements from notable figures such as:

- Ben Shapiro, host of the Ben Shapiro Show and Editor-in-Chief of The Daily Wire,

- Ron Paul, a medical doctor, U.S. Air Force veteran, former Congressman, author, and educator,

- Candace Owens, a conservative author, an activist, and a host of her rapidly-growing political talk show.

On top of that, there are a bunch of other celebrities and personalities, like Dr. Ben Carson and Larry Elder, among others, who also recommend Birch Gold Group.

But does this confirm the company’s legitimacy?

Not necessarily.

However, these endorsements do contribute to building a foundation of trust with potential customers like you.

So, let’s dig even deeper.

BGG is listed on Crunchbase, with information largely mirroring that on their website.

We noticed a discrepancy: their address is listed as Burbank, California, on Crunchbase, while their website shows Des Moines, Iowa. This could seem odd, but it might simply be a minor oversight.

We also reviewed their LinkedIn account and found that it aligns with the information on their site, including a consistent address.

Lastly, we reviewed their profile on the Bullion Directory and found that the details provided there match those on their website.

This being said, is Birch Gold Group legit?

Yes, we think that Birch Gold Group is indeed a legitimate company that has been operating for 20 years.

Apart from the minor discrepancy we found on Crunchbase, all the information we found aligns with what the provider offers on their site.

As usual, we recommend you do your research as well before transacting with any Gold IRA companies.

One of the best ways to do so is to request a free information kit from Birch Gold to get first-hand knowledge of what they offer.

Birch Gold Group Fees and Minimum Investment Amount

Now that we’ve established the legitimacy of BGG, let’s take a closer look at Birch Gold fees and what you can expect when opening a precious metals IRA with them.

Generally speaking, opening a precious metals IRA comes with a lot of fees.

For new investors, these extra costs can seem intimidating, especially if you don’t have a lot of money to start with.

But don’t worry, these extra fees aren’t just there for no reason.

They cover other services that are required to keep your retirement account running. Here are them:

- Account setup fee

As its name implies, this fee is associated with setting up your retirement account. BGG charges a $50 one-time payment for your account setup.

- Wire transfer fee

This refers to the cost of sending money between banks and is usually associated with opening an account. At BGG, you’ll be charged a $30 one-time fee for a wire transfer.

- Storage fee

For a precious metal to be qualified for a retirement account, it must be stored in a state-approved depository, which, of course, will cost you money.

With BGG’s chosen depository, the annual fee is $100, though this may vary if you opt for a different storage location.

Update: Birch sent an email to us with an update that as of January 1st of 2026, Equity Trust Company is changing their annual management fee to $125. So keep these changes in mind.

- Maintenance fee

This fee covers the various services required to maintain your retirement account. With BGG, an annual fee of $125 is applicable.

What stands out most about BGG is their fixed annual fee policy, regardless of the investment amount.

This approach is particularly advantageous, especially since many providers charge fees as a percentage of your assets.

On top of that, Birch Gold Group is transparent with its fees, ensuring there are no hidden charges allowing you to budget your investment effectively.

And, of course, this provider has a low minimum required deposit.

For only $10,000, you can open your gold IRA. The same amount applies to cash transfers if you prefer physical gold delivery.

You might want to take advantage of their ongoing promotions, such as:

- First year fees waived on IRAs over $50,000

- Free shipping for cash purchases over $10,000

- Up to $10,000 in free precious metals on qualified purchases

(Please always confirm with their team on what the current promos are.)

All in all:

Birch Gold Group is ideal for those who want to explore the precious metals industry without the need to commit a large sum of money upfront.

Start by grabbing their FREE information kit here.

Products Offered

Now that you know how much money you’ll need to open to work with Birch Gold, we’re going to look at your precious metal options.

So, what products can you expect from this provider?

Well, a lot!

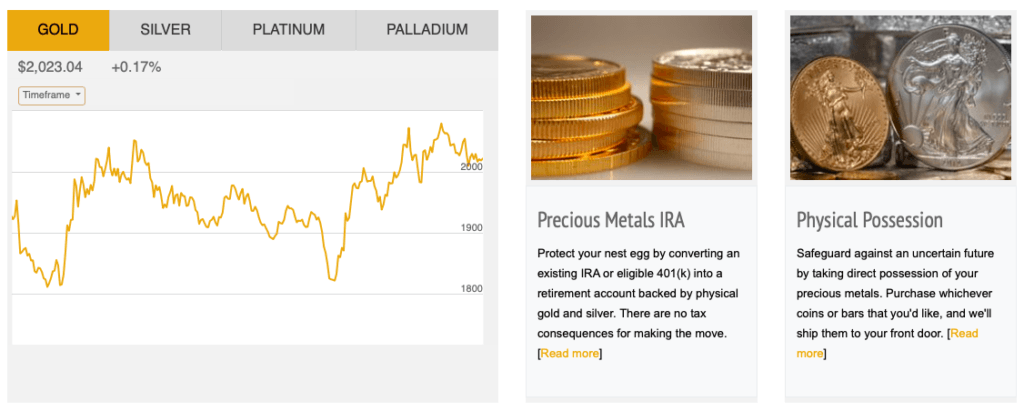

From gold to silver and palladium to platinum, Birch offers a wide range of precious metals to choose from.

These metals are available in various forms, such as coins and bars, which ensures that you can find one that suits your investment goals.

Whether you want to hold an American gold coin or a Canadian silver leaf coin, you’ll find it here.

The best part?

All products offered by this provider adhere to the stringent IRA purity standards, meaning these metals are among the purest available in the market.

On top of that, each product page on their website provides in-depth information to assist you in selecting the right precious metal for your account.

This includes detailed histories and specifications, ensuring you’re well-informed about your choices.

If you’re interested in buying any of their metals outside of your retirement account, you can also do so too.

In this case, you don’t need to look for products that adhere to the IRA purity standards. You can simply choose whatever metals speak to you.

The process is simple: choose your metal and pay for the asset. Once your purchase is confirmed, it will be securely shipped to the address you provided.

If you don’t want to store it at home, there’s no problem. You can choose from any precious metals storage provider nationwide, even those that are not accredited by the IRA.

Just one thing to note: you need to report sales of physical precious metals on your taxes at the end of the year.

Opening A Precious Metal IRA

How to open a Gold IRA account with Birch Gold Group?

Let us walk you through it:

Step 1: Pick your funding source

When it comes to starting an account with Birch, the first thing you need to consider is how you will fund it.

Whether by making a cash purchase or rolling over your funds from a 401(k) into a new self-directed Gold IRA to purchase your metal.

You can also transfer eligible retirement accounts to your Precious Metals IRA without penalties, fully or partially, based on your preference.

Eligible accounts for rollover include Traditional, Roth, SEP, SIMPLE IRAs, and eligible 401(k), 403(b), 457, and other plans.

Remember, Birch Gold Group requires a minimum of $10,00 to start a new IRA, so make sure you can fund your new account with this much money.

If you’re confused about which source to choose, BGG will provide you with access to a Precious Metals Specialist who will be with you every step of the way.

Step 2: Choose your precious metals

If you haven’t set your eyes yet on what metal to hold, this is the time to go shopping around.

With a wide variety of metals and forms available, making a choice can be overwhelming for new investors.

Fortunately, when you open an account with BGG, you don’t have to navigate this decision alone.

As mentioned, a dedicated Precious Metals Specialist will assist you, offering tailored information and answering questions based on your situation and goals.

They will guide you through your choices, making sure they meet IRS criteria, and discuss the details with you.

We also recommend consulting with your financial advisor before making any decisions.

Step 3: Purchase your bars or coins

Once you’ve decided what you want to add to your portfolio, it’s now time to make a purchase.

At BGG, your Specialist will walk you through the necessary paperwork.

Once successful, your chosen metal will be sent to your chosen depository (we’ll get more into that in the next step).

This is also the part where the custodian, or the one responsible for holding the physical precious metals in a secure storage facility.

A custodian is a financial institution that manages your assets, from completing transactions to executing withdrawals and handling paperwork.

They basically ensure that your investments are where they should be.

Step 4: Select your storage

Even though you can’t hold your metals at home, you still have control over where to store it.

At Birch, you have numerous options to choose from, including Delaware Depository and Brink’s Global service.

Delaware Depository shines with its experience in the precious metals industry, 200 years of combined experience, to be exact.

They also have an expansive insurance policy, which we think is an important thing to consider when selecting your storage.

Apart from the all-inclusive $1 billion coverage of assets under their management, the company also boasts a $100,000 transit insurance per package, which means that your metals will be insured while in transit.

They also have two facilities to choose from: Wilmington, Delaware, and Boulder City, Nevada.

Another option is Brink’s Global Service, which is the largest non-bank, non-government holder of precious metals in the world.

This facility is very popular among institutions like banks, jewelers, and even the government.

Their facilities are located in different states: New York City, New York, Los Angeles, California, and Salt Lake City, Utah.

Texas Precious Metals Depository is also another choice.

Located in Shiner, Texas, it offers fully segregated, sealed, annually audited, and 100% insured storage of your physical precious metals.

They also offer world-class service at a low rate, which is why it has become one of the favorite depositories of BGG customers.

Step 5: Monitor your assets

A precious metals IRA is a long-term investment.

Even though you’re not directly managing your assets, it’s still best to be updated with it. This will also give you peace of mind.

At BGG, your dedicated Specialist will be able to provide you with an up-to-date buy-back quote when you need it.

This isn’t just any statement; it’s detailed and accurate, allowing you to make an informed decision.

Educational Resources

Gold IRA is a pretty complex process, and understandably, some may need help understanding its benefits and downsides.

That’s why it is important to choose a provider that offers educational resources to their customers.

It demonstrates their commitment to ensuring that you, as an investor, fully understand the nature of your investment.

Birch offers a wide range of educational resources perfect for new investors.

They have guides that answer pretty much every question a beginner might have, which includes fees, storage options, benefits, and much more.

On top of that, you’ll get access to a real-time price chart, allowing you to monitor the prices of your assets.

BGG also features interviews with their endorsers, offering insights into gold IRA management and its advantages.

And as we mentioned before, Birch offers a free information kit that explains the benefits of diversifying with precious metals.

Birch Gold Group’s Buy-Back Policy

If you’re seeking a safety net for your precious metals investment, choosing a provider that offers a buyback policy is a wise decision.

BGG provides such a policy, enabling you to sell your metals back to them whenever you decide not to hold them anymore.

Importantly, this policy is integrated into the final step of opening an account with BGG, where you’ll receive periodic updates on the current prices and status of your assets.

One aspect we’ve observed is the limited information BGG provides about their buyback policy, only noting that it’s included in their account opening process.

However, we don’t consider this a major concern. BGG emphasizes that this policy is part of their ongoing service to customers, indicating their dedication to client satisfaction.

Customer Service

When selecting a gold IRA provider, it’s crucial to consider not only the quality and services offered but also their commitment to exceptional customer service.

So, how do you check for good customer service?

Look for accessibility. It’s essential to have a provider you can easily reach, particularly for urgent matters.

Birch can be reached via three different channels: email, phone, and in-person visits.

If you don’t have any urgent matter, emailing them at info@birchgold.com is a great way to get a hold of their support.

You can also submit a form on their site if that’s more convenient for you.

For those who want their concerns addressed right away, you can call them or visit their office at 309 Court Avenue, Suite 809, Des Moines, IA 50309.

Do note that they’re only open from Monday to Friday, 8 am to 7:30 pm Central Time.

Additionally, ongoing support post-service is crucial, considering a precious metals IRA is a long-term financial commitment.

Essentially, you need a provider that’s committed to being there for you over the long haul.

Birch Gold provides that with their dedicated Specialist who will be with you every step of your gold IRA journey. No questions left unanswered.

Birch Gold Group Reviews And Ratings

Now…

- Are there any Birch Gold Group complaints?

- How do they value their customers?

- Is Birch Gold a reputable company?

Let’s turn our attention to real and verified customer experiences, the Birch Gold IRA reviews.

On Better Business Bureau (BBB), Birch is currently rated 4.55 out of 5 stars, based on 142 reviews.

It also has received three complaints in the last 12 months and only seven complaints in the last three years. That’s quite a low amount of complaints for such a time frame.

Interestingly, though the company has been in business since 2003, they were only accredited by BBB in 2013.

But that’s not all.

Over nearly a decade on this platform, they’ve accumulated just 143 reviews, suggesting either a low volume of feedback or less inclination among their customers to leave reviews.

Despite this, BGG maintains an A+ rating from BBB.

But let’s not limit ourselves to this platform.

Moving beyond BBB, Birch is also a member of the Business Consumer Alliance (BCA), holding an AAA rating and a 5-star score based on seven customer reviews.

They joined BCA in 2011, again showing a pattern of fewer customer reviews than might be expected for their time in the industry.

Birch is also rated 4.5 out of 5 stars on Trustpilot, based on 154 total reviews.

Even though the small number of reviews has made us raise our eyebrows, we still find their rating pretty good. On top of that, they address complaints quickly, which is a positive indicator of their customer service quality.

It does help knowing that highly respectable figures endorse Birch, which builds trust and makes us believe in its legitimacy.

Birch Gold Group Pros and Cons

Reasons to invest:

- Transparent with fees

- Control over your metal’s storage and custodian

- Low minimum deposit of $10,000

- Dedicated Precious Metals Specialist

- Flat-rate charge structure

- FREE gold IRA information kit

- Good customer service

- Wide range of precious metals to choose from (gold, silver, palladium, and platinum), that are IRS-approved

Reasons to avoid:

- Few customer reviews on third-party platforms

- Flat fee structure may not be beneficial for small investors

We can’t really find a lot of cons for this gold IRA company.

The only drawback is that there aren’t many reviews on Birch Gold Group across various third-party platforms.

But given its glowing reviews and prompt response to complaints, we can safely assume that its customers weren’t too keen on leaving them reviews.

Birch vs. Other Gold IRA Companies

Birch Gold Group vs. Augusta Precious Metals

These two leading gold IRA companies cater to distinct customer bases.

Augusta Precious Metals is an excellent choice for investors high net worth individuals with a $50,000 minimum deposit requirement, while Birch is more suited for those just beginning their investment journey.

Although we often recommend Augusta, we recognize Birch Gold Group as one of the top affordable options in the industry, known for its high-quality products and services.

Birch Gold Group vs. American Hartford Gold

Both of these gold IRA providers have a low barrier entry of $10,000, making them perfect for smaller investors.

They also offer high-quality metals and services.

While American Hartford Gold is a decent choice, Birch has been in the industry since 2003, giving them the leverage of experience.

Birch Gold Group vs. Goldco

Like Augusta, Goldco is targeted at those who can afford to start their investment with more money.

It’s also one of our top recommended gold IRA companies for their excellent customer support, great reputation, and free silver rebate.

However, if you can’t afford the minimum deposit of $25,000, Birch Gold Group is definitely an option to consider.

Birch Gold Review 2026: Is It Worth It?

Look:

Following our thorough background check and review of Birch Gold Group, we can affirm their reliability as a precious metals IRA company.

Their years of experience in the industry, combined with the range of endorsers they’ve garnered, attest to the high quality of their service and products.

They are also very transparent with their fees, which is an indicator of the integrity they possess as an organization.

On top of that, they offer:

- a wide range of precious metals

- education resources

- a dedicated Precious Metals Specialist

Not to mention that their accessible minimum deposit of just $10,000 is especially appealing.

So, if you’re interested in opening your account, then start by requesting your free information kit today!

Now, over to you:

- Have you worked with this business before?

- Do you agree with our Birch Gold Group review and their legitimacy, or do you have a different opinion/experience?

Let us know in the comment section below!