Let’s face it:

Despite silver often being referred to as the “poor man’s gold”, it has held a special place in human civilization throughout history. From jewelry to coins, it’s been a showstopper.

(In some cultures, silver was even more prized than gold!)

But you may wonder:

- Is silver a good investment for the future?

- Can silver ever be worthless?

- How long until silver runs out?

Today, we’ll discuss the factors that affect this precious metal’s value and potential threats to it, as well as its future prospects.

Without further ado, let’s get started.

Factors Affecting Silver Value

We all know that there is a battle between gold and silver, where gold gets all the glory, but silver is also highly valuable.

Historically, people have been all over it, using it for money, jewelry, and even armor.

And today, it’s everywhere! From your smartphone to those solar panels you’ve been eyeing, silver’s got a starring role.

But what factors affect the value of this precious metal? Let us break it down.

Supply and Demand Dynamics

Here’s the lowdown:

Silver’s value depends on how much everyone wants it (demand) and how much of it there is to go around (supply).

- Demand Side:

Electronics love silver. Those gadgets you’re glued to? They’ve got silver inside. Renewable energy is also hopping on the silver train, especially with solar panels.

- Supply Side:

This is all about mining. Sometimes we dig up a lot; sometimes, not so much. Plus, recycling old products can also bring more silver back into the game.

Economic Factors Influencing Silver Prices

When the global economy gets a little wobbly, people see silver as a safe bet. But when things are all rainbows and unicorns in the economy, silver might not get as much attention.

Here’s a fun tidbit:

The U.S. dollar and silver? They’ve got this drama-filled relationship.

When the dollar is feeling strong and buff, silver prices might slump a bit. But when the dollar’s having a bad day? Silver’s out here shining even brighter.

The Impact of Government Policies and Regulations

Now…

What’s the government got to do with silver value?

Quite a bit, actually. Governments can make decisions that either make it easier or tougher for silver mining.

They also have a say in trade policies, which can affect how silver moves around the globe.

Technology

Well, a lot of the latest gadgets that we love relies on silver.

But if some genius out there finds a cheaper or better material, silver might get a bit less screen time in the tech world.

Potential Threats to Silver’s Value

Look:

Even though silver has been historically valuable, there are threats to its glamor. Let’s unpack those.

Technological Advancements Reducing Demand for Silver

We all know that tech is always changing.

And sometimes, it evolves in ways that could make silver less of a go-to metal.

For example:

If tech gurus manage to upgrade our gadgets without needing silver or if they stumble upon a cheaper alternative, silver might not be the star player in our electronics anymore.

And those shiny solar panels catching the sun? If they start using less silver, it could be a game-changer for the metal’s demand.

Shifting Economic Landscapes Affecting Silver’s Industrial Use

The world’s economy can be a bit of a roller coaster sometimes.

If big manufacturing spots decide to up and move to areas where making stuff is cheaper or if the world goes gaga for tech like 3D printing, it might shake up how much silver we need in industry.

And, if there’s an economic slump and factories slow down, especially in the electronics realm, silver might feel the pinch.

Substitutes and Alternatives

In the vast universe of materials, there’s always the possibility of some new kid on the block trying to replace our trusty silver.

If industries find something that does the job as well as silver but costs less, our shiny friend might have some competition.

In a nutshell, while silver has been sparkling for ages, there are a few things on the horizon that could challenge its VIP status.

But hey, silver’s been around for millennia, and it’s got a knack for sticking around. So, we’ll just have to wait and see how it rolls with the punches.

Arguments Against Silver Becoming Worthless

Okay, so we’ve heard the whispers about how silver will lose its value.

So, will silver ever be worthless?

Let’s balance the scale and dive into the reasons it is probably not heading to the bargain bin anytime soon.

Persistent Demand for Silver Across Industries

For starters, there’s a reason everyone loves this precious metal, and it’s not just about bling.

The truth is:

Silver’s got some incredible qualities that make it special in a bunch of industries. Its rockstar status as an amazing conductor and its knack for killing bacteria makes it a top choice for loads of applications.

Whether it’s in those wound care products you pick up at the pharmacy or in fancy tech gadgets, silver’s a hard act to follow.

Limited Supply and Mining Challenges

Mining silver isn’t exactly a walk in the park.

We’re talking about old mines, rising costs, and the whole drama of finding new silver hotspots.

Plus, with Mother Earth getting extra attention (and rightly so!), there are more eco-regulations around mining.

All of this makes silver a bit of a tease, not showing up as often as we’d like. And when something’s in short supply, it usually means that it’ll keep its value.

All in all, with mines not churning out endless supplies, scarcity could play its part in keeping silver prices on the up and up.

Historical Resilience of Silver as a Store of Value

If there’s one thing we’ve seen, it’s that silver’s been the real MVP, holding onto its value through thick and thin.

Even when economies go up and down, this precious metal, just like gold, always has been a go-to for people looking for a safe bet.

Future Prospects of Silver Value

Now…

When it comes to silver, it’s a blend of tea leaves, expert predictions, and a whole lot of unknowns.

But, just for fun, let’s dive into some of the chatter about where silver might be headed.

Expert Opinions and Market Projections

First, let’s talk about the experts who follow this stuff for a living.

Market experts and analysts are always giving their two cents about where silver’s price is headed.

Some days, they’re all “silver is the next big thing!” and other times, they’re a tad more cautious.

Always keep an ear out for these forecasts. They’ve got data, trends, and insights that can offer some solid clues.

Potential Scenarios for Silver’s Value in the Future

Now, we’re not fortune tellers, but there are a few ways this could play out.

On one hand, with the world being such an economic rollercoaster, silver might just keep its rep as the stable buddy we all turn to when things get wild.

But then, technology and industries are ever-changing. What if they decide to play the field and see other metals? Only time will tell.

Factors That Could Boost Silver’s Value

Looking ahead, there’s a bunch of stuff that might just give silver its moment in the limelight. Think about the rise of green tech and renewable energy.

Solar panels? They’ve got a crush on silver.

And let’s not even start on the growing love for gadgets and electronics. All of these could be big tickets for silver’s demand.

Also, don’t forget about those wildcard factors. A surprise turn of events on the global stage or a sudden shift in how folks invest could send silver’s value sky-high.

Will Silver Ever Be Worthless? (Verdict)

So…

- Is buying physical silver a good investment?

- Will it ever lose its value?

With technology ever-changing and industries shifting gears, it’s got some challenges ahead. But let’s not forget – this metal’s been a rockstar for ages.

Those unique silver-y perks it offers? Not easy to replace, hence why it’s so heavily relied on in many industries.

Also, it’s a popular choice for investors for portfolio diversification.

Let’s face it:

History’s shown us that silver knows how to roll with the punches. It’s been through thick and thin and has always found a way to stay relevant.

While the road ahead might have a few bumps, silver’s reputation and its longstanding track record give it a good shot at holding onto its worth.

So, while we don’t have a magic 8-ball to predict the exact future, one thing’s pretty clear: silver’s not going anywhere anytime soon.

Now…

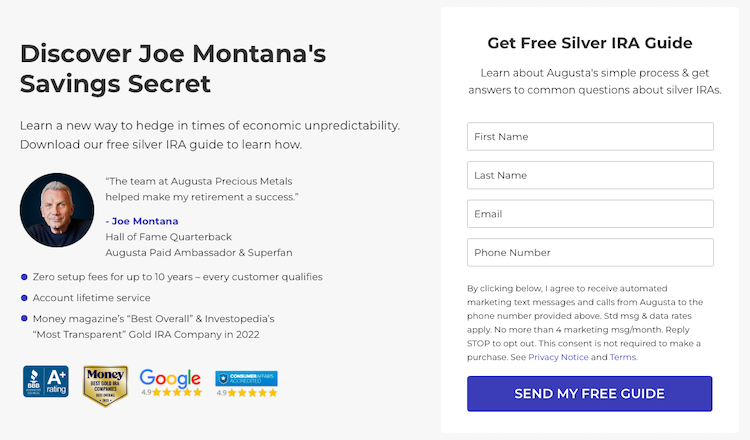

Whether you want to take possession of your physical coins and bars, or looking to buy them in an IRA, check out our #1 recommended Gold IRA company in the US, Augusta Precious Metals.

They will educate you on diversifying with gold and silver, will hold your hand through every step of the process, and do 95% of the paperwork with you.

If this is something that interests you, give the Augusta team a call at 833-989-1952 to learn more.

You can also grab your FREE Silver IRA guide here to learn more.

Now, we’d like to hear from YOU:

- What is your prognosis on how long until silver runs out?

- Do you buy physical silver as an investment?

Share your thoughts in the comments below!