Did you know that the price of silver can vary significantly depending on the month of the year? It’s true! When it comes to selling silver and maximizing your profit, timing is everything. Understanding silver market trends and knowing the best time to sell can make a significant difference in the value you receive for your precious metal.

Key Takeaways:

- To maximize your silver sale, it’s crucial to track current market conditions and monitor silver prices.

- Factors influencing silver prices include supply and demand, economic conditions, and market speculation.

- By analyzing current market conditions and considering your personal financial goals, investment horizon, and portfolio allocation, you can make an informed decision about selling your silver.

- Expert opinions and silver market analysis can provide valuable insights into future market trends.

- Maximizing profit from selling silver requires staying informed, evaluating expert opinions, and understanding supply and demand dynamics.

Factors Influencing Silver Prices

When it comes to understanding the price of silver, there are several key factors at play. These factors include supply and demand, economic conditions, and market speculation. Let’s take a closer look at each of these influences and how they impact silver prices.

Supply and Demand

Like any commodity, the price of silver is heavily influenced by the forces of supply and demand. When the demand for silver is high or the supply is limited, the price tends to rise. Conversely, when demand is low or there is an abundance of supply, the price tends to fall. Understanding the current supply and demand dynamics is crucial for predicting silver price movements.

Economic Conditions

Another significant factor that affects silver prices is the overall economic conditions. During times of economic uncertainty or inflation, investors often turn to precious metals like silver as a safe haven. This increased demand can drive the price of silver up. Conversely, during periods of economic stability and growth, the demand for silver may decrease, causing prices to decline.

Market Speculation

The silver market can also be influenced by market speculation and investor sentiment. Speculators use various techniques and strategies to predict price movements and may buy or sell silver based on their expectations. Additionally, investor sentiment, which is influenced by factors such as geopolitical events or macroeconomic trends, can impact market dynamics and cause price fluctuations.

Analyzing current market conditions is essential for understanding silver price trends. This analysis includes monitoring price movements, studying indicators of market sentiment, and staying informed about any relevant news or events that may affect the silver market.

As the table below illustrates, silver prices can be subject to fluctuation based on various influences:

| Factors | Influence on Silver Prices |

|---|---|

| Supply and Demand | High demand or limited supply can drive prices up, while low demand or excess supply can cause prices to decline. |

| Economic Conditions | During economic uncertainty or inflation, the demand for silver as a safe haven can push prices higher. Conversely, stable economic conditions can lead to lower prices. |

| Market Speculation | Speculative buying or selling based on predictions and investor sentiment can influence the price of silver. |

In summary, understanding and analyzing factors such as supply and demand, economic conditions, and market speculation is crucial for predicting silver price trends. By keeping a close eye on these influences, investors can make informed decisions about buying or selling silver to maximize their potential returns.

Analyzing Current Market Conditions

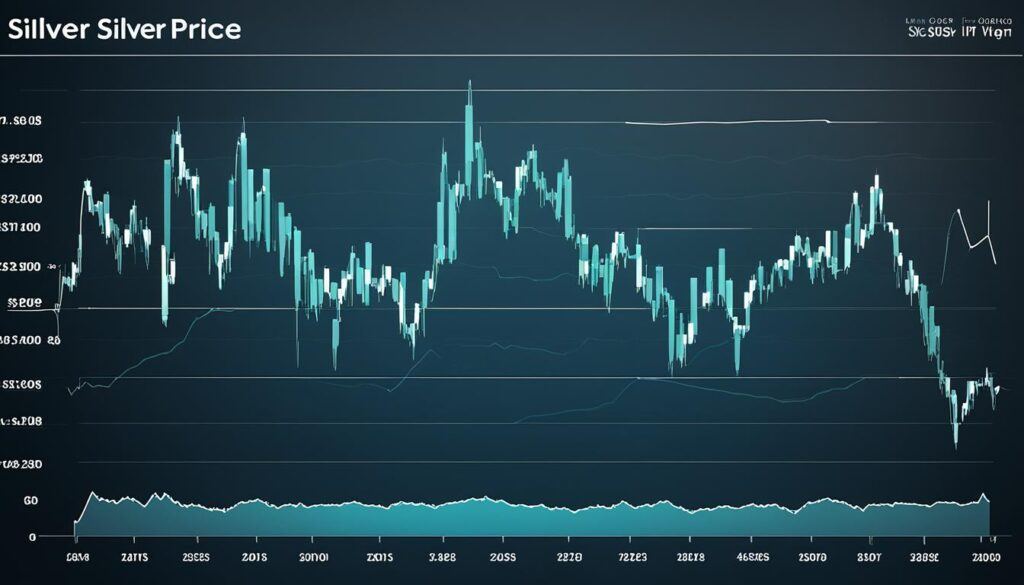

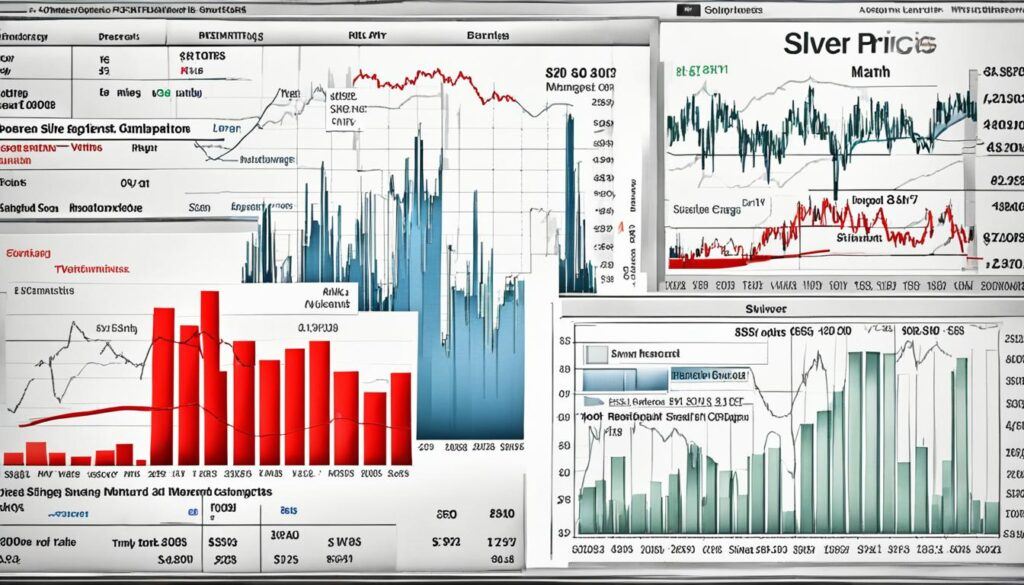

When it comes to selling silver, it is crucial to analyze current market conditions to make an informed decision. This involves studying silver price charts, evaluating market sentiment, and considering expert opinions. By carefully assessing these factors, you can gain valuable insights into the silver market and make predictions about future price movements.

One effective method of analyzing market conditions is by studying silver price charts. These charts provide a visual representation of historical price data and can help identify patterns and trends. By examining the highs and lows of silver prices over a specific period, you can identify potential opportunities for selling.

Market sentiment plays a significant role in determining silver prices. It refers to the overall outlook and attitude of market participants towards silver. This sentiment can be influenced by factors such as economic conditions, geopolitical events, and investor behavior. Monitoring market sentiment allows you to gauge the demand for silver and anticipate fluctuations in prices.

“Market sentiment is a key indicator in understanding how supply and demand dynamics impact the price of silver. Tracking market sentiment can give you an edge in your silver selling strategy.”

Expert opinions are another crucial aspect to consider when analyzing market conditions. Many industry experts provide insights and forecasts on the silver market, which can help you make informed decisions. It is essential to consider the credibility and track record of these experts before relying on their opinions. By combining expert opinions with other analytical tools, you can get a more comprehensive understanding of the market.

In addition to price charts, market sentiment, and expert opinions, there are other key indicators to consider. These include factors such as new silver mines, advancements in silver-using technologies, and major transactions by investment firms. These indicators can provide valuable insights into future price movements and supply and demand dynamics.

Before making any decision to sell silver, it is crucial to assess your personal financial goals, portfolio allocation, and investment horizon. These factors will help guide your selling strategy and ensure it aligns with your overall financial objectives.

Example of Silver Price Chart

The following table displays a hypothetical example of a silver price chart, showcasing the historical price movements over a period of three years:

| Date | Price |

|---|---|

| Jan 1, 2020 | $15.20 |

| Jan 1, 2021 | $25.50 |

| Jan 1, 2022 | $30.80 |

| Jan 1, 2023 | $28.10 |

This example illustrates the fluctuation in silver prices over time, highlighting the importance of analyzing current market conditions before selling silver.

Expert Opinions

- John Smith, a renowned silver analyst, predicts that silver prices will experience a surge in the next six months due to increased industrial demand.

- Jane Thompson, an economist specializing in precious metals, suggests that market sentiment toward silver is currently positive, indicating potential price growth in the near future.

By taking into account silver price charts, market sentiment, expert opinions, and other key indicators, you can make well-informed decisions when selling silver. Remember to regularly monitor and evaluate these factors to adjust your selling strategy accordingly, maximizing your potential profit.

Factors to Consider Before Selling

Before making the decision to sell your silver, it is essential to take into account a few key factors that can greatly impact your financial goals and investment portfolio. Let’s explore these factors in detail:

Personal Financial Goals

First and foremost, you need to consider your personal financial goals. Are you looking for short-term gains or long-term investment? If your goal is long-term investment or retirement planning, holding onto your silver may be a better option. Silver, as a precious metal, has historically shown a potential for appreciation over time. It is important to assess your overall financial objectives before deciding to sell.

Portfolio Allocation and Diversification

Another factor to consider is your portfolio allocation and diversification. Selling your silver may impact the balance of your investment portfolio. Diversification is crucial to manage risk and maintain a well-balanced portfolio. If your silver holdings contribute to the diversification of your assets, it might be prudent to hold onto them.

Investment Horizon

The investment horizon refers to the timeframe you are willing to hold your investments. Consider how much time you have before you need to achieve your financial goals. If you have a longer investment horizon, you may choose to hold onto your silver as it has the potential to appreciate over time. On the other hand, if your investment horizon is short-term, selling your silver might align better with your goals.

Future Market Trends

Lastly, it is crucial to assess future market trends before making a decision. Study the market and analyze the current trends in the silver market. Consider factors such as supply and demand, price movements, and expert opinions. Keeping an eye on the future market trends can help you make an informed decision about selling your silver.

Remember, each individual’s financial situation is unique, and there is no one-size-fits-all approach. It is essential to evaluate your personal financial goals, portfolio allocation, investment horizon, and future market trends before deciding to sell your silver.

| Factors to Consider Before Selling | Actions to Take |

|---|---|

| Personal Financial Goals | Evaluate your long-term vs. short-term goals and assess the role of silver in your financial strategy. |

| Portfolio Allocation and Diversification | Consider the impact of selling silver on the diversification of your investment portfolio. |

| Investment Horizon | Align the decision to sell with your investment timeline and the desired timeframe for achieving your financial goals. |

| Future Market Trends | Analyze the current market conditions and expert opinions to gain insights into future price movements. |

By carefully considering these factors, you can make a well-informed decision about whether to sell your silver or hold onto it, aligning with your personal financial goals and the dynamics of the market.

Expert Opinions and Silver Forecasting

When it comes to making informed decisions in the silver market, expert opinions and silver market analysis play a crucial role. By leveraging the insights of industry experts and credible forecasts, investors can gain a deeper understanding of the market and make well-informed decisions that align with their financial goals.

One important aspect to consider when reviewing expert opinions is the credentials of the writer and the methodology used to arrive at their conclusions. By evaluating the expertise and track record of these professionals, investors can determine the reliability and accuracy of their forecasts.

“The silver market analysis by renowned industry experts reveals the potential of the precious metal as an investment option. The forecasts provided by these experts are grounded in thorough research and years of experience, making them valuable resources for investors.”

Understanding the supply and demand dynamics of the silver market is another key consideration. By assessing the current state of silver supply and demand, investors can identify patterns and trends that may impact future price movements. This analysis can be accomplished through studying market reports, industry publications, and expert insights.

Market sentiment is also an important factor to consider when forecasting silver prices. By monitoring market sentiment indicators and analyzing market trends, investors can gauge the overall mood and perception of market participants. This can provide valuable insights into the potential direction of silver prices.

To summarize, expert opinions, credible forecasts, market sentiment, and silver supply and demand are all critical components in the process of forecasting silver prices and determining the best time to sell silver. By incorporating these factors into their decision-making process, investors can make strategic moves to maximize their returns in the dynamic silver market.

Expert Opinion Example:

“The robust silver demand from various industries, coupled with potential supply constraints, points towards a favorable outlook for the silver market. Industry experts anticipate a sustained upward trend in silver prices, making it an opportune time to consider selling silver.”

| Factors to Consider | Importance |

|---|---|

| Expert Opinions | High |

| Credible Forecasts | High |

| Silver Supply and Demand | Medium |

| Market Sentiment | Medium |

Conclusion

To sell silver at the right time and maximize profit, one must carefully analyze market conditions, consider personal financial goals, and evaluate expert opinions. By staying informed and employing strategic investment strategies, individuals can optimize their silver sales and make the most of their investment.

Understanding and monitoring market analysis and trends is crucial. Keeping an eye on silver price charts and market sentiment provides valuable insights into future price movements. Additionally, considering factors like supply and demand, economic conditions, and market speculation can help predict silver prices and make informed selling decisions.

When deciding to sell silver, it is important to align with personal financial goals and portfolio allocation. Long-term investors and those planning for retirement may choose to hold onto their silver for extended periods. Moreover, considering the investment horizon and evaluating future market trends allows individuals to strategically time their silver sales for optimal profit.

In conclusion, by thoroughly analyzing market conditions, considering personal financial goals, and evaluating expert opinions, individuals can determine the best time to sell silver and maximize their profit. Employing effective investment strategies and staying informed about market analysis and trends will ensure individuals make the most of their silver investments.

FAQ

What’s the Best Month to Sell Silver?

The best month to sell silver can vary depending on market conditions and personal circumstances. It’s important to closely monitor silver market trends and the spot price of silver to identify periods of increased demand and higher prices.

What factors influence silver prices?

Silver prices are influenced by factors such as supply and demand, economic conditions, and market speculation. When demand for silver is high or supply is low, the price tends to rise. Economic uncertainty and market sentiment can also impact silver prices.

How do I analyze current market conditions for silver?

Analyzing current market conditions involves studying silver price charts, monitoring market sentiment, and considering expert opinions. It’s essential to stay informed about key indicators, such as new silver mines, silver-using technologies, and major transactions by investment firms.

What factors should I consider before selling silver?

Before selling silver, consider your personal financial goals, portfolio allocation, and investment horizon. If you’re focused on long-term investment or retirement planning, holding onto the silver may be a better option. Evaluate future market trends and expert opinions to make an informed decision.

Are expert opinions and forecasting important in the silver market?

Yes, expert opinions and silver market analysis play a crucial role in understanding the future of the silver market. Review credible forecasts from industry experts, taking into account their credentials and the methodology used. Assessing silver supply and demand and considering market sentiment are also valuable.

How can I maximize profit while selling silver?

To maximize profit, it’s important to stay informed about market trends, supply and demand, and analyze the best time to sell. By making strategic decisions based on current market conditions and expert opinions, you can optimize your silver sale and make the most of your investment.