Let’s face it:

If you’re a looking into Gold IRA investing, then you most certainly have heard of Augusta Precious Metals – one of the best Gold IRA companies in the United States.

Top-Rated Gold IRA Company in the US |

|

Highlights:

|

Our Rating: |

Now…

This won’t be a typical Augusta Gold IRA review, but rather we’ll cover some of the frequently asked questions people have about this business.

Expect lengthy answers to the following questions:

- Is Augusta Gold IRA legit?

- What is the annual fee for Augusta?

- Does a Gold IRA kit come with gold?

- What is the minimum investment amount?

- How much does Augusta Precious Metals cost?

- How to safely roll over your 401K into a Gold IRA?

- What are the Augusta Precious Metals pros and cons?

Grab a coffee because it’ll be a long post.

(You can also check the table of content below to click on the question that interests you the most.)

What is a Gold IRA?

First things first:

What is a gold-backed IRA?

In a nutshell…

Gold IRAs are the individual retirement accounts that were created with the Taxpayer Relief Act of 1997.

Under the Act, the IRS broadened the types of assets that could be held in this type of account to include physical gold, silver, platinum, and palladium, either as coins or bullion.

Since gold is the most popular of the four precious metals, these accounts are commonly referred to as gold IRAs.

Today I will not go into the details of what a Gold IRA is, but the video above should give you a basic understanding.

What Are Augusta Precious Metals Fees?

These are the most commonly asked questions:

- What is the annual fee for Augusta?

- How much do Augusta Precious Metals charge?

- What are Augusta Precious Metals fees in 2026?

Including the custodian, set up costs, and so forth.

Augusta is transparent about the costs, fees, and transaction statuses. When you open a gold IRA with this provider, you incur a one-time setup fee and recurring annual fees.

Setup Fee (One-Time)

- Custodian application fee: $50

- Custodian annual fee (1st year): $100

- Sample depository storage fee (1st year): $100

- Total setup fee: $250

Annual Fee (Recurring)

- Custodian annual fee: $100

- Sample annual storage fee: $100

- Total recurring annual fees: $200

Please note that these fees are for the IRA custodian and the depository. Augusta doesn’t charge any management fees.

Now…

Because Gold IRA fees are (should be) fixed, it’s actually in your favor to invest more because regardless of your order amount, you pay the same minimal fees every year.

For example:

If the fixed Gold IRA costs with the company you went with are $200, then even if your investment amount is $5 million, you’ll still pay only $200 annually.

Percentage wise you pay much less in fees contributing a larger amount of $5 million vs if you were to invest or rollover $100,000 USD.

In other words, you’ll only be paying a total of $250 for your first year, and $200 for the succeeding years, regardless of the amount of your account.

This fixed structure is one of the reasons many investors consider Augusta Precious Metals Gold IRA fees to be straightforward and predictable compared to other Gold IRA providers.

Yes, you heard that right.

We’ve confirmed with a company representative that these fees apply regardless of your IRA investment amount.

So whether you invest or rollover $50,000 or $5,000,000, you only pay $250 the first year and $200 annually.

But we have even BETTER news for you…

As a valued Gold & Silver Central reader, you have an opportunity to get ZERO fees for up to 10 years!

How?

One way is to call at 833-989-1952 to waive your Gold IRA fees.

Or you can fill out this form (with real contact info).

There’s one “BUT” though…

It’s the required minimum investment amount. Which leads me to the next point.

What Is the Minimum Investment at Augusta Precious Metals?

Here’s the thing:

When researching for the best Gold IRA companies, people almost always come across Augusta Precious Metals.

And while it’s one of our top picks when it comes to Gold IRA investing, it’s certainly not for everyone.

Augusta caters to high net worth investors and has a higher minimum investment amount than other firms.

So, what is the minimum investment at Augusta Precious Metals?

Augusta requires a minimum order of $50,000 for any purchase, whether for an IRA or cash account.

You can reach this amount using any combination of products offered – gold, silver, or a combination of both.

They don’t have a maximum order size.

So even if you want to purchase a large quantity of gold and silver, this firm can fulfill your needs.

Now you can understand why Augusta, despite being is a highly rated Gold IRA company, is not for everyone because of their minimum contribution amount.

It can be a cash purchase or rollover from your other retirement accounts like:

- Traditional IRA

- Roth IRA

- 401(k)

- 403(b)

The fact that you can roll over your funds is a relief for many.

But it doesn’t have to be a Gold IRA account.

If you wish to purchase precious metals outside of an IRA, Augusta can help with that too.

Just call them at 833-989-1952 for assistance or visit the website for more info.

However…

If $50,000 is something you can’t currently afford to invest or rollover, there are other options too.

Consider this highly rated Gold IRA company that recently removed a minimum purchase requirement (subject to change).

How to Open a Gold IRA Account?

Before you can open an account, you are required to participate in a one-on-one conference call.

If you’re wondering how to speak with an Augusta Precious Metals representative, the process is straightforward.

You can call them directly at 833-989- 1952 or request a callback through their website to discuss investment strategies, fees, and available options based on your goals.

The call will cover investment strategies that best fit your goals and outline all fees and costs.

Your specialist will also cover the advantages and drawbacks of each metal type and strategy.

All orders are placed and confirmed through a recorded phone line with an order specialist for added security.

Again, remember that their minimum contribution amount of $50,000 can be a drawback for smaller investors.

If you can afford to invest a minimum of $50,000, Augusta Precious Metals accepts payments made by:

- Bank wire – no limit

- Personal check – up to $50,000 maximum

- Rollover from traditional IRA, Roth IRA, 401(k) or 403(b)

If you wish to purchase precious metals outside of an IRA, they can help with that too with the following simple 3-step process:

As per their return policy, if you’re a first-time customer, then Augusta extends the cancellation period for premium gold and silver coin transactions for up to 7 calendar days after the date your transaction is confirmed.

Be sure to read the Transaction Agreement carefully when you become a customer and speak with your advisor before making any decisions.

Call Augusta at 833-989-1952 or visit the website to get started!

What Are the Augusta Precious Metals Pros and Cons?

Next.

Let’s talk about Augusta Precious Metals pros and cons.

APM is definitely one of my top 3 choices when it comes to Gold IRA investing in 2026.

But you need to know whether it’s the right choice for YOU.

Augusta Precious Metals Pros

- Professional Coin Grading Service authorized dealer

- Abide by the NGC’s coin grading standards

- A+ rating by the Better Business Bureau

- Excellent customer support

- 5-star rating on TrustLink

- FREE Gold IRA guide

- Competitive pricing

- Account lifetime support

- No high-pressure sales tactics

- No hidden fees or commissions

- ZERO Gold IRA fees for up to 10 years

- 7-day return policy for first-time buyers

- Low one-time and annual maintenance fees

- 2 Stevie Awards for Customer Service Success

- “Best Overall Gold IRA Company” by Money Magazine

As you can see it’s a long list of pros.

BONUS:

If you are high net worth with over $50,000 to invest/rollover, then you’re qualified to get ZERO Gold IRA fees for up to 10 years.

Call Augusta at 833-989-1952 to waive your fees.

Augusta Precious Metals Cons

- Available for US residents only

- Higher mark-ups on premium coins

- Requires a minimum commitment of $50,000

- Need to inquire about platinum or palladium options

Generally speaking, there aren’t many gold-backed IRA cons.

In this particular case, however, you just need to be aware of the high minimum contribution amount and higher mark-ups on some of the coins.

Be sure to download this checklist to avoid a Gold IRA nightmare.

This leads me to the next question.

Is Augusta Precious Metals Legit?

Let’s face it…

Augusta Precious Metals is a widely known gold IRA company who knows all the ins and outs of the game, and caters to high net worth investors.

And still it’s wise to ask:

- Is Augusta Precious Metals legit?

- Is Augusta Gold IRA safe to invest in?

- Where will Augusta store your precious metals?

Yes, Augusta Precious Metals is legit.

It is a well-established Gold IRA company with over 20 years in the industry and offers many IRS-approved products for your IRA account.

(In fact, it’s one of my top recommended Gold IRA companies.)

It is backed by thousands of positive reviews on different platforms such as BBB, Trustpilot, Google reviews, Trustlink, and Consumer Affairs.

Here are the Augusta Precious Metals ratings as of today:

- 4.95 rating in BBB

- AAA rating with BCA

- 5.0 rating in TrustLink

- 4.6 rating in TrustPilot

- 5.0 in Consumer Affairs

- 4.9 rating in Google reviews

These ratings alone will show you that the team takes their business seriously.

If you’re considering diversifying your retirement account with gold and silver, you might want to check out Augusta Precious Metals.

If you can afford contributing/rolling over $50,000+ USD, then be sure to call 833-989-1952 to get ZERO fees for up to 10 years.

Thousands of positive reviews on BBB, TrustPilot, and Trustlink, BCA also speak for themselves.

You’ll also see other major media leaders like Joe Montana and Mark Levine (no longer paid ambassadors), among others to recommend this firm.

And you can barely find any Augusta Precious Metals complaints, but if there are, APM is pretty quick in addressing these concerns, leaving most of the customers satisfied with their service.

A common theme found in reviews on third-party watchdog sites is the smoothness of the account opening process and the helpfulness of Augusta Precious Metals educators.

Remember that “BUT” though…

You must have a minimum of $50,000 to invest or rollover from your other retirement account (IRA, 401k, 401b etc) or as a cash transfer.

Augusta caters to high net worth individuals, so if you can’t afford that, then it’s not the right company for you.

Don’t fret though:

There are other GREAT options for investors of any size (like Goldco and Birch Gold Group).

Next.

Is Augusta Gold IRA Safe?

You may have wondered:

- Is Augusta Precious Metals a good investment?

- Where will Augusta Precious Metals store your gold?

- Is your gold individual retirement account safe with them?

Augusta works with reputable companies to make sure your gold and silver purchase is safe and secure.

First, their preferred IRA custodian is Equity Trust.

Equity Trust has over 45 years of experience as a self-directed IRA custodian. They serve customers in all 50 states and have over $34 billion in assets.

Augusta will act as your liaison with Equity Trust.

Still, you can contact Equity Trust directly and will always have complete control over your investments.

For storage, Augusta has contracted with Delaware Depository.

This depository is IRS-compliant, serves the CME (Chicago Mercantile Exchange) and ICE (Intercontinental Exchange), and specializes in precious metal storage.

Or you can choose from one of their other approved storage facilities:

- Los Angeles, CA

- Nampa, ID

- Salt Lake City, UT

- Dallas, TX

- Las Vegas, NV

- Shriner, TX

- South Fargo, ND

- Bridgewater, MA

- New Castle, DE

- New York, NY

In addition to the physical security provided by the depository, your gold and silver investment is protected by a $1 billion all-risk insurance policy provided by Lloyd’s of London.

This can’t get safer than that, can it?

Who Is the Founder of Augusta Precious Metals?

You might have wondered…

Who is the CEO of Augusta Precious Metals?

Isaac Nuriani is the Founder and CEO of Augusta Precious Metals.

I actually hopped on a call with him once when I was just learning about his company.

So he’s definitely real 😁

Here’s what I’ve learned about Isaac:

He is a successful entrepreneur that formed one of the leading Gold IRA companies in the United States that caters to high net worth investors.

Beyond the business realm, unfortunately, there isn’t much about his personal life aside from an interview and a business page on Instagram.

The timeline isn’t as clear but like any successful person’s journey, I’m sure it was marked by milestones, challenges, and triumphs.

The formative years of his journey in the early 2000s working with investment companies lay the groundwork for what would later become a remarkable career/business.

Without a doubt…

Founding Augusta Precious Metals, under Nuriani’s leadership, is a pivotal moment in his timeline.

In 2012, he took the plunge into the precious metals industry, setting the stage for a paradigm shift in how individuals approached wealth preservation.

Now:

He works specifically with high net worth investors who can afford depositing/rolling over a minimum of $50,000 USD to their new self-directed account.

And that included Joe Montana (who is no longer their paid ambassador as of 2026).

Needless to say, these investors get the white-glove treatment.

In fact, Augusta Precious Metals was named “The Best Overall Gold IRA Company” in the last 3 years and won numerous awards for their excellent customer support.

They are an industry-recognized PCGS (Professional Coin Grading Service) authorized dealer, who abides by the NGC’s (Numismatic Guaranty Corporation) coin grading standards.

Augusta’s CEO Isaac Nuriani has made it his personal mission to help people understand potential retirement concerns caused by financial policies that favor big banks rather than individual investors.

(And clearly, he’s doing a great job considering how it gains hundreds of 5-star reviews, awards, and recognition by major media companies.)

Isaac launched Augusta to help educate retirement savers on how they can diversify their portfolios with precious metals and protect their hard-earned retirement savings.

With a strict commitment to ethics and professionalism, Augusta makes customer satisfaction its highest priority. Every potential new customer may receive a personalized call before they can open an account.

Or you can call them directly at 833-989-1952.

During this call, you will learn ways to diversify your portfolio to protect yourself against inflation, and what precious metals options may suit you.

This firm even offers you tips on avoiding gimmicks and high-pressure sales tactics while researching other gold IRA companies.

Augusta isn’t looking to make a quick sale but rather to build a relationship to be your Gold IRA precious metals provider for life.

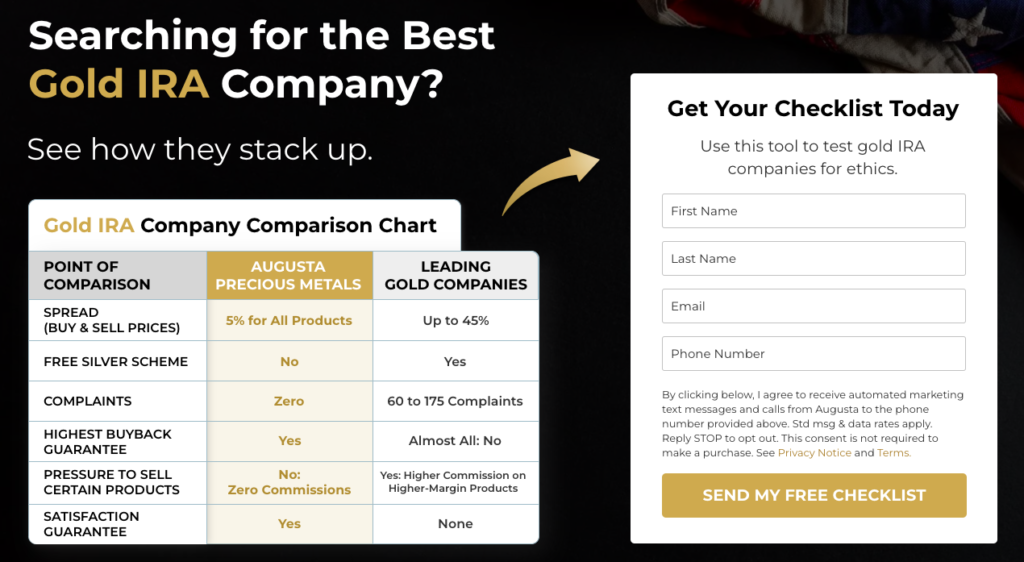

See how they stack up against other companies here. ↴

Moving on to the next question.

How Much Does Augusta Precious Metals Cost?

Alright:

When considering investment with Augusta Precious Metals, understanding the full cost structure is essential for making an informed decision.

Let’s break down exactly what you’ll need to invest.

The total financial commitment to begin investing with Augusta Precious Metals includes:

- Minimum contribution requirement: $50,000

- Initial setup expense: $250 (one-time payment)

- Yearly maintenance expense: $200 (recurring)

The exceptional news for serious folks is the potential to eliminate these administrative costs entirely.

Augusta currently offers to receive ZERO fees for up to 10 years when you call 833-989-1952 to waive fees.

With this special promotion, your investment dollars can work entirely toward building your precious metals portfolio rather than covering administrative expenses.

Make sure to submit real contact info when you fill out the form:

Beyond these transparent costs, Augusta doesn’t impose additional hidden charges or fees.

Which leads me to the next question.

Is There a Gold IRA With No Fees?

When it comes to Gold IRAs, one of the first questions investors ask is whether there are any with absolutely no fees.

(Augusta is an exception if you qualify for their no-fee program.)

The truth is…

When it comes to Gold IRAs, there are a few fees that you can’t avoid, but understanding them can help you manage your investment more effectively.

Setup Fees

These are the initial costs for opening your Gold IRA account.

Typically, they cover the administration and paperwork involved in getting your account up and running.

Expect one-time fees ranging from $50 to $250, depending on the provider.

Custodian Fees

Custodians are responsible for managing and safeguarding the precious metals in your IRA.

These fees are charged annually and can range from $100 to $300 or more, depending on the custodian and the size of your account.

It’s important to choose a custodian with transparent fees and a solid reputation.

Storage Fees

To meet IRS requirements, your physical gold must be stored in a secure, IRS-approved facility.

Storage fees are typically charged annually and can range from $100 to $300, depending on whether you opt for segregated or non-segregated storage.

Segregated storage (where your gold is stored separately from others) is generally more expensive.

Transaction Fees

Whenever you buy or sell gold within your IRA, you’ll incur transaction fees.

These fees vary by provider, but they typically range from $25 to $50 per transaction.

While these fees are unavoidable, understanding them will help you make better-informed decisions when setting up your Gold IRA.

How to Minimize Gold IRA Fees to the Minimum

While you can’t entirely avoid certain fees when setting up a Gold IRA, there are strategies to minimize them as much as possible, ensuring your investment stays cost-effective.

Choose a Low-Cost Custodian

Some custodians have lower annual fees than others.

Research your options and look for providers with transparent pricing structures.

For instance:

Augusta waives fees for qualified accounts for up to 10 years, offering an excellent opportunity to save on setup and annual fees if you meet their investment requirements.

Call Augusta at 833-989-1952 or fill out this form: ↴

Just a reminder about their “BUT”…

It’s the required minimum investment amount, which is a minimum of $50,000 USD to invest or rollover from your other retirement account into a Gold IRA.

Consider the Setup Fee

Many Gold IRA companies offer promotional periods with discounted or waived setup fees, particularly if you’re investing over a certain amount.

Goldco, for example, often has special offers where you can receive up to $10,000 in FREE silver, which can help offset the initial setup costs.

It’s subject to change, but as of January 2026, they also announced that NO purchase minimums are now required!

(The minimum purchase amount before used to be $25,000).

So…

If you can’t afford to invest with Augusta Precious Metals, you have an excellent alternative with Goldco.

Opt for Non-Segregated Storage

If you’re looking to save on storage fees, consider choosing non-segregated storage.

It’s less expensive than segregated storage, where your gold is stored separately from others, though it does come with slightly less control over the storage of your precious metals.

Limit Transactions

Frequent buying and selling can rack up transaction fees.

Try to keep your trading activity to a minimum to avoid these additional costs. This approach works well if you’re focused on long-term wealth preservation rather than short-term gains.

Negotiate

Don’t be afraid to negotiate with the company handling your Gold IRA.

Some firms may be open to reducing certain fees, especially if you’re making a significant investment or have been a long-time client.

It never hurts to ask for a better deal.

By taking these steps, you can reduce the overall cost of maintaining your Gold IRA, allowing more of your money to work for you.

Does a Gold IRA Kit Come With Gold?

Gold IRAs are a popular choice for individuals looking to protect their retirement savings with the stability of precious metals.

However, a common question among potential investors is whether a Gold IRA kit actually comes with physical gold.

So, does a Gold IRA kit come with gold?

Let’s find out.

As we’ve established, a Gold IRA (Individual Retirement Account) is a special type of retirement account.

It lets you invest in physical gold, along with other metals like silver, platinum, and palladium.

Unlike traditional IRAs that hold stocks, bonds, or mutual funds, a Gold IRA focuses on precious metals.

It’s designed to give investors the benefit of gold’s stability, especially during economic uncertainty or inflation.

A Gold IRA kit is what you receive when you set up this kind of account.

It’s the starter package to help you begin the process of funding a self-directed IRA. With it, you can purchase and store precious metals in your account.

The exact contents of a Gold IRA kit vary by provider.

But typically, it includes the following:

Documentation

This includes the necessary forms to establish your Gold IRA, transfer funds from existing retirement accounts (like a 401(k) or traditional IRA), and open the account with a custodian.

Guides and Educational Materials

Many providers include educational resources to help you understand the process of investing in gold through an IRA.

These guides may cover topics such as the benefits of precious metals, how gold can protect against inflation, and the steps required to purchase physical gold through the account.

Forms

To set up the account, you’ll need to complete various forms.

These forms are required to open your self-directed IRA and direct the purchase of precious metals.

It is the initial setup for investing in gold through your IRA.

Once your account is open and funded, you’ll work with a custodian or precious metals dealer to select and purchase the physical gold or other precious metals that will be stored in the account.

The gold purchased through the IRA is typically kept in a secure, IRS-approved storage facility, ensuring that it complies with IRS rules for retirement accounts.

When you receive a Gold IRA kit, it’s important to understand that the kit itself does not include any physical gold.

However, I should make a note here:

In the past, Augusta used to have a special offer of free gold coin on qualified purchases.

Be sure to give them a call at 833-989-1952 to find out.

Or fill out this form with real contact info to see if their FREE gold coin offer is still available.

The Gold IRA kit is simply a set of tools and documents to help you set up and manage your account, not an immediate investment in gold.

The gold itself is purchased separately after the account is opened and funded.

However, if you want to push through with having gold in your portfolio, here are the steps to purchasing gold within a Gold IRA:

1. Set Up Your Self-Directed IRA

Once you’ve received your Gold IRA kit and filled out the required paperwork, the first step is setting up a self-directed IRA.

This type of account gives you the flexibility to invest in physical precious metals which is something you can’t do with a standard IRA that only allows paper assets like stocks or bonds.

2. Work With a Custodian and Choose Your Dealer

Your self-directed IRA requires a custodian, a financial institution that ensures your account complies with IRS regulations.

While custodians don’t directly handle the gold, they manage your account and storage.

You’ll also need to work with a broker or dealer who specializes in precious metals to purchase the gold.

Most custodians can recommend a reputable dealer, ensuring that your transaction meets all IRS requirements.

Some custodians even have partnerships with specific dealers, while others allow you to choose from a network of authorized sellers.

3. Select the Right Gold Investments for Your IRA

Once your IRA is set up, you’ll decide which gold (or other precious metals) to invest in.

Your options typically include gold coins, bars, or bullion that meet IRS purity standards (usually 99.5% or higher).

To make the best decision, consult with your IRA custodian or a precious metals broker.

They can guide you based on your retirement goals and help you choose the most suitable investments while ensuring that the gold meets the IRS’s requirements for inclusion in a Gold IRA.

Not all gold is eligible for a Gold IRA. The IRS has strict standards, and only certain types of gold qualify:

- Gold Coins: Popular ones like American Eagle, Canadian Maple Leaf, and South African Krugerrand are often allowed.

- Gold Bars: Must be at least 99.5% pure and produced by an approved refiner or manufacturer.

- Gold Bullion: Like bars, bullion must meet purity requirements and come from an authorized source.

4. Fund Your Account and Purchase Gold

To start purchasing gold, transfer funds into your self-directed IRA through a rollover from an existing retirement account (like a 401k or traditional IRA), a direct transfer, or a new contribution.

Once the funds are in your IRA, you’ll instruct your custodian to make the purchase of physical gold.

The custodian will work with a gold dealer to complete the transaction.

The dealer will then source and deliver the gold to a secure, IRS-approved storage facility, where it will remain until you decide to take a distribution or sell.

5. Store the Gold in a Secure, Approved Storage Facility

According to IRS rules, physical gold in a Gold IRA must be stored in a secure, IRS-approved depository.

These facilities offer high levels of security and insurance for your metals.

You won’t have direct access to the gold, but this ensures that your IRA remains compliant with regulations.

The custodian will arrange the storage of the gold in one of these facilities, providing peace of mind that your investment is safe and sound.

These depositories are highly secure, and many of them offer insurance for the stored precious metals, giving you peace of mind about the safety of your investment.

While a Gold IRA kit won’t arrive with actual gold, it gives you the roadmap to owning physical precious metals inside your retirement account.

With the right custodian and trusted dealer, you’re in a strong position to build long-term protection for your portfolio.

Is Augusta Precious Metals for You?

And is Augusta Precious Metals worth it?

Look…

After learning about Augusta’s fees, minimum investment requirements, and security measures, you might be wondering if this Gold IRA provider is the right fit for your goals.

So, who stands to benefit most from their services?

Augusta Precious Metals gold IRA company is for those who:

- Have at least $50,000 to contribute/roll over

- Don’t want to feel pressured to make a decision

- Desire a long-term relationship with the company

- Are looking for help through every step of the set up

- Want a simple, transparent, and straightforward process

- Are looking to diversify their portfolio with precious metals

If this is you, then start by visiting the website or call Augusta Precious Metals at 833-989-1952 to learn more.

You can also watch this in-depth video review we did:

Augusta Precious Metals Promotions

1) Free Gold Coin

Look…

Augusta Precious Metals previously offered a FREE gold coin promotion for qualified accounts.

To determine if this special offer remains available, again contact them directly at 833-989-1952.

(Note: This promo might no longer be available.)

2) Zero Fees for Up to Ten Years

As already mentioned:

Augusta Precious Metals offers a compelling promotion that focuses on zero fees for up to 10 years.

This no-fee opportunity presents an excellent option for long-term investors who want to maximize their initial contribution.

For qualified purchases, Augusta Precious Metals waives all fees, including IRA setup fees, storage fees, and any other account-related costs.

This valuable offer allows you to keep more of your money working for you rather than paying administrative expenses.

The zero-fee promotion can lead to significant savings over time.

Since fees typically reduce investment returns, starting your Gold IRA without these costs ensures you can maximize your initial deposits and allow your precious metals investments to grow unimpeded by administrative expenses.

This offer is particularly advantageous for those planning to hold their Gold IRA for many years as part of a long-term wealth preservation strategy.

To find out if you qualify, call Augusta at 833-989- 1952.

Or fill out this online form (with accurate contact info). ↴

If you have $50,000 available to roll over, this represents an outstanding opportunity to secure long-term savings with Augusta’s promotion.

Moving on.

What to Consider When Choosing a Gold IRA Provider?

This is not Augusta related but helpful section.

Choosing the right Gold IRA provider requires careful consideration of several factors that will impact both your investment experience and overall returns.

While special promotions like fee waivers or free precious metals can be attractive, it’s essential to evaluate the following:

1. Comprehensive Fee Structure

Understanding the complete fee landscape is crucial, as these costs directly affect your investment returns over time.

When evaluating providers, examine:

- Setup Fees: The one-time costs to establish your account

- Annual Maintenance Fees: Recurring administrative charges

- Transaction Fees: Costs associate d with buying or selling metals within your account

- Storage Fees: Annual expenses for securing your physical metals in an IRS-approved facility

Review these fees thoroughly and verify whether promotions like Augusta’s fee waiver program apply to your specific situation.

While short-term savings are appealing, always consider the long- term cost structure before making your decision.

2. Customer Service Excellence

Quality customer service is paramount when managing a Gold IRA, as you’ll likely have questions and need guidance throughout your investment journey.

Look for providers offering:

- Responsiveness: Prompt, knowledgeable assistance when you have questions

- Educational resources: Materials that help you understand precious metals investing

- Transparency: Clear, straightforward information about services, fees, and investment options

Verify a company’s service quality by checking independent reviews on trusted platforms like the Better Business Bureau, Trustpilot, or Google Reviews.

3. Secure Storage Solutions

Since IRS regulations require physical precious metals to be store d in approved facilities, your provider’s storage options are critically important.

Ensure they partner with reputable depositories that:

- Meet all IRS compliance requirements

- Provide comprehensive insurance coverage

- Maintain robust physical and digital security measures

- Offer either segregated or non-segregated storage based on your preferences

Don ‘t hesitate to ask detailed questions about where an d how your precious metals will be stored and the specific insurance protections in place.

4 . Company Reputation and Track Record

The reputation of your Gold IRA provider reflects their trustworthiness and expertise in the industry.

Research these aspects:

- Customer feedback: What do existing clients say about their experiences?

- Industry experience: How long have they operated in the precious metals space?

- Accreditations: Are they members of respected organizations like the BCA or BBB?

Avoid companies with concerning patterns in customer reviews, particularly those mentioning hidden fees, poor service quality, or questionable business practices.

How to Safely Roll Over Your 401k Into Gold IRA?

Look…

In today’s uncertain economic climate, many folks are looking for ways to protect and grow their retirement savings.

One strategy gaining significant attention is rolling over a 401(k) into a Gold IRA.

While this applies to any retirement account, we’ll focus specifically on 401(k) rollovers since they’re most common.

401k Rollover into a Gold IRA: Why Consider It?

Rolling over your 401(k) into gold is a powerful strategy for diversifying your retirement portfolio and protecting your savings from traditional market volatility.

Gold has historically maintained value during economic uncertainty and inflation.

Unlike stocks and bonds that fluctuate with market conditions, gold often performs well when other assets decline, providing an excellent hedge against inflation and market downturns.

As a tangible asset, gold is believed to offer security that digital or paper assets cannot.

It avoids paper currency risks and, unlike real estate, requires no maintenance.

Having preserved value for centuries, gold is known to provide stability during turbulent economic times.

For those worried about their retirement savings’ future, especially during rising inflation or economic uncertainty, a 401(k) to Gold IRA rollover may preserve long-term wealth.

Rolling Over Your 401k Into Gold: Step-by-Step Guide

The process of converting your 401(k) into a Gold IRA follows these straightforward steps:

1) Determine Eligibility for Rollover

You can typically roll over your 401(k) into a Gold IRA when you:

- Change jobs or retire

- Are over 59½ and want to move funds without penalty

- If still employed, check with your plan administrator about rollover possibilities

2) Open a Gold IRA Account

You’ll need an IRA account with an IRS-approved custodian to hold gold in a retirement account.

Look for providers that offer:

- Secure, streamlined account setup

- Personalized support throughout the process

- Clear guidance on IRS compliance requirements

3) Select Appropriate Gold Products

Choose IRS-approved gold products for your IRA, such as:

- IRS-approved gold coins

- Gold bullion bars meeting 99.5% purity standards

4) Fund Your Gold IRA

Transfer your 401(k) funds to your Gold IRA using one of two methods:

- Direct Rollover: Funds transfer directly from your 401(k) to your Gold IRA without tax penalties

- Indirect Rollover: You receive the 401(k) funds and have 60 days to deposit them into your Gold IRA to avoid penalties

5) Choose a Secure Storage Option

By law, gold in your IRA must be stored in an approved depository. Look for:

- Secure, IRS-compliant storage facilities

- Insurance coverage for your precious metals

6) Monitor and Manage Your Gold IRA

After funding and securing your gold, regularly monitor your account to ensure everything remains on track.

401k Rollover into Gold IRA: Common Mistakes

Be aware of these potential pitfalls:

1) Not Following IRS Guidelines for Eligible Gold

The IRS has specific requirements about what gold qualifies for IRAs. Ensure your selected products meet IRS criteria (coins or bars at least 99.5% pure).

2) Ignoring the 60-Day Rollover Rule

With indirect rollovers, you must deposit funds into your Gold IRA within 60 days to avoid taxes and penalties.

3) Choosing the Wrong Custodian or Depository

Select IRS-approved custodians and secure storage facilities to maintain compliance and protect your investment.

4) Underestimating Associated Fees

Gold IRAs typically have higher fees than traditional retirement accounts due to physical storage and security costs. Factor in setup fees, annual storage fees, and transaction costs. Augusta Precious Metals IRA fees are pretty straightforward and understandable.

5) Proceeding Without Professional Guidance

DIY rollovers can lead to costly mistakes.

Gold IRA rollovers involve specific tax regulations where even minor errors can trigger penalties.

By avoiding these mistakes, you’ll ensure your Gold IRA rollover succeeds while remaining tax-efficient and compliant with IRS regulations.

Is a Gold IRA Right for Your Retirement Strategy?

Look…

A Gold IRA can be a powerful tool for protecting retirement savings against market volatility, inflation, and economic uncertainty.

By adding precious metals to your portfolio, you achieve greater diversification and help shield your wealth from fluctuations in traditional investments like stocks and bonds.

If you’re concerned about potential economic downturns, inflation, or geopolitical instability, consider safely rolling over your 401(k) into a Gold IRA.

Gold’s historical ability to maintain value during challenging times makes converting your 401(k) into gold a proactive approach to securing your financial future.

Working with reputable Gold IRA companies ensures your investment fully complies with IRS regulations while avoiding penalties.

With proper guidance and transparency, you can confidently take control of your financial future through a properly structured Gold IRA.

Remember to consult with a financial advisor before making any significant changes to your retirement strategy.

Is Augusta Precious Metals Worth It?

Here’s the truth…

If you can afford a minimum of $50,000 and prefer working with Augusta Precious Metals, you certainly can.

Especially with their ZERO FEES for up to 10 years offer on qualified purchases.

It ‘s a legitimate business and worth considering for your precious metal investments, whether in an IRA or outside of it.

In fact, it ‘s been named the Best Overall Gold IRA company in 2023, 2024, and 2025 by Money Magazine.

Augusta Precious Metals is one of our top recommended companies for several reasons:

- No pressure sales tactics

- Transparent fee structure

- Excellent customer service

- Educational resources available

- Strong reputation in the industry

- Secure, IRS-approved storage options

- High- quality precious metals products

If you’re interested in learning more about Augusta and determining if it’s the right for you, call them at 833-989- 1952 or visit their website to request their free Gold IRA guide.

Remember…

Regardless of which Gold IRA provider you choose, it’s essential to conduct thorough research, understand all fees and costs, an d ensure the company aligns with your investment goals and financial situation.

All in all:

Augusta Precious Metals stands out as one of the top Gold IRA companies in the United States in 2026.

While their $50, 000 minimum investment requirement may be prohibitive for some investors, those who can meet this threshold can benefit from their exceptional service, zero-fee promotions, and secure storage options.

Their transparent fee structure, excellent customer service, and positive reviews across multiple platforms make them a trustworthy choice for diversifying your retirement portfolio with precious metals.

Before making any investment decision, be sure to thoroughly research your options, understand all associate d costs and fees, and consider how a Gold IRA fits into your overall retirement strategy.

If you have at least $50,000 to invest or rollover, Augusta Precious Metals is certainly worth considering.

Again, to learn more about Augusta, call them at 833-989- 1952 or visit their website today.